EIA WPSR Summary for week ending 1-10-25

Summary

Crude: -2.0 MMB

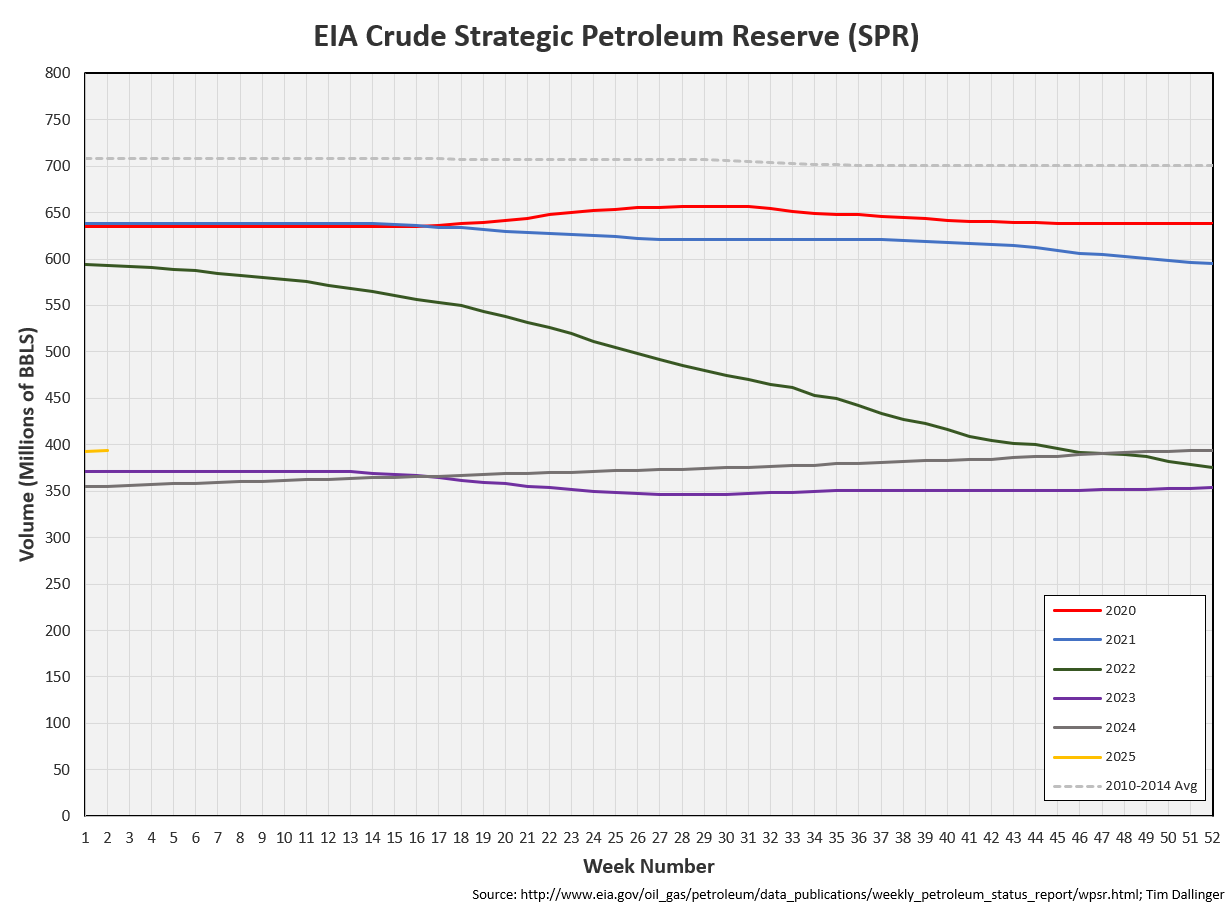

SPR: +0.5 MMB

Cushing: +0.8 MMB

Gasoline: +5.9 MMB

Distillate: +3.1 MMB

Jet: +2.1 MMB

Ethanol: +0.9 MMB

Propane: -4.7 MMB

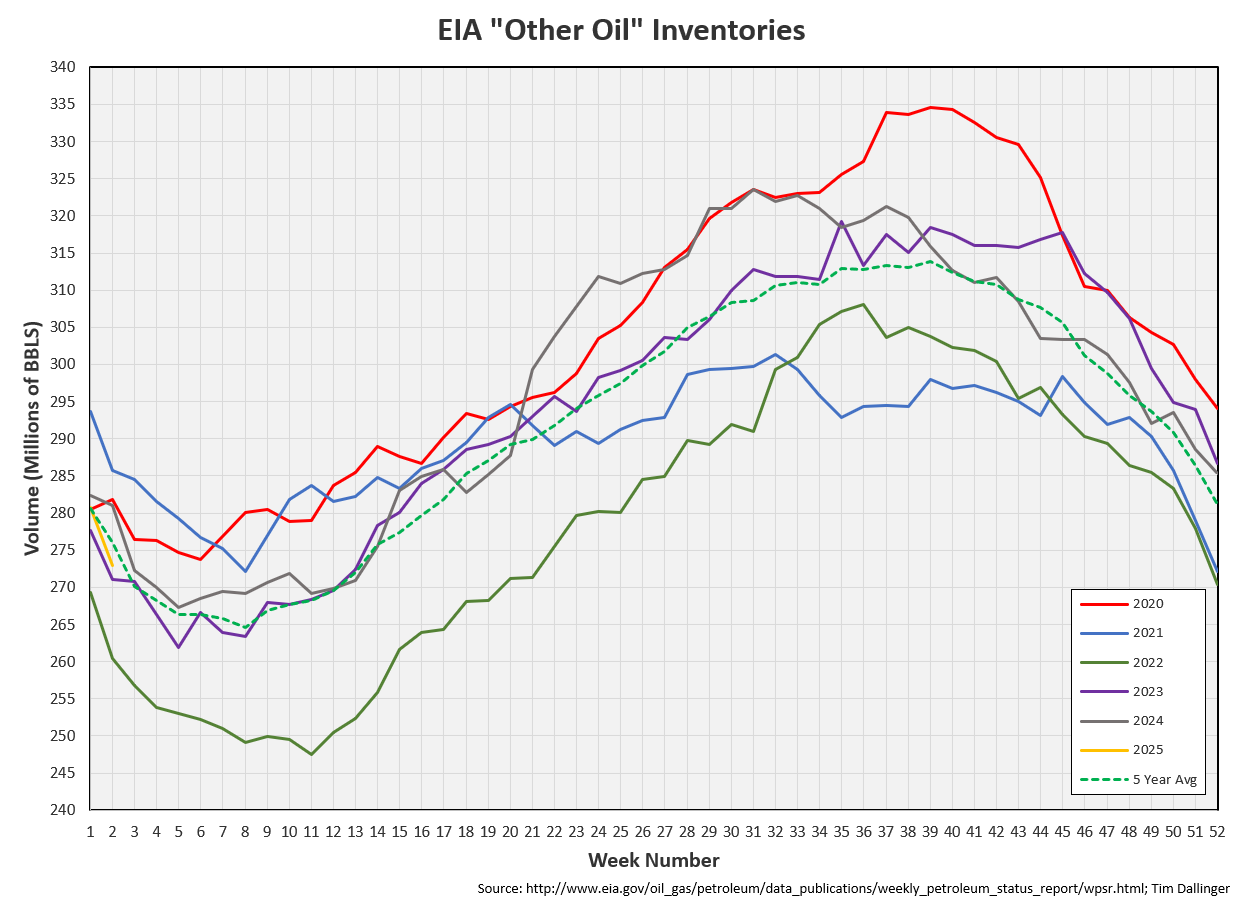

Other Oil: -7.8 MMB

Total: -3.4 MMB

Spot WTI is currently pricing $80. Spot WTI prices approaches estimated fair value based on a price model derived from reported EIA inventories. The price model uses certain product inventories which have built recently, lowered the modeled fair value while simultaneously, spot has rallied. The discrepancy is now within acceptable model error limitations.

