EIA WPSR Summary for week ending 11-1-24

Summary

Crude: +2.1 MMB

SPR: +1.4 MMB

Cushing: +0.5 MMB

Gasoline: +0.4 MMB

Distillate: +2.4 MMB

Jet: -0.2 MMB

Ethanol: +0.2 MMB

Propane: -1.0 MMB

Other Oil: -5.0 MMB

Total: +1.1 MMB

Spot WTI is currently pricing $71. Prices remain significantly below estimated fair value based on a price model derived from reported EIA inventories.

Crude

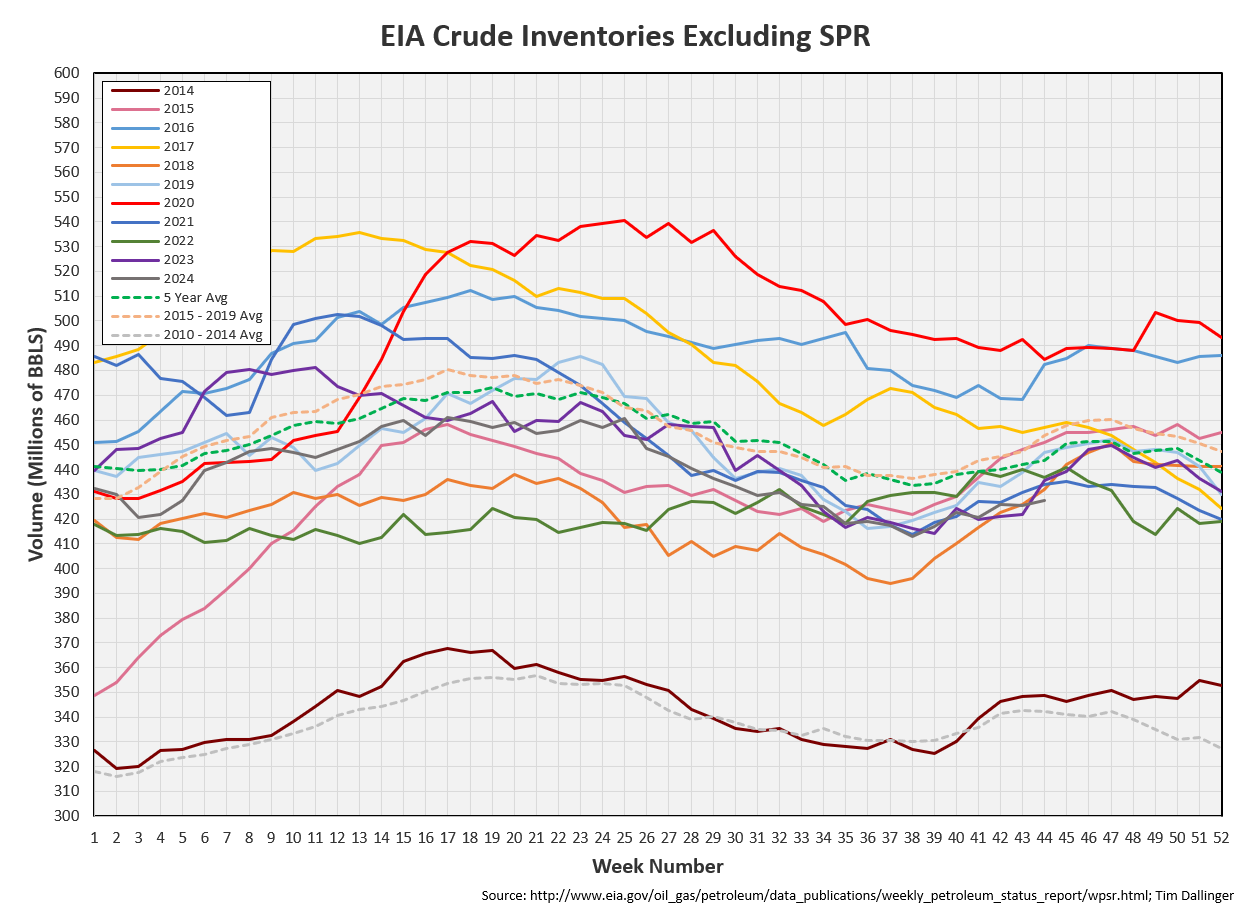

US Crude oil supply built by 2.1 MMB. Crude inventories are currently 5% below the seasonal average.

The following is a messy graph, but it illustrates that seasonal crude inventories are the lowest they’ve been since 2014.

