EIA WPSR Summary for week ending 1-17-25

Summary

Crude: -1.0 MMB

SPR: +0.2 MMB

Cushing: -0.1 MMB

Gasoline: +2.3 MMB

Distillate: -3.1 MMB

Jet: +0.1 MMB

Ethanol: +0.9 MMB

Propane: -3.7 MMB

Other Oil: +0.4 MMB

Total: -4.1 MMB

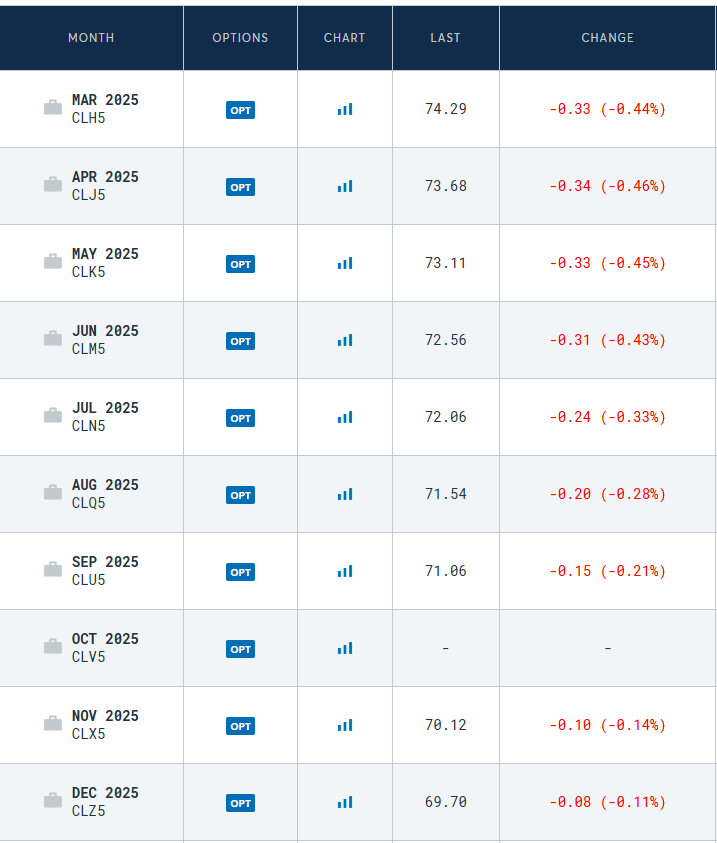

Spot WTI is currently pricing $74. After last week’s rally, prices have fallen, again diverging from estimated fair value based on a price model derived from reported EIA inventories.

