EIA WPSR Summary for week ending 2-21-25

Summary

Crude: -2.3 MMB

SPR: 0.0 MMB

Cushing: +1.3 MMB

Gasoline: +0.4 MMB

Distillate: +3.9 MMB

Jet: +0.7 MMB

Ethanol: +1.4 MMB

Propane: -3.7 MMB

Other Oil: -3.3 MMB

Total: -2.2 MMB

This is an odd report across a multitude of categories. There were weather-related impacts that don’t appear to be captured in this week’s data.

Spot WTI is currently pricing $68. Prices are below estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 2.3 MMB. Crude inventories are currently 4% below the seasonal average.

0.0 MMB were added to the SPR. This is the second week in a row with no SPR deposition. All the barrels previously purchased may have been delivered. It’s difficult to determine the magnitude of the original purchase because the Biden Administration issued several conflicting announcements and actual purchases were difficult to reconcile with government guidance. It has not yet been reported that the Trump administration has purchased any additional barrels.

US crude imports hit a 2025 low last week. Most imports arrive from Canada so tracking ships isn’t very helpful for import estimates. The cold should not have affected Canada. Pipelines rarely are impacted by even the most harsh weather conditions.

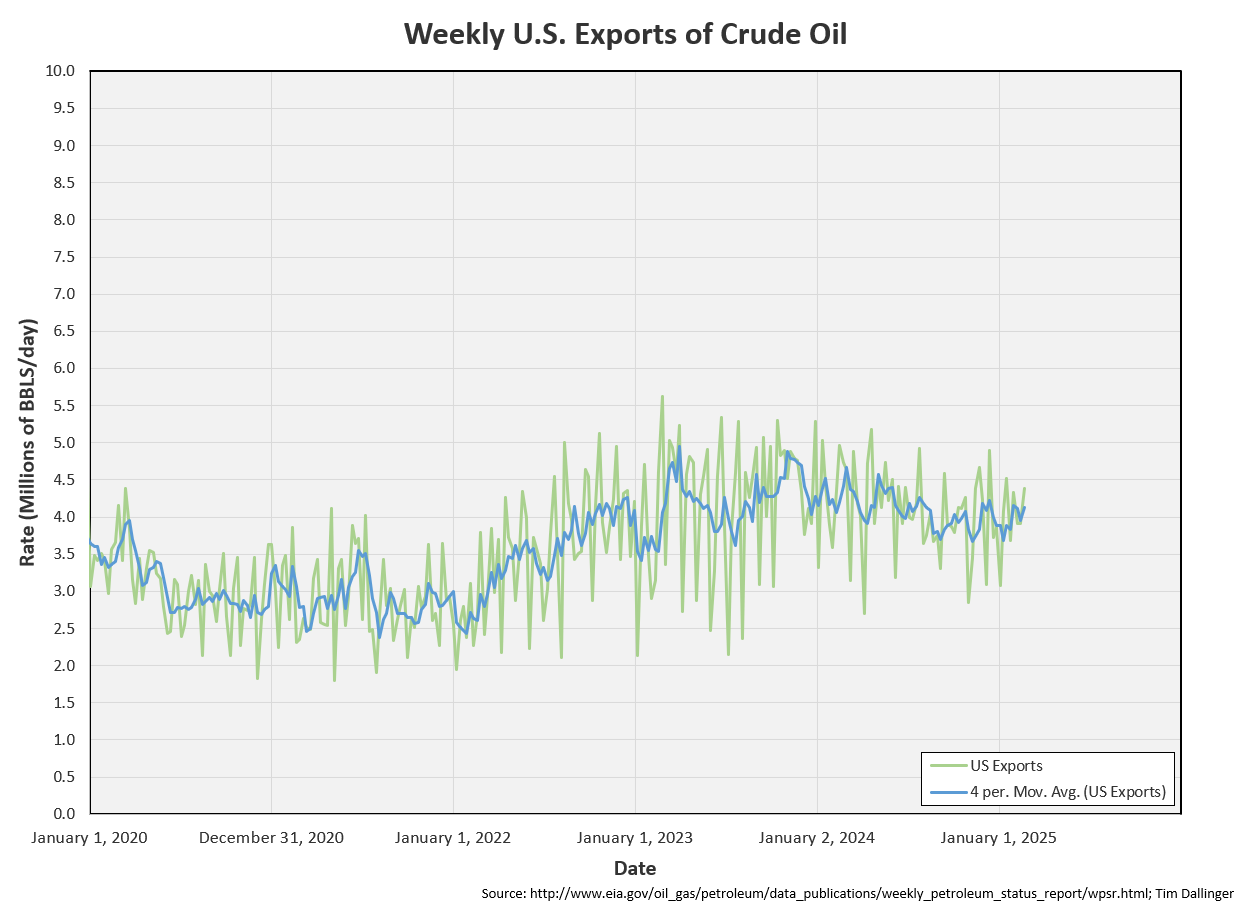

Crude exports were up. The value reported here by Customs matches the export volume predicted by independent ship trackers.

Unaccounted for crude fell but remains positive. This suggests EIA undercounted production or missed imports.

The EIA is not undercounting production. They showed US production increased in a weekly where West Texas had 2 days of freezing issues. Production should have declined.

Cushing

Crude storage in Cushing, OK, built by 1.3 MMB week on week. Inventories have built back to 2022 levels.

Gasoline

Total motor gasoline inventories increase by 0.4 MMB and are just below the seasonal 5-year average. As one can see from the chart, gasoline never builds this early in the year. This data is suspect.

Blending components increased, suggesting “other oil” is being classified as winter blend gasoline.

