EIA WPSR Summary for week ending 4-19-24

Summary

Bullish report.

Crude: -6.4 MMB

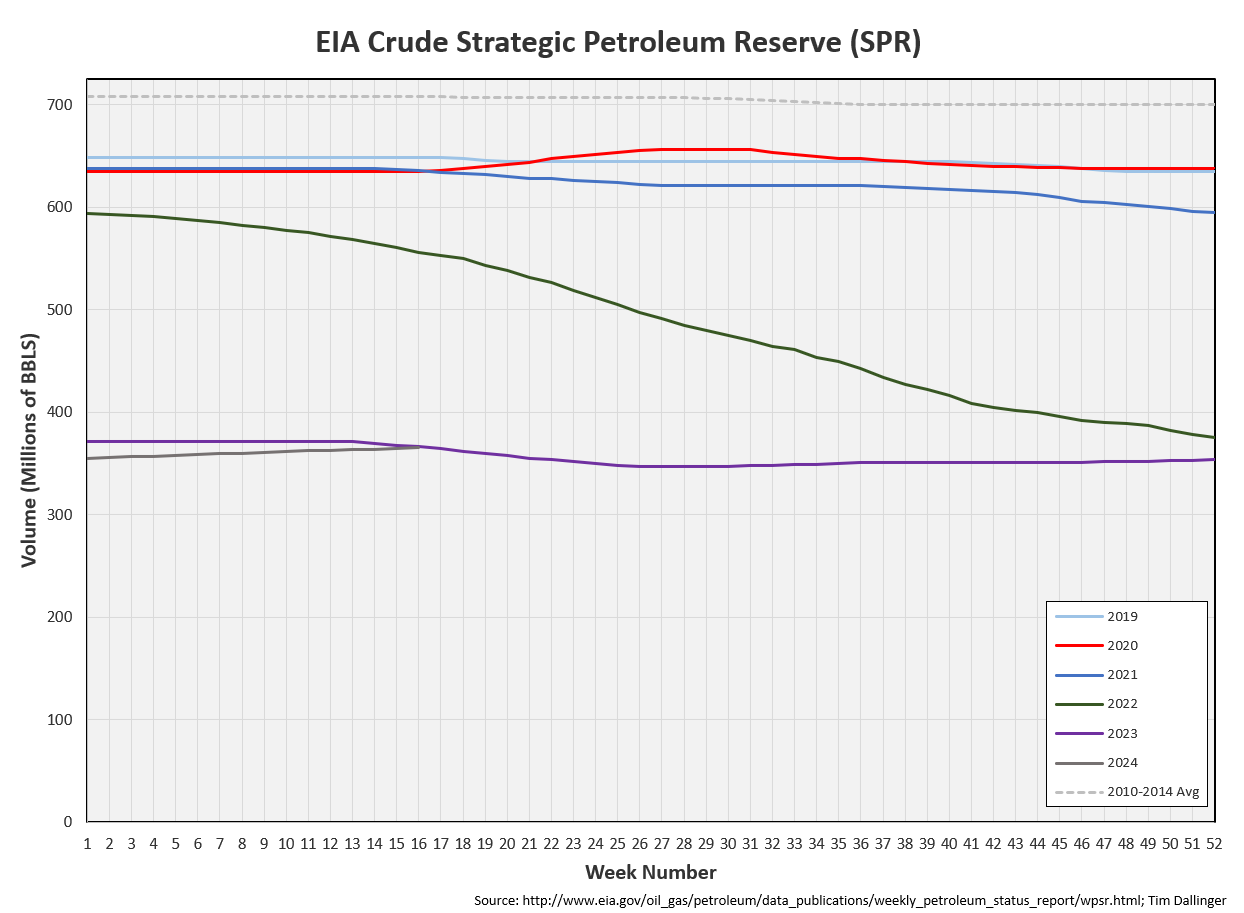

SPR: +0.8 MMB

Cushing: -0.6 MMB

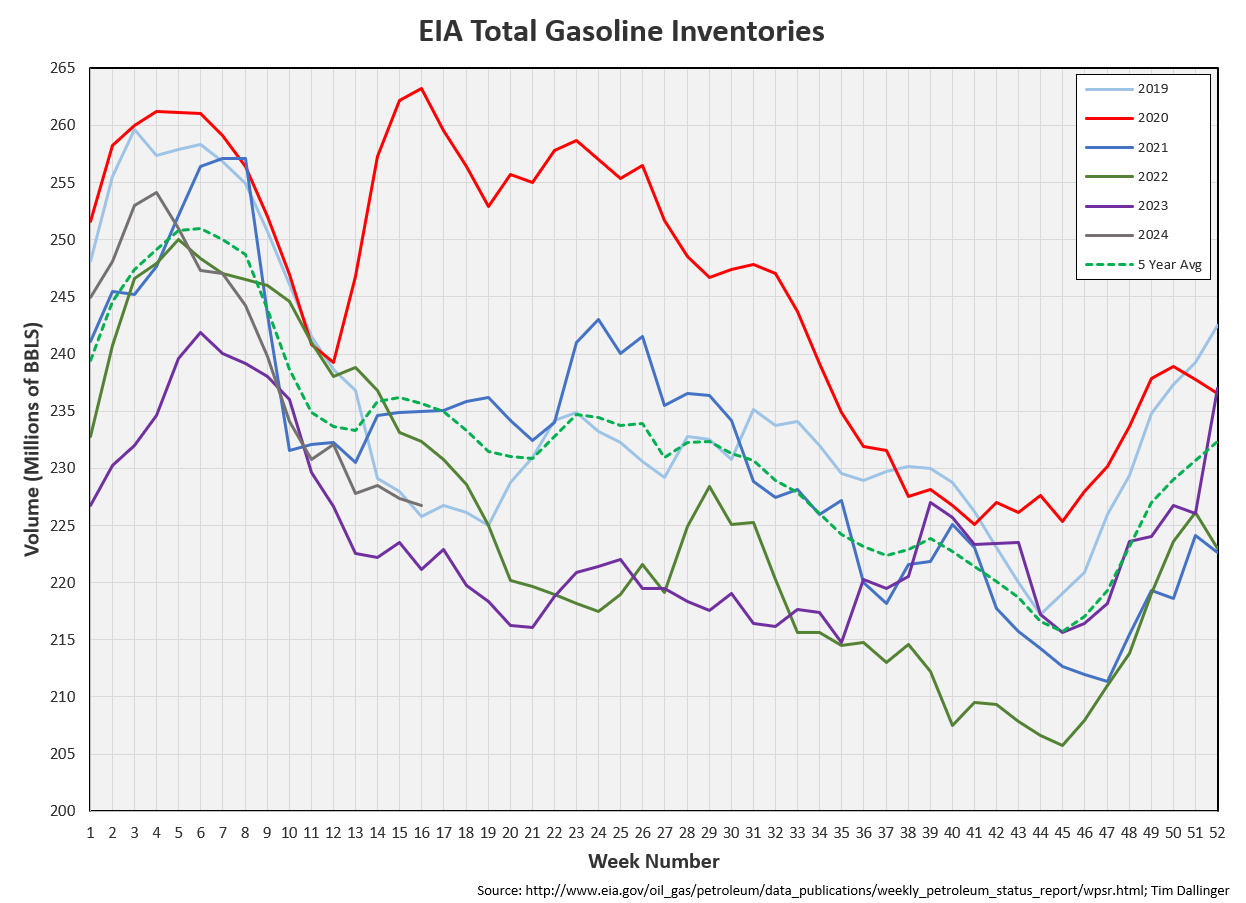

Gasoline: -0.6 MMB

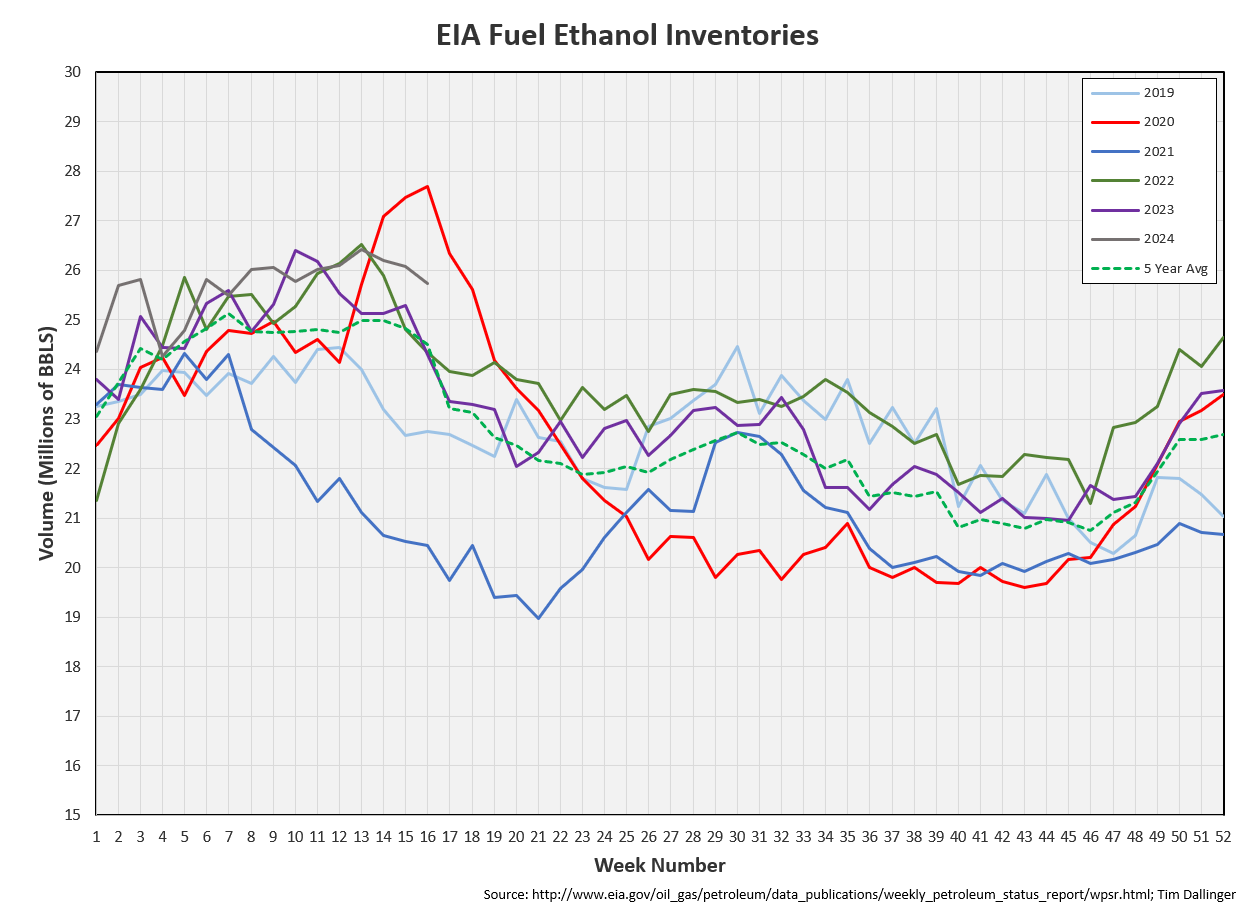

Ethanol: -0.3 MMB

Distillate: +1.6 MMB

Jet: -1.3 MMB

Propane: +1.0 MMB

Other Oil: +1.9 MMB

Total: -3.8 MMB

Spot WTI is currently pricing $82. Prices approach fair value based on a price model derived from reported EIA inventories. The market appears to have sold geopolitical premium.

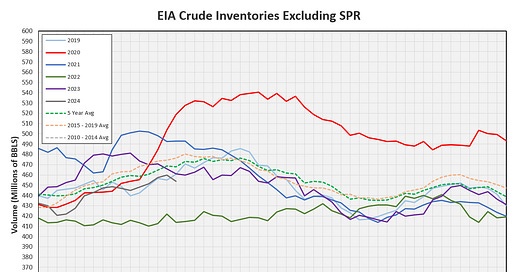

Crude

US Crude oil supply drew by 6.4 MMB. Crude inventories are currently 3% below the seasonal average. Only 2022 has been seasonally lower in the recent past.

0.8 MMB were added to the SPR. 10.6 MMB have been added to the SPR in 2024. There were no additional public discussions of SPR release. This topic will likely resurface this summer as gasoline prices rise.

