Summary

Bullish report.

Crude: -4.5 MMB

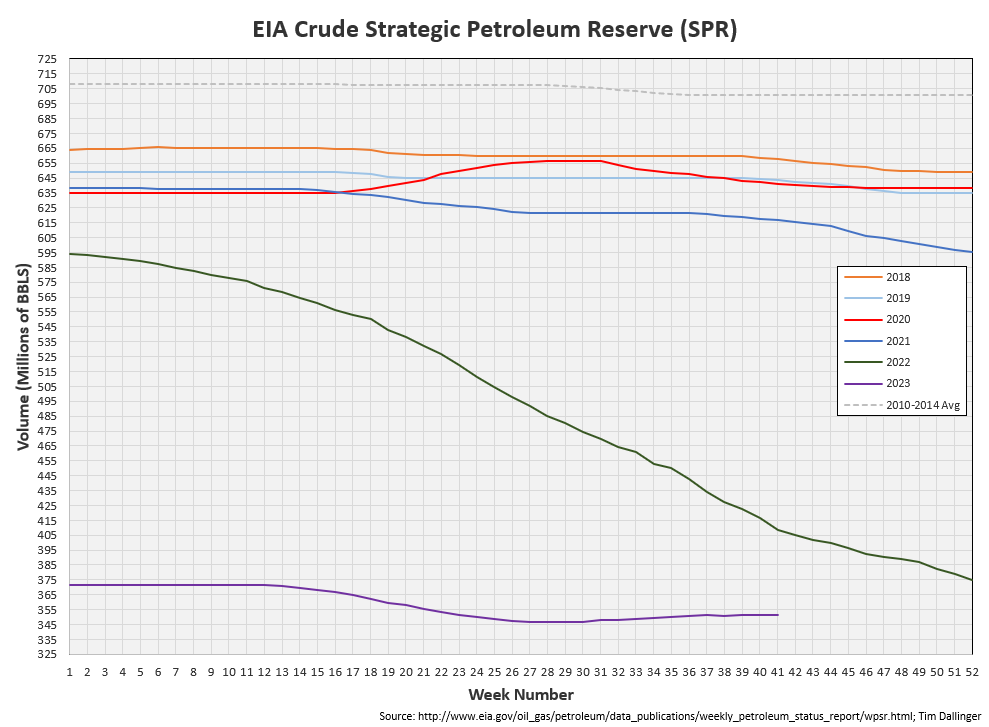

SPR: 0 MMB

Cushing: -0.8 MMB

Gasoline: -2.4 MMB

Ethanol: -0.4 MMB

Distillate: -3.2 MMB

Jet: +0.1 MMB

Other Oil: -1.5 MMB

Total: -11.9 MMB

Spot WTI is currently pricing $88. This is fair value, based on price model derived from reported EIA inventories.

Crude

U.S. commercial crude oil inventories decreased by 4.5 MMB from the previous week. At 419.7 million barrels, U.S. crude oil inventories are about 5% below the seasonal 5-year average for this time of year.

SPR was again unchanged this week. Another 1.2 MMB additions are planned for 2023.

US crude imports remain low.

This was the third lowest on record for Saudi Arabian crude imports. Saudi has not waivered in their guidance to reduce to reduce flows.

