EIA WPSR Summary for week ending 1-3-25

Summary

Crude: -1.0 MMB

SPR: +0.2 MMB

Cushing: -2.5 MMB

Gasoline: +6.3 MMB

Distillate: +6.1 MMB

Jet: +0.4 MMB

Ethanol: +0.5 MMB

Propane: -2.5 MMB

Other Oil: -4.6 MMB

Total: +5.0 MMB

Crude

Slightly bearish report but there are some bright spots.

Spot WTI is currently pricing $73. Spot prices remain dislocated from estimated fair value based on a price model derived from reported EIA inventories. However, the margin has narrowed significantly.

0.2 MMB were added to the SPR.

US crude imports were about average.

Crude exports were down into year end. Saudi Arabia just increased their official selling price (OSP) to Asian markets so teapot refineries should start looking for light sweet from the US.

Unaccounted for crude was negative. The average amount of unaccounted for oil continues to trend negative. US Customs has miscounted some exports according to independent ship trackers. But that should balance over time.

It seems more likely that the EIA is overcounting US production in their short-term energy outlook (STEO), which is where the WPSR derives its production figures.

Cushing

Crude storage in Cushing, OK, drew by 2.5 MMB week on week. This is lowest Cushing inventory has been in decades. Cushing is on the verge of being inoperable due to tanks being at their heels (sludgy bottoms). This is likely contributing to the recent WTI price rally.

Gasoline

Total motor gasoline inventories increased by 6.3 MMB and are about 1% below the seasonal 5-year average. This is a significant build. Refiners are running hard and there’s often strange movement around year end to defer tax obligations.

Distillate

Distillate fuel inventories increased by 6.1 MMB last week and are about 4% below the seasonal 5-year average.

Jet

Kerosene type jet fuels increased by 0.4 MMB. Jet fuel inventories are relatively high.

Airline travel is experiencing high demand. The 2024 year finished with record holiday passengers.

The first week of 2025 is showing a similar pattern.

Ethanol

Ethanol inventories increased 0.5 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories drew by 2.5 MMB. Inventories are still high though, matching 2020 levels

Other Oil

Other oil drew by 4.6 MMB as refiners make winter blend gasoline. Other oil inventories are at average levels.

Total Commercial Inventory

Total commercial inventory remains below average.

