EIA WPSR Summary for week ending 10-11-24

Summary

Crude: -2.2 MMB

SPR: +1.0 MMB

Cushing: +0.1MMB

Gasoline: -2.2 MMB

Distillate: -3.5 MMB

Jet: -1.2 MMB

Ethanol: +0.1 MMB

Propane: +3.4 MMB

Other Oil: -1.6 MMB

Total: -7.0 MMB

Spot WTI is currently pricing $70. Spot price has now dislocated from the modeled fair value by the largest magnitude in nearly in a decade.

Crude

US Crude oil supply drew by 2.2 MMB. Crude inventories are currently 5% below the seasonal average.

1.0 MMB were added to the SPR.

US crude imports fell to the second lowest level of 2024.

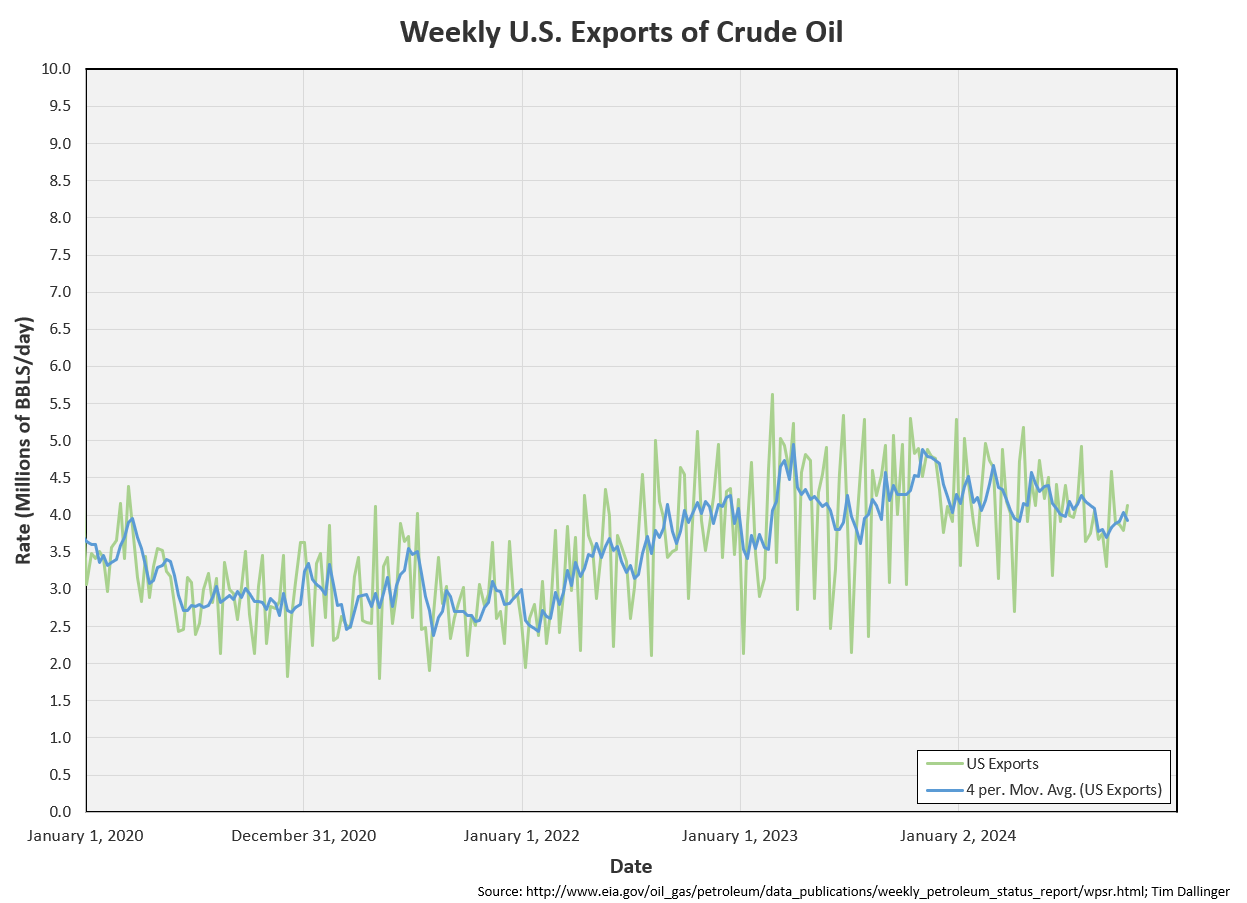

Crude exports were near average levels.

Unaccounted for crude is again positive, suggesting imports were higher than reported.