Crude

US Crude oil supply drew by 2.0 MMB. Crude inventories are currently 6% below the seasonal average.

0.5 MMB were added to the SPR.

US crude imports fell below average.

US crude exports reverted higher, back to the recent mean.

Unaccounted for crude spiked positive. It appears imports were undercounted as US crude production was re-benchmarked lower.

Cushing

Crude storage in Cushing, OK, built off tank bottoms, increasing inventories by 0.8 MMB week on week. Volumes remain near record lows.

Gasoline

Total motor gasoline inventories increased by 5.9 MMB and are near the seasonal 5-year average.

Finished gasoline inventories are at record low levels.

Gasoline is typically stored in its blending constituencies. The EIA doesn’t break out the quantities so it’s not possible to determine if there’s a limiting component. Refiners are making winter blend currently so more condensate and NGL’s are currently added to gasoline.

Distillate

Distillate fuel inventories increased by3.1 MMB last week and are about 4% below the seasonal 5-year average.

Jet

Kerosene type jet fuels increased by 3.1 MMB. Jet inventories seem high but there is currently significant air travel which could explain the need for higher inventories.

Ethanol

Ethanol inventories increased by 0.9 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories drew by 4.7 MMB. Inventories are absolutely higher than average but following their normal seasonal trajectory.

Other Oil

Other oil drew by 7.8 MMB. Inventories are slightly below seasonal averages. Some fluid that gets dumped into this “leftover” category, is likely being used as gasoline blending components.

Total Commercial Inventory

Total commercial inventory drew by 3.4 MMB and remain below seasonal averages. Only 2022 has been lower in recent years.

