EIA WPSR Summary for week ending 10-24-25

Boats!

EIA WPSR Summary for week ending 10-24-25

Summary

Crude: -6.9 MMB

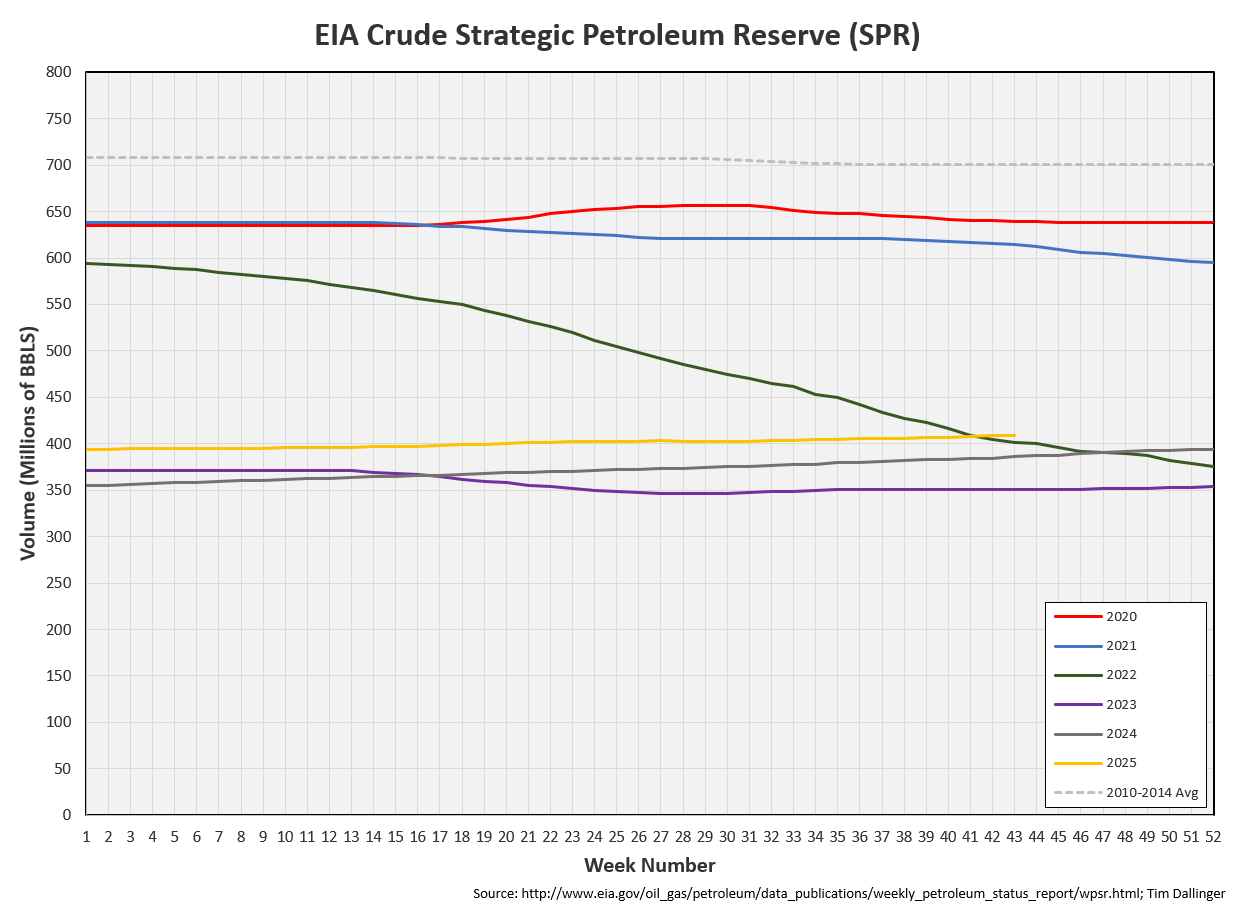

SPR: +0.5 MMB

Cushing: +1.4 MMB

Gasoline: -5.9 MMB

Distillate: -3.4 MMB

Jet: -1.5 MMB

Ethanol: +0.4 MMB

Propane: +2.5 MMB

Other Oil: -1.1 MMB

Total: -15.9 MMB

Exceedingly bullish report, surpassing even yesterday’s API numbers. Refineries are still undergoing maintenance and yet crude draws hard. US crude exports are healthy. Crude imports fell on the week. Negative adjustment suggests US crude production continues to be overcounted. There was also a significant jump in implied consumer demand.

Spot WTI is currently pricing $60. This report should have driven a price rally. However, spot WTI prices again set a record for amount they have diverged from the estimated fair value based on a price model derived from reported EIA inventories. Of course, US inventories aren’t the only factor in a global energy market. But the divergence seems excessive.

