EIA WPSR Summary for week ending 2-16-24

Summary

Neutral report.

Crude: +3.5 MMB

SPR: +0.7 MMB

Cushing: +0.7 MMB

Gasoline: -0.3 MMB

Ethanol: -0.3 MMB

Distillate: -4.0 MMB

Jet: +0.1 MMB

Propane: -2.3 MMB

Other Oil: +1.0 MMB

Total: -0.8 MMB

Spot WTI is currently pricing $78. This is slightly above fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built 3.5 MMB. Crude inventories are currently 2% below the seasonal average.

0.7 MMB were added to the SPR. That’s about half of the planned 2024 purchases.

US crude imports were again at seasonal average levels.

US crude exports were also at average levels this week. The EIA reported 5 MMBD of exports. Independent ship trackers confirmed this export volume.

Unaccounted for oil again turned negative. It appears the EIA’s goal of normalizing adjustments by capturing blending components elsewhere is working.

Cushing

Crude storage at Cushing, OK built by 0.7 MMB. Draws are expected to resume after maintenance season.

Gasoline

Total motor gasoline inventories decreased by 0.3 MMB and are 2% below the seasonal 5-year average.

Ethanol

Ethanol inventories built drew by 0.3 MMB. Inventories are 1.5% above average.

Distillate

Distillate fuel inventories decreased by 4.0 MMB last week and are about 10% below the seasonal 5-year average. Volumes fall below 2023 levels with the 2022 record in-sight.

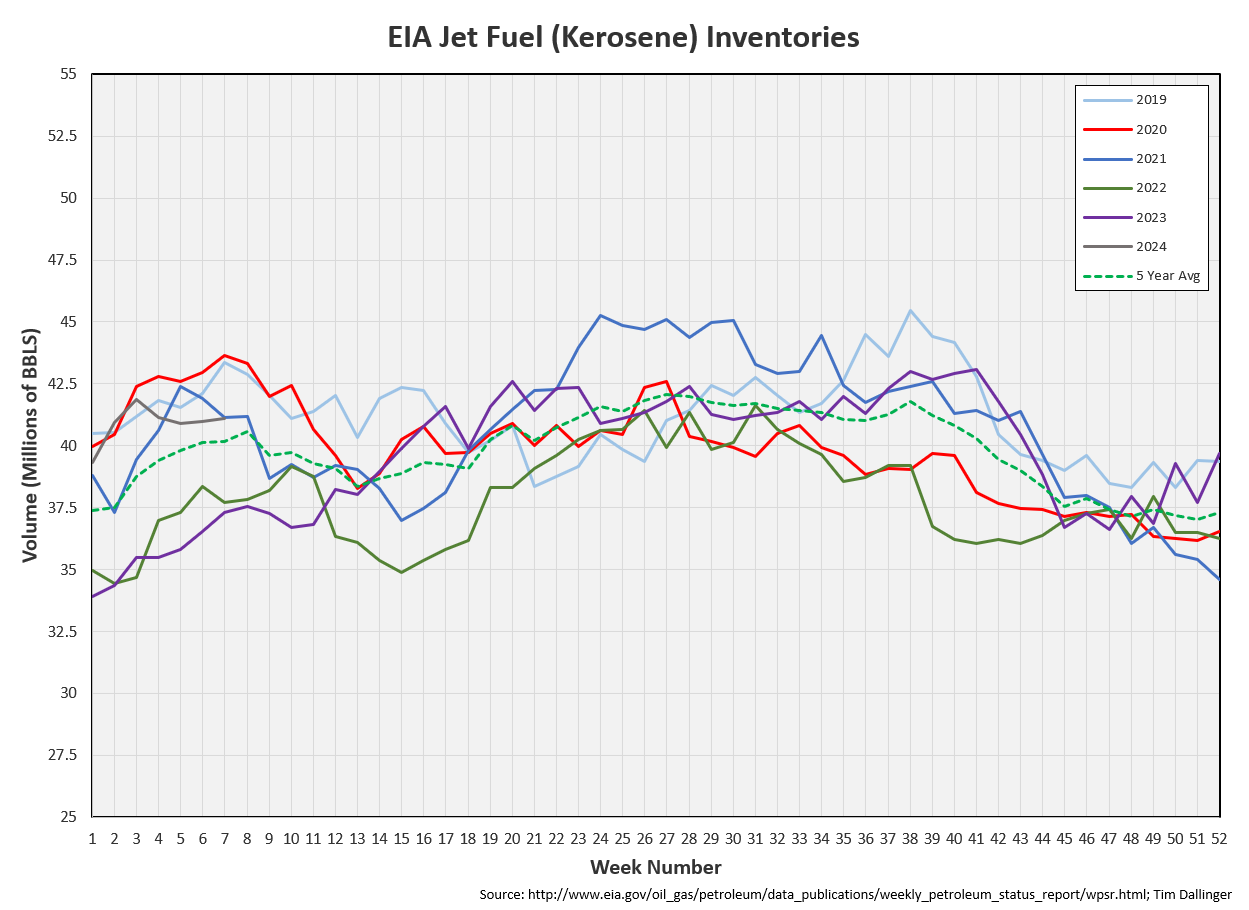

Jet

Kerosene type jet fuels increased by 0.1 MMB. Seasonal jet inventories are slightly above average.

Global flights are at record levels.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories decreased by 2.3 MMB from last week. Inventories have fallen slightly below seasonal averages.

