EIA WPSR Summary for week ending 11-24-23

Charlie, Don't Forget What Happened to the Man Who Suddenly Got Everything he Always Wanted

EIA WPSR Summary for week ending 11-24-23

Summary

Neutral report.

Crude: +1.9 MMB

SPR: +0.3 MMB

Cushing: +1.8 MMB

Gasoline: +1.8 MMB

Ethanol: -0.3 MMB

Distillate: +5.2 MMB

Jet: -0.6 MMB

Other Oil: -2.6 MMB

Total: +2.9 MMB

Spot WTI is currently pricing $77. This is slightly below fair value, based on a price model derived from reported EIA inventories.

Crude

U.S. commercial crude oil inventories increased by 1.9 MMB from the previous week and are at the seasonal 5-year average.

0.3 MMB of crude oil was transferred from commercial inventories to the SPR. Another 0.9 MMB additions are still planned for the remainder 2023.

US crude imports retreat further.

US exports remains near all-time highs.

Unaccounted oil remains stubbornly high, even after the “transfer to crude oil supply” measure. Exports appear over-counted but that alone cannot account for the entire adjustment.

This doesn’t make sense. The EIA has not corrected the weekly model. The recent changes just lead to additional confusion.

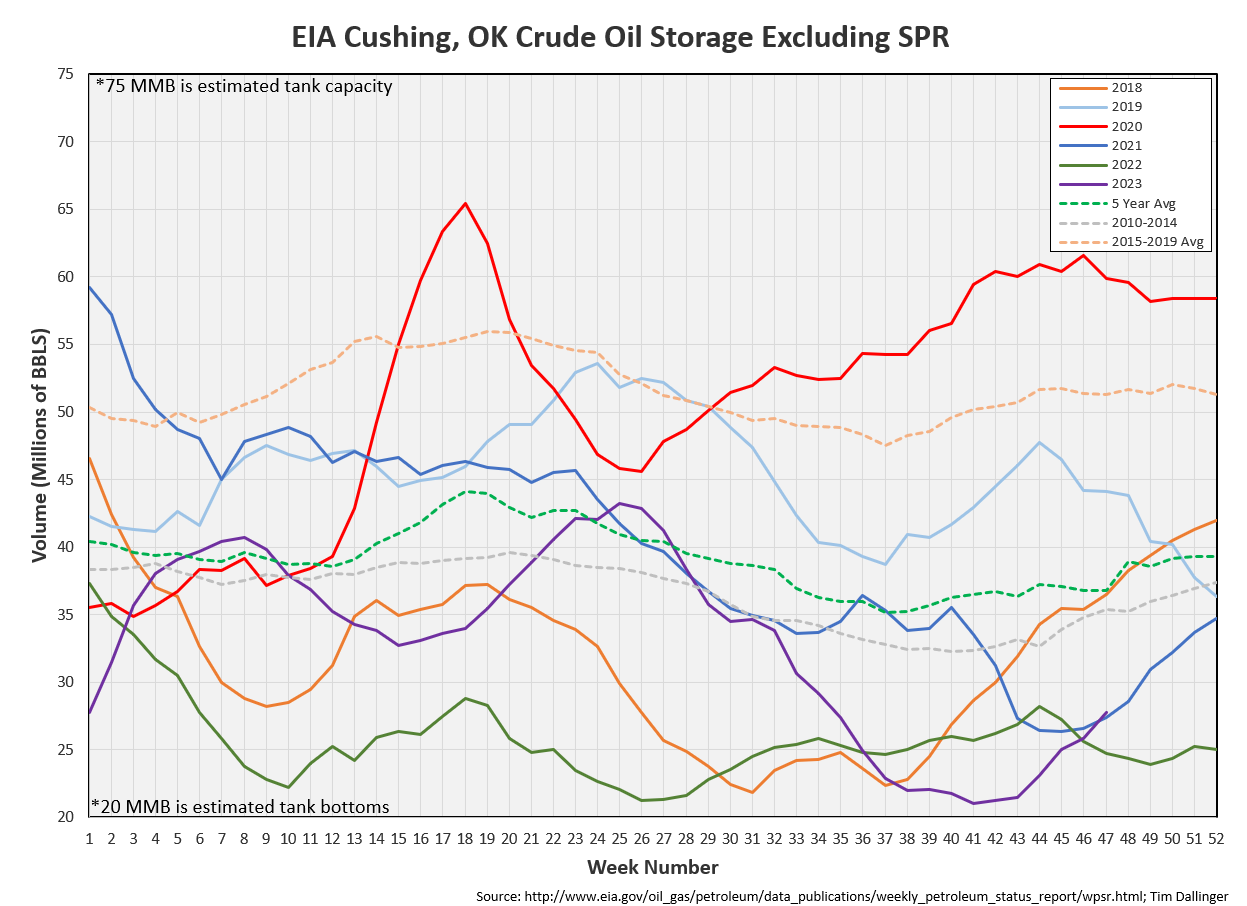

Cushing

Cushing built by 1.9 MMB. Cushing volumes appear to have reverted to expected seasonal behavior. Cushing looks to build into year end.

Gasoline

Total motor gasoline inventories decreased by 1.8 MMB and are about 2% below the seasonal 5-year average. Gasoline inventories should continue to build over the next month.

Finished gasoline inventories are still low while blending components build.

Ethanol

Ethanol inventories drew 0.3 MMB, resulting in volumes near the seasonal 5-year average.

