EIA WPSR Summary for week ending 3-22-25

Summary

Moderately bearish report.

Crude: +3.2 MMB

SPR: 0.7 MMB

Cushing: +2.1 MMB

Gasoline: +1.3 MMB

Ethanol: +0.1 MMB

Distillate: -1.2 MMB

Jet: +0.7 MMB

Propane: +0.0 MMB

Other Oil: +0.7 MMB

Total: +5.3 MMB

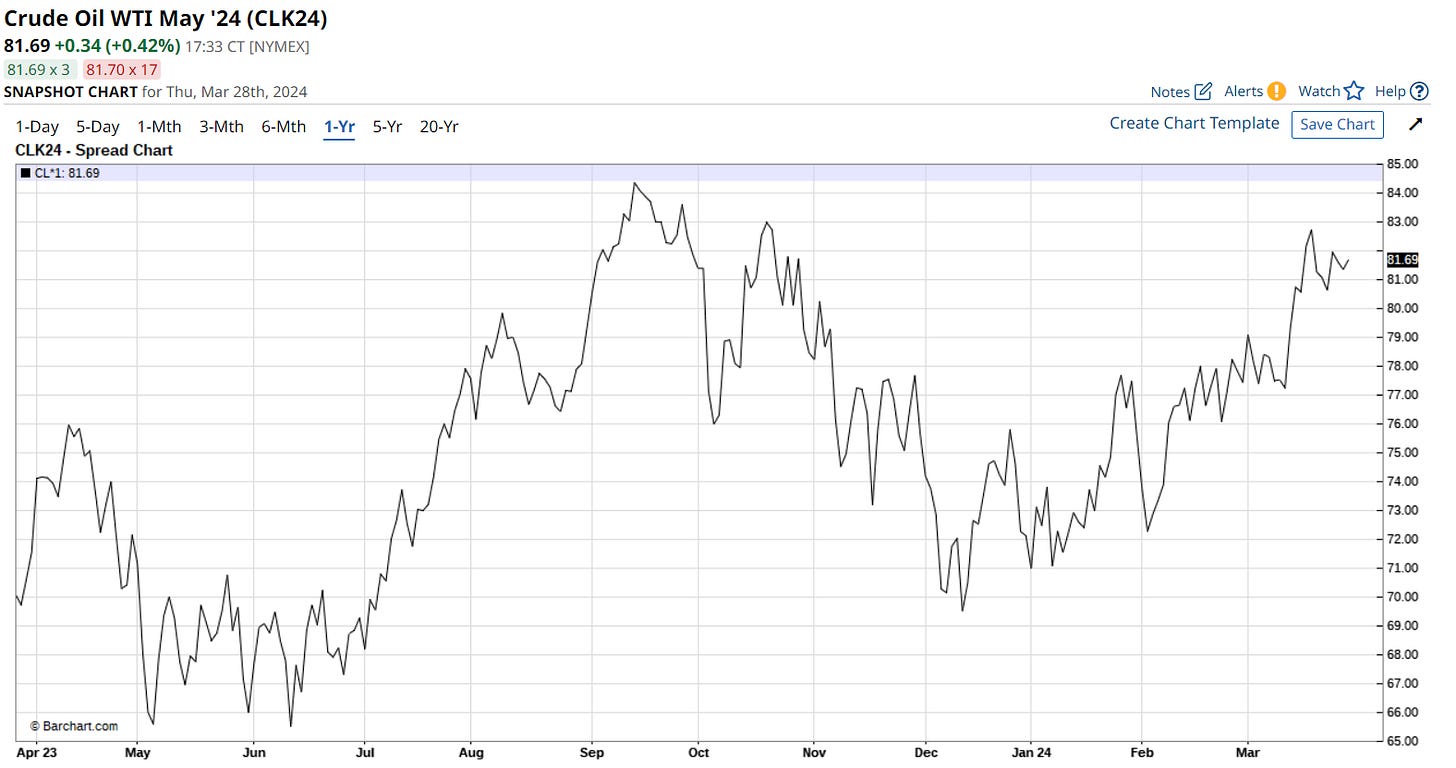

Spot WTI is currently pricing $81. Due to the build in crude and products, this is slightly above fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 3.2 MMB. Crude inventories are currently 2% below the seasonal average.

0.7 MMB were added to the SPR. 8 MMB have been added to the SPR in 2024.

Crude imports were up week-on-week. They came in a little higher than expectations.

