EIA WPSR Summary for week ending 9-22-23

Summary

Bullish report.

Crude: -2.2 MMB

SPR: +0.3 MMB

Cushing: -0.9 MMB

Gasoline: +1.0 MMB

Ethanol: +0.4 MMB

Distillate: +0.4 MMB

Jet: +0.7 MMB

Other Oil: -2.4 MMB

Total: -1.5 MMB

Spot WTI is pricing $93. This is above fair value, based on price model derived from reported EIA inventories.

Crude

Crude oil drew by 2.2 MMB. At 418.5 million barrels, U.S. crude oil inventories are about 4% below the seasonal 5-year average.

The US added 0.3 MMB to the SPR. Another 1.5 MMB additions are planned for 2023. Another SPR release may occur, but if it used with political motivation, it will likely be closer to November 2024.

Crude exports fell back to 4 MMBD. Independent ship trackers corroborate this number.

Unaccounted for oil flipped negative.

This could balance last week’s significant adjustment figure. Or it might indicate that US production is not what is being reported in the weekly Short-Term Energy Outlook (STEO).

Cushing

Cushing showed 0.9 MMB weekly disposition, leaving total Cushing volume at 22.0 MMB. Cushing continues to test tank bottoms.

Energy Tranfer’s Centurion pipeline was struck by a backhoe and leaked oil on Monday. Crews were on-site quickly to address the situation. The company reports that the line has been repaired and is back in full-service. Had this line been down longer than a day, Cushing would have been pressured further.

Gasoline

Total motor gasoline inventories built by 1.0 MMB and are about 2% below the seasonal five-year average. Draws should resume within the next two weeks.

Ethanol

Ethanol inventories built 0.4 MMB. They are about 2% above the five-year average.

Distillate

Distillate fuel inventories increased by 0.4 MMB and are about 13% below the seasonal five-year average. Global diesel inventories continue to be stressed due to fallout from the Russian conflict.

Jet

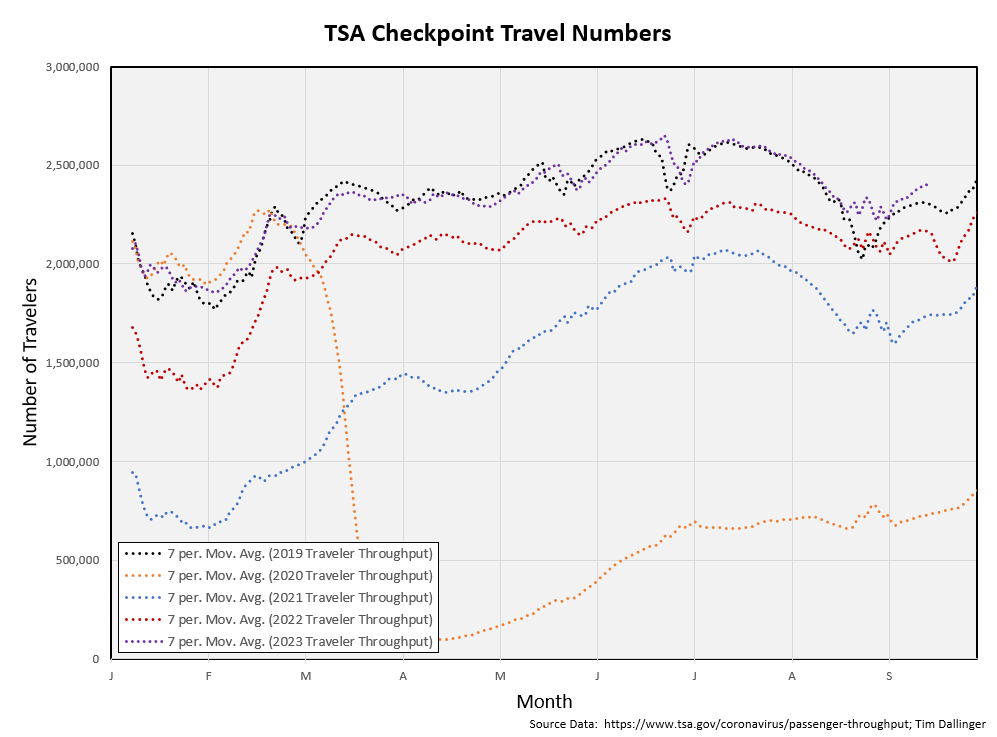

Kerosene type jet fuel built by 0.7 MMB. Inventories are about 2% above average.