Other Oil

Other oil increased by 1.0 MMB. Other oil inventories are just above seasonal average.

Total Commercial Inventory

Total commercial inventories drew by 0.8 MMB.

Natural Gas

Seasonally warm weather led to another limited drawdown in natural gas storage.

Natural gas prices remain under pressure as supply remains robust due associated gas in shale production. Gas prices spiked 10% the week when Chesapeake Energy announced guidance to reduce production. It remains unknown as to whether that can balance the market. It seems more likely that recent low prices will remain.

Discussion

Crude input was low again this week. There’s one more week of maintenance remaining. Sources report that BP’s Whiting facility will restart next week, reaching full capacity again in early March.

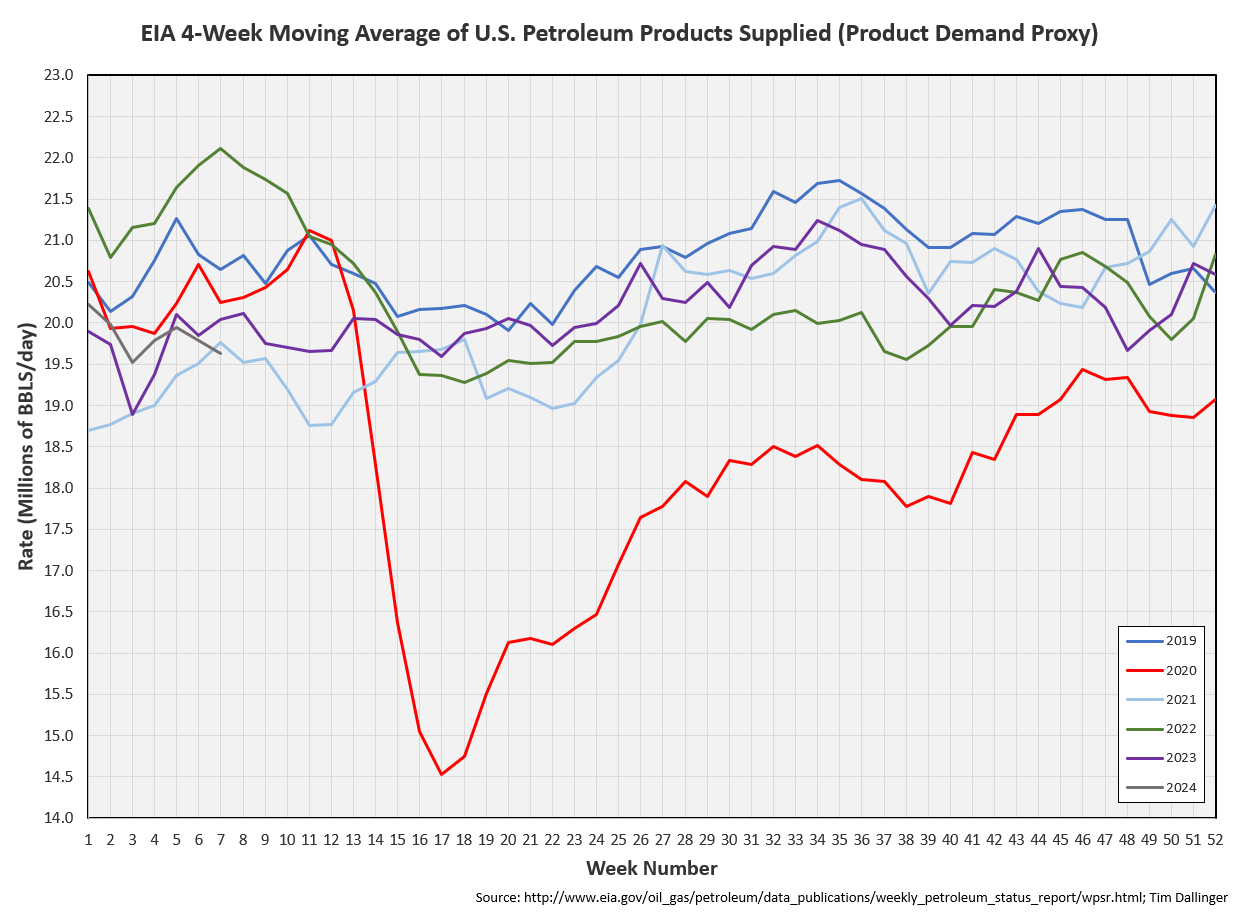

The EIA demand proxy still show product weakness. Other measures of demand do not corroborate this behavior.

Even with allegedly impacted demand, transportation fuels are seasonally low. Driving season will pressure them more.

The simple 3-2-1 crack spread fell back from recent high’s. Refining margins are still healthy though.

WTI has moved firmly into a backwarded structure, showing physical strength.

The brent backwardation is steeper. This comes at a time when OPEC exports remain stable. Bears point to these export figures as a signal that OPEC+ is cheating quotas. It seems more likely, given the strength of the physical market, OPEC is simply covering the robust demand.

As March arrive and Spring breaks begin, US consumer travel demand should increase. From there, it’s a short duration until summer driving season begins. Outlook appear bullish, especially if US production growth stalls.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Navin R Johnson, portrayed by Steve Martin, is “The Jerk” in the 1979 American comedy film.

I look forward to reading your report every week. Clear and concise. Thank you for your efforts Tim!