EIA WPSR Summary for week ending 5-2-25

That Place Where the Wave Finally Broke and Rolled Back

EIA WPSR Summary for week ending 5-2-25

Summary

Crude: -2.0 MMB

SPR: +0.6 MMB

Cushing: -0.7 MMB

Gasoline: +0.2 MMB

Distillate: -1.1 MMB

Jet: -1.1 MMB

Ethanol: -0.2 MMB

Propane: +1.0 MMB

Other Oil: +3.0 MMB

Total: 1.2 MMB

Spot WTI is currently pricing $57. Spot prices continue to be dislocated by the most significant amount in decades from estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 2.0 MMB. Crude inventories are currently 7% below the seasonal average.

0.6 MMB were added to the SPR. The SPR has communicated that they received my FOIA communication and are working on fulfilling the request.

US crude imports were up week-on-week.

Crude exports were flat near average levels.

Unaccounted for crude was again balanced.

The EIA has re-benchmarked US production lower, likely due to the vast discrepancy between the weekly figures and the more-accurate monthly figures. The EIA is still over-counting US production but this week’s correction lower was a step in the right direction.

Cushing

Crude storage in Cushing, OK, drew by 0.7 MMB, reversing last week’s build. Cushing inventories remain low.

Gasoline

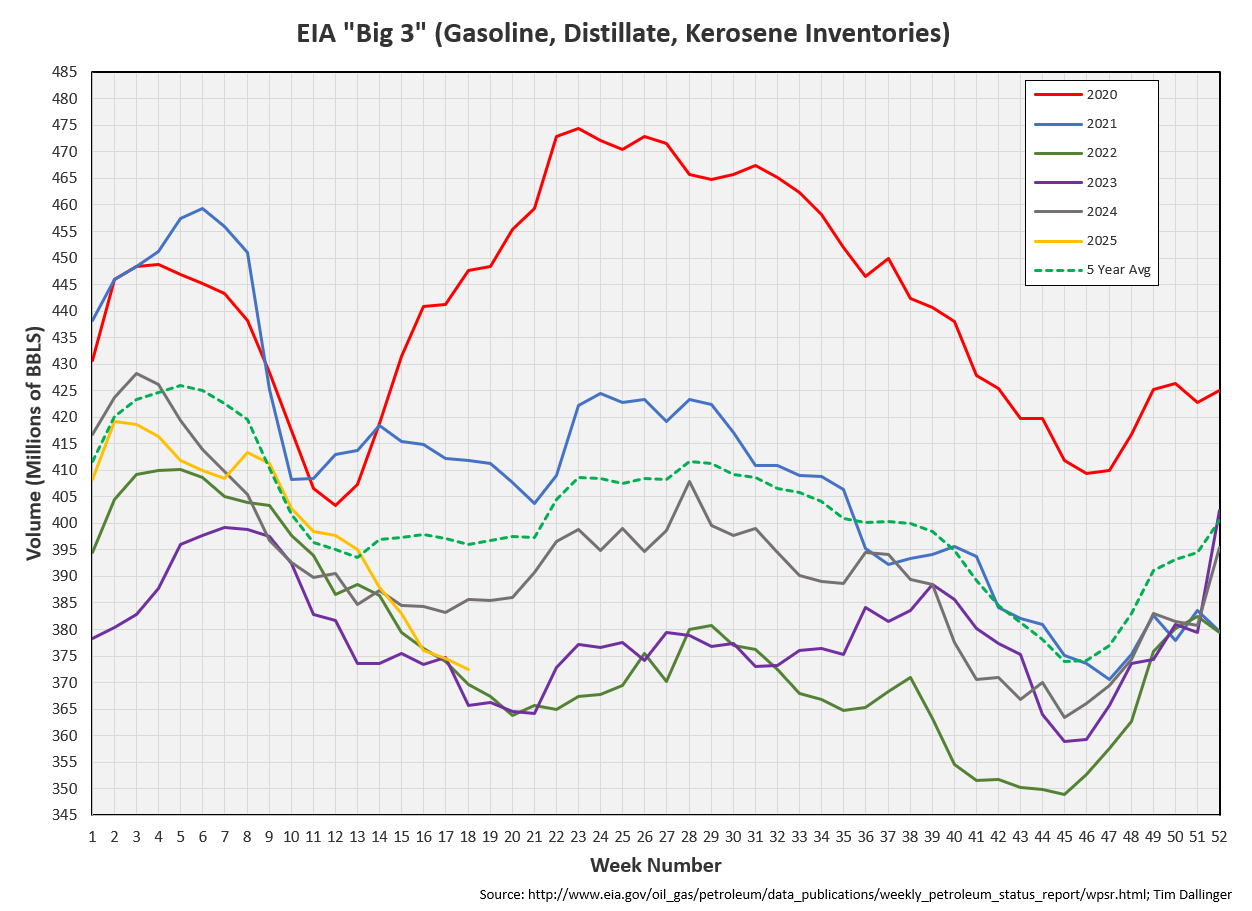

Total motor gasoline inventories increased by 0.2 MMB and are about 3% below the seasonal 5-year average. Draws should resume next week. Build season hasn’t started yet.

Finished conventional motor gasoline inventories increased.

Conversely, gasoline blending components drew.

Distillate

Distillate fuel inventories decreased by 1.1 MMB last week and are about 13% below the seasonal 5-year average.

Distillate inventories are seasonally and absolutely low.

Jet

Kerosene type jet fuels drew by 1.1 MMB. Jet fuel inventories are near average.

