EIA WPSR Summary for week ending 8-9-24

Summary

Crude: +1.4 MMB

SPR: +0.7 MMB

Cushing: -1.6 MMB

Gasoline: -2.9 MMB

Distillate: -1.7 MMB

Jet: +0.1 MMB

Ethanol: -0.4 MMB

Propane: +2.2 MMB

Other Oil: -1.7 MMB

Total: -3.1 MMB

Spot WTI is currently pricing $77. Prices are below estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 1.4 MMB. Crude inventories are currently 5% below the seasonal average and near 2022 levels.

0.7 MMB were added to the SPR. 21.3 MMB have been added to the SPR in 2024. Expectations are for about 4 weeks of additions. As November approaches without a crude price spike, the likelihood of a politically motivated SPR release diminishes.

US crude imports were slightly up on the week but remain absolutely below the annual average.

US Crude oil exports also remained low. This was not observed by independent ship trackers so perhaps that can explain the wide delta between last night’s bullish API report and the more moderate EIA today.

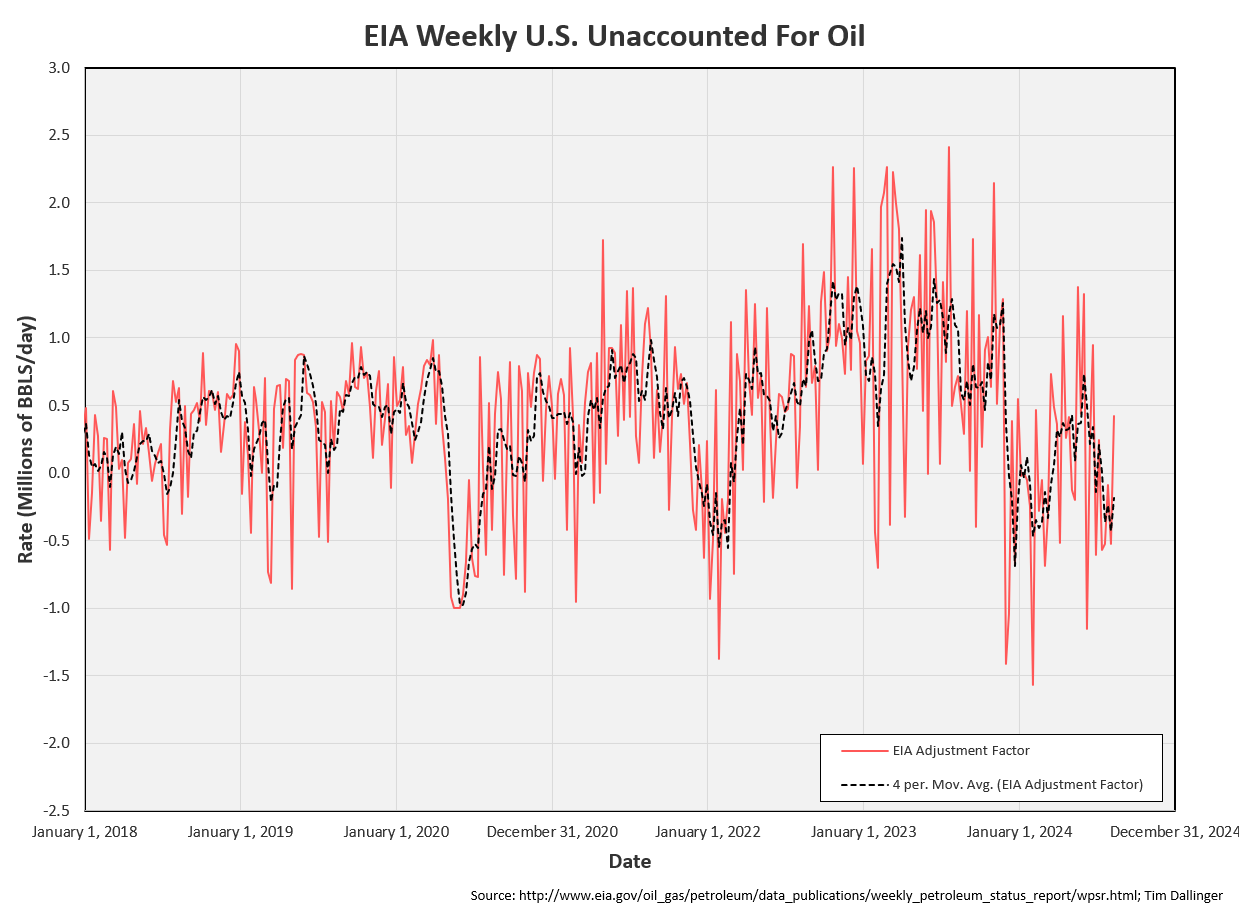

Unaccounted for crude flipped positive and US production fell back. The EIA continues to struggle with how to account for crude blending.

Cushing

Crude storage in Cushing, OK, drew by 1.6 MMB week on week. The trajectory appears to mimic 2023, when tank bottoms were tested in early fall. While it’s an unlikely event, watch for WTI price spikes should Cushing approach tank bottoms as traders scramble to buy paper barrels to cover their physical contractual obligations.