TSA traveler numbers are at all-time seasonal high’s and should pick up further into year end with holiday travel.

Propane

Propane inventories increased by .07 million barrels last week and are about 19% above the five-year average.

Propane heating demand increases seasonally but near-term weather continues to delay that pattern.

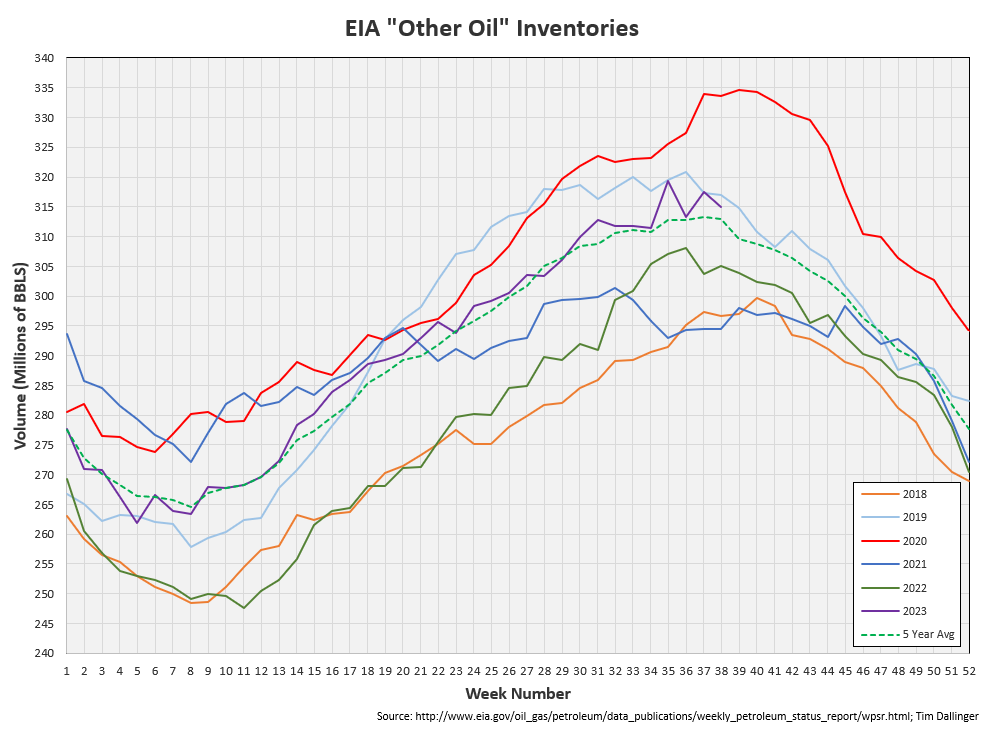

Other Oil

Other oil drew 2.4 MMB. Volumes are just over seasonal averages.

Total Commercial Inventory

Total commercial inventories decreased by 1.5 MMB.

Natural Gas

Natural gas inventories remain stubbornly high.

Even though the weather is warmer than seasonal averages, it’s no longer hot enough to increase power burn.

Australian LNG plant strike ends as Union workers and Chevron reach an agreement. That temporarily drove prices higher on speculative outages.

Discussion

Maintenance season begins in the US. Crude demand will fall further over the next month. This is normal and the market instead focuses on product inventories during this time.

The EIA consumer demand proxy is below record levels but almost 1.5 MMBD higher than last year.

Transportation inventories have increased, although they remain well below the seasonal average. They will resume their decline during turn-around, over the next month.

Crack spreads have declined substantially over the past week.

Meanwhile, crude timespreads are roofing.

This is odd behavior. One would expect flat or lower crude prices during turn-around because temporarily lower crude demand. One might conclude that WTI spot pricing is due to extremely low Cushing levels. After all, that’s the location WTI is priced. Perhaps a squeeze is occurring as contracts are purchased back because physical barrels cannot be delivered.

If that were the singular explanation, why would Brent be acting similarly?

It does appear the market is trying to close the export arbitrage window.

To do that, refiners must pay higher prices to keep US crude at home.

While price does seem to have outpaced inventories, it’s important to note that market could be forward-looking. Also, the rest of the world, with less transparent inventories could be tighter. Saudi and Russia have successfully tightened the physical market. Dubai crudes are already fetching prices north of $100.

While higher prices do put additional strain on the global economy, the bullish thesis currently remains intact. Short-term traders may exercise caution during turn-around season, a traditionally weaker period for crude pricing.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Rounders is a 1998 American dramatic film about underground poker, staring Matt Damon and John Malkovich.