The EIA is showing all-time record US oil production. This will be corrected lower, later in the Petroleum Supply Monthly report.

Cushing

Crude storage in Cushing, OK, built slightly week on week. Cushing inventories remain seasonally and absolutely low but they are no longer at immediate risk of empty tanks.

Gasoline

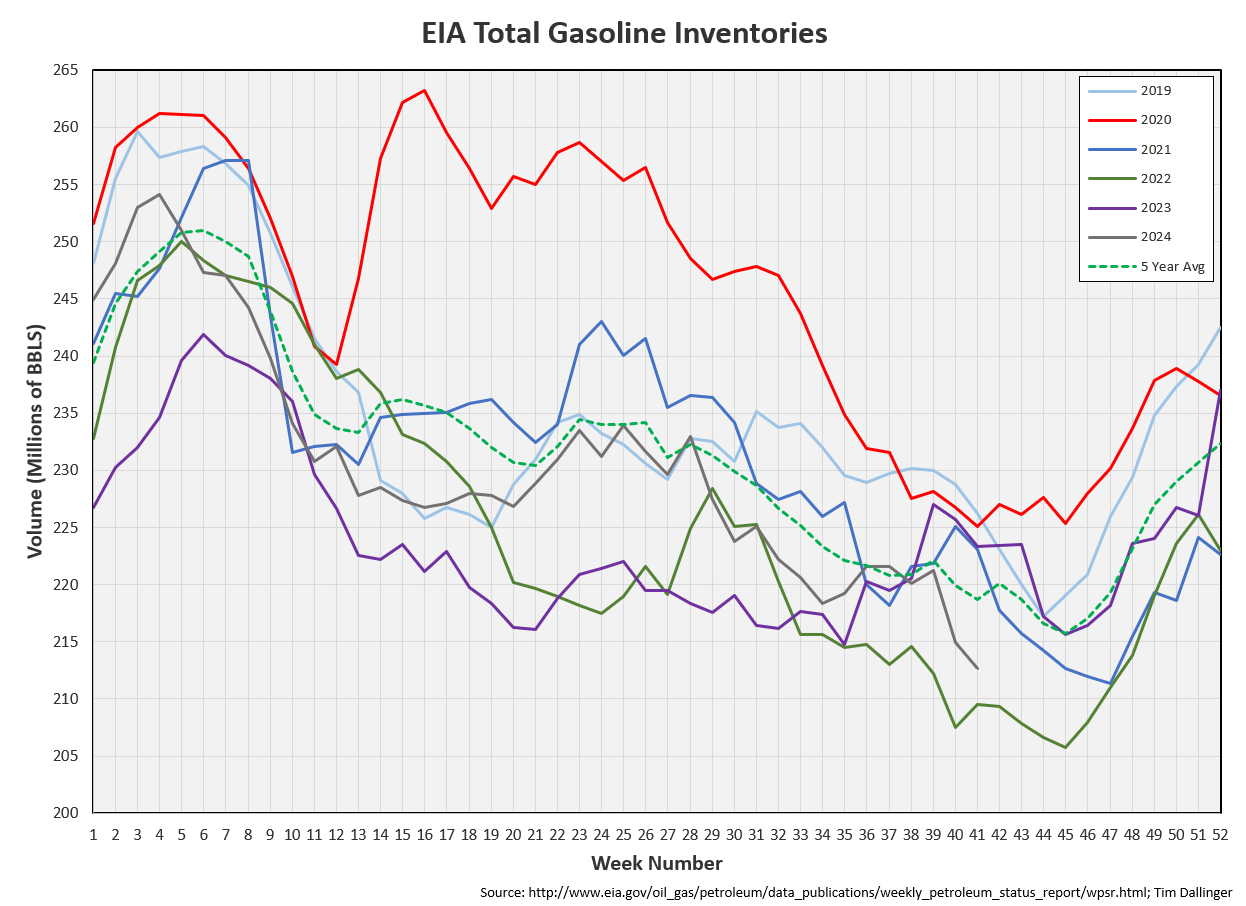

Total motor gasoline inventories decreased by 2.2 MMB and are about 4% below the seasonal 5-year average. Only 2022 was seasonally lower.

Finished gasoline inventories are at record seasonal lows.