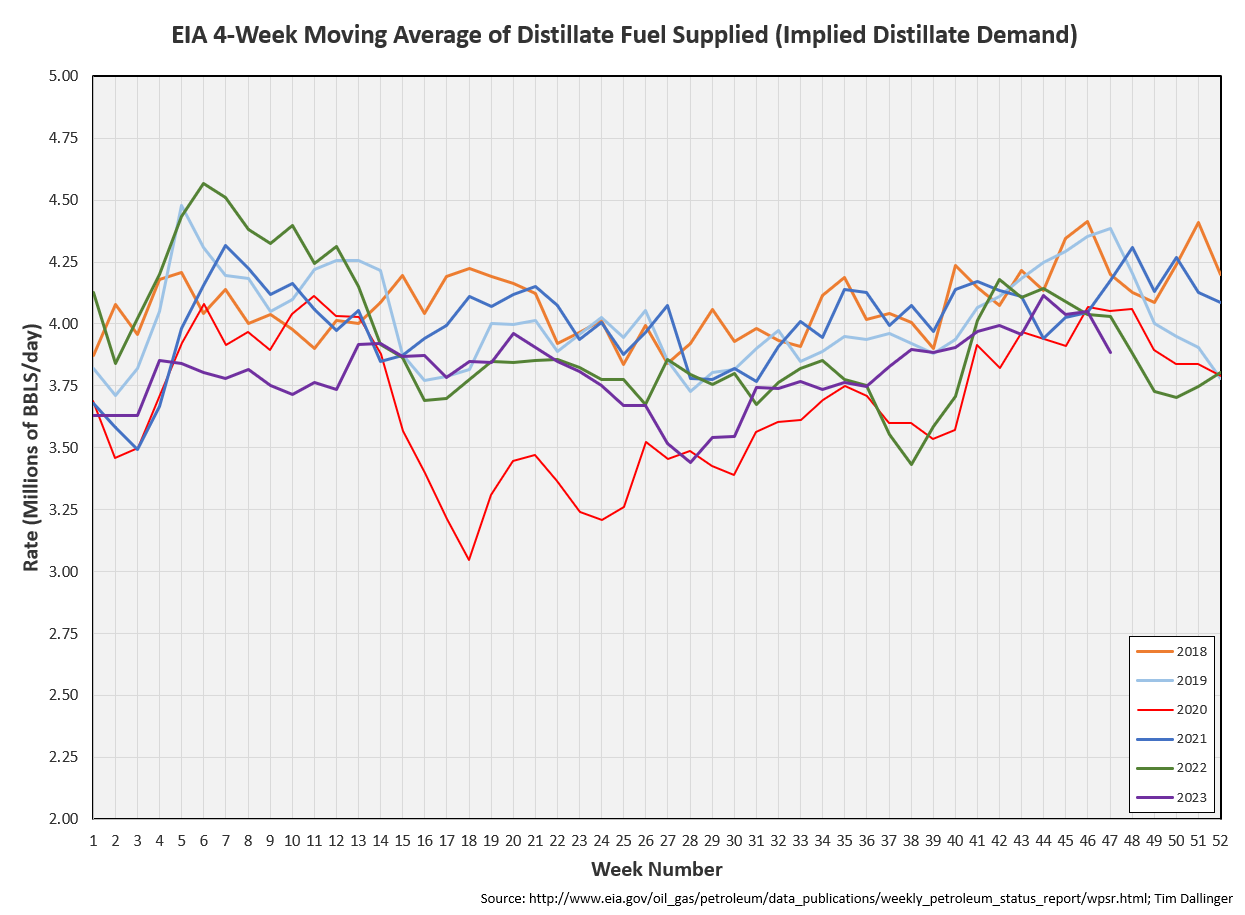

Distillate

Distillate fuel inventories increased by 5.2 MMB last week and are about 11% below the season 5-year average. Inventories are near 2022 levels.

The EIA is showing implied distillate demand to be below COVID levels. This doesn’t seem accurate. But it will be two additional months until the weekly data can be benchmarked against monthly reports.

Jet

Kerosene type jet drew 0.6 MMB. Inventories are 2% below the seasonal 5-year average.

TSA reports all-time US air traveler numbers on November 26, 2023.

Chinese flights recover back toward 2019 high’s.

https://www.airportia.com/flights-monitor/?country=CN

Propane

Propane/propylene inventories decreased by 0.5 MMB from last week and are 17% above the seasonal 5-year average.

Other Oil

Other oil decreased by 2.6 MMB. Inventories are still seasonally high but should fall into year end.

Total Commercial Inventory

Total commercial inventories increased by 2.9 MMB. This is less valuable figure than in previous years as higher carbon chain light ends and NGL’s are inflating the figures.

Natural Gas

Natural gas appears to have reached its seasonal peak. Inventories are still bloated due to high associated gas from oil production.