Gasoline

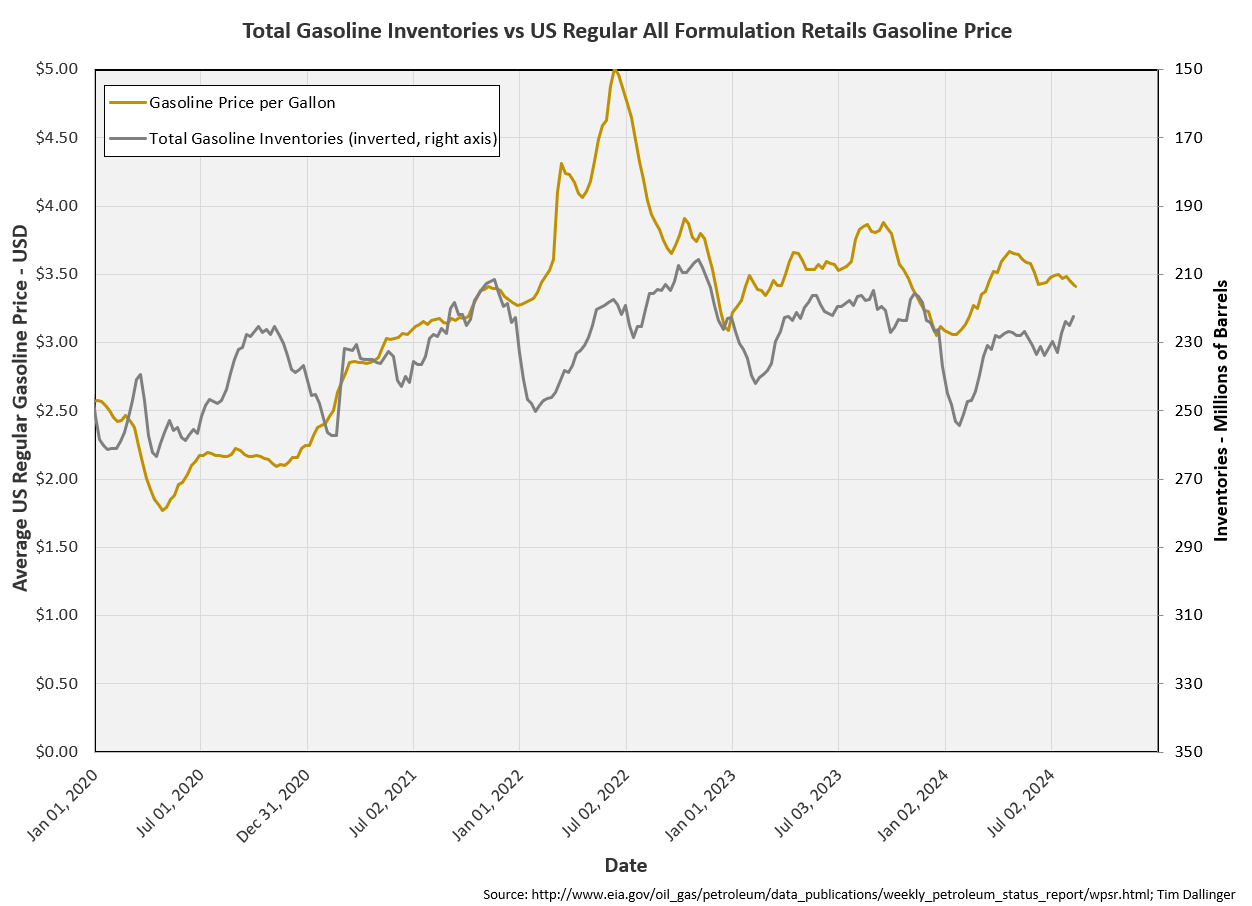

Total motor gasoline inventories decreased by 2.9 MMB and are about 2% below the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 