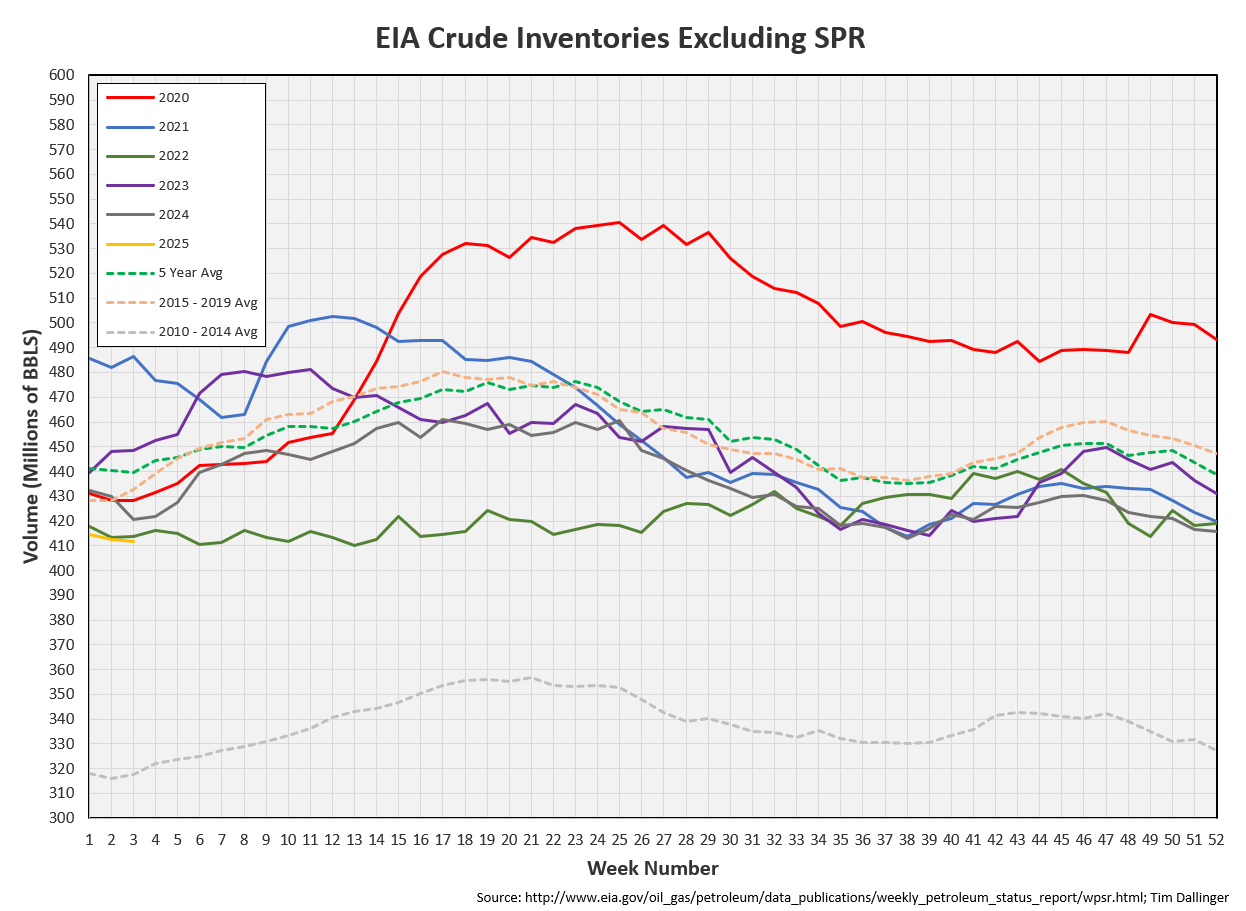

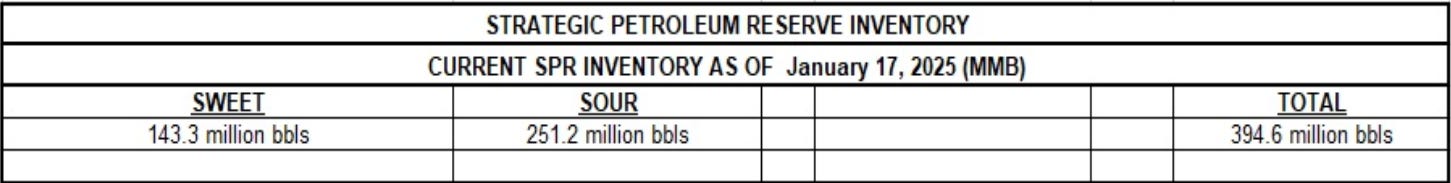

Crude

US Crude oil supply drew by 1.0 MMB. Crude inventories are currently 6% below the seasonal average, the lowest they’ve been seasonally since 2018.