Crude

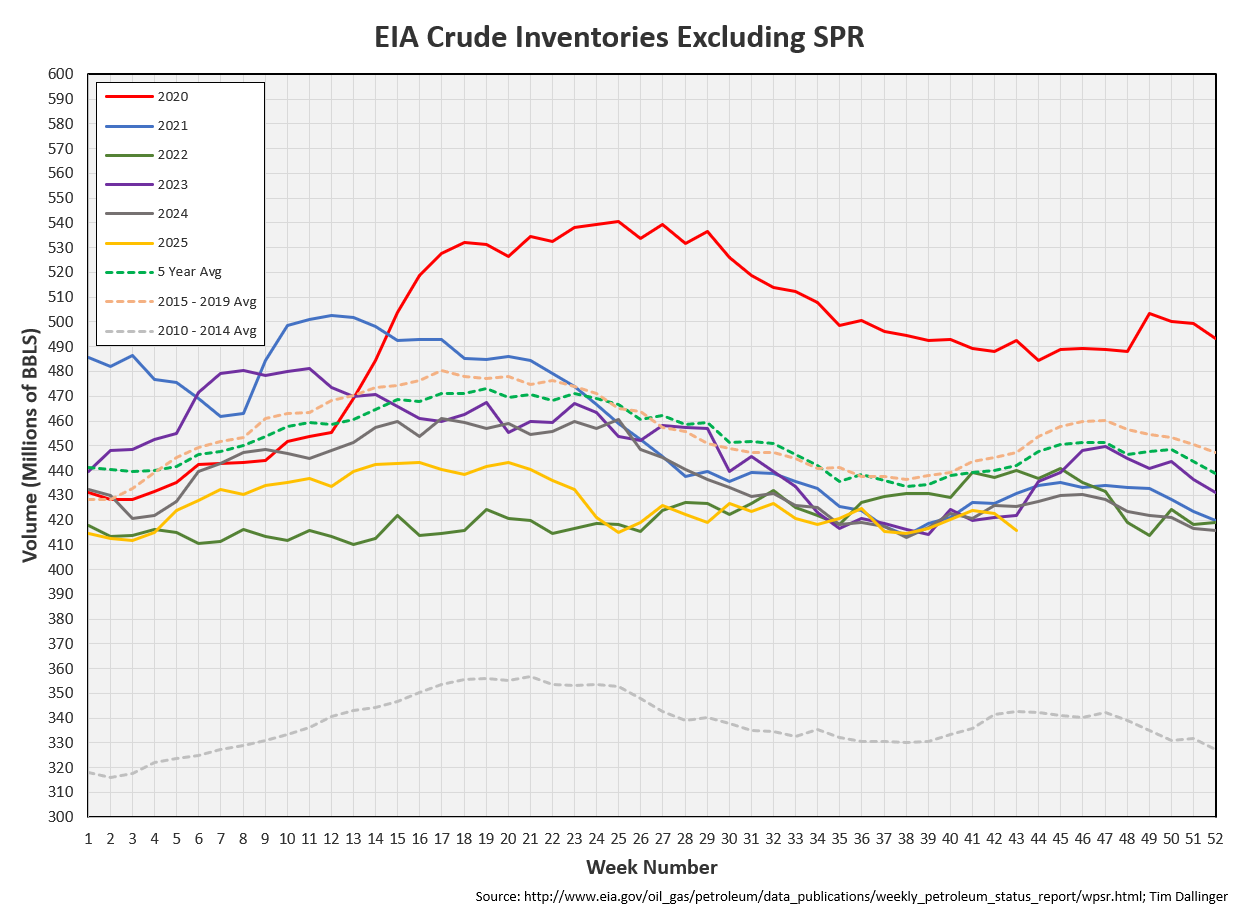

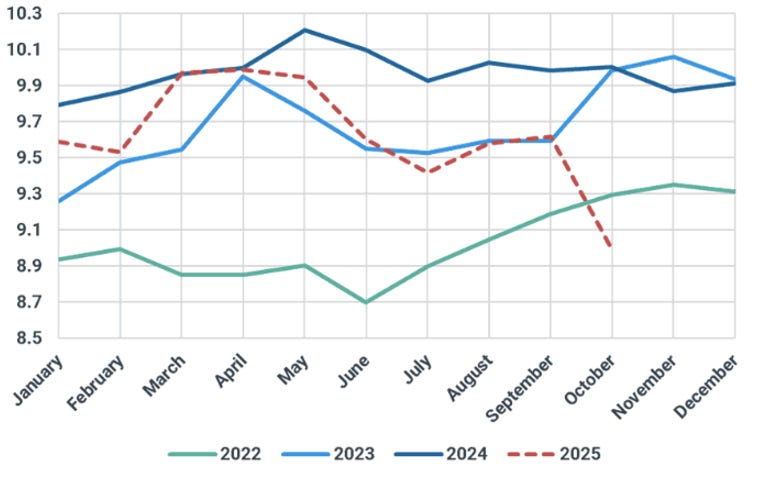

US Crude oil supply drew by 6.9 MMB, greatly exceeding expectations. Crude inventories are currently 6% below the seasonal average. US crude oil inventories have not been this low seasonally since 2014. Remember, this inventory number also includes pipeline linefill and condensate that being counted as crude oil.