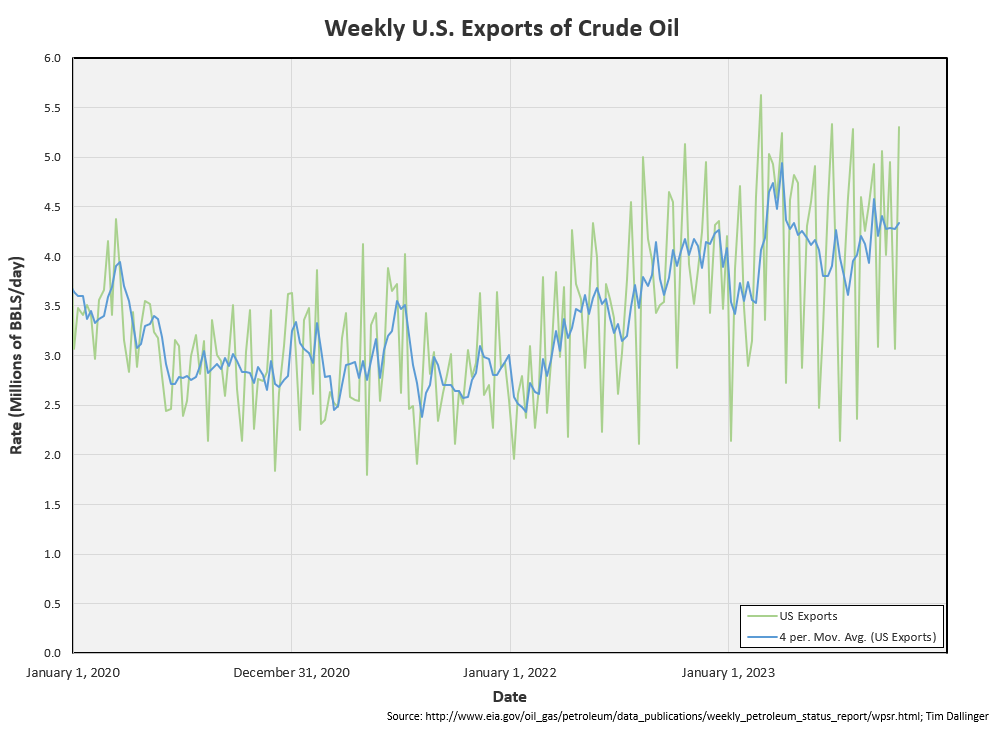

US exports surged back over 5 MMBD. Independent ship trackers show that this was overstated.

High exports were not expected with the decreased WTI Brent differential. It appears there are still some favorable arbitrage opportunities at a $3.20 differential. US refiners will need to bid WTI higher to keep it from being sent to the gulf and exported.

Unaccounted for oil jumped from its low value last week, due the overcounting in US exports.