1.7 MMB last week and are about 7% below the seasonal 5-year average.

Jet

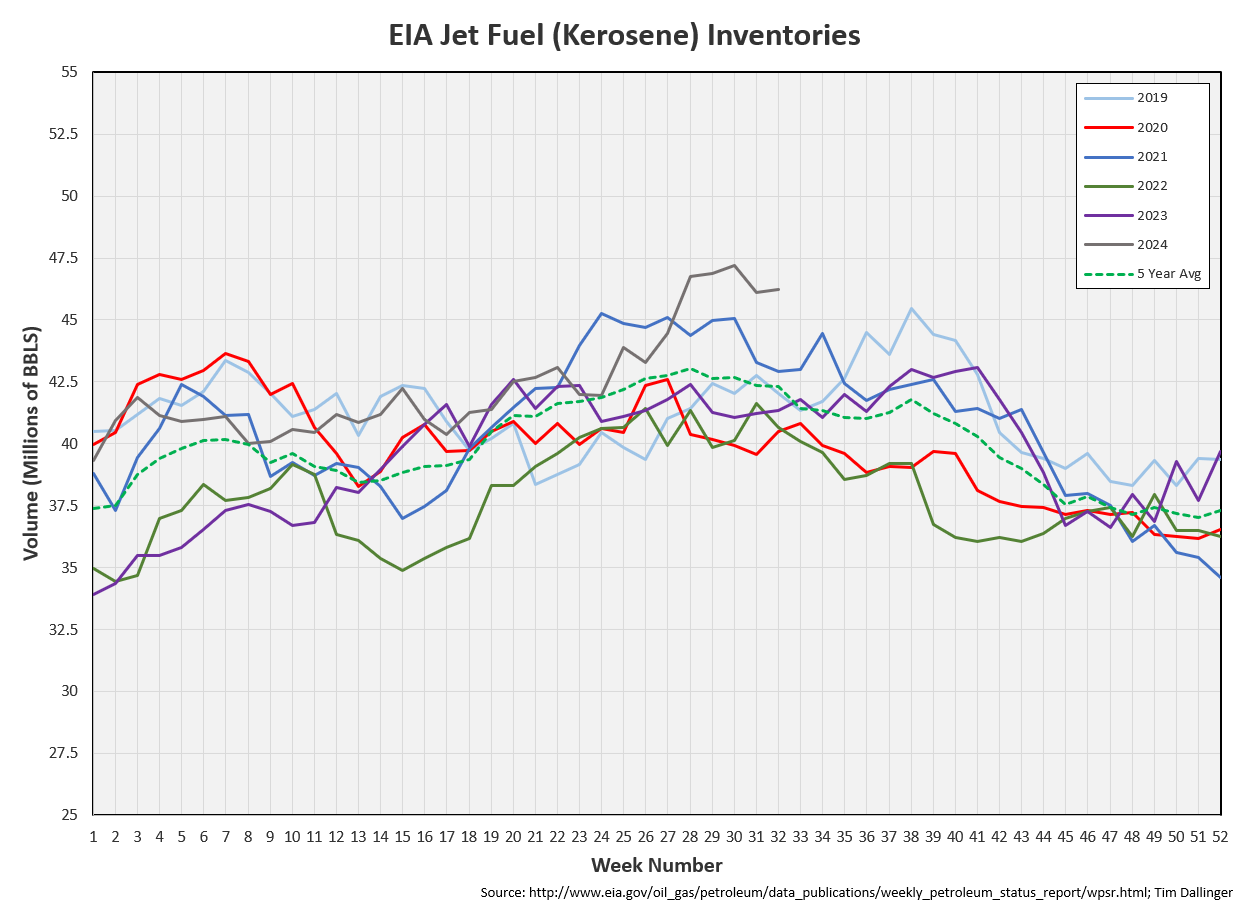

Kerosene type jet fuels built by 0.1 MMB.