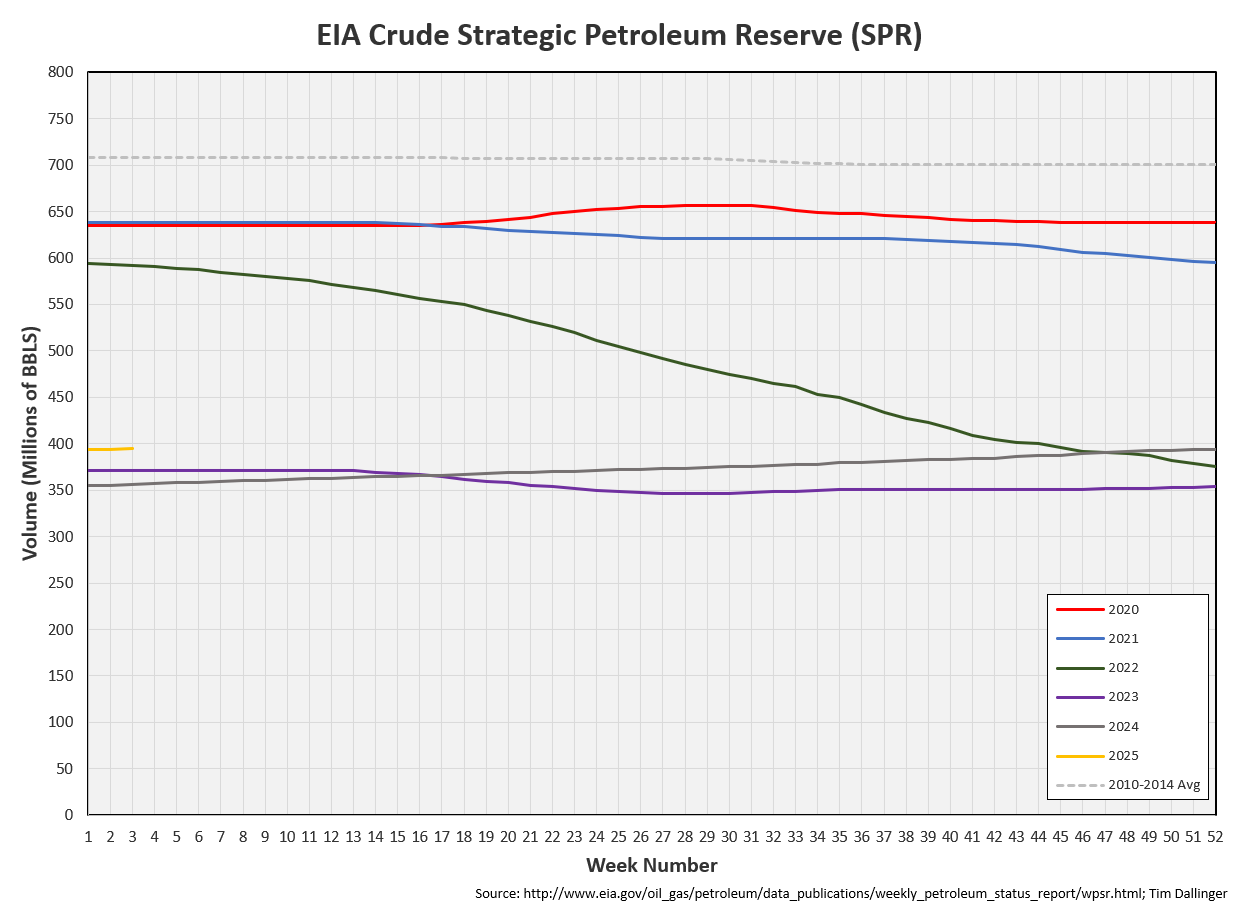

0.2 MMB were added to the SPR.

President Trump made comments this week about refilling the SPR. The SPR has been drawn down 332 MMB from the peak. Refilling that would take years, especially as it makes the most sense to store heavy sour barrels because the US produces excess light, sweet.

US crude imports were above average.

US crude exports were also high.