Cushing

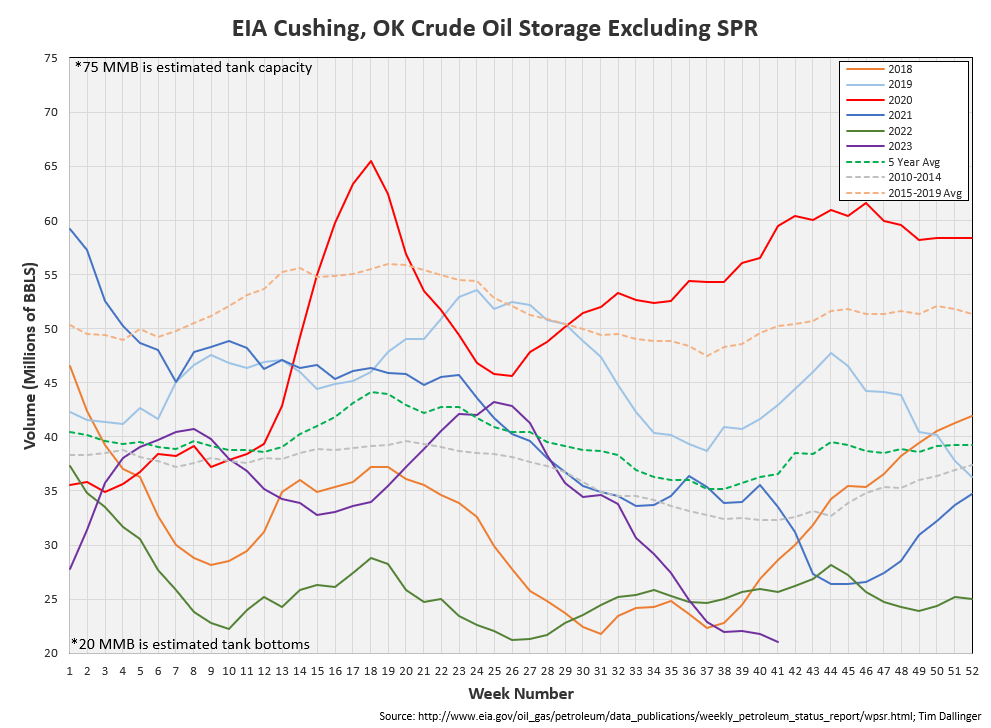

Cushing drew by 0.8 MMB. Total Cushing volume sits at 21.8 MMB. That’s a new low in recent years. At 21 MMB total inventory, Cushing is getting close to its operational limits. A price spike on the front contract is possible should a shipper be unable to deliver on a physical contract.

Gasoline

Total motor gasoline inventories decreased by 2.4 MMB and are slightly above the seasonal five-year average.

Ethanol

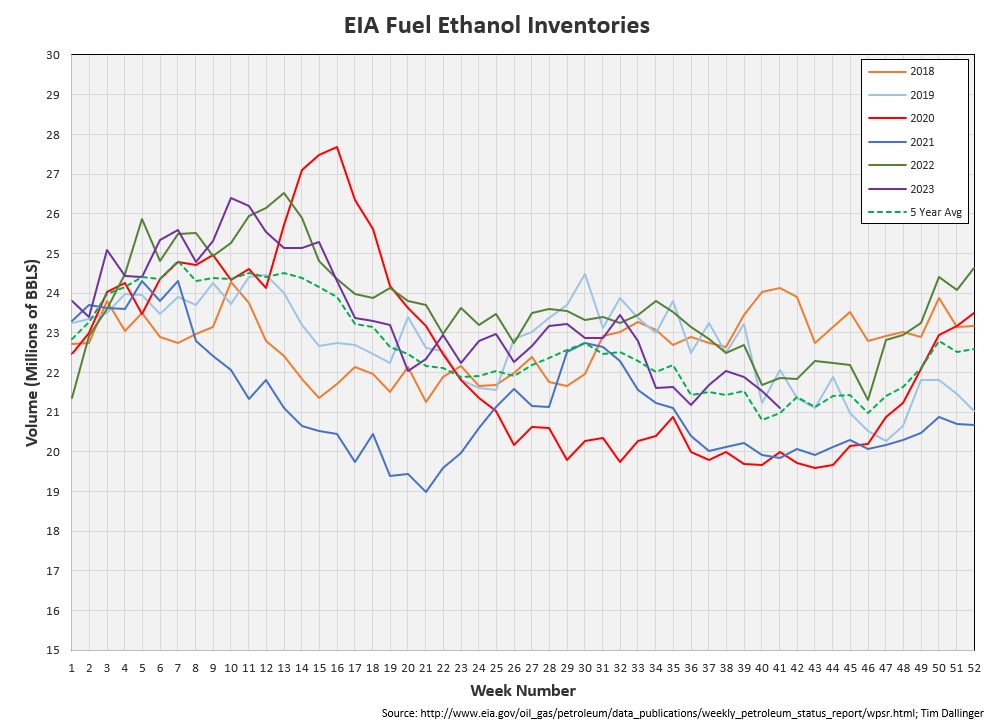

Ethanol inventories drew by 0.4 MMB, resulting in volumes at the five-year average.

Distillate

Distillate fuel inventories decreased by 1.8 MMB and are about 11% below the seasonal five-year average.

While inventories are universally low, there are pockets of more concern. PADD 1 is most concerning.

Specifically, New England inventories are extremely low.

The Northeast is forecasted to experience mild weather in the near term so heating oil demand shouldn’t be considerable yet. This could be an escalating issue soon.

Jet

Kerosene type jet increased by 0.1 MMB. Inventories are above average.