US crude imports were about average.

Crude exports were reported at 5.1 MMBD. This is slightly higher than that expected by independent ship trackers. Interestingly though, Platts had modeled weekly record exports which didn’t materialize.

The WTI Brent spread has widened. This should encourage crude exports. Exports are still expected to remain high as the global TARS concludes over the next several weeks.

Unaccounted for crude fell back to a reasonable level.

Cushing

Crude storage in Cushing, OK, drew by 0.6 MMB week on week. Cushing storage will be watched carefully with Canada’s TransMountain (TMX) line startup in May. How much Canadian crude will go west towards the coast instead of heading south to Cushing? Tankers are already waiting offshore in anticipation.

Gasoline

Total motor gasoline inventories decreased by 0.6 MMB and are about 4% below the seasonal 5-year average.

Ethanol

Ethanol inventories decreased 0.3 MMB week-on-week. Inventories are about 6% above seasonal averages.

Distillate

Distillate fuel inventories increased by 1.6 MMB last week and are about 4% below the seasonal 5-year average.

Jet

Kerosene type jet fuels decreased by 1.3 MMB. Seasonal jet inventories are about 5% above the 5-year average.

Propane

Propane/propylene inventories increased 1.0 MMB week-on-week. Inventories are above seasonal averages. Builds will continue until fall.

Other Oil

Other oil built by 1.9 MMB. Inventories are above seasonal averages.

Total Commercial Inventory

Total commercial inventory fell 3.8 MMB. Inventories are near 2023 levels.

Natural Gas

Natural gas inventories are high.

The first tanker in almost 2 weeks is set to sail from Freeport LNG this week, highlighting that service has been restored at this plant.