1.4 MMB were added to the SPR. Inventories are back to December 2022 levels.

US crude imports were slight up, week-on-week, near average levels.

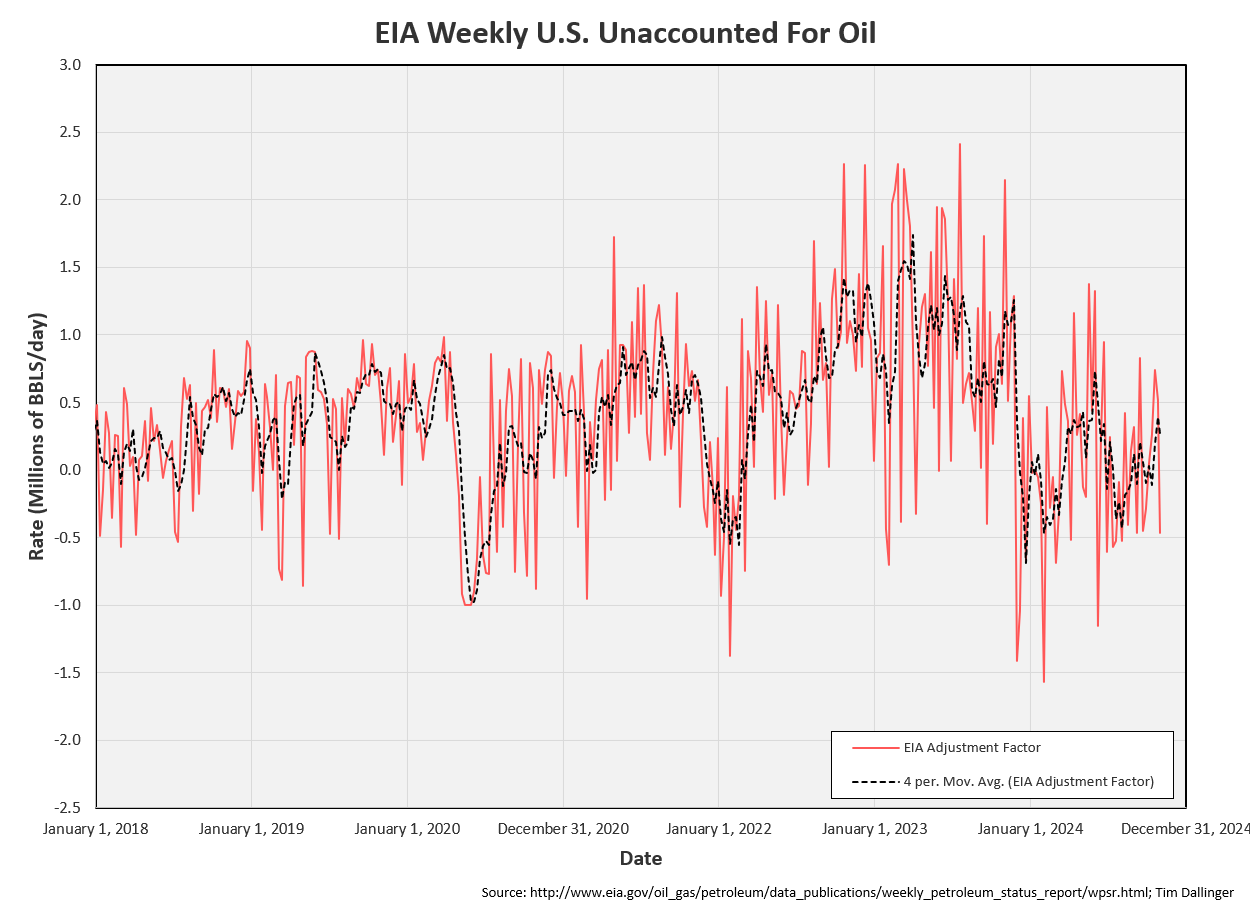

Crude exports fell significantly. Exports were down but independent ship trackers did not confirm it was by that much. It appears US Customs miscounted.

Unaccounted for crude flipped negative. Part of this explained by the miscounted exports.

The EIA is still estimating that US production remains at record levels.

The August Petroleum Supply Monthly is matched the weeklies fairly well.

The EIA plans to refine the weekly production estimate further in 2 weeks:

Cushing

Crude storage in Cushing, OK, built by 0.5 MMB week on week.

Gasoline

Total motor gasoline inventories increased by2.4 MMB and are about 2% below the seasonal 5-year average.