Crude exports were reported at 4.18 MMBD. This was a higher value than that projected by independent ship trackers. However, it doesn’t make up the for the export barrels that appear to have been miscounted over March.

Adjustment was positive again. There’s no clear trend anymore.

Cushing

Crude inventories in Cushing, OK built by 2.1 MMB. This was much larger than expectations. However, draws don’t normally start until driving season picks up.

Gasoline

Total motor gasoline inventories increased by 1.3 MMB and are about 1% below the seasonal 5-year average.

Finished gasoline inventories are at a multi-year low.

The gasoline build was in blending components. Unfortunately, the EIA doesn’t break out which blending components. Not all components are equally important. As refiners switch over to summer blend gasoline, it will be interesting to see how much of the blending components are useful for lower RVP (Reid Vapor Pressure) blends.

The EIA gasoline demand proxy quietly improves, even as the public narrative conflicts with this data.

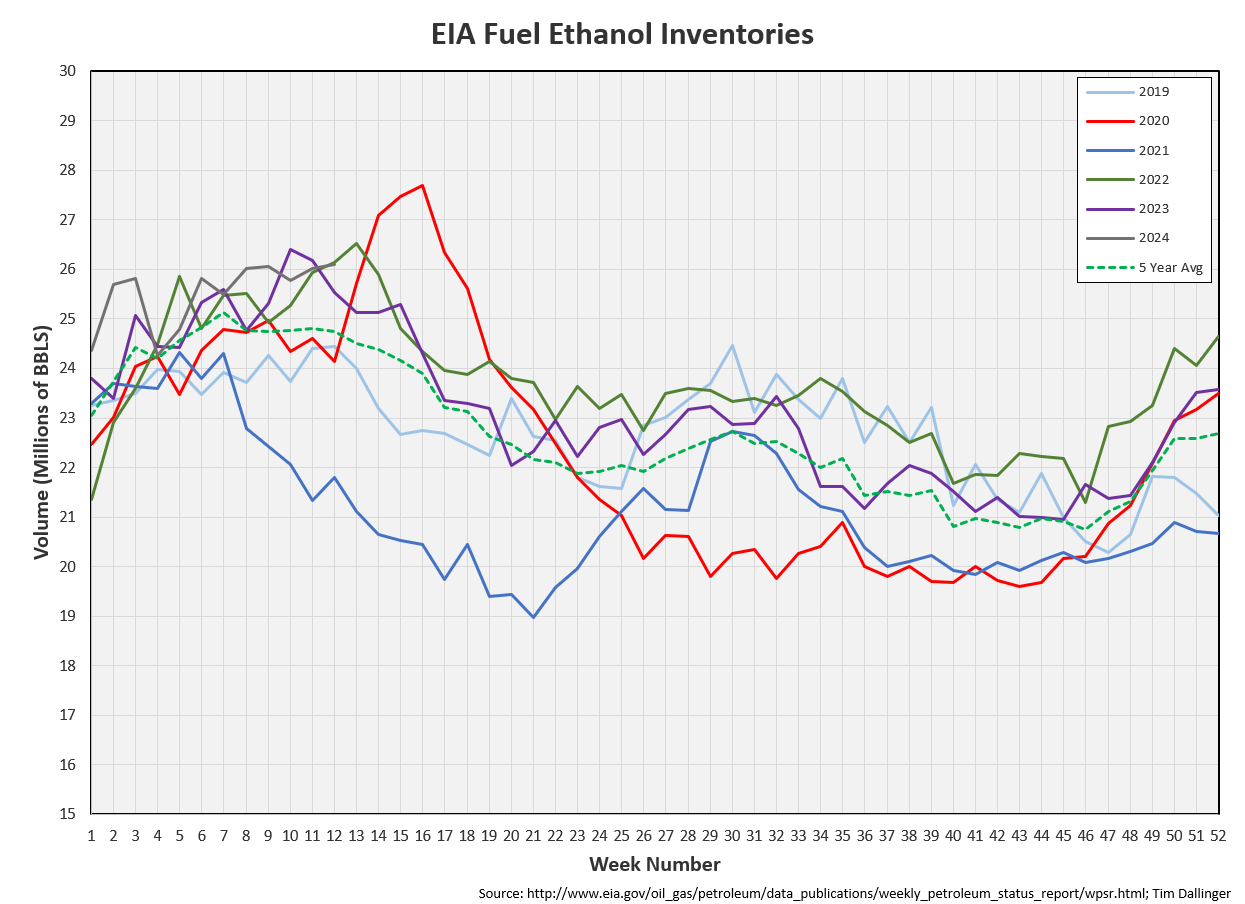

Ethanol

Ethanol is at 2022 levels. Inventories are high.

