EIA WPSR Summary for week ending 6-24-24

Summary

Crude:+3.6 MMB

SPR: +1.3 MMB

Cushing: -0.2 MMB

Gasoline: +2.7 MMB

Distillate: -0.4 MMB

Jet: +1.9 MMB

Ethanol: -0.2 MMB

Propane: +2.1 MMB

Other Oil: -1.0 MMB

Total: +8.2 MMB

This was a bearish report, although some of the details seem odd and physical market indicators aren’t expressing similar pessimism.

Spot WTI is currently pricing $80. Prices exceed fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 3.6 MMB. Crude inventories are currently 2% below the seasonal average.

1.3 MMB were added to the SPR. 17.2 MMB have been added to the SPR in 2024. SPR inventories have now been refilled to January 2023 levels.

US crude imports fell back again slightly. They are still above 2024 average imports.

Crude exports also fell. Crude exports are near 2024 average levels.

Unaccounted for crude was up again, nearing 1 MMBD. Independent crude ship trackers are not reporting widely different import or export figures this week so the source of this is unknown. With the addition of the “transfer to crude oil” category, unaccounted for oil should revert to zero.

Cushing

Crude storage in Cushing, OK, drew by 0.2 MMB week on week. Cushing inventories are below average but there’s plenty of available storage for the remainder of the summer.

Gasoline

Total motor gasoline inventories increased by 2.7 MMB and are at the seasonal 5-year average. This build was unexpected but there’s often odd movement around large summer driving holidays. The build should reverse as consumers take the highways for the 4th of July.

The build was in blending components.

Distillate

Distillate fuel inventories decreased by 0.4 MMB last week and are about 9% below the seasonal 5-year average.

Jet

Kerosene type jet fuels built by 1.9 MMBD.

US TSA traveler numbers have been at record high’s for most of 2024.

Global flights and airline miles traveled are also at all-time records.

