EIA WPSR Summary for week ending 1-19-24

Summary

Bullish report, but messy data set as it was heavily impacted by the winter storm.

Crude: -8.3 MMB

SPR: +0.9 MMB

Cushing: -2.0 MMB

Gasoline: +4.9 MMB

Ethanol: +0.1 MMB

Distillate: -1.4 MMB

Jet: +0.9 MMB

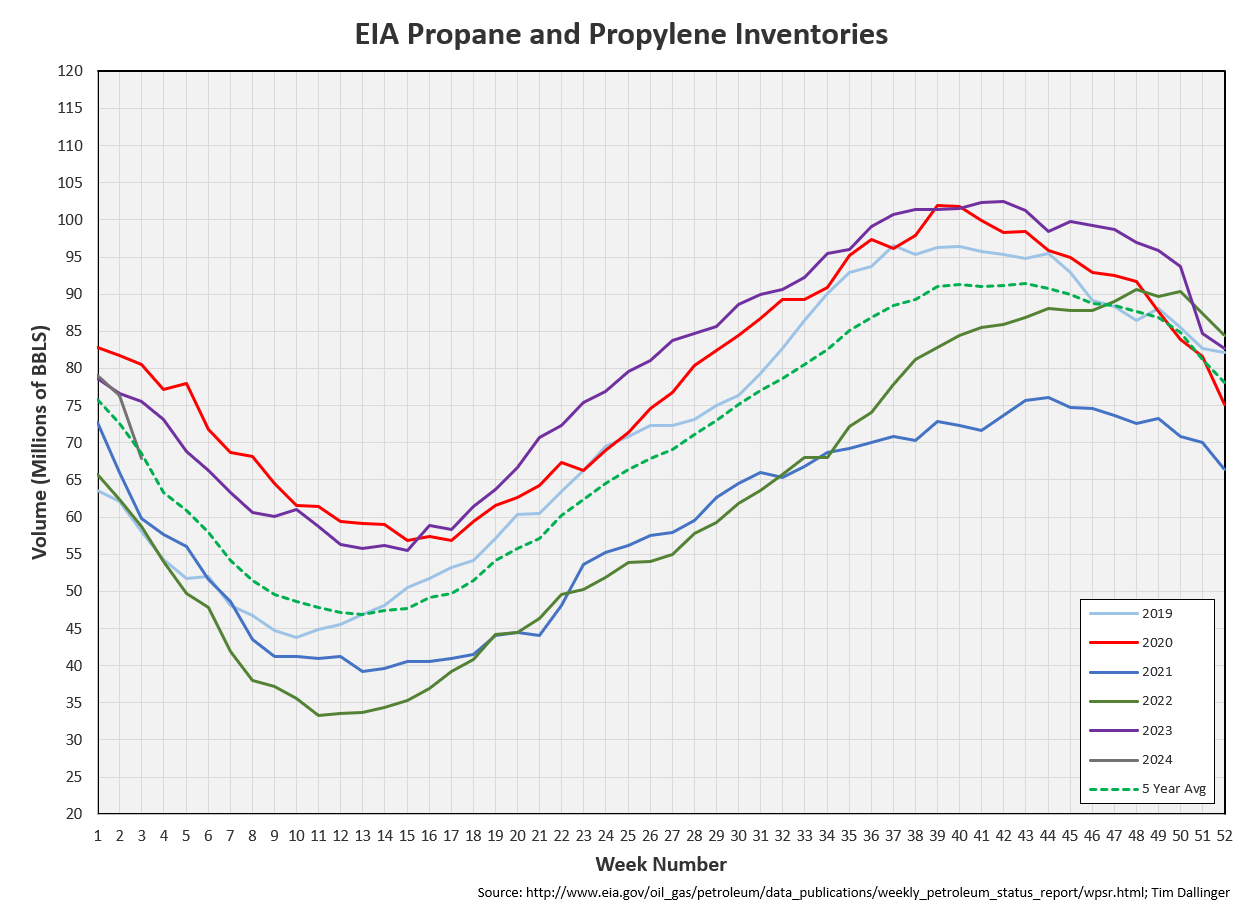

Propane: -8.4 MMB

Other Oil: -8.7 MMB

Total: -21.4 MMB

Spot WTI is currently pricing $75. This is slightly above fair value based on a price model derived from reported EIA inventories. It appears several dollars’ worth of geopolitical premium has been added to spot prices. Caution is recommended for long crude trades from this level. Although supply disruption risk is real and managed money is bearishly skewed, price is stickier when driven by fundamentals.

Crude

U.S. commercial crude oil inventories decreased by 9.2 MMB from the previous week and are about 5% below the seasonal 5-year average.