Distillate

Distillate fuel inventories decreased by 1.2 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels increased by 0.7 MMB. Seasonal jet inventories are above the 5-year average.

Propane

Propane/propylene inventories are flat week-on-week. Inventories are above seasonal averages.

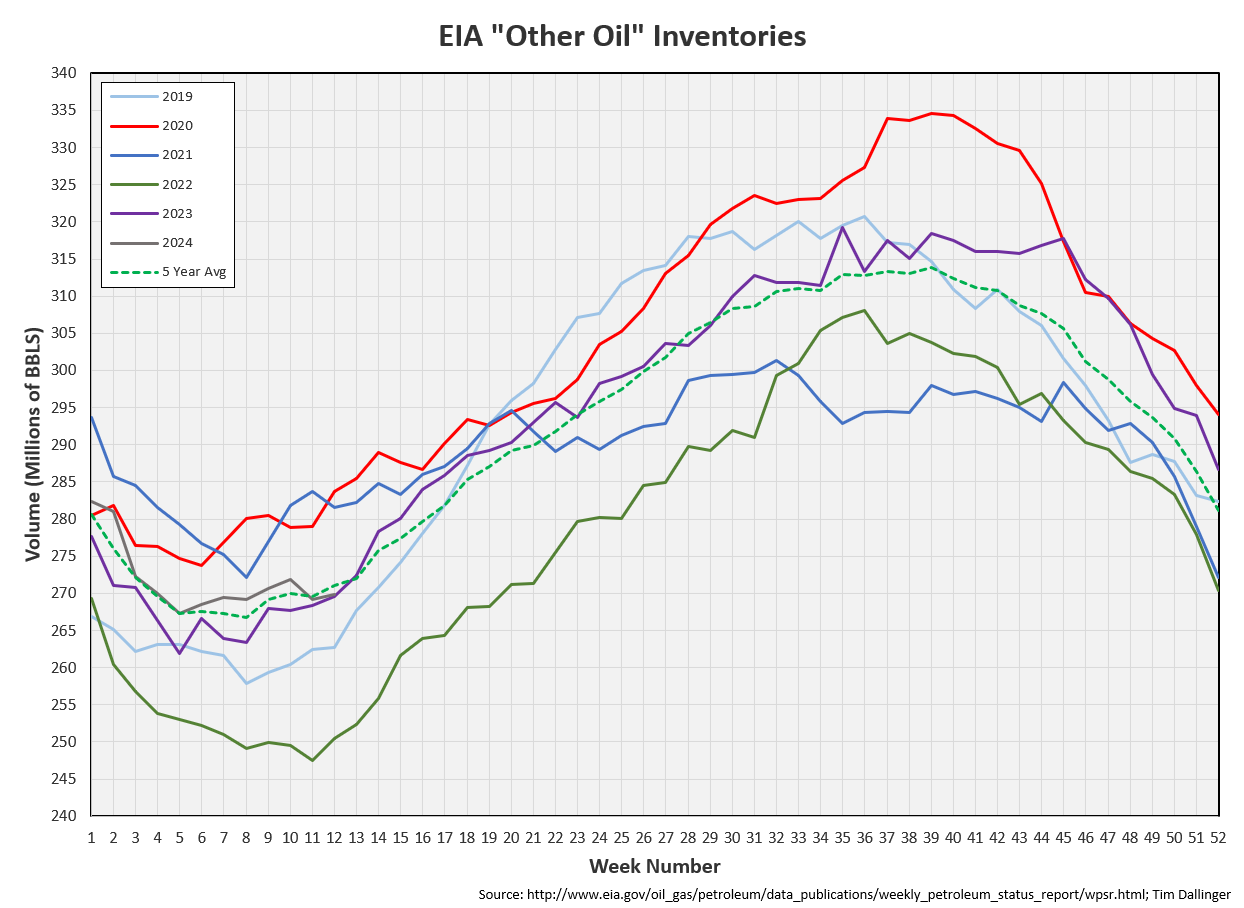

Other Oil

Other oil increased by 0.7 MMB. Other oil inventories are just below seasonal average.

Total Commercial Inventory

Total commercial inventories built by 5.3 MMB, bringing them to 2019 levels.