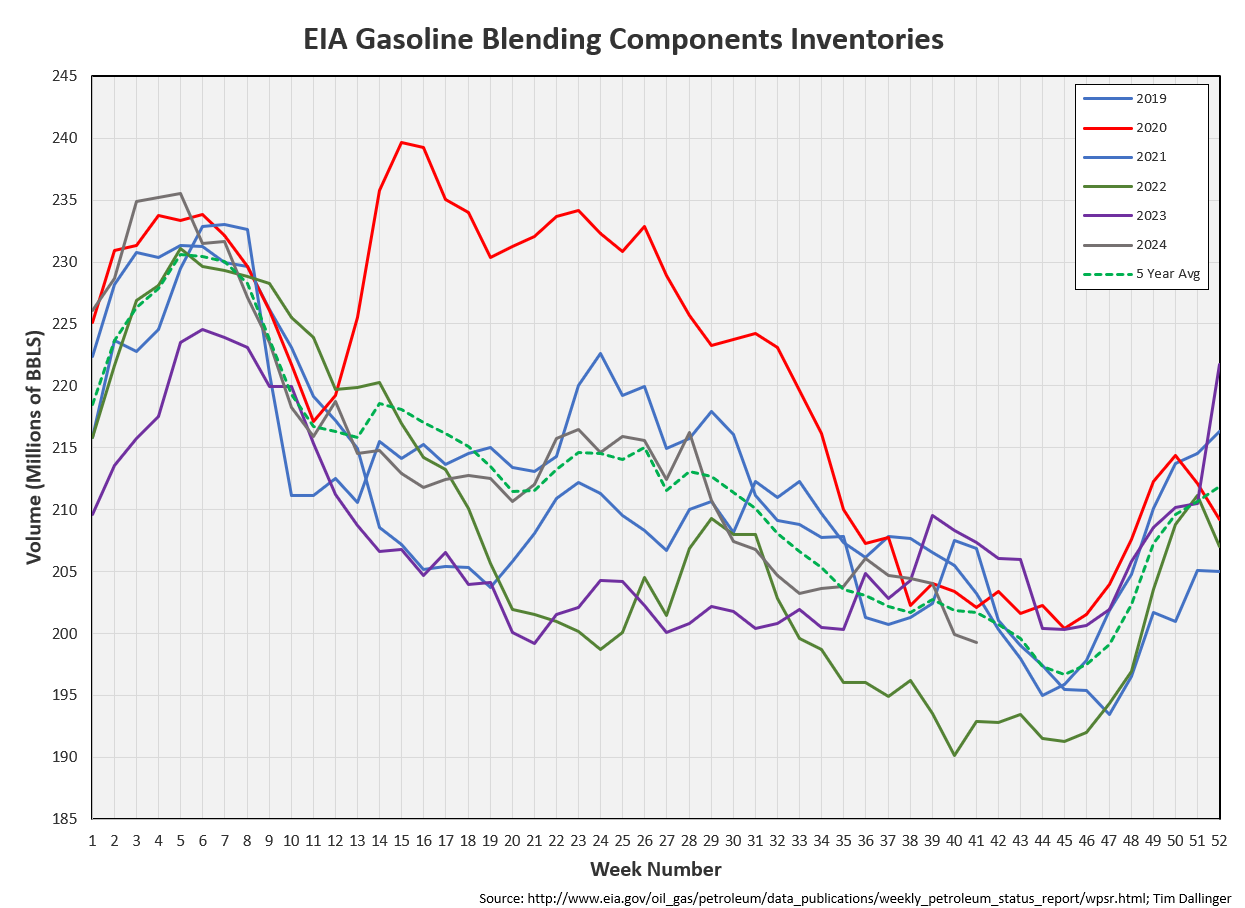

Gasoline blending components are below seasonal average but above the 2022 lows.

Distillate

Distillate fuel inventories decreased by 3.5 MMB last week and are about 10% below the seasonal 5-year average. Distillate inventories near the 2023 levels.

Jet

Kerosene type jet fuel decreased by 1.2 MMB. Inventories are above average but continue to fall.

Global airfare continues to set seasonal records.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories increased 0.1 MMB week-on-week. Inventories are about above seasonal averages.

Propane

Propane/propylene inventories increased 3.4 MMB to an all-time record. Propane is a natural-gas liquid. It drops out of natural gas during processing. More natural gas, more propane.

Other Oil

Other oil inventories decreased 1.7 MMB and is just below the seasonal average.

Total Commercial Inventory

Total commercial inventory drew by 7 MMB.