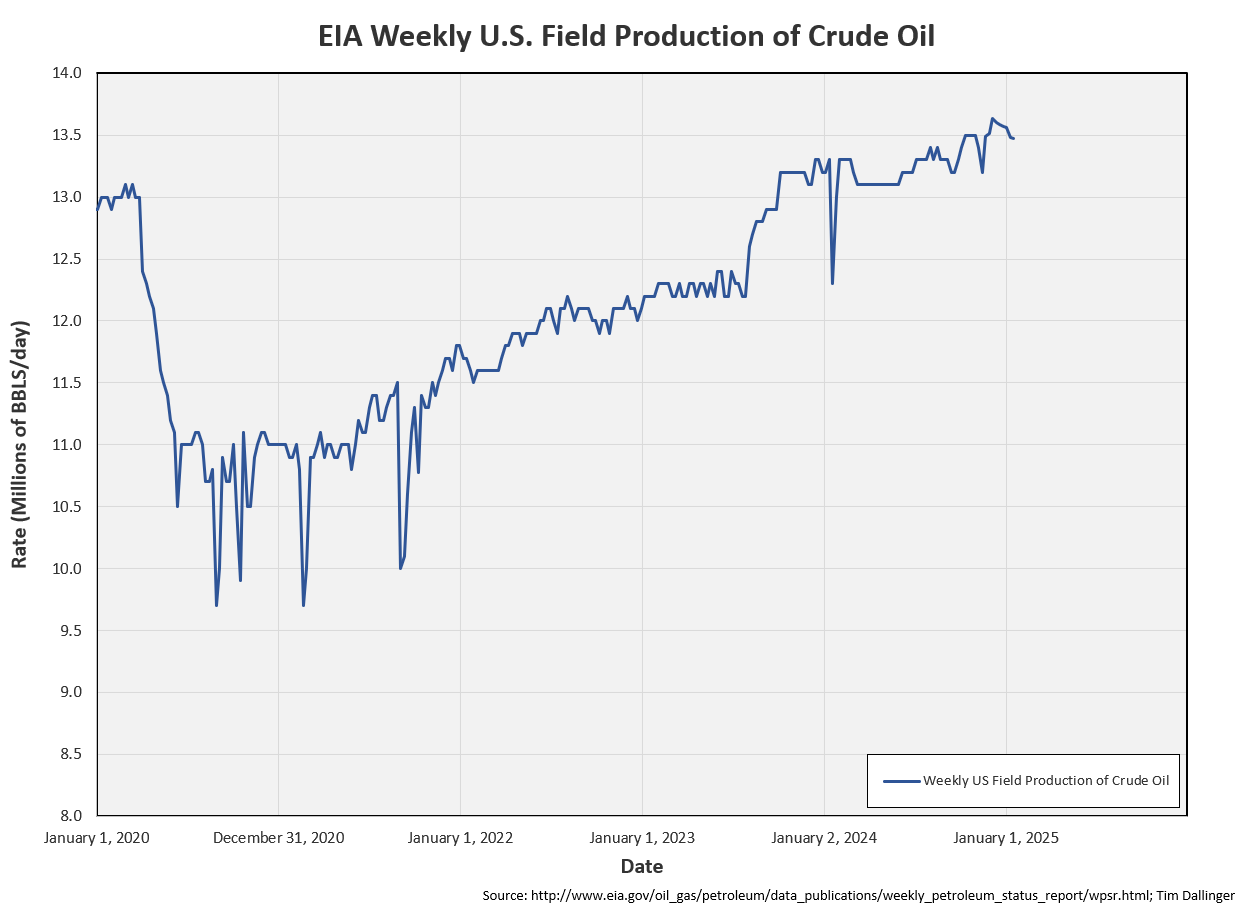

Unaccounted for crude fell to almost -1 MMB. US production experienced some weather-related outages although that doesn’t appear to have been captured. That can explain the large negative adjustment. Next week’s report will have similar issues as the Gulf coast experienced snow.

US production appears to be overcounted this week. However, that’s temporary, due to weather conditions, not natural decline.

Cushing

Crude storage in Cushing, OK, drew by 0.1 MMB week on week. Cushing remains near its operational minimum.

Gasoline

Total motor gasoline inventories increased by 2.3 MMB and are about 1% below the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 3.1 MMB last week and are about 6% below the seasonal 5-year average.

Jet

Kerosene type jet fuels built 0.1 MMBD. Global jet fuel demand appears to be at seasonal records. New data sources are still being vetting before they included in this publication.

Ethanol

Ethanol inventories increased by 0.9 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories drew by 3.7 MMB, due to the cold weather. Inventories are above average but that was a significant draw. Expect similar movement next week.