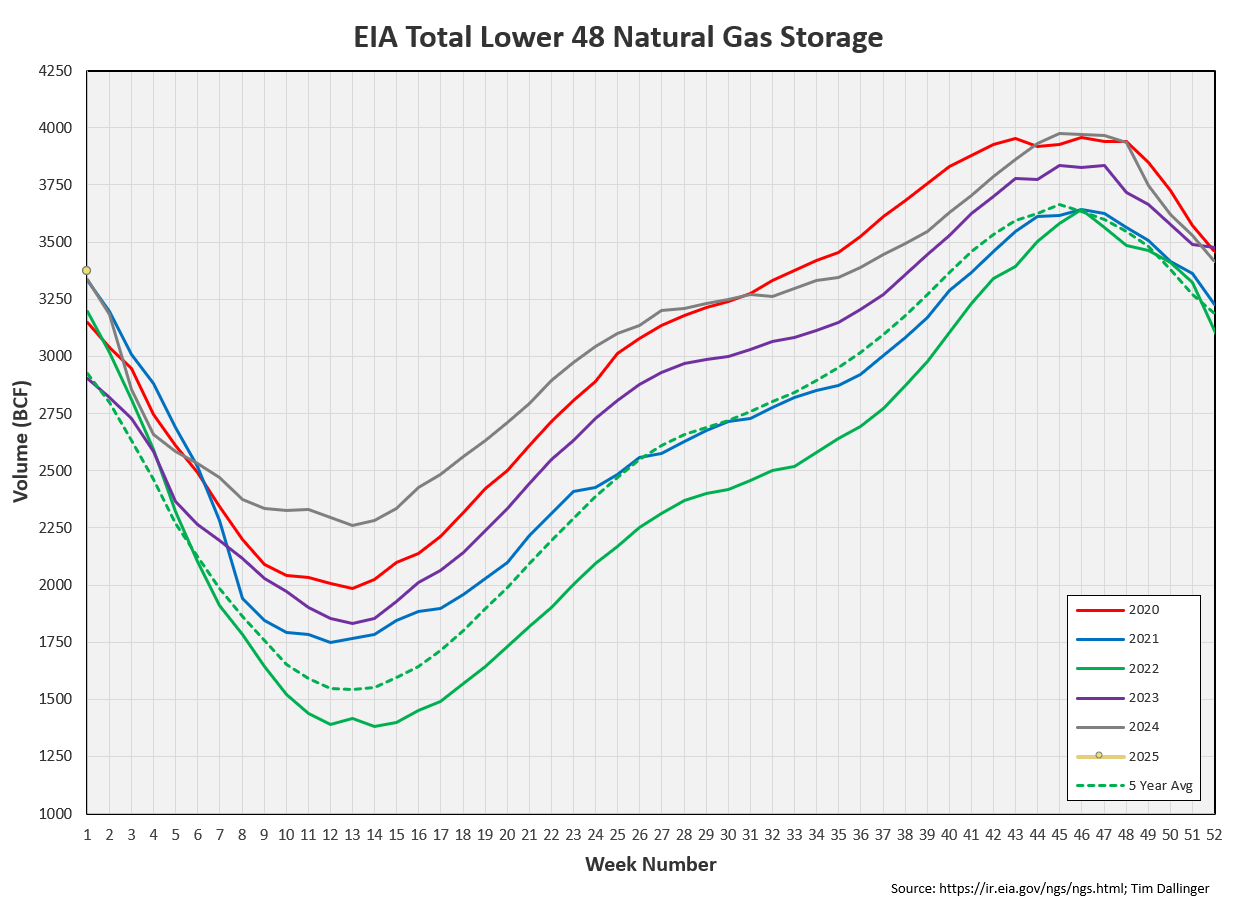

Natural Gas

The chart provided last week for natural gas inventories has not been updated. The new EIA report will be released tomorrow.

More cold weather approaches. This should drive heating oil, propane and natural gas demand.