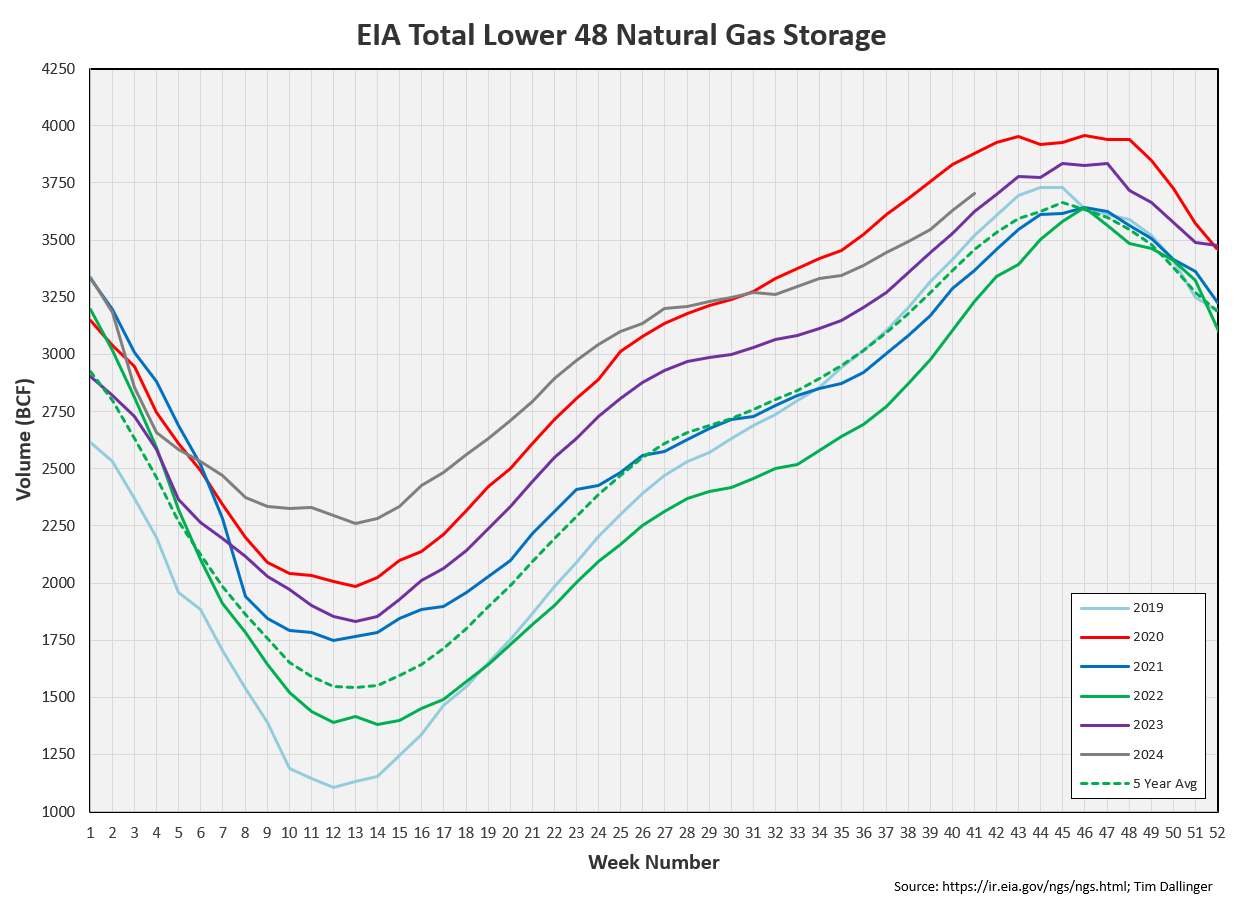

Natural Gas

Natural gas inventory builds continue in-line with seasonal trends. However, the magnitude is higher though than ever year except COVID. US tight production generates more associated gas. This is why gas prices continue to struggle.