0.5 MMB were added to the SPR.

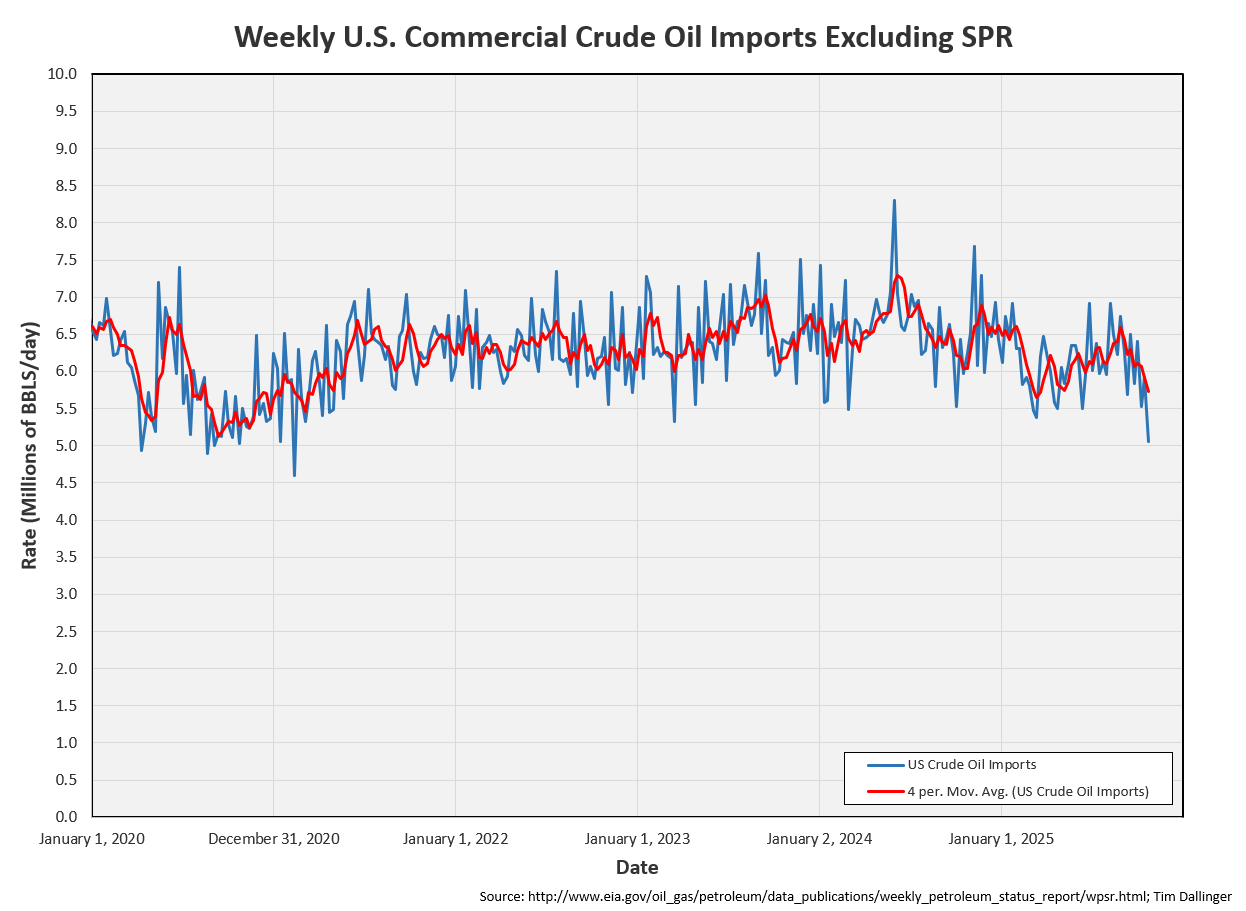

US crude imports cratered. There is no apparent reason. It’s possible that imports were the lowest that they’ve been since 2020. It’s also possible that the over-reporting is crude production is causing issues with the inventory model. Imports should be reported by US customs but there is no way to independently track that data. It’s possible that the BP Whiting facility imported less Canadian crude. But that refinery was back up and running after their fire incident last week.

Crude exports remain high.

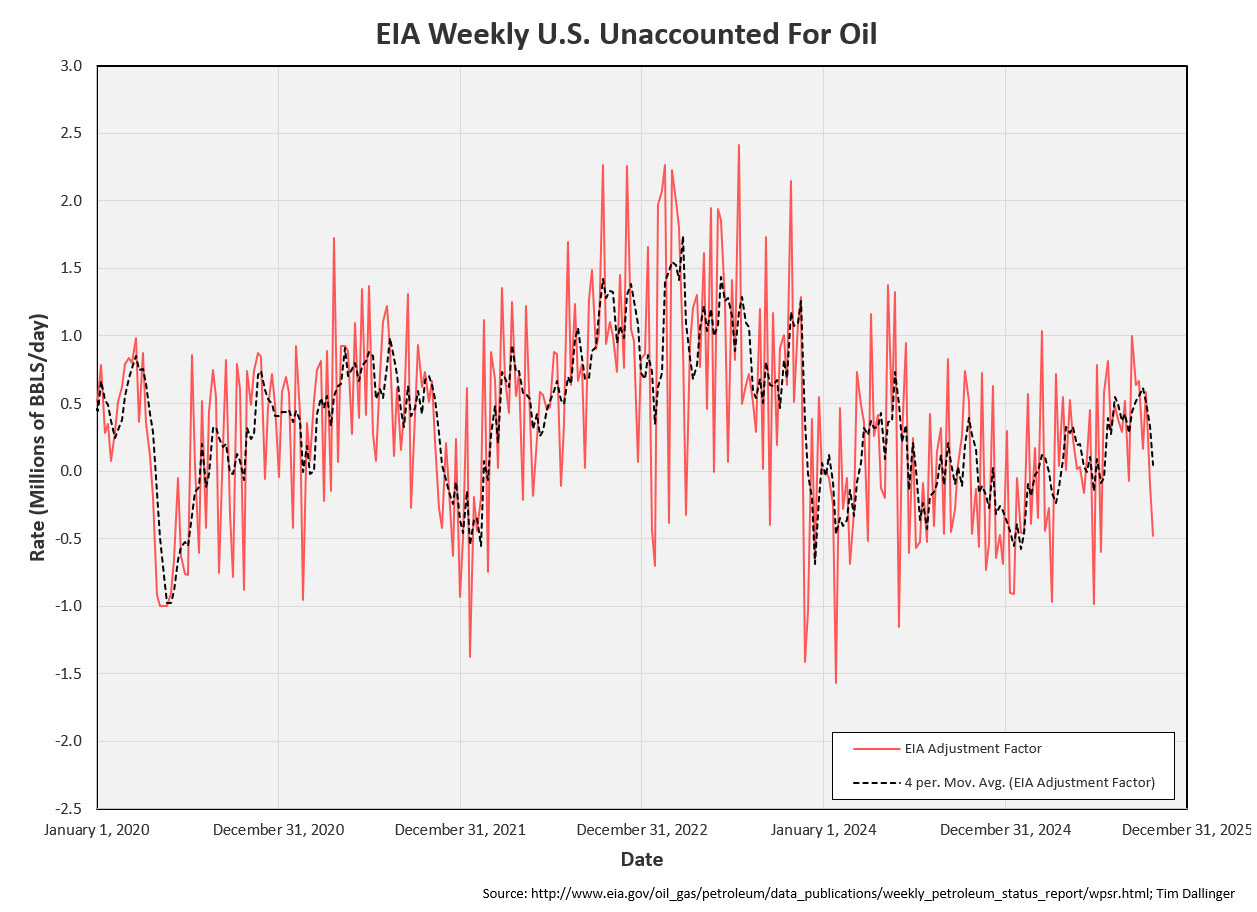

Unaccounted for crude falls further into negative territory.