Distillate

Distillate fuel inventories increased by 3.9 MMB last week and are about 8 below the seasonal 5-year average. That’s a massive build for a week when heating oil demand would have been substantial. Refineries are running again but still, that’s an anomalous, significant build to the normal seasonal trend.

Jet

Kerosene type jet fuels increased by 0.7 MMB.

And yet, the EIA jet fuel demand proxy hit a seasonally record value.

Ethanol

Ethanol inventories increased 1.4 MMB week-on-week to record levels. Inventories are above seasonal averages.

Propane

Propane/propylene inventories drew by 3.7 MMB, which is the average seasonal rate. Again, this seems odd as parts of the country that rely primarily on propane for heat, experienced several days of blistering cold.

Other Oil

Other oil drew by 3.3 MMB.

Total Commercial Inventory

Total commercial inventory drew by 2.2 MMB. Inventories remain below average.

Natural Gas

The chart presented for natural gas inventories is identical the one in last week’s report, as last week’s WPSR was delayed due to the Monday holiday. Updated natural gas inventories are released by the EIA tomorrow.

Refiners

Refining jumped. Refiners are wrapping up turn-around season early. Utilization should ramp into summer driving season.

The EIA’s product demand proxy is down from records but still relatively high from a seasonal perspective.

Transportation inventories increased across the board. Even with refiners ramping, inventories should have drawn unless demand is impacted. However, there are no external signs of poor demand.

Simple cracks fell with the increase of product. If demand remains robust, this should be temporary.

Discussion

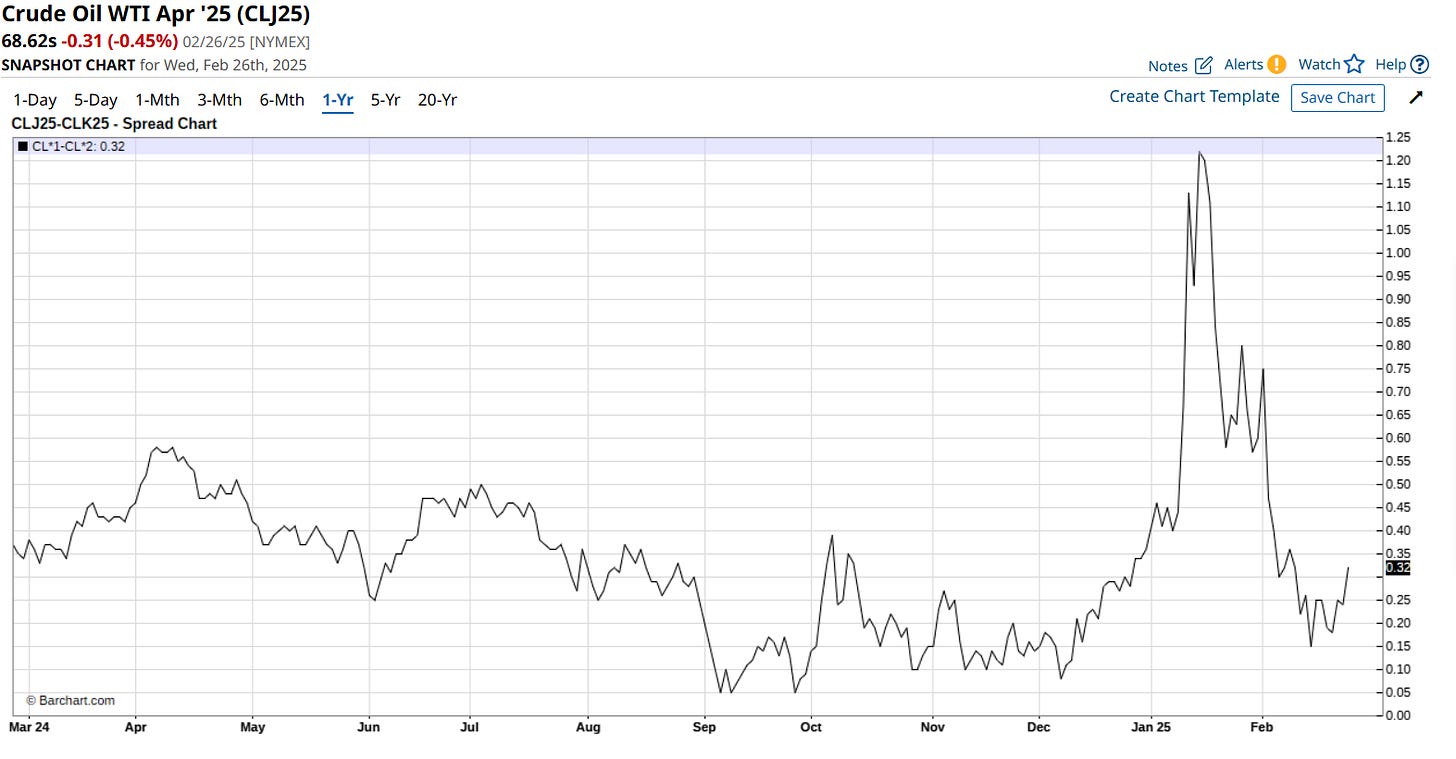

Both WTI and Brent remain backwarded. There’s no sign of over-supply.

Spot prices fell below $70 this week, reportedly on fear of OPEC oversupply, weak demand, increased US production, increased Russian production.

This report didn’t help to answer any questions. Crude production should have been impacted by weather and products should have drawn seasonally, aided by additional heating demand. Refineries are ramping early, but it should not have been enough to offset the expected draws. Further data is needed to asses whether normal trends are changing but this was bearish versus expectations.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Adult Josh Baskin, portrayed by Tom Hanks, expresses confusion during an executive meeting in the 1988 American comedy film, “Big.”