Blending components were flat. This is odd as winter blend gasoline is currently being produced.

Distillate

Distillate fuel inventories increased by 2.4 MMB last week and are about 6% below the seasonal 5-year average.

Jet

Kerosene type jet fuels drew by 0.2 MMB.

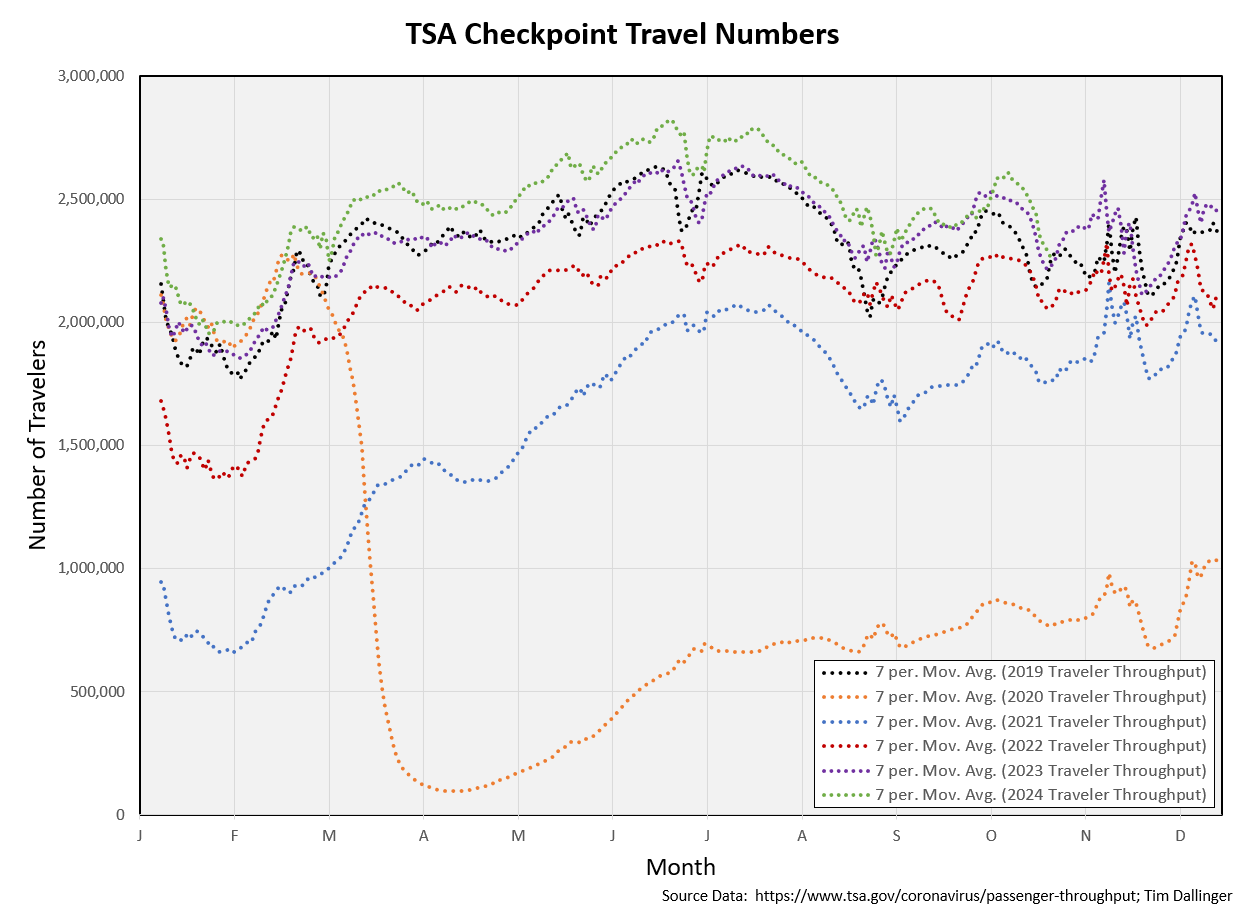

US traveler data remains strong.

But there does appear to be some weakness from the record highs in the global figures.

Ethanol

Ethanol inventories increased 0.2 MMB week-on-week.

Propane

Propane/propylene inventories decreased by 1.0 MMB. Propane inventories are at record highs but should match 2023 levels with a draw next week.