The EIA is still modeling record production levels.

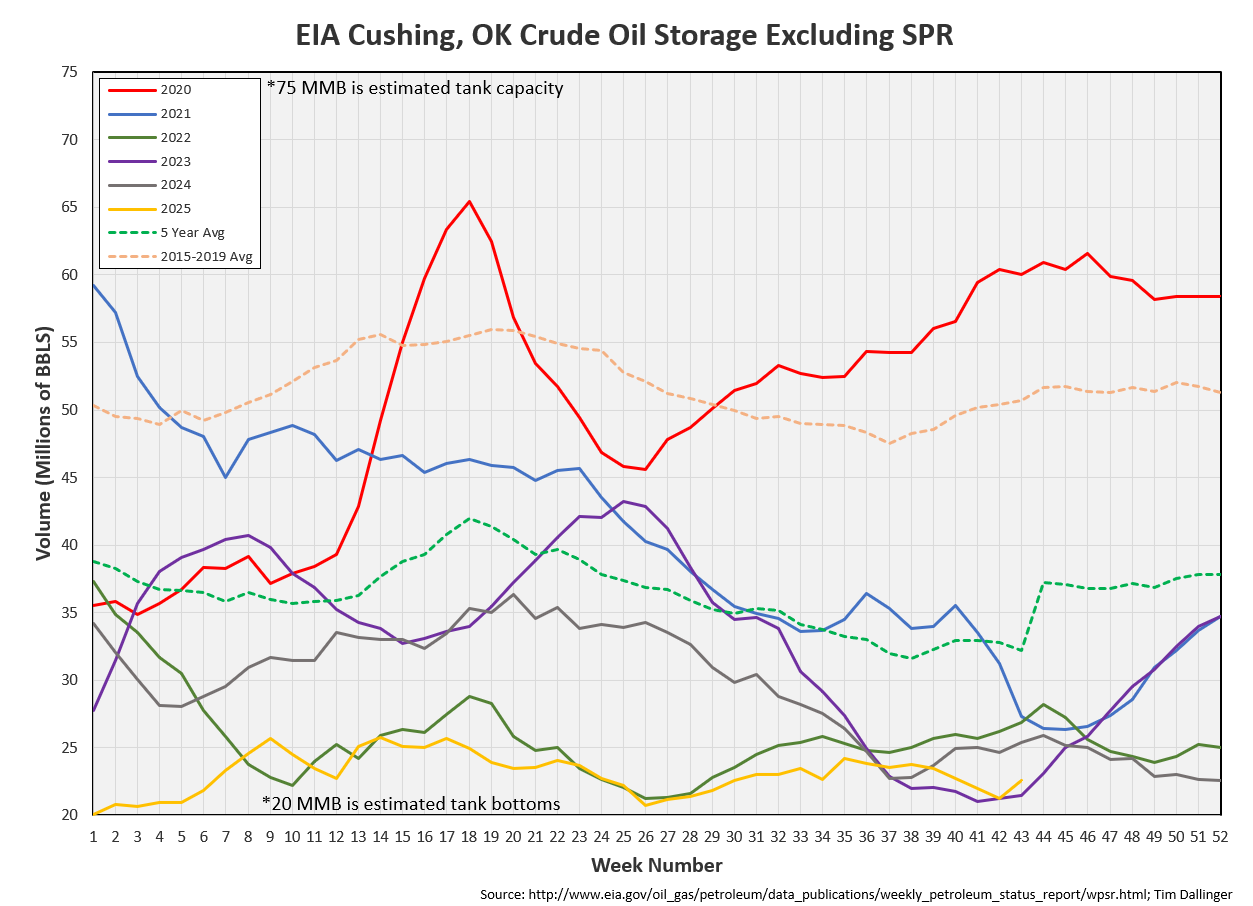

Cushing

Crude storage in Cushing, OK, increased by 1.4 MMB week on week. This was expected and follows seasonal trends. The low for Cushing should be in for the year.

Gasoline

Total motor gasoline inventories decreased by 5.9MMB and are about 3% below the seasonal 5-year average. Gasoline inventories now match 2024 levels.