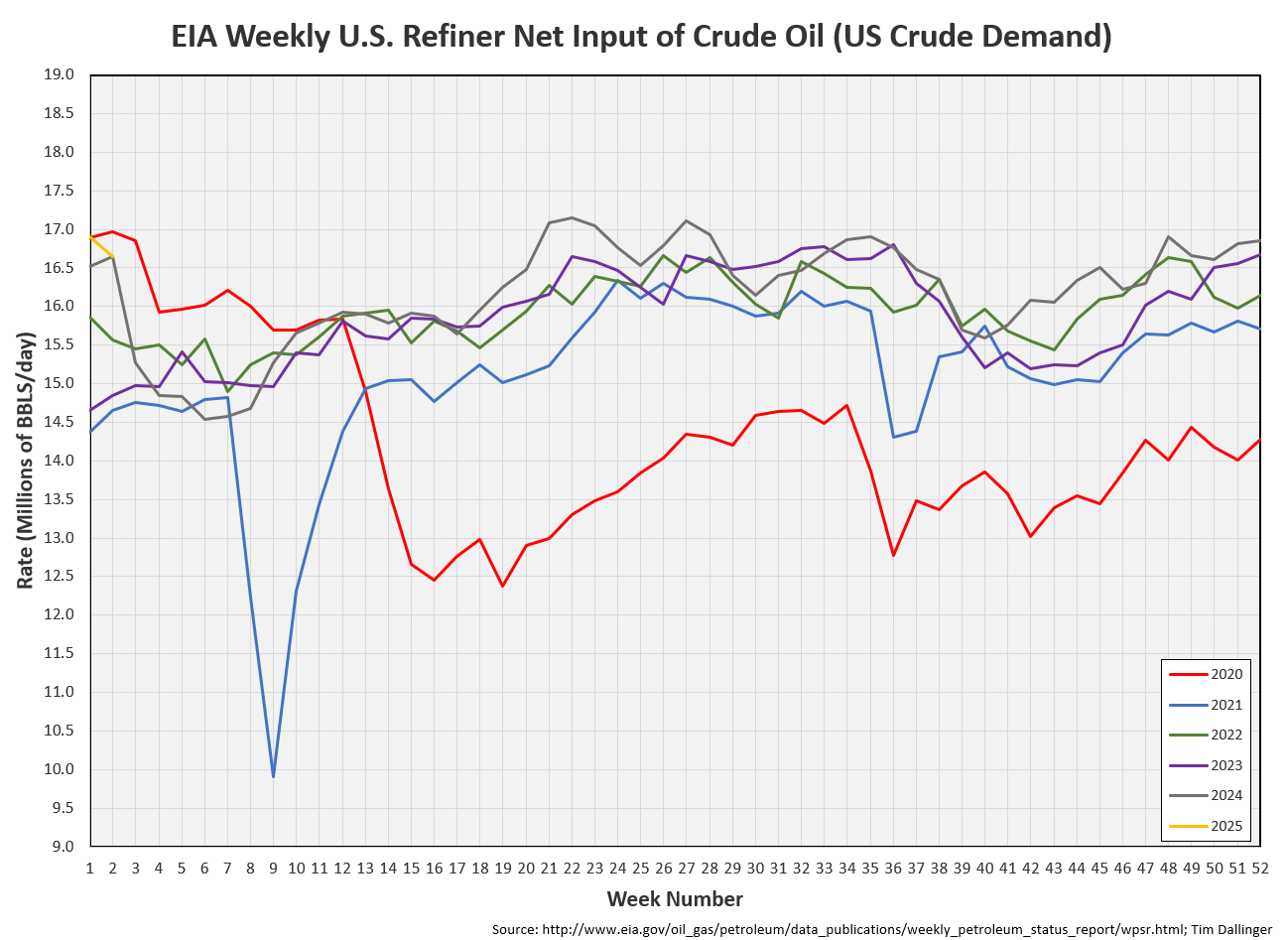

Refiners

The amount of crude oil refiners processes last week fell slightly. It remains at elevated levels though.

The EIA’s product demand proxy is healthy. Only 2022 has been higher.

Implied demand for transportation inventories is a little lighter but still near high’s.

Transportation inventories have been building but remain below average in a normal seasonal trajectory.

Including crude and inventories are even lower, seasonally.

Surprisingly, simple cracks rallied today even with the product builds. Cracks aren’t extremely healthy but the recent bounce off the bottom is a bullish sign.

Discussion

Both WTI and Brent have rallied hard, over the past month. Today, WTI cracked $80 in the first time since July, 2024.

