EIA WPSR Summary for week ending 5-24-24

Neural report, skewing bearish.

Summary

Neutral report.

Crude: -4.2 MMB

SPR: +0.5 MMB

Cushing: -1.7 MMB

Gasoline: +2.0 MMB

Distillate: +2.5 MMB

Jet: +0.2 MMB

Ethanol: -1.0 MMB

Propane: +2.1 MMB

Other Oil: +11.6 MMB

Total: +12.7 MMB

Spot WTI is currently pricing $77. Price is at fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 4.2 MMB. Crude inventories are currently 4% below the seasonal average.

0.5 MMB were added to the SPR. 14.1 MMB have been added to the SPR in 2024. Even with this addition, SPR inventories are still below January 2023 level.

US crude imports were up slightly.

Crude exports fell.

Unaccounted for crude fell but was still positive at 436 kbd. Imports and exports appear accurate this week according to independent ship trackers, so the source of this volume is unknown.

Cushing

Crude storage in Cushing, OK, drew by 1.7 MMB week on week. This is a considerable, unexpected draw.

Gasoline

Total motor gasoline inventories increased by 2 MMB and are about 1% below the seasonal 5-year average. This is normal seasonal behavior, although a week earlier than expected.

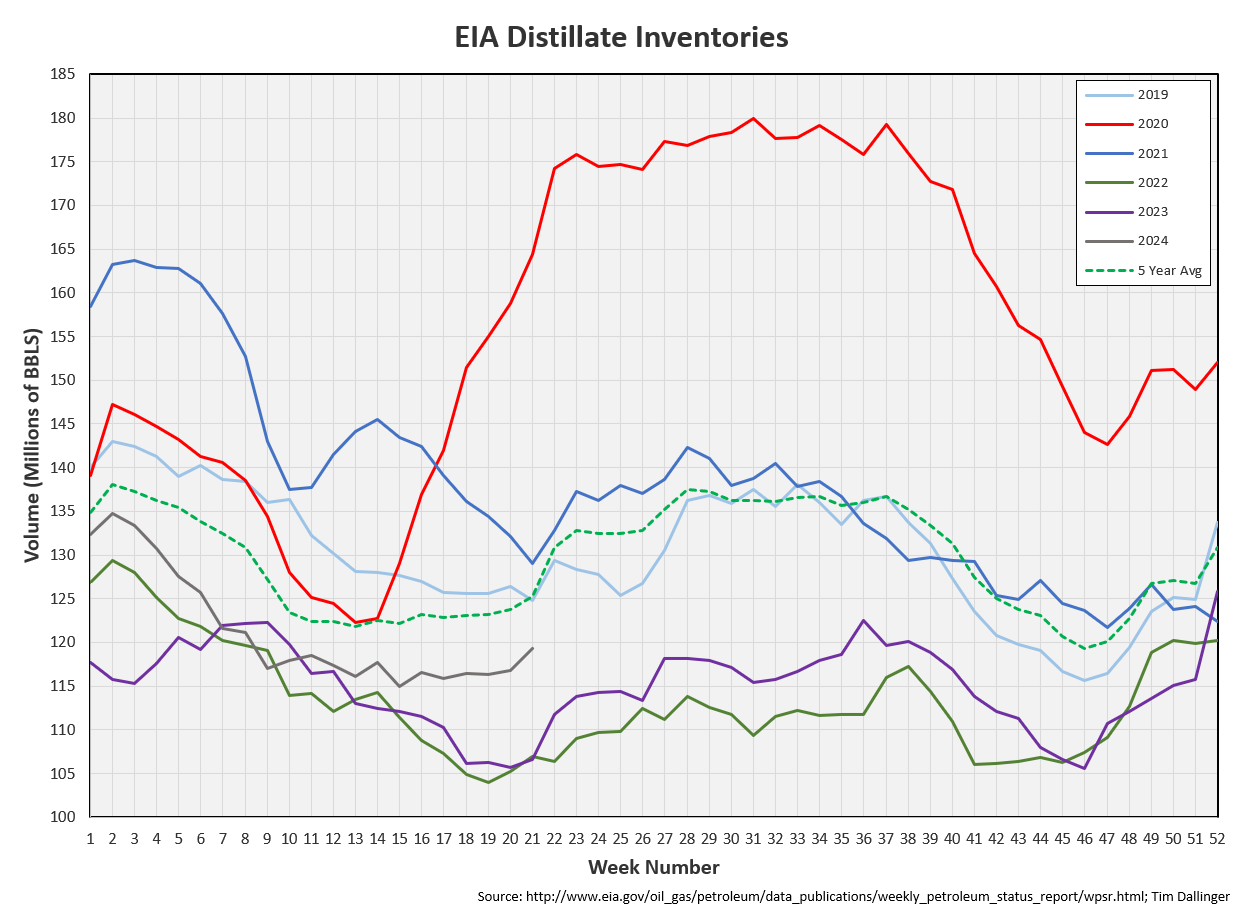

Distillate

Distillate fuel inventories increased by 2.5 MMB last week and are about 6% below the seasonal 5-year average. This is also seasonally normal behavior.

Jet

Kerosene type jet fuels built slightly.