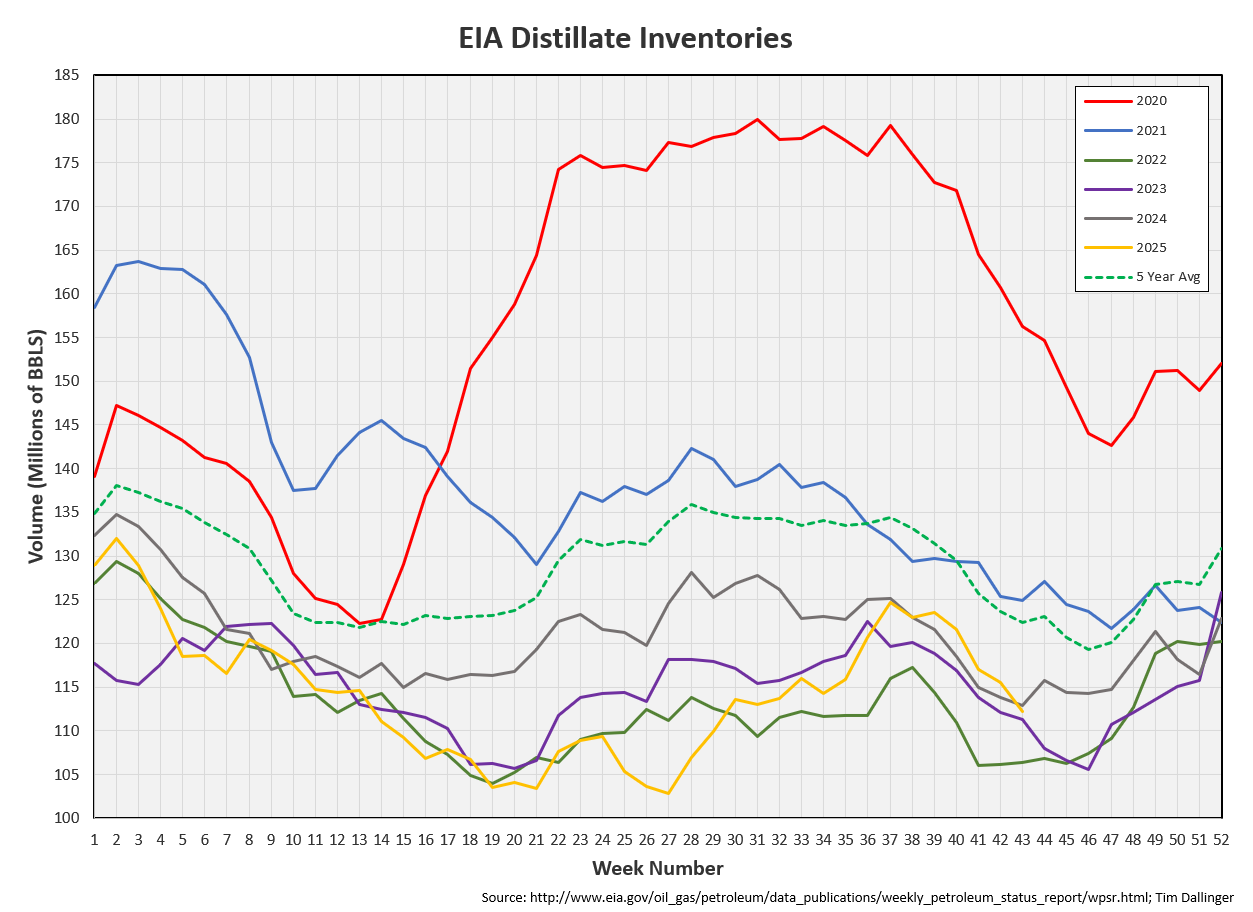

Distillate

Distillate fuel inventories decreased by 3.4 MMB last week and are about 8% below the seasonal 5-year average. 2025 distillate inventories fall back below 2024 levels.

Jet

Kerosene type jet fuel inventory decreased by 1.5 MMB. Inventories are above average but should continue to fall with Thanksgiving holiday travel approaching. Jet fuel inventories match 2021 levels.

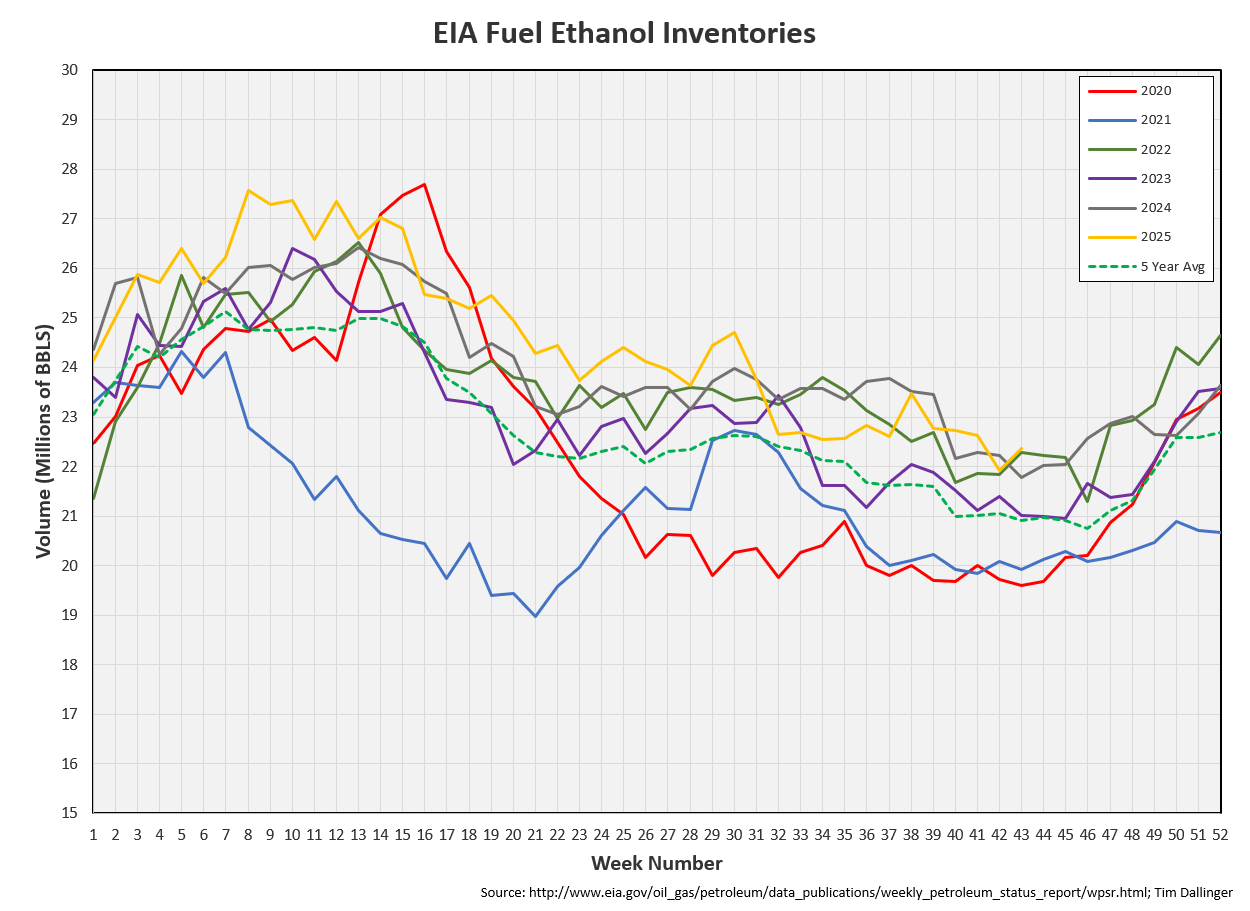

Ethanol

Ethanol inventories increased 0.4 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories increased by 2.5 million barrels from last week and are 14% above the seasonal five-year average.