https://www.airportia.com/flights-monitor/

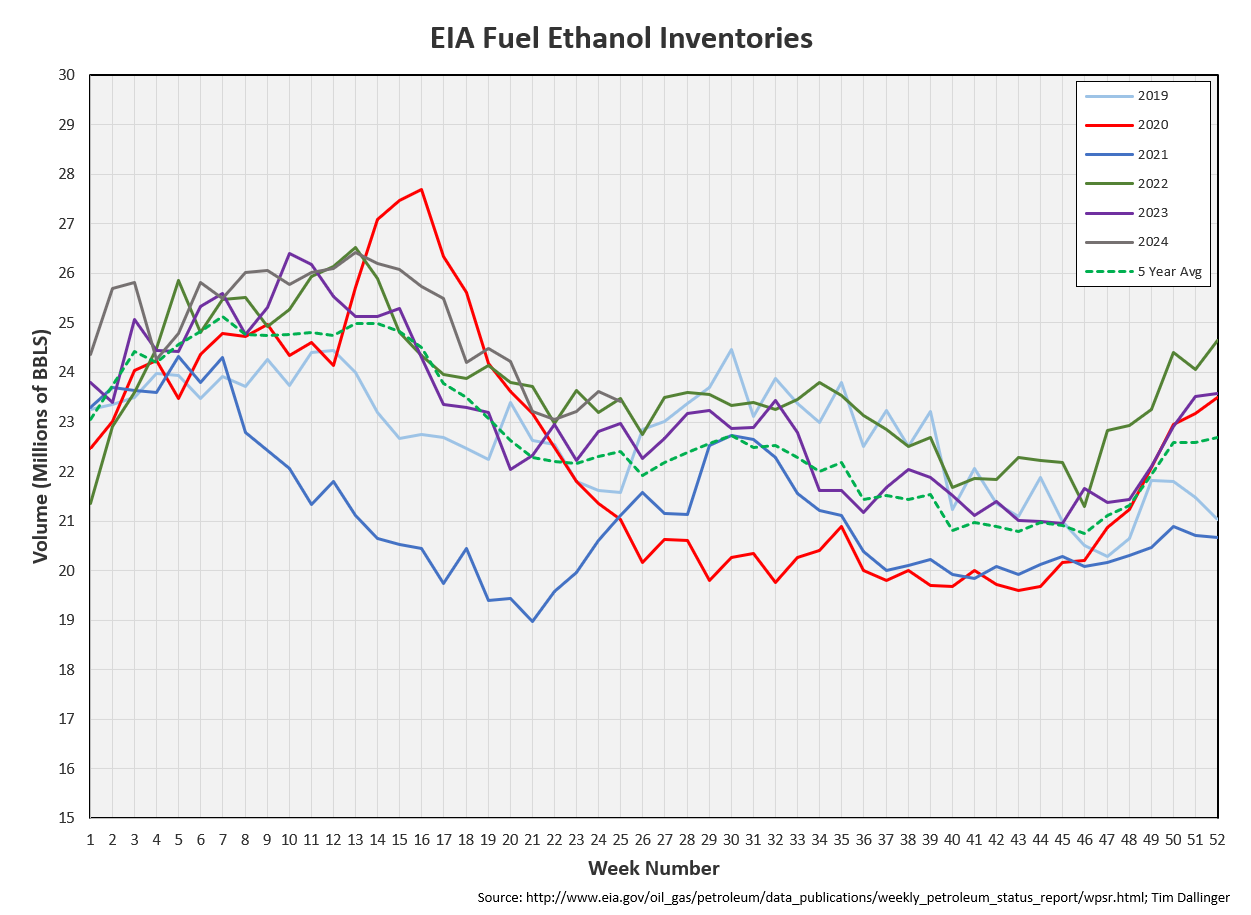

Ethanol

Ethanol inventories decreased 0.2 MMB week-on-week. Inventories are about 5% above seasonal averages.