Discussion

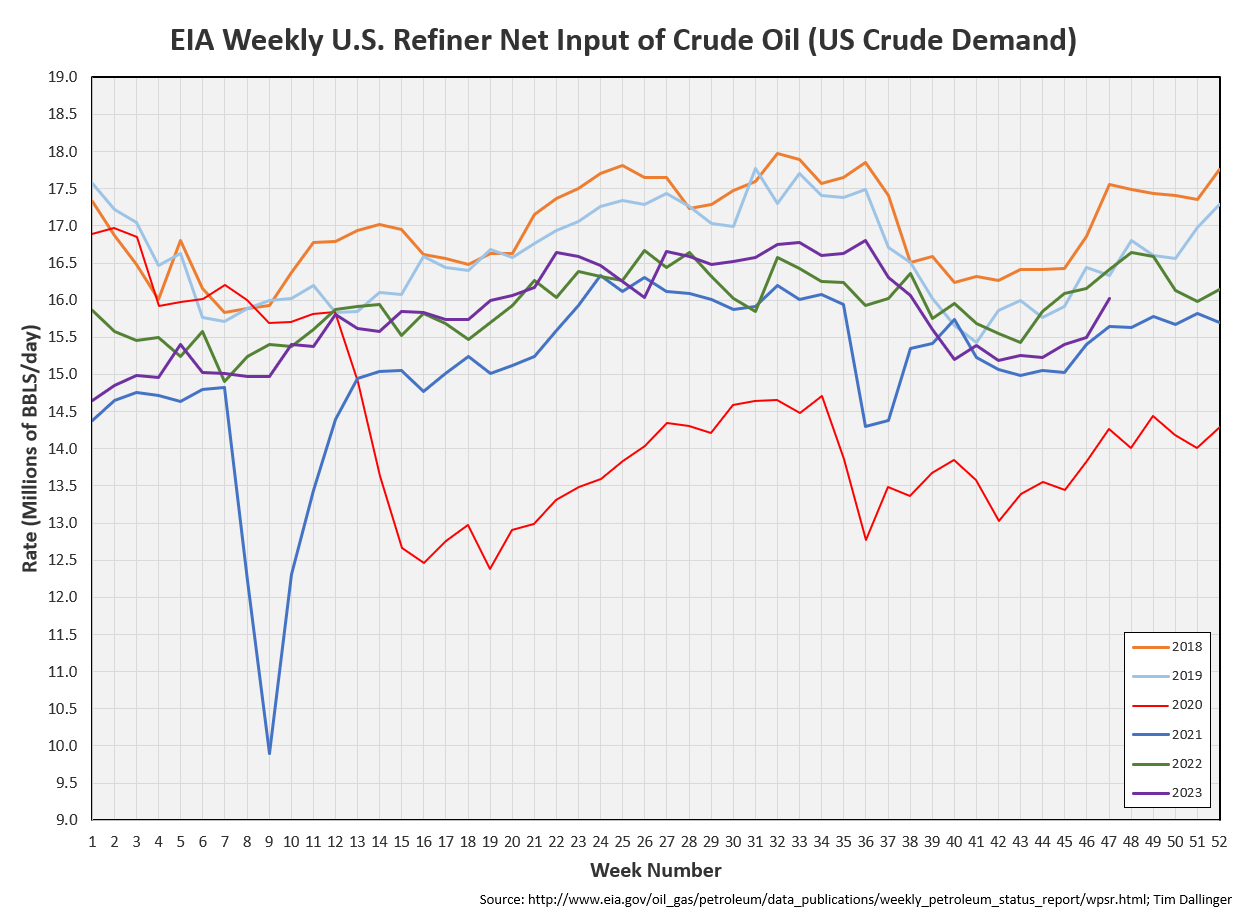

US refiners have completed maintenance season and ramp significantly this week. Utilization should increase higher next week.

The EIA is still showing a seasonally lower product demand proxy.

Looking at the components, something is off. Whatever the EIA changed with their latest model update appears to have impacted the product demand proxy significantly. It seems highly unlikely that transportation fuel demand is lower than the COVID period.

And yet, although building, transportation fuel inventory are still low.

Crack spreads have recovered. That’s a positive sign for refiners.

WTI has shifted back into slight backwardation for the front months.

Brent time spreads are slight steeper. US exports should increase, drawing US inventories are pushing the WTI Brent spread back closer.

WTI experienced significant price volatility during the US Thanksgiving week. This seems to be recent trend. A record number of brent puts were sold last Wednesday, following the announcement that OPEC+ was postponing their meeting by a week. Uncorroborated rumors are circulating that Saudi Arabia is displeased with quota compliance. OPEC+ provided no clarification for the delay. The meeting is currently scheduled for tomorrow amid continued bearish sentiment.

The bullish thesis has weakened with recessionary pressures. OPEC guidance will be important for the 2024 outlook.

This report focuses primarily on energy markets. However, today will conclude by honoring one of the greatest investors. Charlie Munger passed away yesterday, November 28, 2023 at the age of 99.

“Spend each day trying to be a little wiser than you were when you woke up. Day by day, and at the end of the day-if you live long enough-like most people, you will get out of life what you deserve.”

“Willie Wonka and the Chocolate Factory” is a 1971 musical film, staring Gene Wilder, based on Rold Dahl’s novel, Charlie and the Chocolate Factory.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.