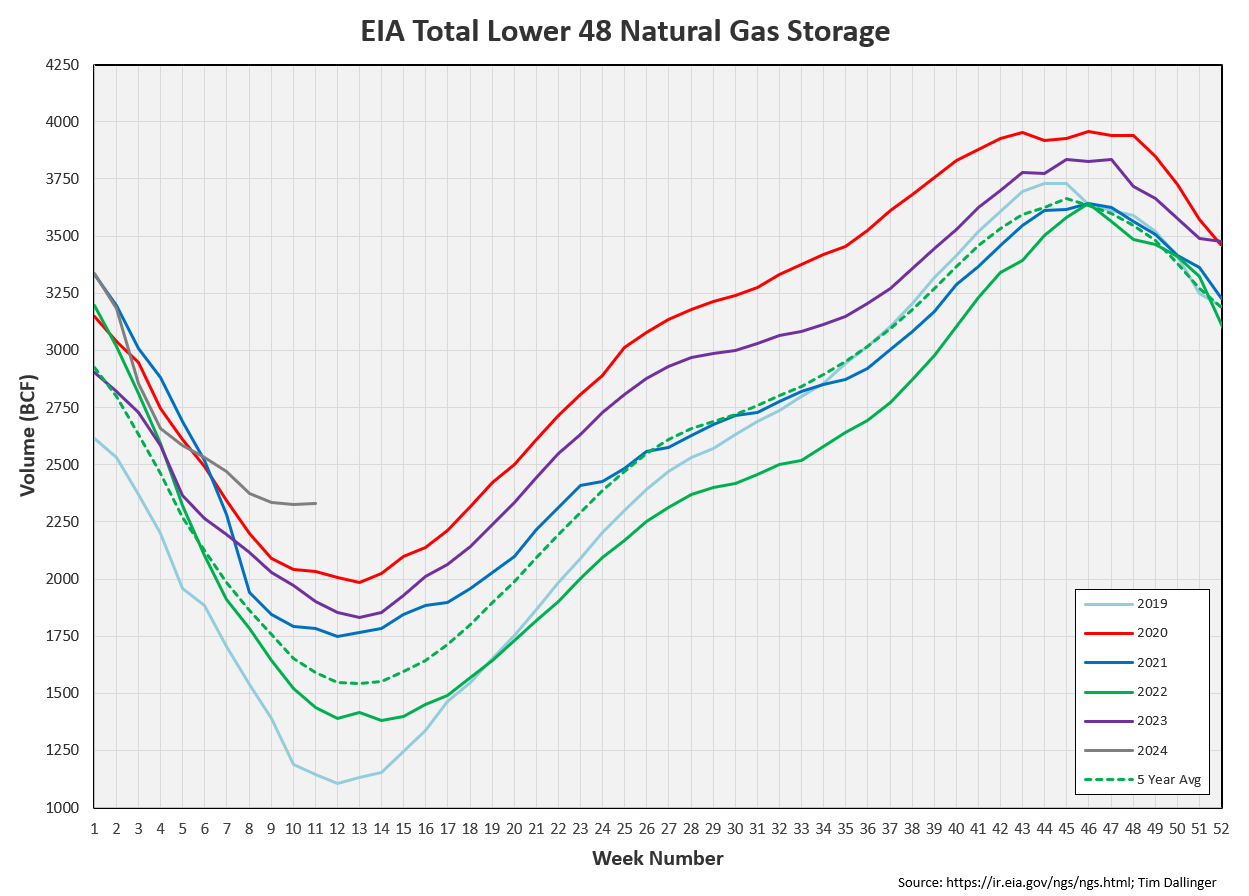

Natural Gas

Natural gas inventories were flat. Storage remains high.

Discussion

US refiner weekly crude input was reported at a seasonal multi-year high. This value should exceed 16 MMB over the summer.

The consumer demand proxy was flat. The market watches this figure so it’s included each week. However, it’s not an accurate measure. Inventories are more relevant.

Transportation inventories build from gasoline. Inventories are still seasonally low.

The 3-2-1 crack spread has fallen. Anything above $90 though is still very profitable for refiners.

Ukraine drones struck another Russian refinery this past weekend. A significant portion of Russian refining capacity is offline. This should drive up global product prices. US product exports will increase, adding additional US product demand.

Crude price action was stronger than anticipated after this report. The physical market still appears tight though.

Spec positioning has increased. For crude prices to rally further, demand must continue to demonstrate strength and inventories tighten further.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Adam Sandler plays Happy Gilmore, the failed hockey player turned professional golfer, in the 1996 American comedy, “Happy Gilmore.”