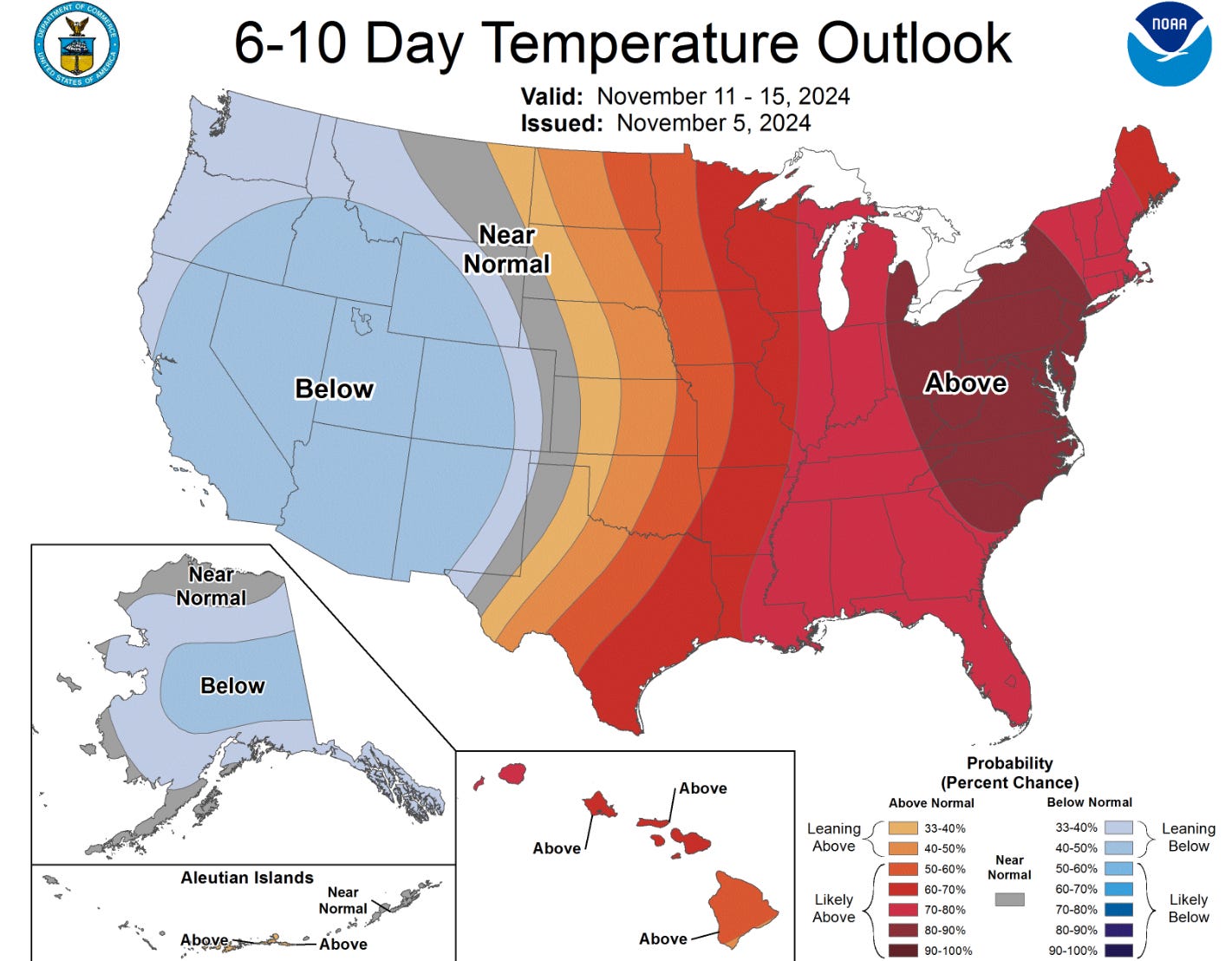

About half of the country is expected to experience cold weather.