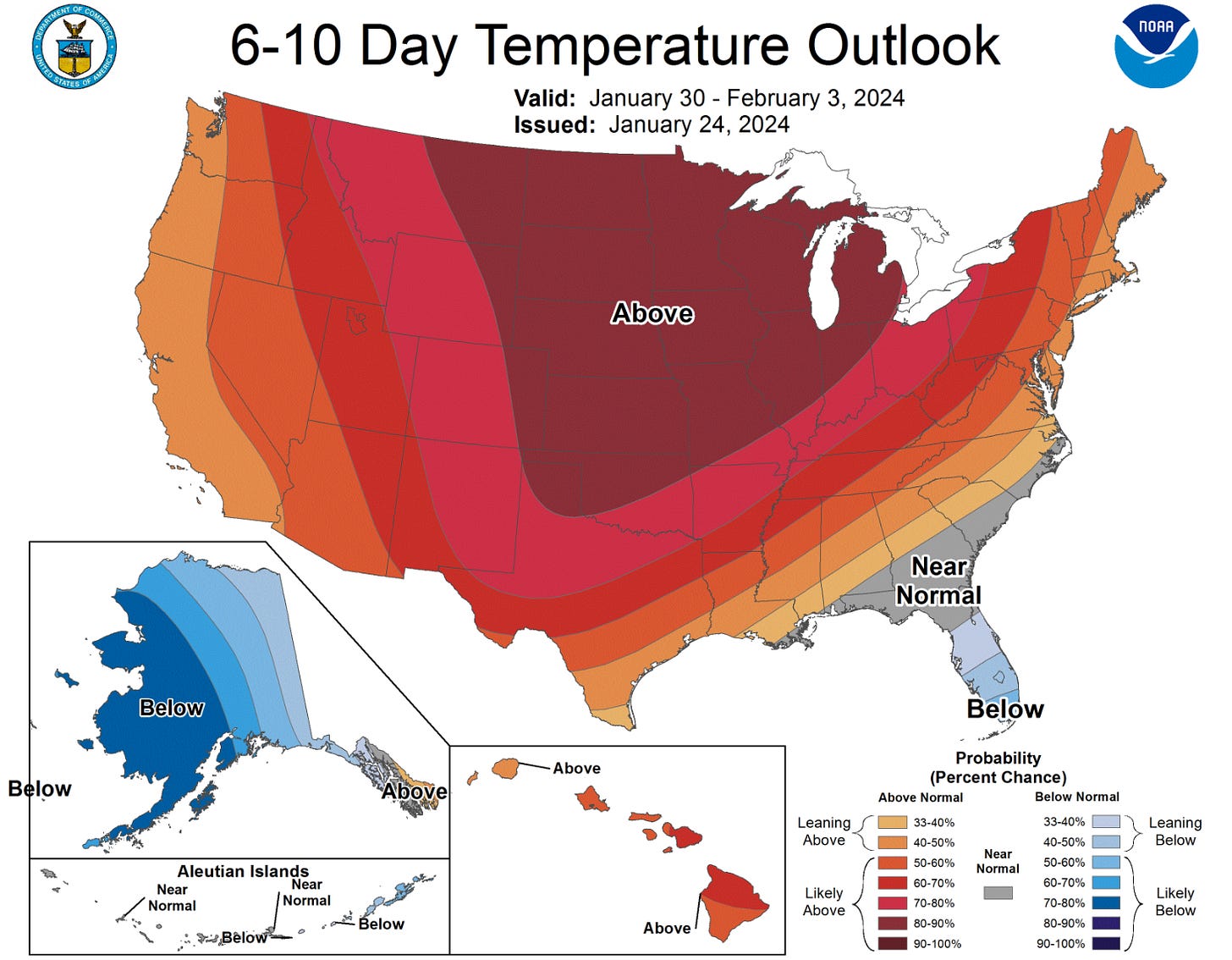

The significant crude draw was primarily driven by production wellhead shut-ins caused by near record cold temperatures last week. Some Bakken wells remain offline but production should be restored soon.