Implied jet fuel demand is roofing.

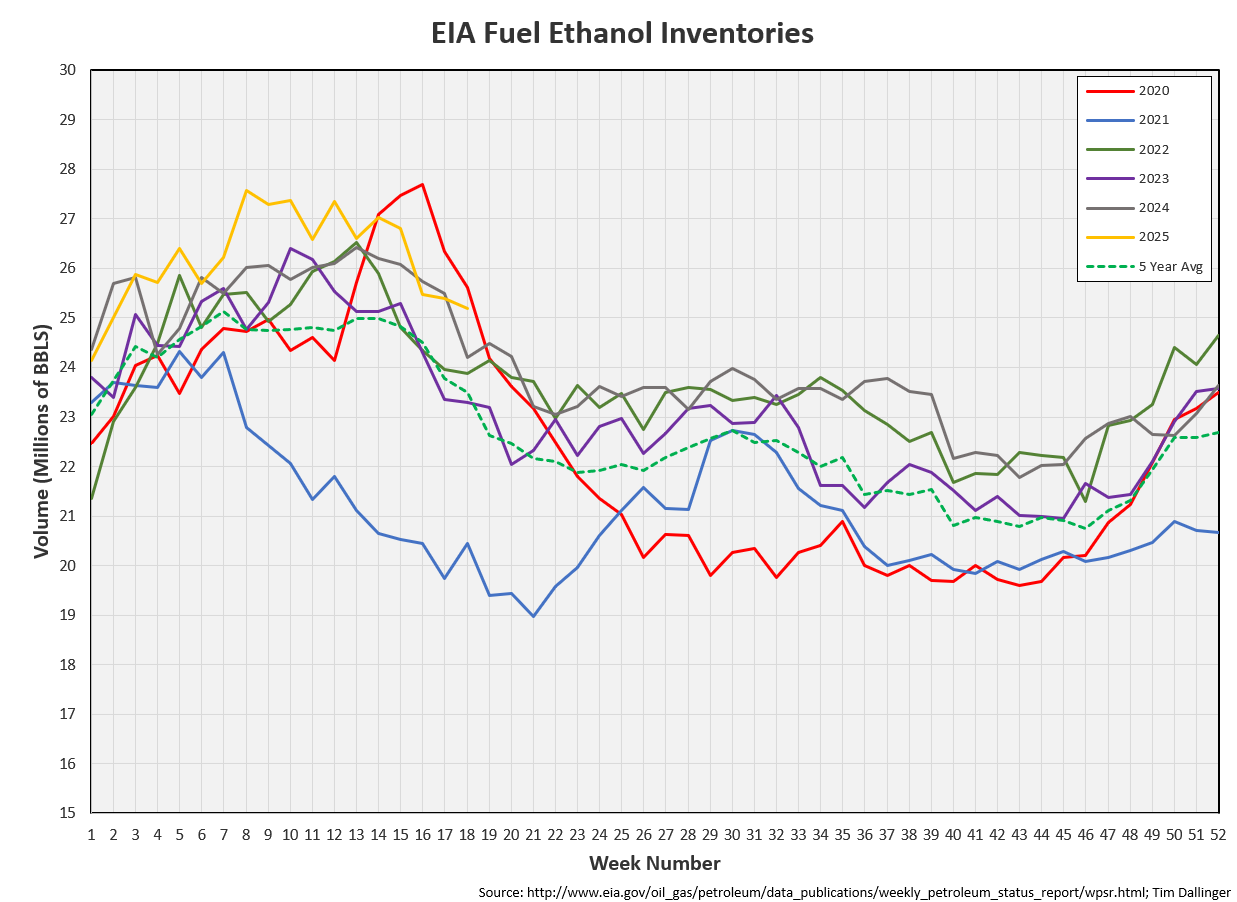

Ethanol

Ethanol inventories decreased 0.2 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories increased by 1.0 MMB. Propane inventories are 11% below the seasonal 5-year average.

Other Oil

Other oil built by 3.0 MMB. Other oil inventories are above average, but the trajectory of builds slowed this week.

Total Commercial Inventory

Total commercial inventory built by 1.2 MMB. Total commercial inventories are below average levels.

Natural Gas

Natural gas inventories are at average levels. Builds accelerated quickly.

Refiners

US refiners again processed a seasonally record amount of crude last week. The ramp should continue.

The EIA’s product demand proxy is near record levels too.

Transportation inventories continue to draw, supporting cracks.

Transportation inventory demand is at 2023 highs.

Simple cracks remain spectacular.

Discussion

OPEC brought forward another month of production cut reversals. The market sold off on the news. Yet there is still no physical glut anywhere.

The US continues to talk tough about sanctioning Iranian barrels and yet they continue to turn a blind eye to record Malaysian crude exports which is actually repacked Iranian barrels.

Energy companies started to report earnings this week. Shale executives are finally saying the quiet part out loud.

On the Diamondback Energy conference call, Chairman and CEO Travis Stice stated, "And so you can apply that also to the 13,000,000 barrels a day that The U. S. Is producing. That’s roughly 4,500,000 or 5,000,000 barrels a day of production and has to be replaced. So I think as capital continues to come out of the investment equation, this decline that we’re on is really going to be magnified.

And because we are in the more mature stage of the development, this is not one of the types of declines that can be offset by improved efficiencies, although we highlighted continued efficiency gains at the Diamondback level in the quarterly results. But we’re picking pennies up now."

US production growth has peaked.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Hunter S. Thompson laments the end of an era in his iconic book, Fear and Loathing in Las Vegas.