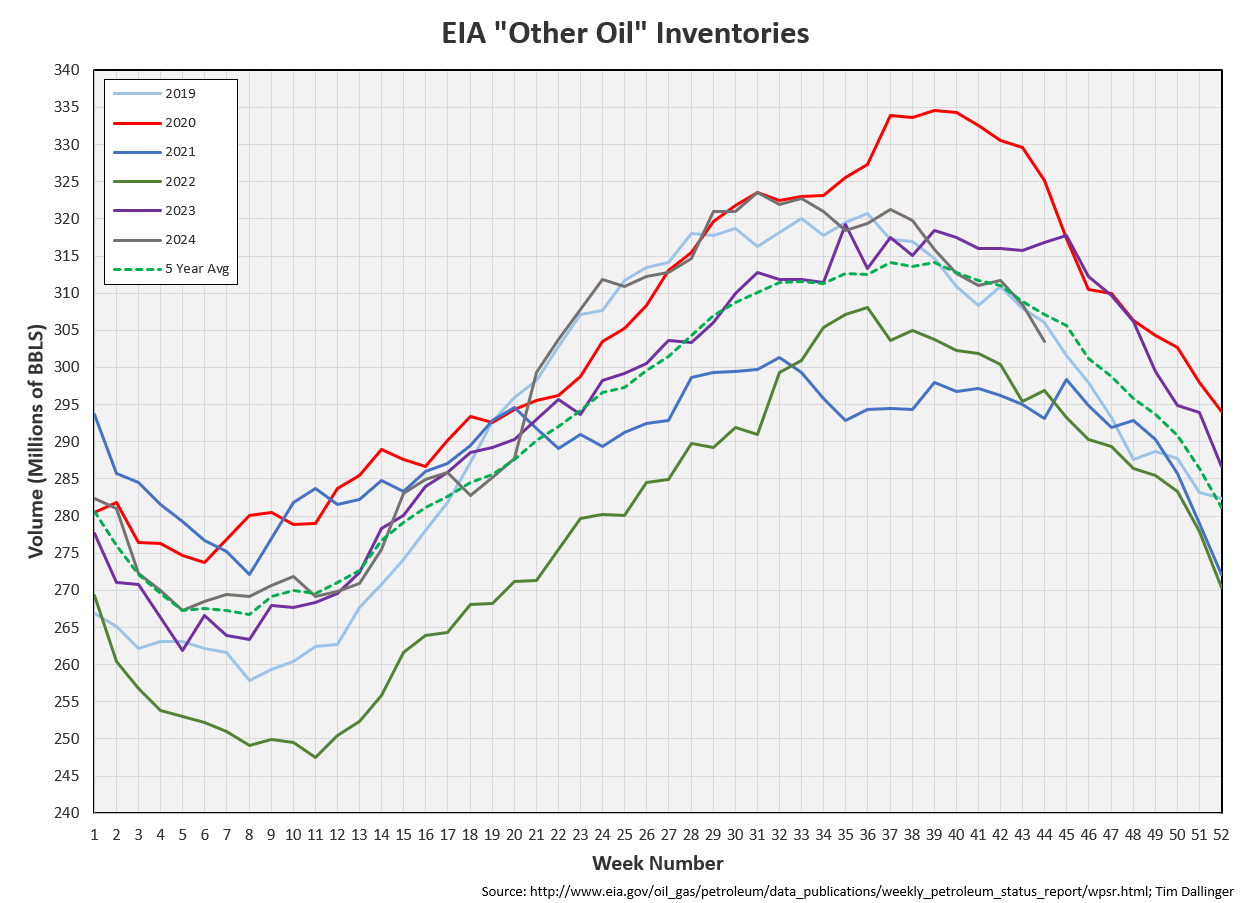

Other Oil

Other oil drew by 5.0 MMMB. This is significant and likely has some overlap with gasoline blending components. Natural gasoline, liquified refinery gases and condensate can be counted in either category.

Total Commercial Inventory

Total commercial inventory built by 1.1 MMB but remain below seasonal averages.