0.9 MMB were added to the SPR. This makes 2.8 MMB total of the 12 MMB planned 2024 purchases.

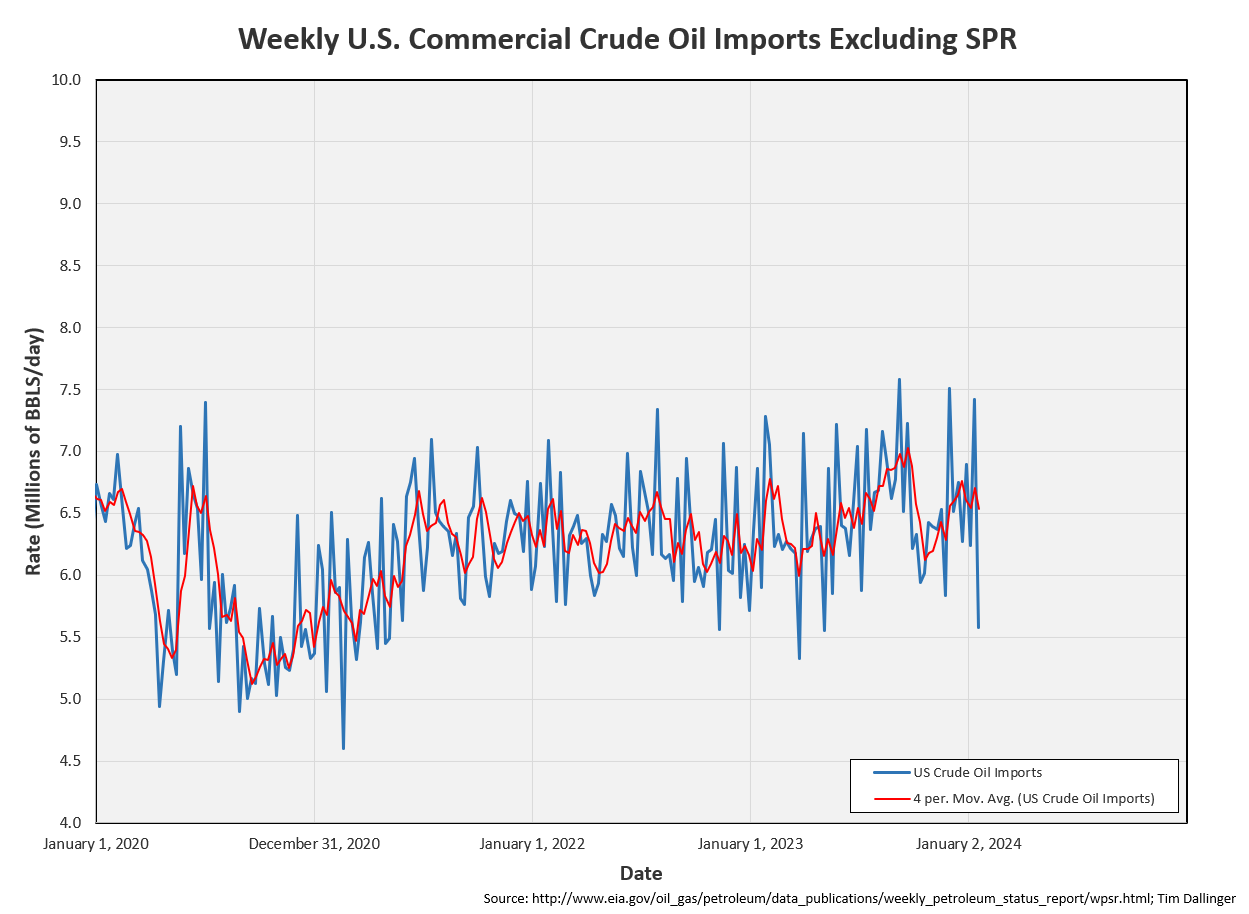

US crude imports were also adversely affected by the weather.