Natural Gas

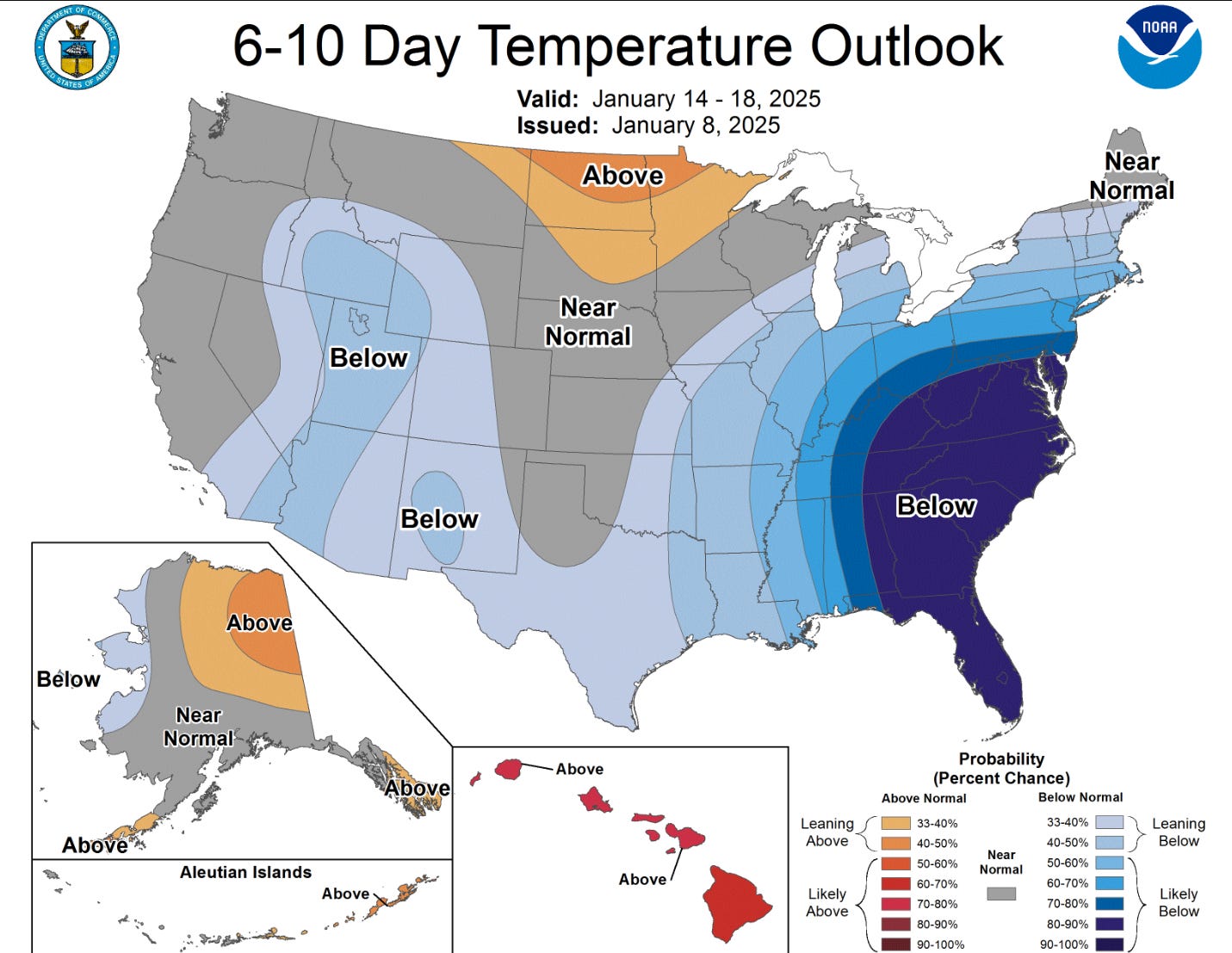

Natural gas inventories drew into year-end, due to increased demand from colder weather.

Refiners

US refiners processed a seasonally record amount of crude oil last week.

The EIA’s product demand proxy shows moderate consumer demand.

The EIA product demand proxy for transportation products shows similar behavior.

Transportation inventories did build significantly this week, pressuring crack spreads. Absolutely inventories remain below seasonal averages though.

This is especially true if crude volumes are included alongside the transportation product inventories.

Simple cracks are struggling. They did bounce off the bottom today and recovered some. The energy market probably needs to see more demand strength, leading to higher cracks, before the crude rally continues much further.

Discussion

Both WTI and Brent remain firmly backwarded. Crude demand is strong. Product demand needs to pick up here or refineries will consider run cuts.

Every WTI future traded today is backwarded.

Thank you for patience, as this report wasn’t produced the past two weeks.

Over the holiday season, crude did rally. There was a slight pullback today but the strength should continue. Those bearish energy question why this rally is occurring. However, they fail to recognize that crude has been mispriced for some time. 2024 was in an energy deficit the entire year. Inventories drew, even in the face of lackluster Chinese demand. Now, it appears China is returning to the market and prices are responding.

Many analysts and international energy agencies are expecting inventory builds over Q1. They are expecting Non-OPEC production growth to exceed global demand growth. At the same time, some are noticing cracks in the US growth narrative. Further elaboration on these global supply and demand models will be included in a later report. For now, just note that these models appear excessively bearish.

When there is no surplus inventory, the market will be forced to recognize price must go higher to incent further production growth.

The bullish narrative is again being in discussed in hushed tones. As price rises, sentiment will change.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Phil, portrayed by Bradley Cooper, and the boys head back to Vegas find their lost friend Doug in the 2009 film, The Hangover.

Video (NSFW language)

Market not buying the oil price moves yet. Oil up 10% in a month and XLE down 2%, XOM down 5%.

Spring is coiling here. I added some XOM leaps yesterday (cheap vol).

The market is still watching the 2025 models predicting surplus. I hope to dig into these reports further this week. Retail also expects, "drill, baby, drill." Production is a different business when operating within cashflow