Refiners

The amount of crude oil refiners processes last week fell slightly, but it remains at above all recent years except 2019 when there was more refining capacity online.

The EIA’s product demand proxy is also above all recent years except 2019. Q1 quarterly reports begin for energy this week. Refiner earnings and guidance will be monitored and reported.

Transportation inventories remain low but not critically.

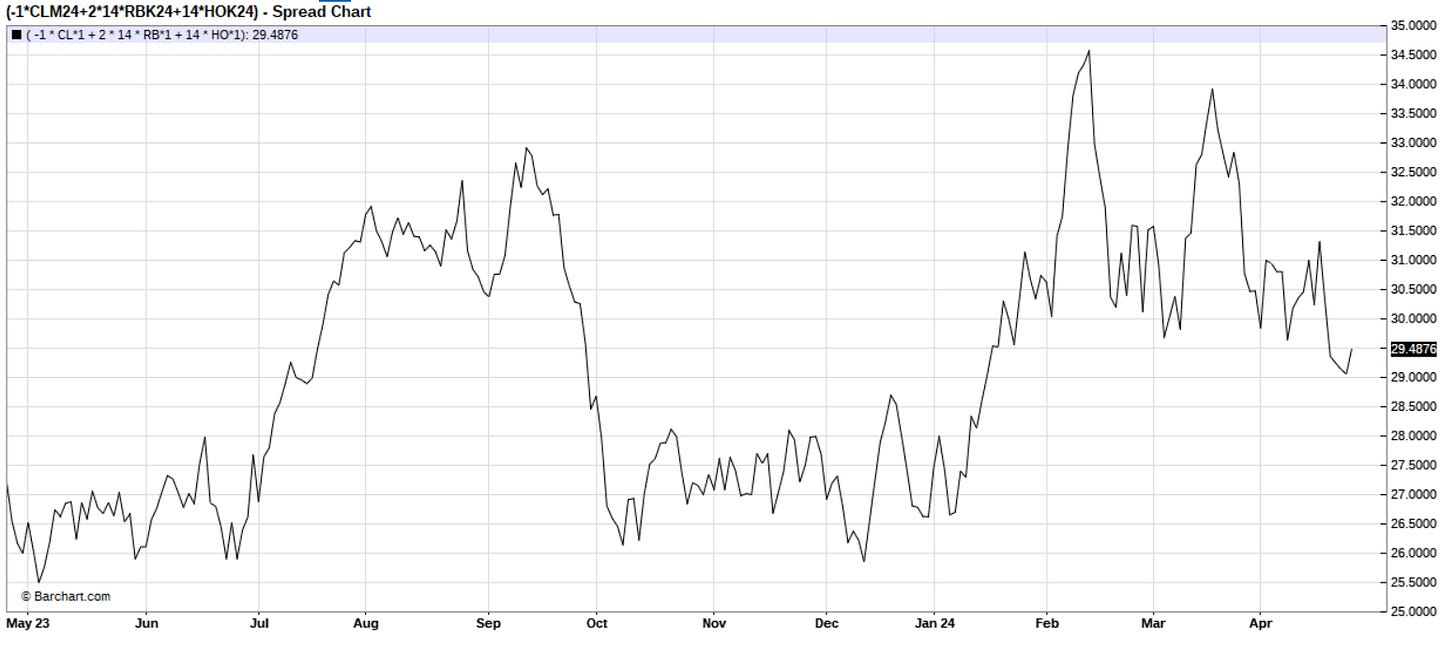

Simple cracks have turned back up. $30 is extremely healthy for the refiner complex. Refiners will run.

Global distillate timespreads are in contango. This cannot be ignored but future curves aren’t nearly as important for products as they are for crude. Crude can be stored until it is refined. Petroleum products don’t have as long a shelf-life.

Crude oil remains backwarded.

Discussion

Pro-Iranian Shiite troops located in Iraq were struck over the weekend. Ukraine again drone attacked Russian refineries. It’s been a relatively quiet week in terms of geopolitics since. Tensions remain high but the market appears unwilling to pay a premium for risk. Supply must be meaningfully disrupted to be reflected in price.

The physical market is tightening again after a brief lull. There are a few pockets of weakness remaining but timespreads better describe the broad market.

Approaching Q1 2024 conference all guidance from refiners, service companies and Majors should reiterate industry health and outlook. The February US production level, to be released next Tuesday, will provide a better view of shale performance.

The bullish thesis continues.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Matthew McConaughey plays burnout, David Wooderson, in the American cult classic 1993 coming-of-age film, ‘Dazed and Confused.’

"Natural Gas inventories are high." Do you expect them to stay high, or with the negative prices in the Permian and (maybe?) taking rigs offline, will inventories correct back toward the long-term mean?

Thank you for the report.