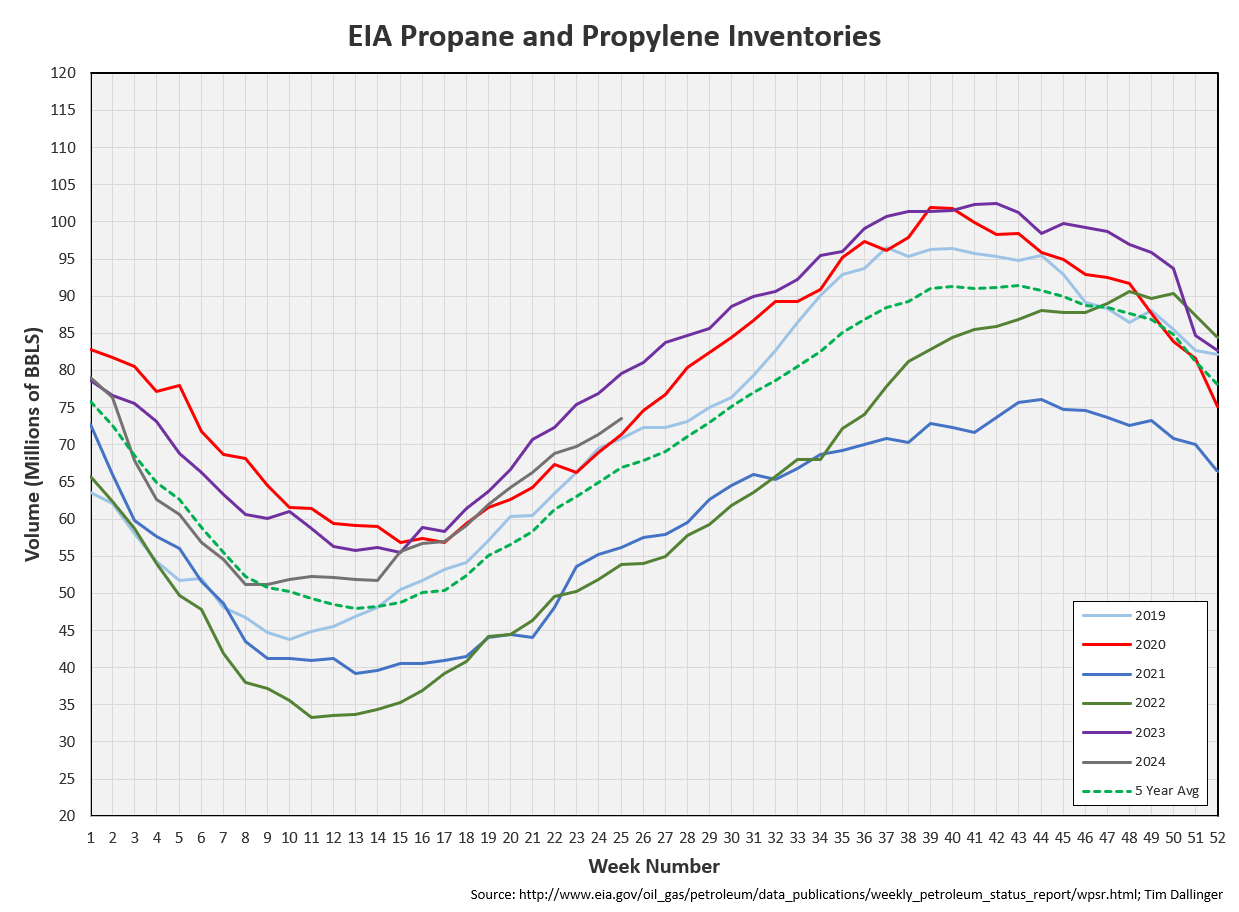

Propane

Propane/propylene inventories increased 2.1 MMB. The build trajectory is lower than previous years. With US production wells experiencing record NGL components, this doesn’t make sense. Perhaps some of these volumes are being counted in the gasoline blending component category.

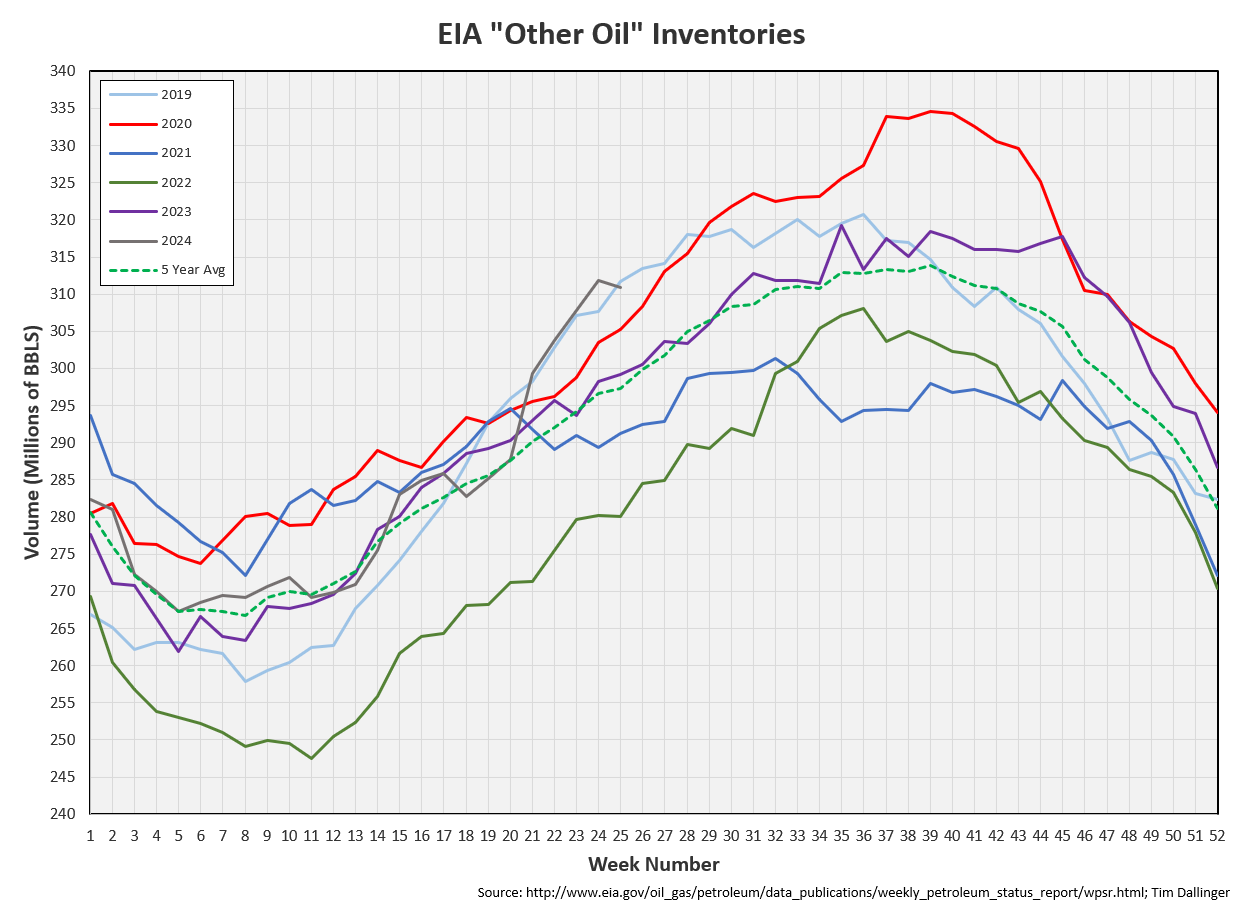

Other Oil

Other oil drew by 1.0 MMBD.