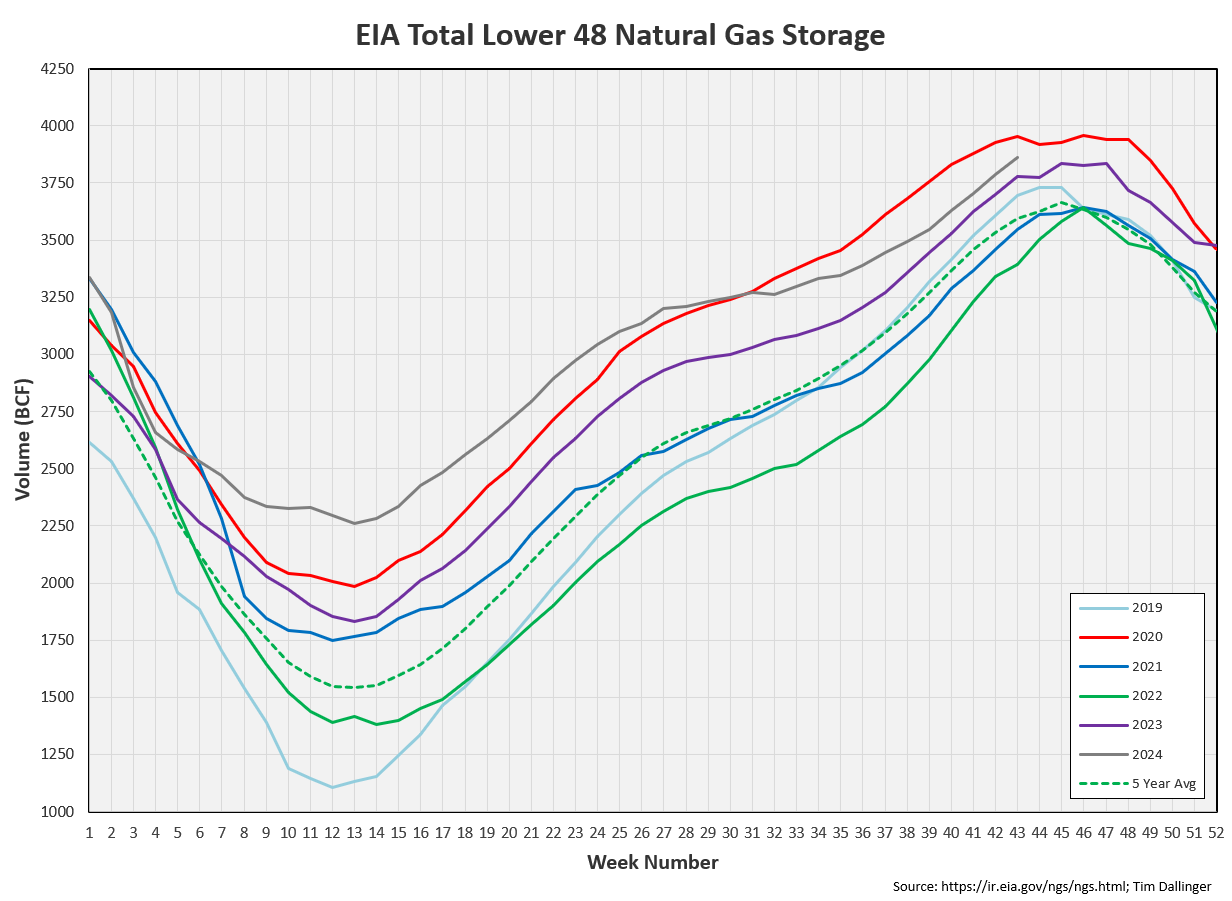

Natural Gas

Natural gas inventories are still building. Draws should begin shortly. Pricing will depend on the rate of storage drawdown which is heavily influenced by weather conditions.

Refiners

US refiners again processed a record amount of crude oil last week. That mean record seasonal crude demand.

The EIA’s product demand proxy did show some weakness but as stressed in previous reports, this calculation is not accurate enough to reflect significant weekly changes. Moving averages are better.

Transportation inventories built due to gasoline and distillate.

Hence, simple cracks fell back a bit from last week.

Discussion

OPEC+ announced that they will postpone the December production increase while they wait on more economic data.

Last night, Donald Trump was elected as the 47th US president. This should result in significant US policy shift in a multitude of areas.

Founder of Turning Points USA, Charlie Kirk likely contributed to the victory as his organization canvassed universities during the campaign. He interacts directly with students and the videos are posted online. In one such interaction, he claims that a Donald Trump presidency would result in “drill, baby, drill” and that US production would drive oil prices back to $30 per barrel and gasoline prices, $1.70 per gallon. If the Trump administration believes this, they are in for a surprise. Break-evens are higher than they were even 4 years ago. Some companies were forced to restructure during COVID and other barely survived bankruptcy. US producers will not willingly produce at a loss. Executive incentive structure is no longer geared towards growth, regardless of cost. There’s currently some layoff occurring for Houston-based companies and quarterly profits are down with price.

There is global supply uncertainty though. Will Trump enforce Iranian sanctions or continue to turn a blind eye to exports? How would a resolution in the Russian Ukraine conflict affect energy markets? There’s a prevailing narrative that peace will allow Russia to produce more oil due to removal of sanctions. However, Russia hasn’t currently lost significant production. They simply sell to India and China instead of Europe.

There is a potential case for natural gas bulls if more US LNG export facilities are commissioned and built.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

“It’s Morning Again in America,” was a presidential ad which aired during the 1984 Ronal Reagan campaign. This is again a new morning for the direction of the US, at least in the near-term.