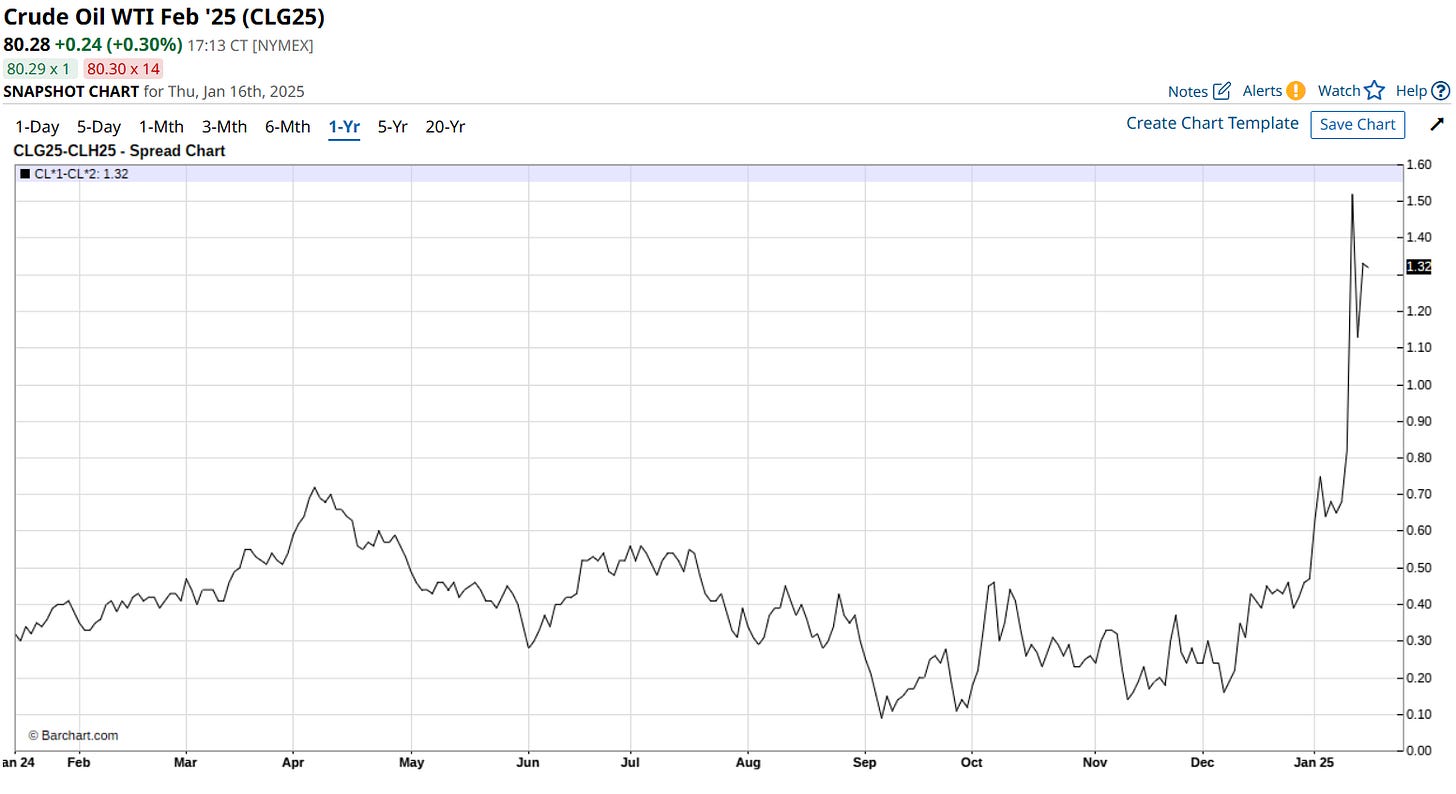

Futures are rallying too. Crude oil is in fairly steep backwardation, suggesting the physical market is undersupplied.

This price movement has bears in disbelief. What changed so quickly?

New sanctions on Russian vessels were announced last week. China also appears tepid to book Iranian crude delivery right now with the uncertainty surrounding Trump’s sanction enforcement plans. Traders estimate this has taken about 1.5 MMBD of supply off the market. This publication has been highlighting that inventories are low globally and there is very little excess supply that can come online quickly in the event of an outage.

Managed money had been net short as a recession hedge. With Cushing at tank bottoms and current supply interruption, shorts closed positions, driving crude prices back to a more fair value.

Shipping routes will likely change, and shrewd traders will explore ways to evade sanctions like ship-to-ship transfers. But for now, this is a real supply issue.

What about supply issues going forward in 2025?

The EIA, the IEA and OPEC have all produced recent 2025 guidance.

The EIA is finally admitting that there was no over-supply in 2024. This was evident by global inventory but still the poor demand narrative prevailed. The EIA previously showed Q1 2025 would experience significant inventory builds. They’ve quietly revised their 2025 outlook, pushing builds out into Q2. Expect another revision down for Q2 when it gets closer.