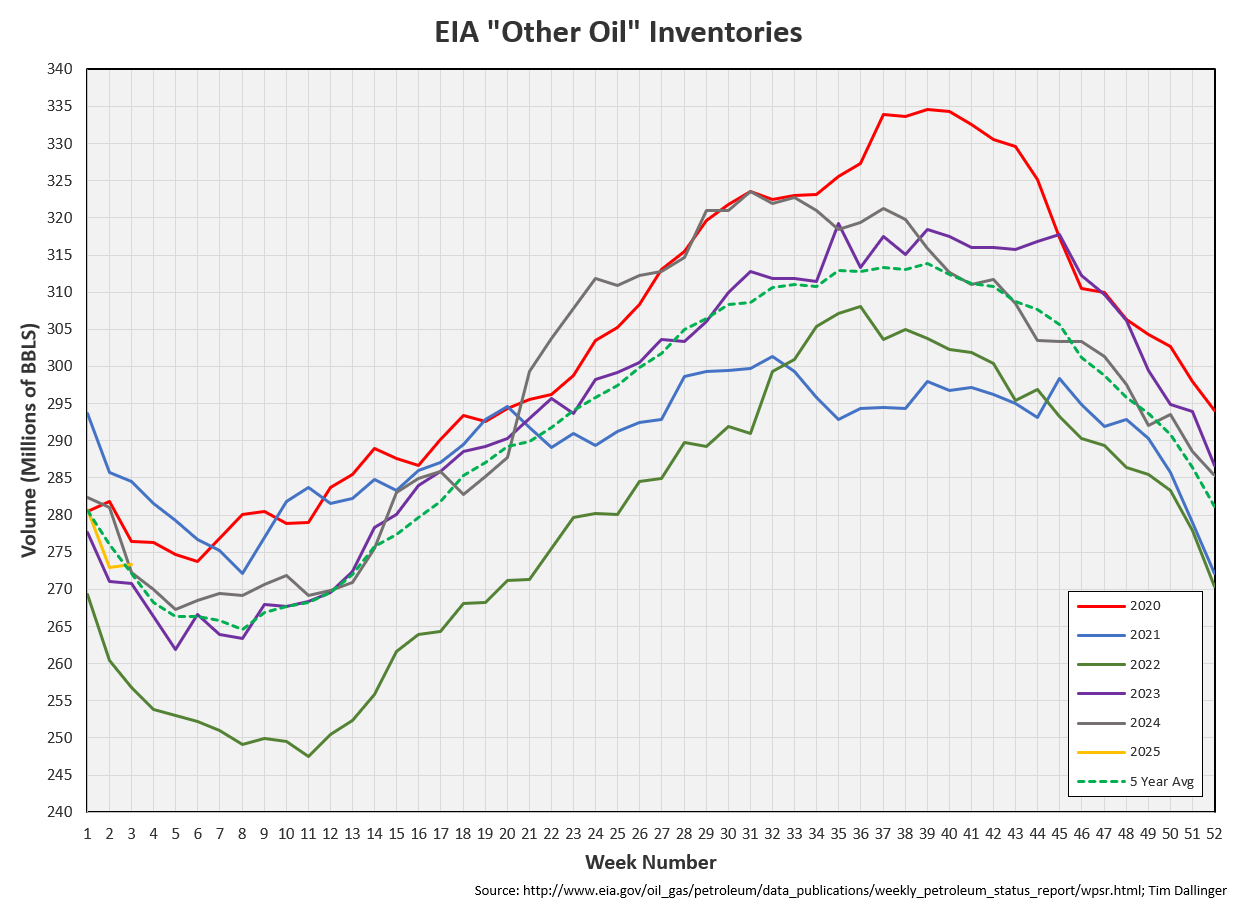

Other Oil

Other oil increased by 0.4 MMB. This should be anomalous. Draws should resume next week. Other oil inventories are right at seasonal averages.

Total Commercial Inventory

Total commercial inventory drew by 4.1 MMB and are below the seasonal 5-year average.

Natural Gas

Natural gas inventories drew considerably, boosting price. The cold weather power burn is the primary driver.

The US Gulf coast experienced unprecedented snowfall since 1899. Florida and the Northeast will be cold for the next several days but then temperatures should rise. It’s too early to predict February patterns.