Total Commercial Inventory

Total commercial inventory increased by 8.2 MMB and is slightly above average levels.

Natural Gas

Due to last week’s holiday-delayed EIA WPSR, the natural gas inventory chart is identical. A new EIA gas inventory will be out tomorrow.

Refiners

The amount of crude oil refiners processes last week again fell. It’s still above average levels but reduced from 2019 records.

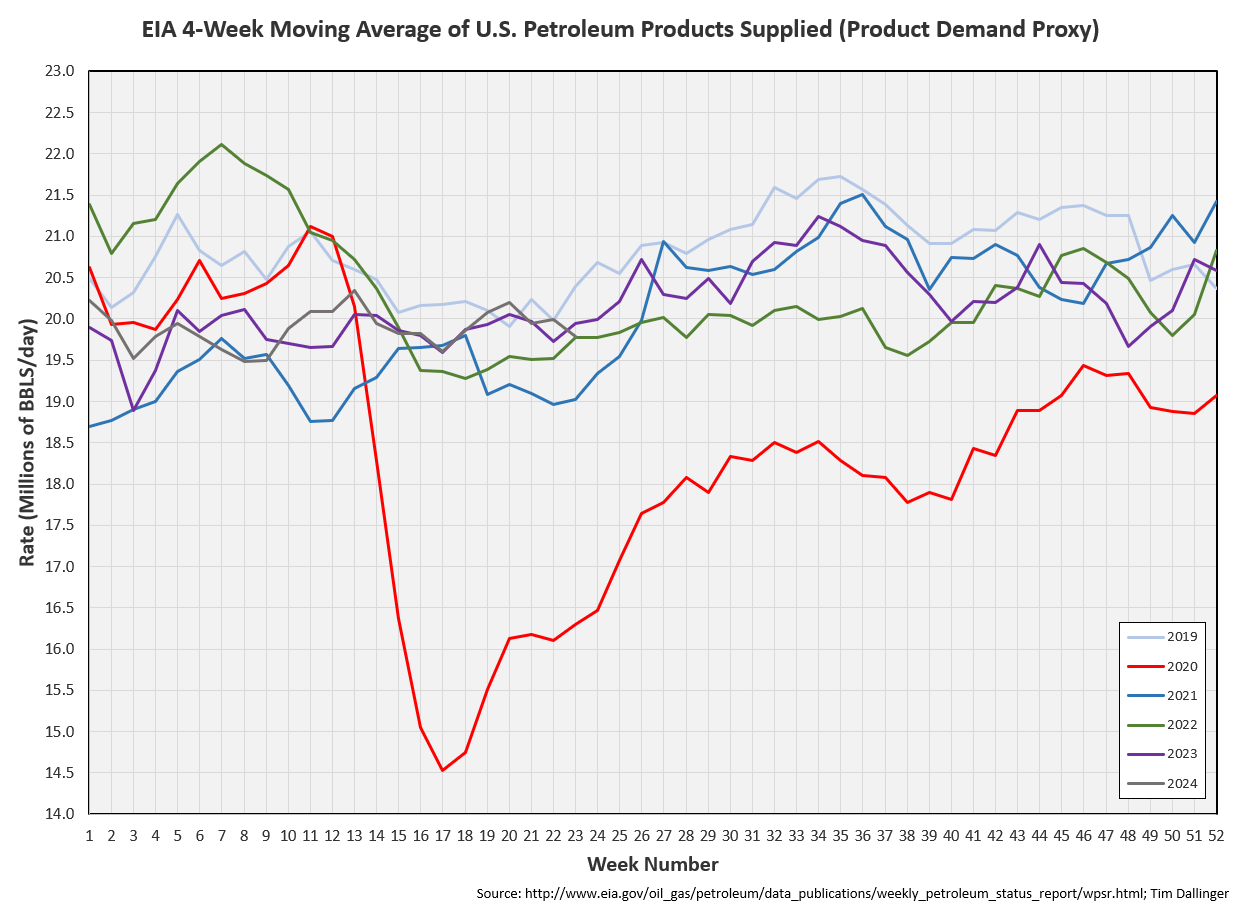

The EIA’s product demand proxy continues to demonstrate low demand. No other demand metrics corroborates this behavior.