The IEA is always the most bearish. They provide similar forecasts. However, they don’t provide as clear charts.

The IEA maintains there will be a 700 kbd oversupply. They show global growth but expect the US, Canada, Guana, Norway and Brazil to grow more.

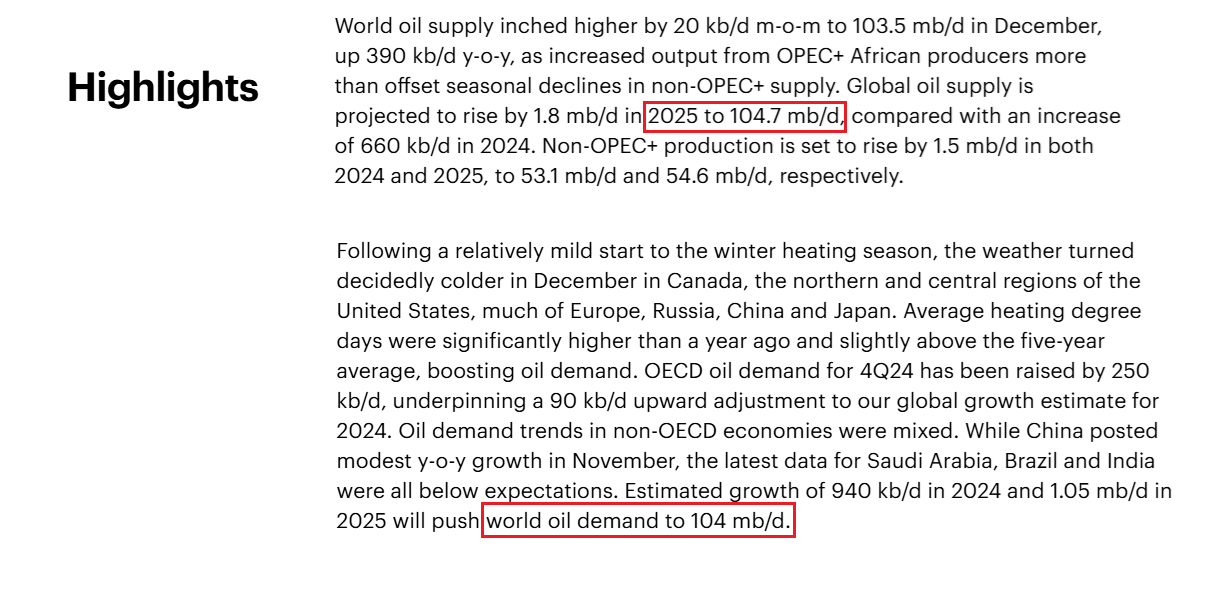

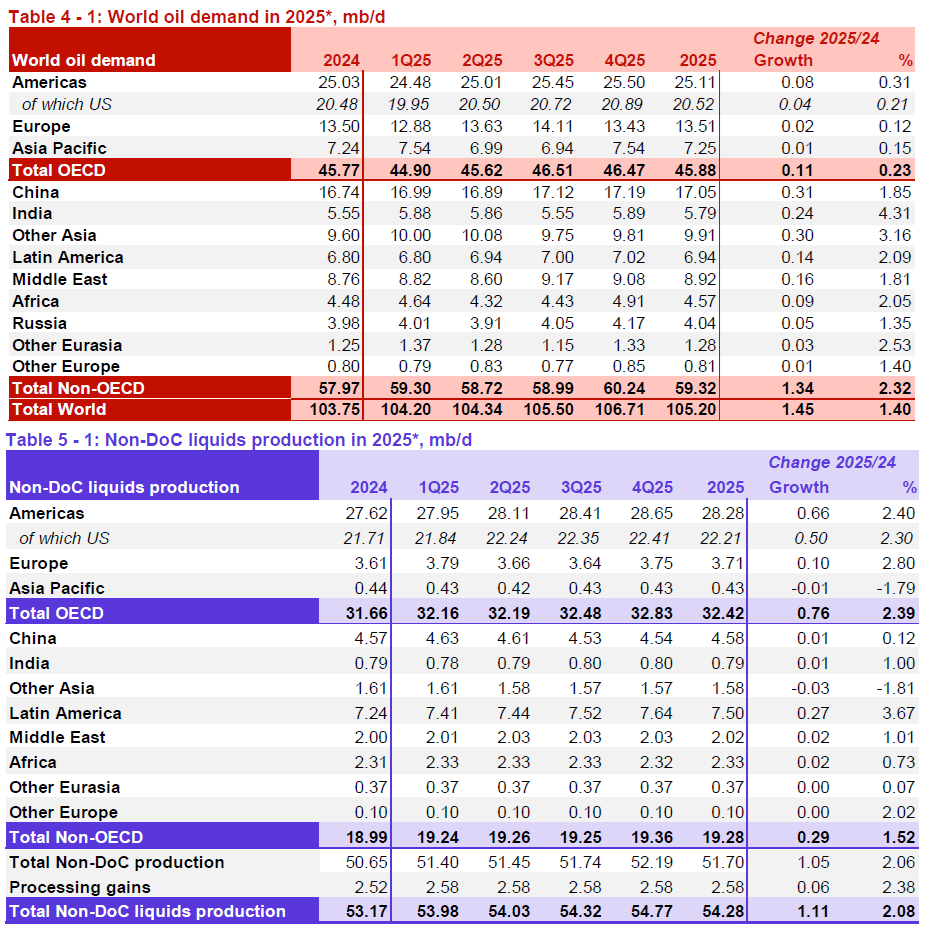

OPEC’s reports are thorough but confusing. They don’t clearly project OPEC production. They derive global demand by adding Total OECD demand and Total No-OECD demand. Notice OPEC’s global demand projections are higher than the other organizations.

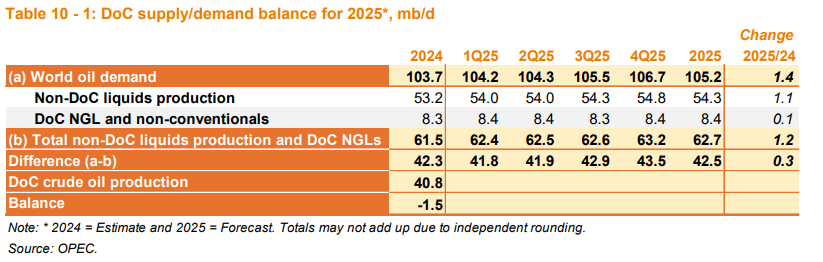

To get Production, Ex-OPEC, they add estimated liquid production and NGL production. Subtracting that from the total demand estimate yields the “call on OPEC.” This is the volume they estimate the countries in the “Declaration of Cooperation” must produce to balance the market.

Notice DOC production fell below the call on OPEC in 2024. Hence the supply deficit.

OPEC has no intention of flooding the market. They wish to keep the market balanced and prices high enough to encourage more production. There is no sign that Saudi Arabia wants a market share war. That was another narrative used to drive price down.

All of the growth models are relying on the US to carry the brunt of new production volume. The EIA re-benchmarked US production lower in the latest STEO.

Is this the start of US shale production faltering? Many insiders watching rig count, frack spreads and shale well GOR have been waiting for this to occur for some time. Interestingly, US production doesn’t even have to falter to drive a supply imbalance. If it flatlines, demand growth appears poised to outpace current supply.

Geopolitical events are driving recent crude price moves. But the fundamental do support these prices. OPEC demand appears optimistic. But even the EIA is starting to question the IEA balances.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Billie Jean, portrayed by Helen Slater, leads a teenage rebellion against authorities in the 1985 cult-classic film, The Legend of Billie Jean.