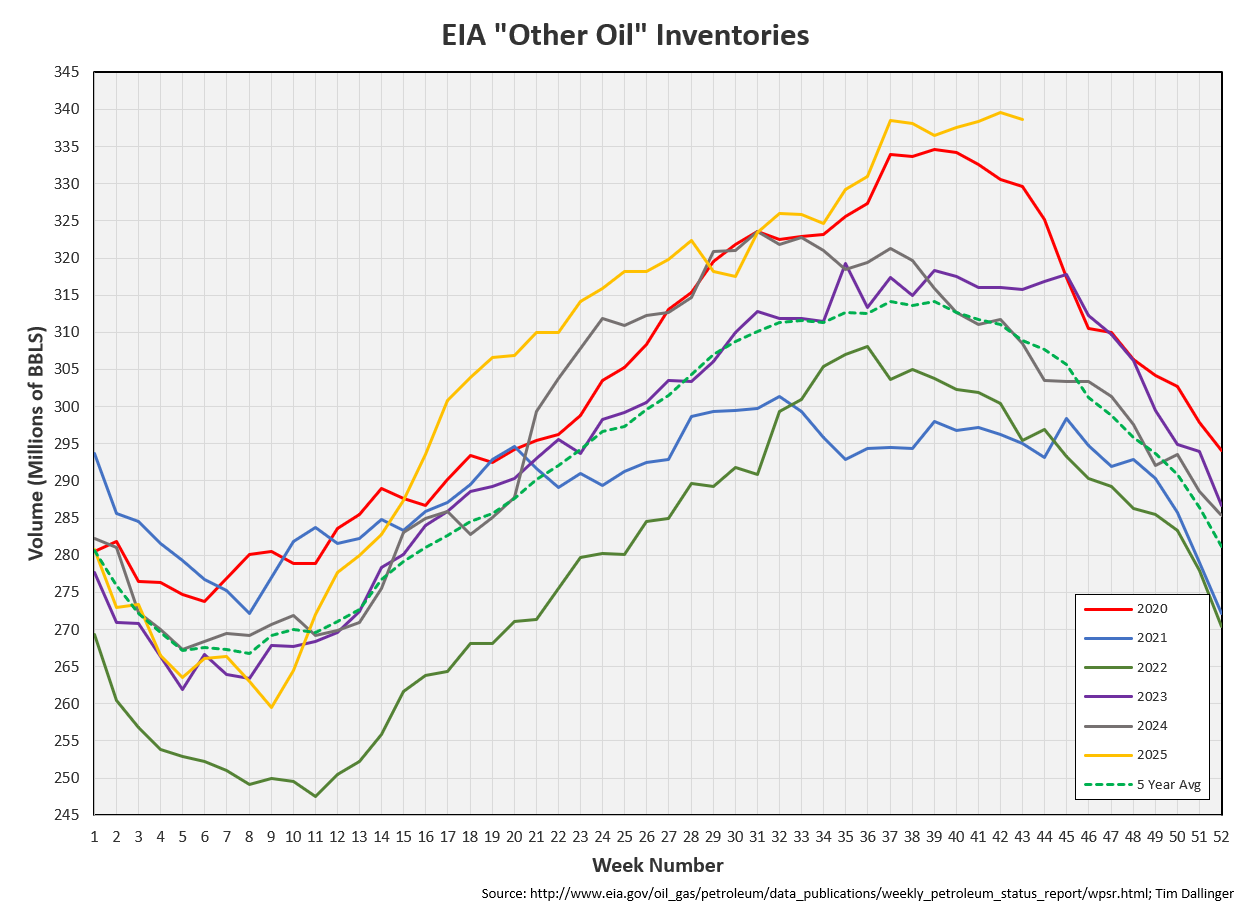

Other Oil

Other oil decreased by 1.1 MMB. Other oil inventories remain at seasonal record highs.