Refiners

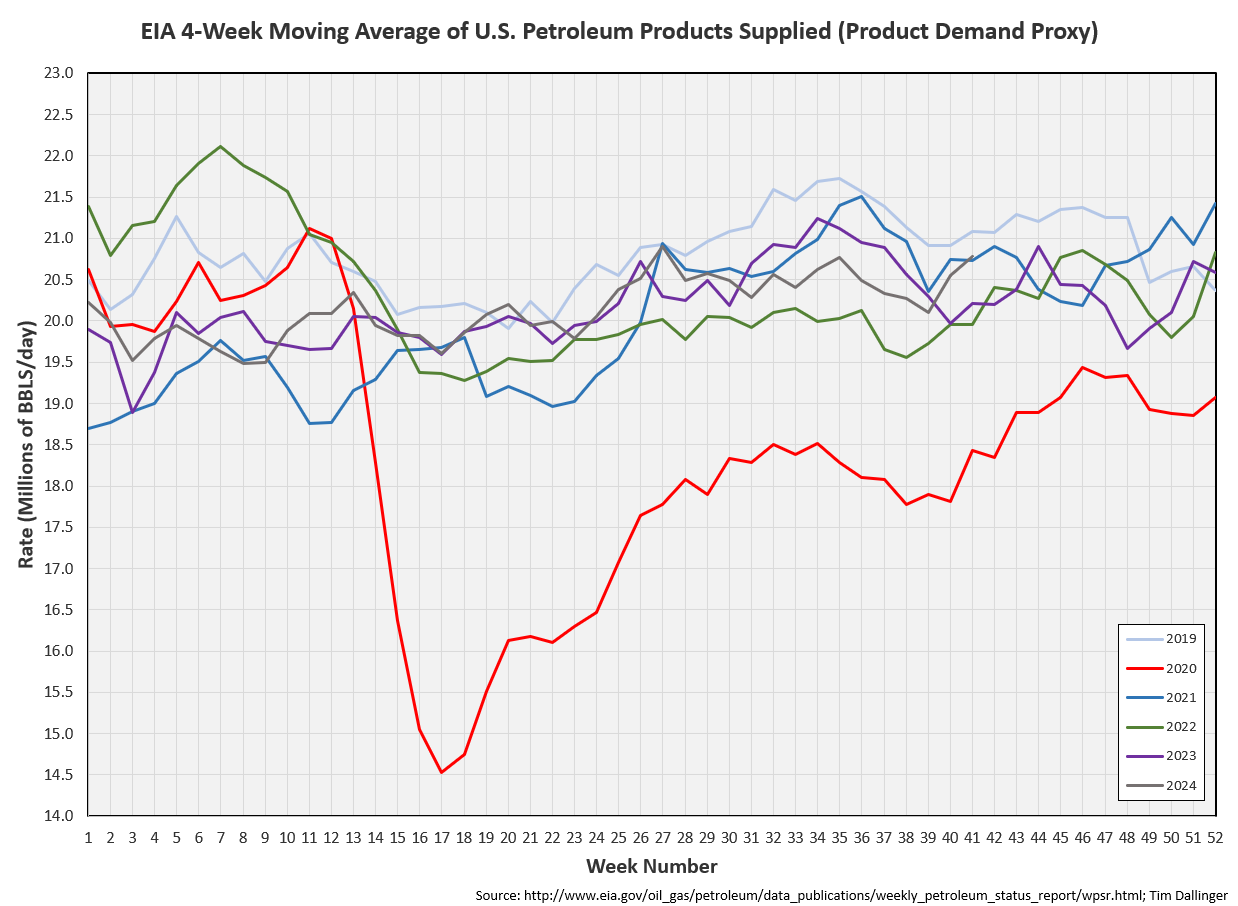

Refiners processed a seasonal record amount of crude oil last week. This is literally “crude oil demand.” Market media often confuses crude demand and petroleum product demand. But remember this chart when reading about weak demand.

The EIA’s product demand proxy is also strong, although not at a seasonal record. But only 2019 was higher.

Transportation inventories are drawing at a rapid rate. Only 2022 was lower.

If crude inventories are included, the big 5 inventories match 2022 levels precisely.

Simple cracks are lower than earlier this year. But they have rebounded convincingly off the bottom.

Discussion

Both WTI and Brent remain in a backwarded time structure.

Financial media and analysts are currently writing that petroleum inventories no longer matter. This is a mistake. The entire global economy operates on petroleum and coal. These commodities are as important as they ever were. Markets are acting oddly currently due to unknown reasons. But one should heed caution when they hear that this time is different. Narrative is a lagging indicator for price.

Israel has not yet retaliated against Iran’s recent attack. The US Administration leaked stories to the media that Israel agreed to not strike energy or nuclear infrastructure. Geopolitical premium has once again been faded. Netanyahu responded that while Israel takes the US position into consideration, the final decisions are based entirely on Israel’s national interests.

The Shustar refinery in Iran’s Khuzestan province caught fire in what they are claiming was an accident. And shortly after, Iran’s export facility Kharg Island experienced an oil spill. Probably just another accident.

Global petroleum inventories continue to fall, physical timespreads are in backwardation for 5 years out, demand calculations remain strong, US production grows more gassy, institutional financial crude short interest remains high and there’s sustained conflict in the middle east on multiple fronts. Yet inventories no longer matter? Storage become critical during shortages.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Bill the Butcher, portrayed by Daniel Day Lewis, “accidently” strikes a locket that belongs to Jenny Everdeane, Cameron Diaz, in a knife-throwing exhibition in the 2002 American historical drama, “Gangs of New York.”

I like your reports. Very consistent and methodical. Keep up the good work.