Global miles flown are just below all-time records.

https://www.airportia.com/flights-monitor/

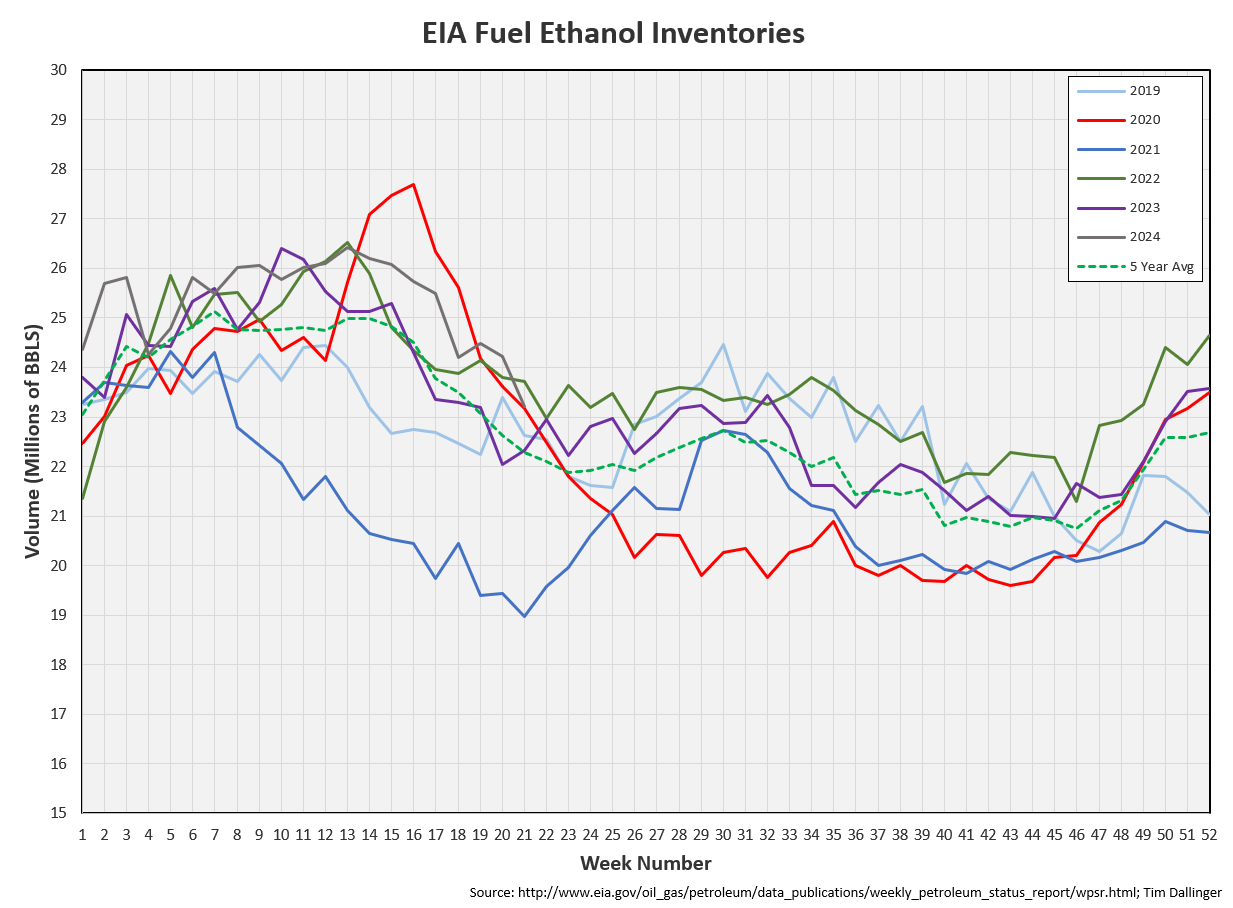

Ethanol

Ethanol inventories decreased 1.0 MMB week-on-week. Inventories are about 5% above seasonal averages.

Propane

Propane/propylene inventories increased by 2.1 MMB. Inventories are above the seasonal average.

Other Oil

Other oil built a massive 11.6.MMB. This is the largest build on record. There’s no clear underlying reason. With the odd behavior recently in “other oil supplied,” this could easily be an artifact from the EIA modelling issues.

Total Commercial Inventory

Total commercial inventory built by 12.7 MMB, mostly from other oil.

Natural Gas

Natural gas inventories remain high.

Refiners

US refiners processed a seasonal amount of crude last week. US refiners have not exceeded 17 MMB of crude oil processed since September, 2019.

The EIA’s product demand proxy fell slightly.

Transportation inventories built seasonally.

Simple crack spreads are really struggling currently.

The WTI term structure remains backwarded.

The 1-2 brent timespread is flat. Industry rumors suggest a large international producer is hedging their prompt production, putting additional pressure on the front month. This doesn’t suggestion strong international demand.

Discussion

The crude draw this week was a surprise. US refiners processed record amounts of crude oil, but consumer product demand proxies didn’t keep up. The product build offset any positive sentiment. Crack spreads sold off in response.

OPEC meets virtually next week. Consensus is for an extension of the production cuts. Volatility is expected.

The long Memorial Day holiday weekend marks the unofficial start of summer. Consumer demand now needs to increase for the bullish thesis to continue.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

American rock group, Alice Cooper, released the anthem “School’s Out” in 1972.