Total mile traveled by air are still tracking record seasonal levels, although total number of flights have fallen back.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories increased by 0.8 MMB from last week and are 18% above the seasonal 5-year average. Seasonal heating demand hasn’t yet increased.

Other Oil

Other oil drew 1.5 MMB. Other oil will continue drawing into year-end.

Total Commercial Inventory

Total commercial petroleum inventories decreased by 11.9 MMB.

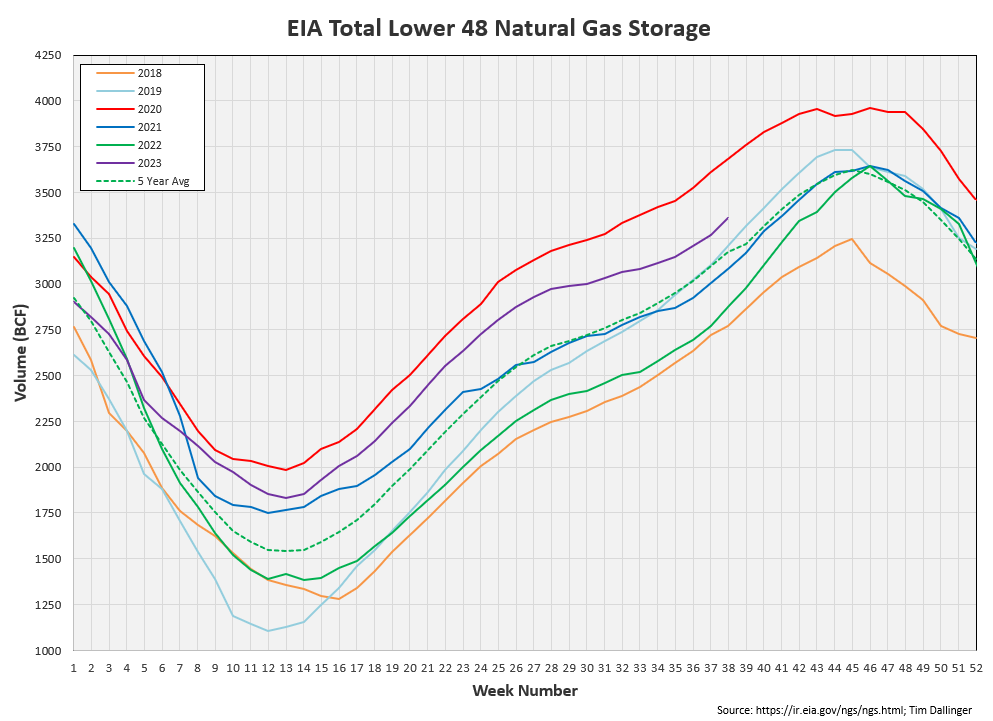

Natural Gas

Natural gas inventories remain high. Another month of builds are expected.

Discussion

Refiner maintenance season continues, although crude processed jumped back a bit. Turn-around should wind down within the next 2 weeks.

The EIA’s product demand proxy jumped higher. The market focuses on gasoline weakness. It will be interesting to see what the US refiners say about demand during their approaching Q3 quarterly conference calls.

Transportation inventories are drawing during turn-around, as expected.

The simple 321 crack spread has rebounded off its recent bottom. While these aren’t the record crack recently experienced, refinery runs shouldn’t need to be cut if prices maintain this level. Distillate cracks remain favorable.

Turmoil in the middle east continues. Tensions remain high across the region. Escalation feels inevitable. Currently, the conflict remains primarily contained to the Gaza strip. The market is not pricing significant geopolitical premium. Due to global recessionary pressures, traders remain hesitant to bid crude until signs of actual physical disruption occur.

The world is still in a supply deficit due to OPEC cuts. Oil-on-water continues to draw, leaving less buffer for any reduced flows.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

“Under Pressure” is a 1981 rock song composed in collaboration by Queen and David Bowie.

Good work, TIm.