Transportation inventories built and appear about average, if the anomalous 2020 is ignored.

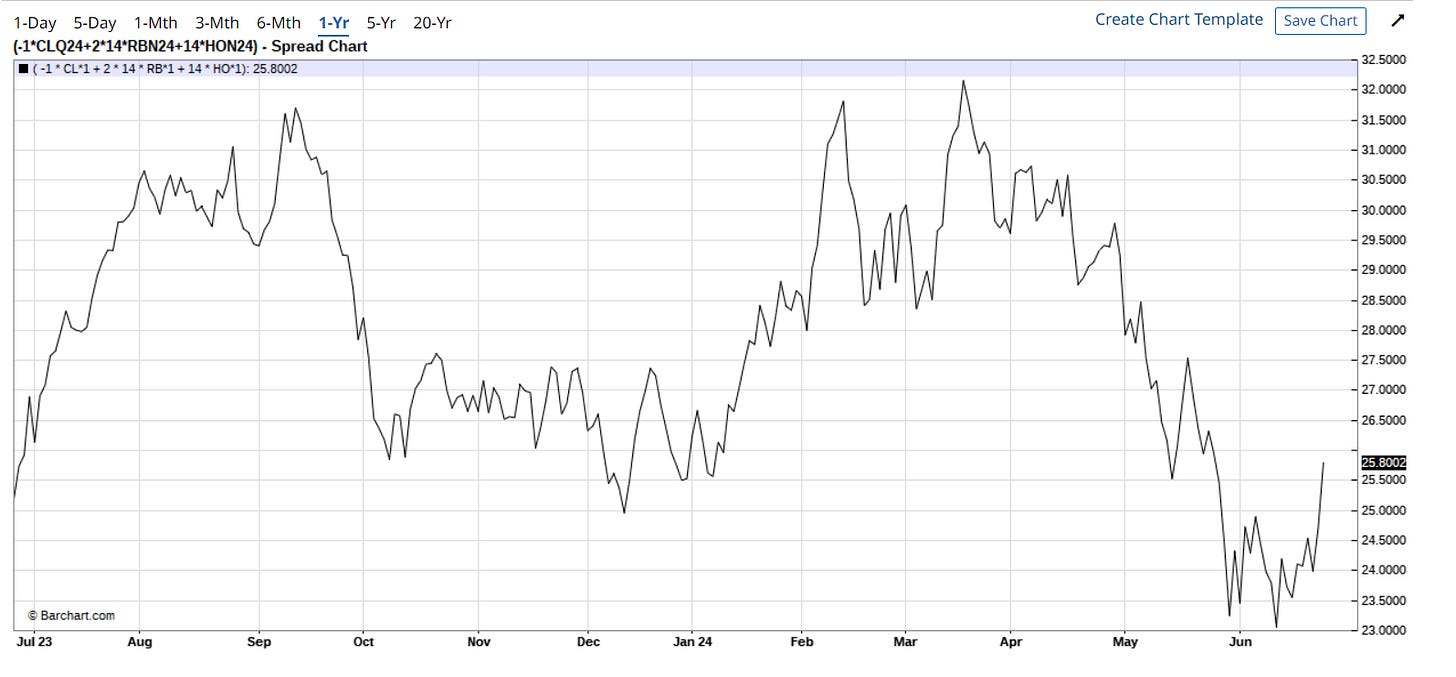

Simple cracks have rebounded and appear healthier. They lag the $30+ mark from earlier in the year but that was near record pricing.

Backwardation on the 1-2 have come in some but remain elevated, suggesting the physical market remains robust. Apparent OPEC exports are down for the entire group.

Discussion

After the recent short covering in crude, prices have remained relatively stable.

The Israeli conflict continues. The Israeli defense minister told the US that Israel is nearing a decision that will affect the entire middle east. Speculation is that direct conflict with Iran is a possibility. Escalation in Lebanon also appears likely. The market is not currently pricing any potential crude oil supply disruptions.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

The earliest appearance of the often-repeated title phrased used here seems to be the 1934 western film, “The Lucky Texan,” staring John Wayn and Barbarba Sheldon.