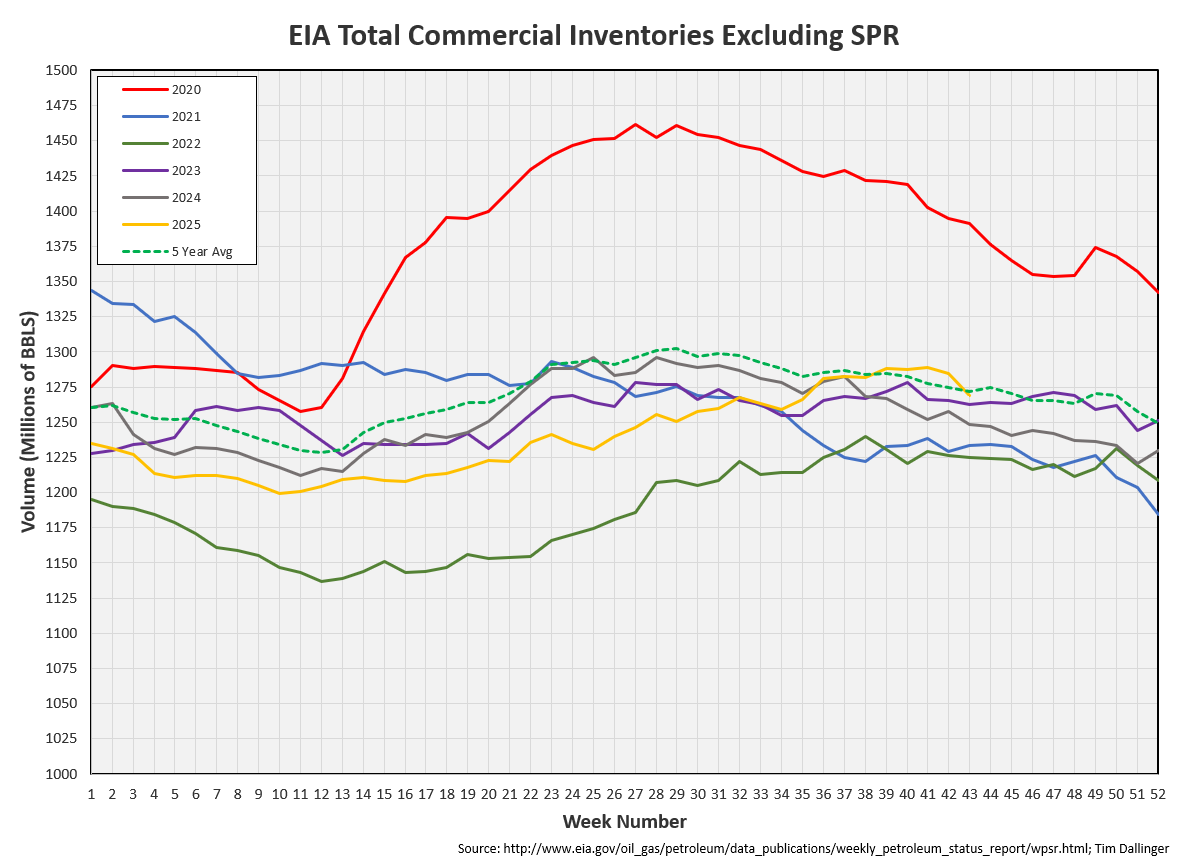

Total Commercial Inventory

Total commercial inventory falls just below average. This can be misleading because it does still include the anomalous inflated 2020 year. But it also includes 40 MMB more than average of additional propane, propylene, and other oil.

Natural Gas

US natural gas inventories are well stocked going into winter.

Refiners

The amount of crude oil refiners processed last week remains low as maintenance season continues. Utilization should increase in the next 2 weeks.

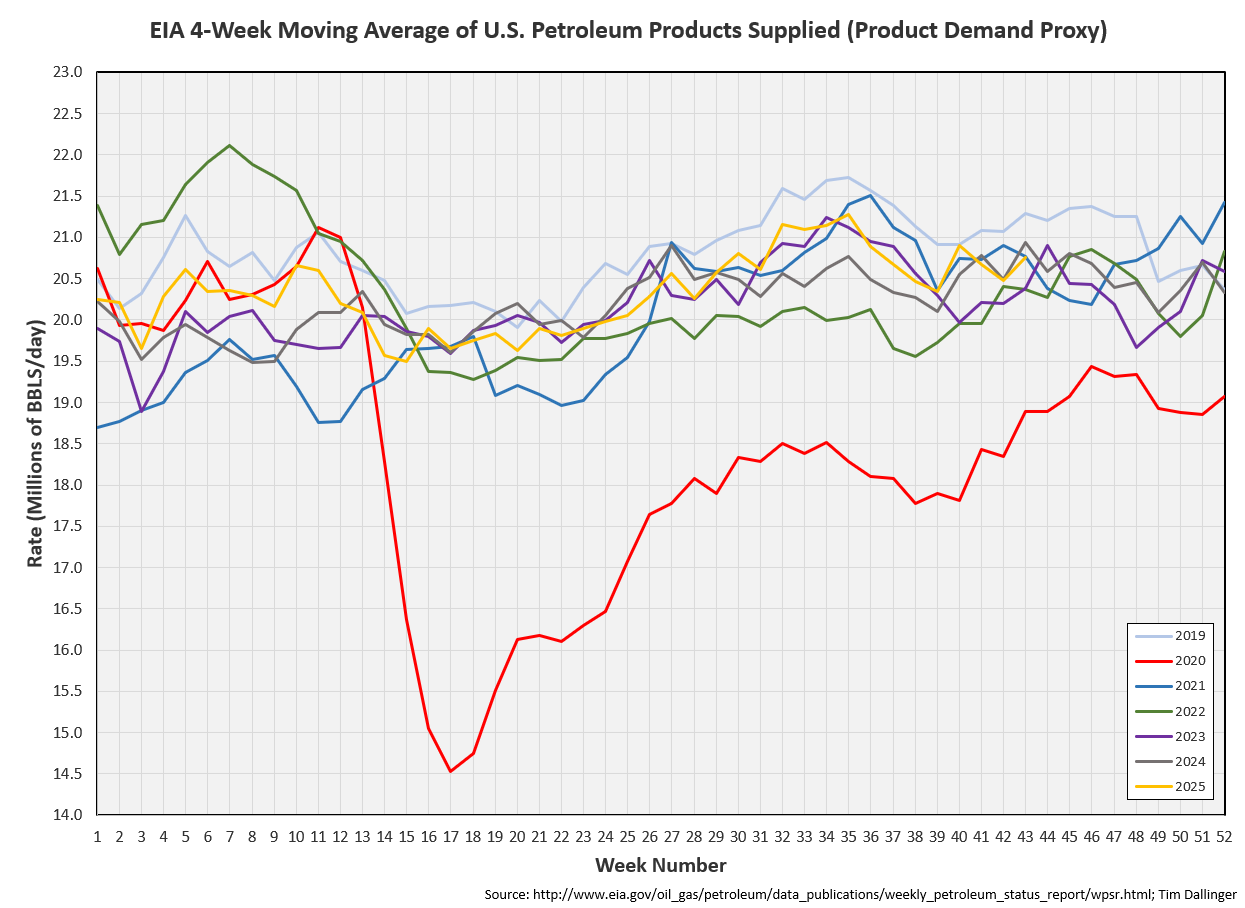

The EIA’s average product demand proxy remains at the top of range.