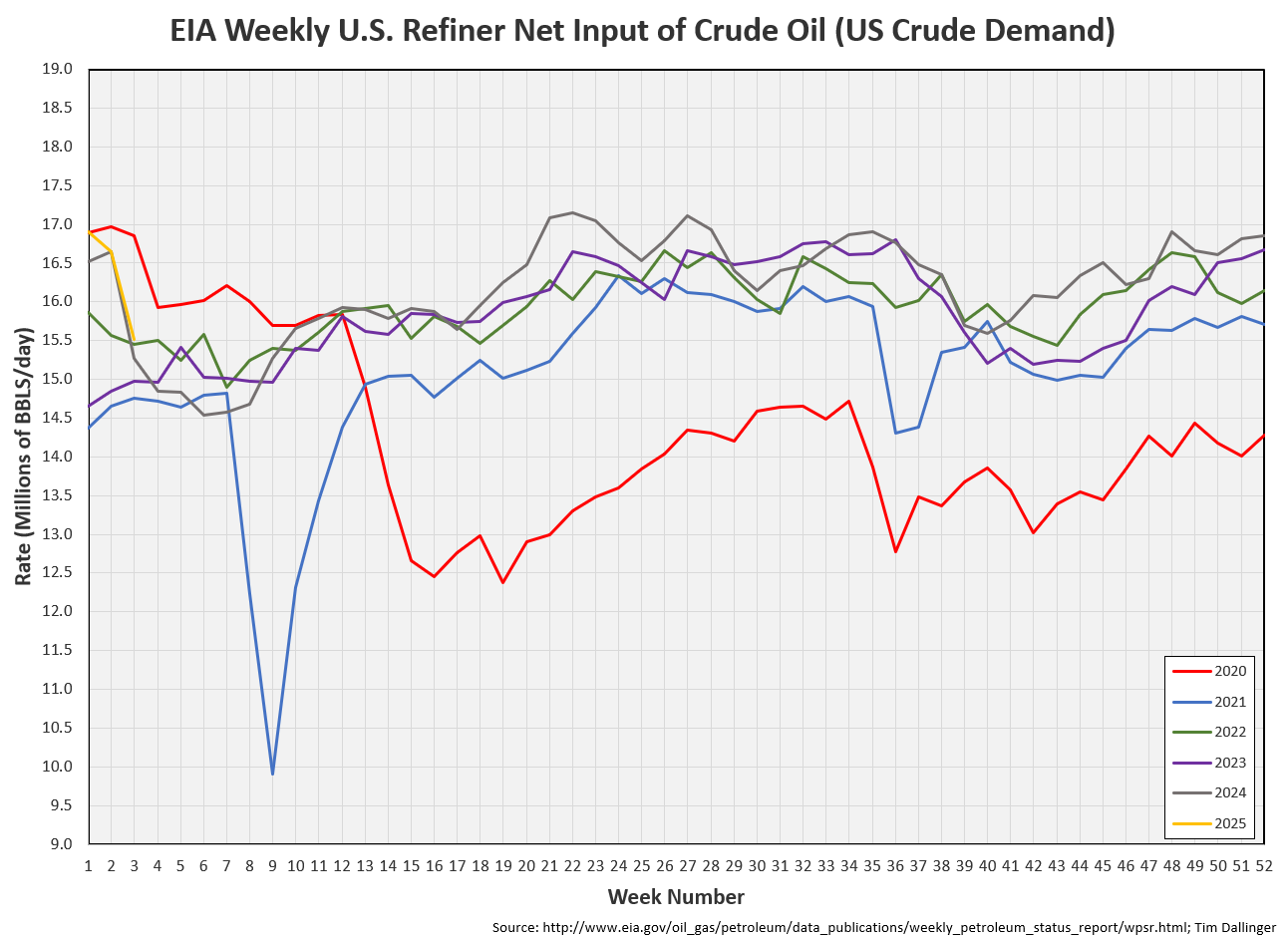

Refiners

The amount of crude oil refiners processed last week fell. This was due to some weather outages and normal seasonal trends. Next week will show similar issues as the Gulf refiners struggled to remain online through the snow.

The EIA’s product demand proxy also fell. It remains near the seasonal average range.

Transportation inventories fell. They remain significantly below seasonal averages.

Critical inventories have only been seasonally lower at the start of 2022.

Simple cracks gain a little more strength week-on-week.

Discussion

The WTI futures curve did flatten out slightly today, although it remains steeply backwarded.

Backwardation in Middle Eastern heavy grades are even steeper as India and China scramble to replace sanctioned Russian barrels. Sanctions have been mostly bluster so the market ignores them. But these are changing the physical market. Global inventories continue to draw.

Potential Trump tariffs remain a focus with rumors they could be as high as 25% and include Canadian energy. A significant portion of Enbridge’s mainline volume lands at the BP Whiting refinery. It’s the largest refinery in the Midwest, producing around 10 million gallons of gasoline, 4 million gallons of diesel and 2 million gallons of jet fuel daily, as well as 7% of all US asphalt.

Line 5 supplies Michigan crude oil.

A tariff on Canadian crude would be passed onto to consumers, increasing retail energy prices. As energy prices have been a perennial focus for President Trump, it seems unlikely that these tariffs will be enacted. Negotiations seem more likely and both sides can claim victory. Until there is more clarity though, expect volatility.

Source: RBN Energy

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Officer Thorny gives some teenagers a hard time at a traffic stop in the 2001 American Comedy film, Super Troopers.

My favorite scene from Super Troopers 😆