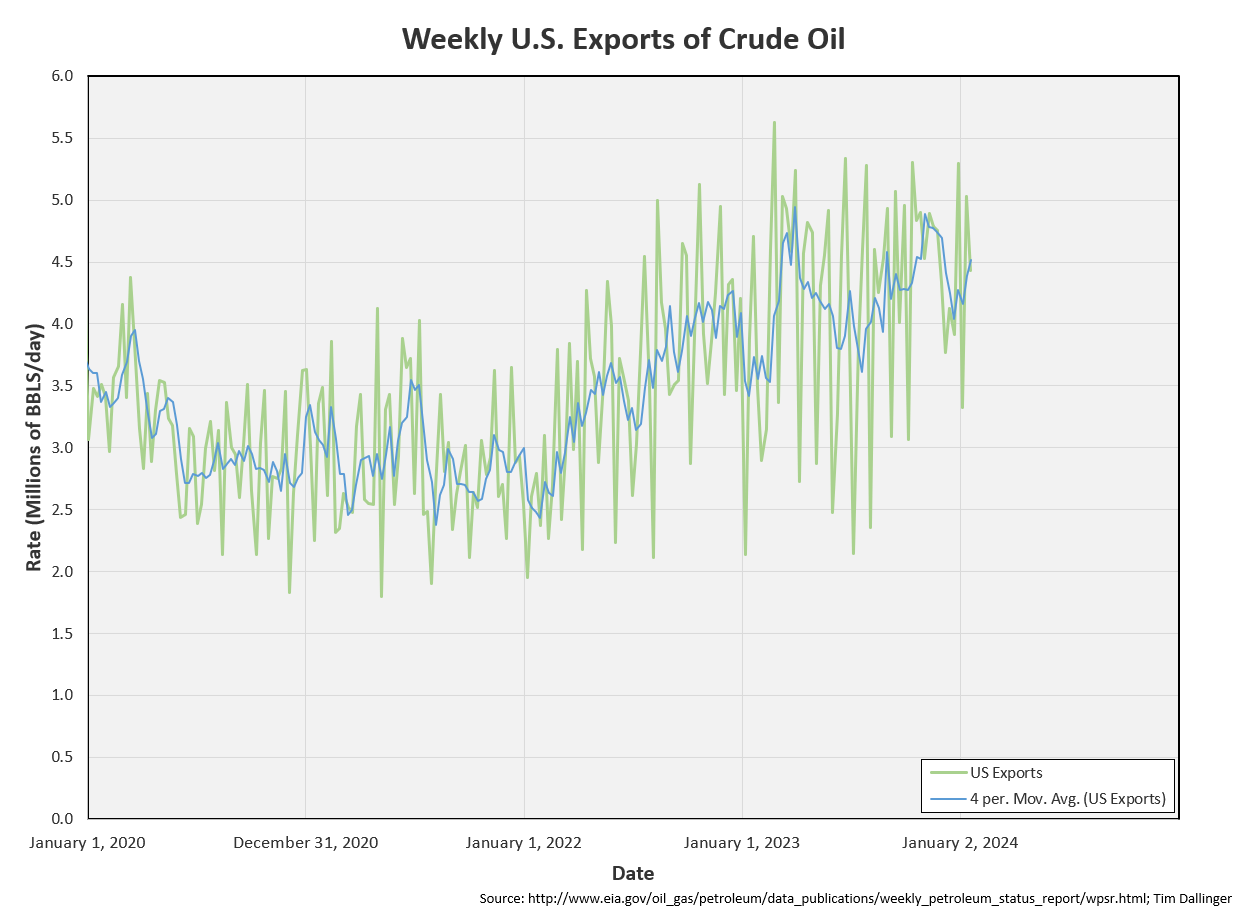

Gulf exports remained resilient for much of the week.

Unaccounted for oil is again near zero.

Cushing

Cushing drew 2.0 MMB. This seasonal draw is early. It’s bullish for WTI, especially as some fund algorithms use Cushing volume as an input.

Gasoline

Total motor gasoline inventories increased by 4.9 MMB and are about 1% above the seasonal 5-year average. Gasoline continues its seasonal build.

Gasoline appears to be well-supplied through spring. It’s important to note that gasoline inventories are driven by seasonally record levels of blending components. It will be interesting to see if all of the blending components can be used for summer blend gasoline or if their RVP are too high.

Ethanol

Ethanol inventories built by 0.1 MMB. Inventories are above average.

Distillate

Distillate fuel inventories decreased by 1.4 MMB last week and are about 4% below the season 5-year average. A more significant diesel draw was expected.

Jet

Kerosene type jet fuels increased by 0.9 MMB. Seasonal jet inventories are above average.

Global miles traveled remains near record levels, although total flights still lags.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories decreased by 8.4 MMB from last week and are at the seasonal 5-year average. Propane drew as significantly as expected due increased heating demand.

Other Oil

Other oil drew 8.7 MMB. Other oil inventories are at the seasonal average.

Total Commercial Inventory

Total commercial inventories decreased by 22.3 MMB.

Natural Gas

The EIA natural gas inventory report is released on Thursday each week. As last week’s EIA WSPR was delayed until Thursday due to the federal holiday, the natural gas inventory graph last week included data current to January 12. Data current to January 19 won’t be released until tomorrow. Therefore, the following graph has not been updated from last week.

The week ahead does work warm though. Alaska is experiencing cold weather. That system may migrate south to California, but it’s too early yet to have much confidence in the model.