On a weekly basis, implied consumer demand is just below record levels. The weekly figures are noisy though which is why the rolling average is preferred.

Transportation inventories fall below 2024.

When crude is included, critical inventories are the lowest they’ve been in 5 years.

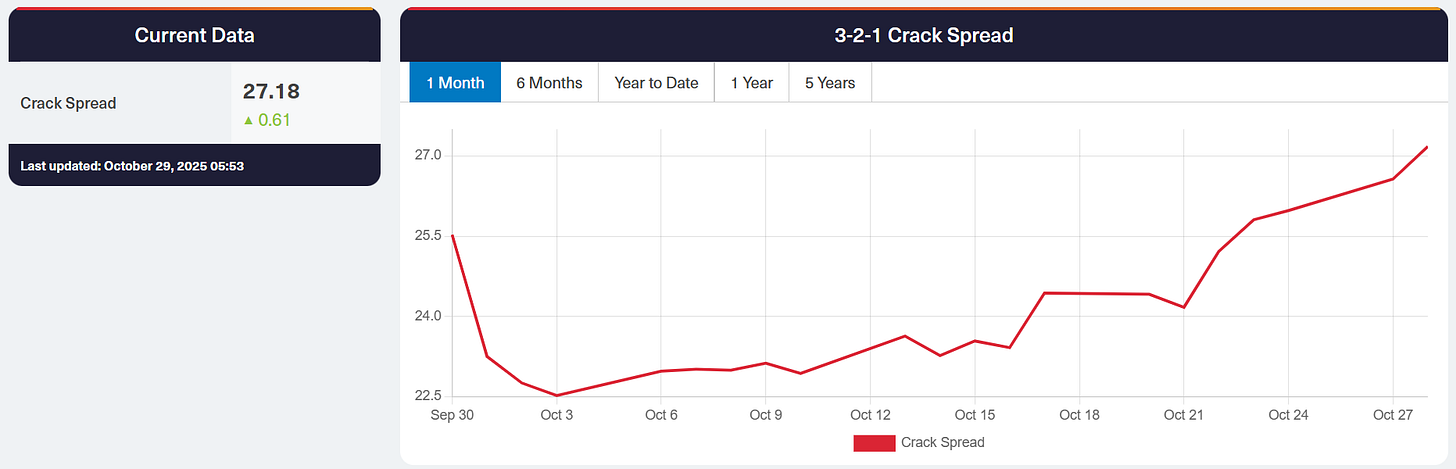

Simple cracks jump substantially with this product draw.

Discussion

Crude oil prices remain under pressure.

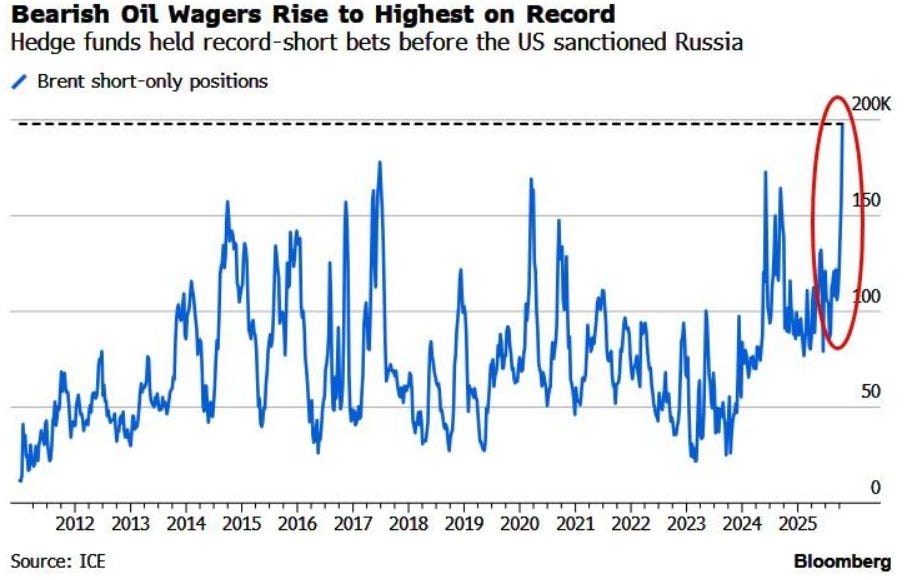

The following chart is getting much attention:

The chart shows a significant increase in oil-on-water. This is the widely reported oil glut. Oil on water is storage. However, onshore inventories are falling. Even inflated Chinese inventory is starting to draw.

Is this a massive oversupply that will land soon, filling onshore inventories? Or has something changed in the market with ship transit?

Consider that VLCC’s are moving at the slow pace since 2020.

Russian crude is being rerouted in an attempt avoid sanctions. With persistent drone attacks on the Russian refinery complex, Russian crude must be exported or shut-in.

That isn’t to make light of this volume of crude oil. It’s just not a necessarily a signal that crude prices are about to crash further. The market is pricing that though. Brent positioning was record short last week.

The WTI futures curve is in slight backwardation until the back-end. Again, this is not bullish but it does not signify a giant supply glut.

It is a confusing time for energy markets. There are conflicting signals everywhere. Floating storage and oil-on-water are both types of inventories. But onshore inventories remain under pressure and demand remains strong. The consensus view already proclaims that oil prices will continue to struggle through 2026. With prices near supply destruction, no current geopolitical outages but constant conflict in areas that produce oil and managed money positions extremely lopsided short, this does not seem like good odds for the consensus view.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Napoleon Bonaparte, played by Joaquin Phoenix, barks at the British ambassadors in the 2023 film “Napoleon.”