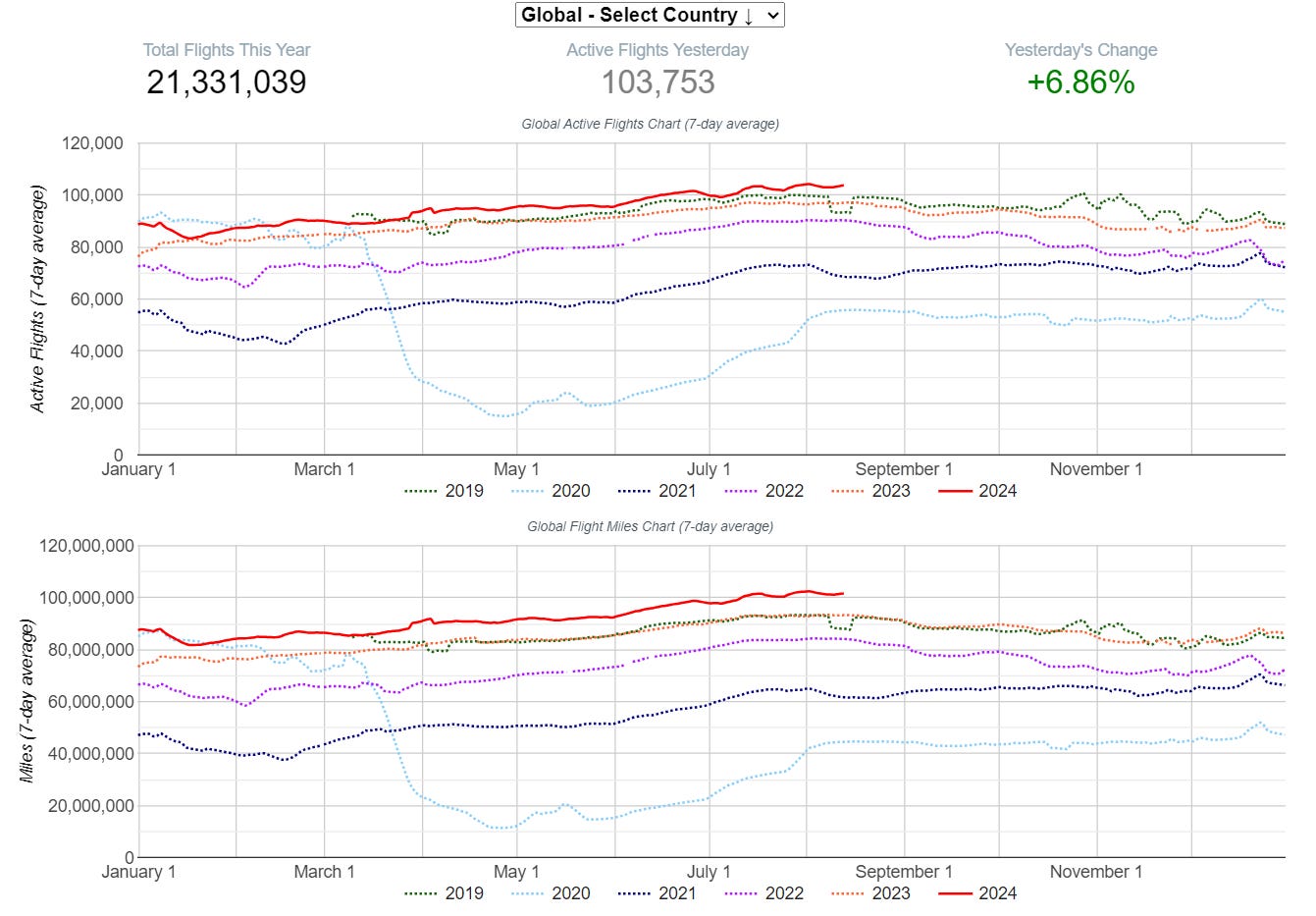

The 7-day moving average of Chinese active flights and Chinese flight miles hit fresh all-time records on August 13, 2024.

https://www.airportia.com/flights-monitor/?country=CN

Global numbers were similar but just under record figures.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories decreased 0.4 MMB week-on-week.