Discussion

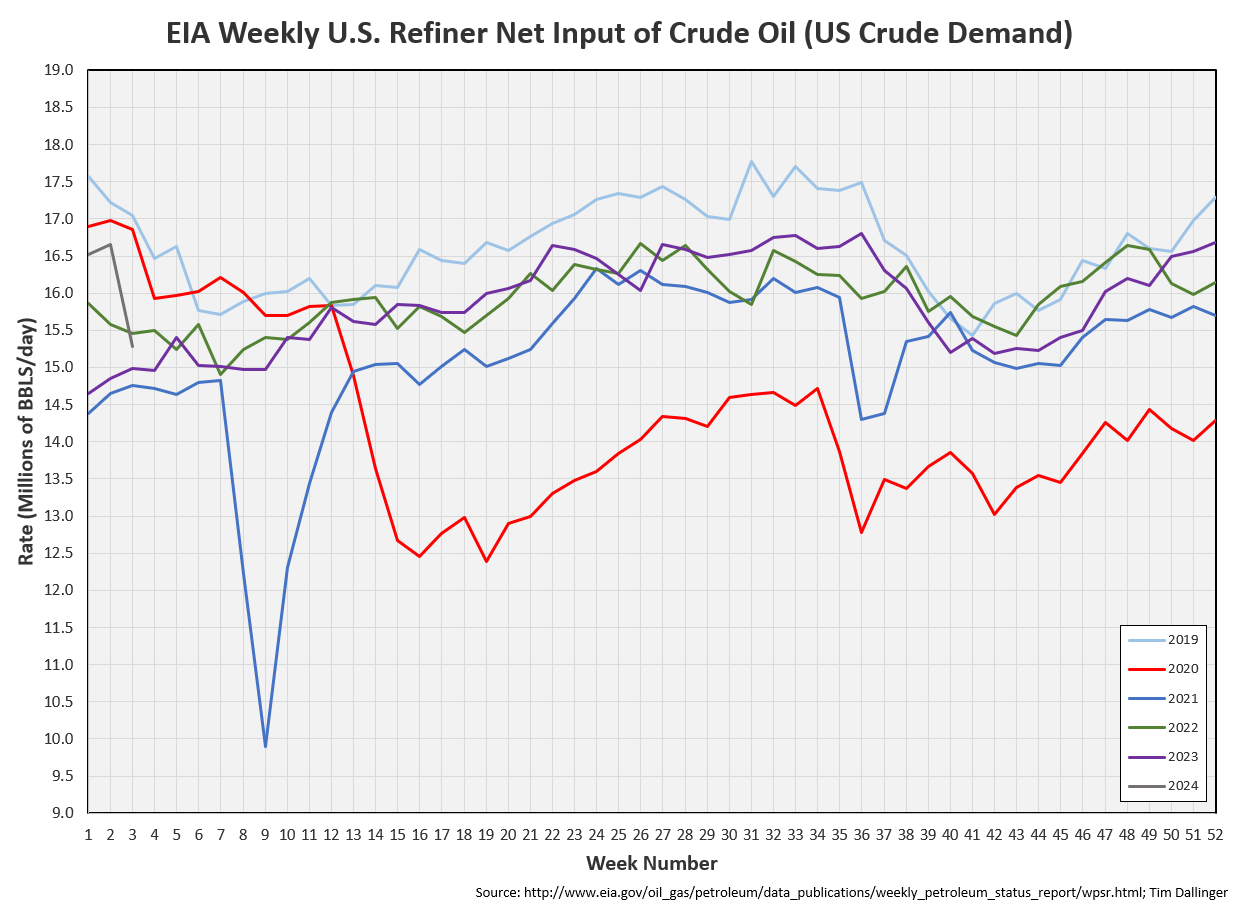

US refiners were also affected by the weather. They should return to full processing within 2 weeks. No permanent damage was reported.

Demand proxies were down as well. Producer, refiner and consumer behavior in response to the cold weather make this a noisy report.

Transportation inventories are building. This is seasonal. And gasoline blending components are contributing the most.

The following graph includes crude with transportation inventories. Notice Q1 typically builds. If inventories behave like 2022, this sets up a bullish summer as the US doesn’t have the SPR or Iran to fill the gap.

Cracks pulled back a little with the crude rally this week. They remain healthy though.

Timespreads have shifted in backwardation. The physical market tightens.

Ukraine executed a successful drone strike on a Russian crude processing plant. Operations have been suspended. This is the first actual supply disruption, and the market has taken notice.

The US – Britain coalition admits that the Yemen strikes have been ineffective in deterring Houthi attacks. They have guided for a longer duration conflict. This is now a proxy war with Iran in both Yemen and Iraq. There have been no reported US casualties. Escalation seems probable.

China is reportedly issuing a stimulus package to support its wavering stock market. Banking reserve requirement ratios are also being reduced.

Oil bull have had a rough beginning to 2024. Selling pressure has been incessant. Articles and analyst reports continually warn of oversupply, anemic demand, and fracturing of the OPEC+ alliance. IEA models project significant inventory builds over the year. Time spread shifted into slight contango. However, bullish green shoots have now started appear as the market is forced to acknowledge that demand is much healthier than projected. The market still needs to see inventories stable over the first quarter before more confidence can build. But things appear to be looking up for bulls.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

The Goonies is a 1985 American comedy adventure film, depicting a rag-tag group of misfits who experience countless mishaps and setbacks, while following an ancient pirate map in search of buried treasure.