Propane

Propane/propylene inventories increase by 2.2 MMB. Inventories remain high due to the associated NGL and condensate produced in shale fields.

Other Oil

Other oil drew by 1.7 MMB.

Implied demand for other oil spike 1.2 MMBD week-on-week.

Total Commercial Inventory

Total commercial inventories drew by 1.3 MMB.

Natural Gas

Natural gas inventories are still building seasonally but the rate has slowed.

Refiners

The amount of crude oil refiners processes last week increased slightly 16.47 MMBD, near 2022 levels.

The EIA’s product demand proxy increased, mostly due to the increase in “other oils.”

Implied transportation fuel demand also increased.

Transportation inventories declined.

Simple cracks were hit hard.

Given this report, that behavior is unexpected. It’s apparent that the decline was driven by the fall in gasoline pricing.

Gasoline price usually follows total gasoline inventories closely. Recently, this trend has broken. There’s no apparent reason.

Discussion

Energy markets are trying to grapple with conflicting narratives and signals.

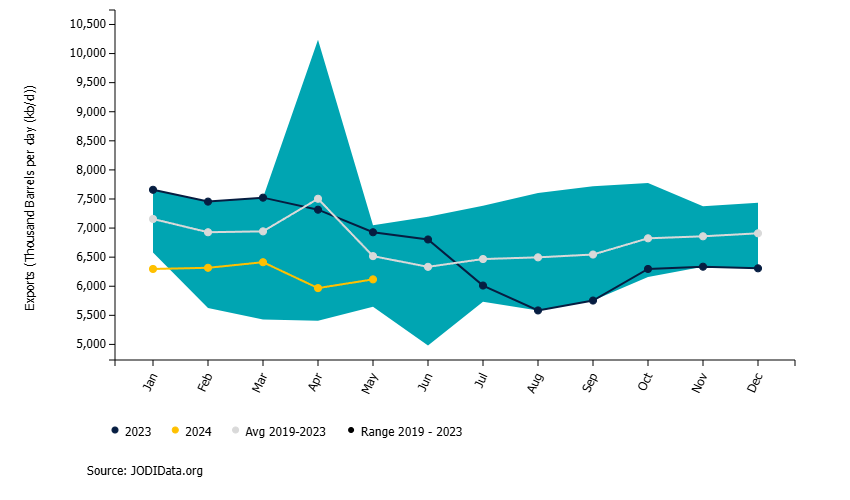

OPEC continues to remain disciplined. Delayed JODI data shows Saudi Arabian exports increased in May but remain below average levels.

Libya production falls considerably due to a pipeline fire today. The Waha Oil Company is claiming this is simply due to maintenance.

Chinese steel manufacturing is struggling suggesting weak Chinese industrial petroleum product demand. And yet Chinese flights and miles traveled surge to record levels.

Vortexa is reporting both that global crude imports are low, especially into China and crude-on-water inventories falls to lowest volume since COVID.

The Bank of America claims there’s a new lower trend in consumer travel spending. Meanwhile, the Federal Highway Administration shows miles driven are up year-on-year and US gasoline inventories remain under pressure.

The IEA reports that should OPEC increase production as guided, there will be a surplus in Q4. But EIA, OPEC and even the IEA all show a current supply-demand deficit.

WTI and Brent remain in steep backwardardation, indicating physical crude market strength.

Global macroeconomic data does show some weakness. But most physical energy signals are strength.

Which one wins?

Spec positioning has collapsed, and crude short interest increased. Sentiment is extremely pessimistic. And yet Brent is still trading near $80 USD. If demand does hold up, there is a lot of money on the sidelines that can push prices much higher.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

“What’s Up?” is a song by the American alternative rock group, 4 Non Blondes, off their their 1993 LP titled Bigger, Better, Faster, More!