EIA WPSR Summary for week ending 12-15-23

Summary

Neutral report.

Crude: +2.9 MMB

SPR: +0.6 MMB

Cushing: +1.7 MMB

Gasoline: +2.7 MMB

Ethanol: +0.8 MMB

Distillate: +1.5 MMB

Jet: +2.4 MMB

Propane: -2.2 MMB

Other Oil: -4.6 MMB

Total: +2.7 MMB

Spot WTI is currently pricing $74. This improved but still slightly below fair value, based on a price model derived from reported EIA inventories.

Crude

U.S. commercial crude oil inventories increased by 2.9 MMB from the previous week and are about 1% below the seasonal 5-year average.

0.6 MMB were added to the SPR. That is all the scheduled refilling of the SPR for 2023. The DOE just purchased an additional 3 MMB for delivery in February, 2024.

Weekly crude imports were about average.

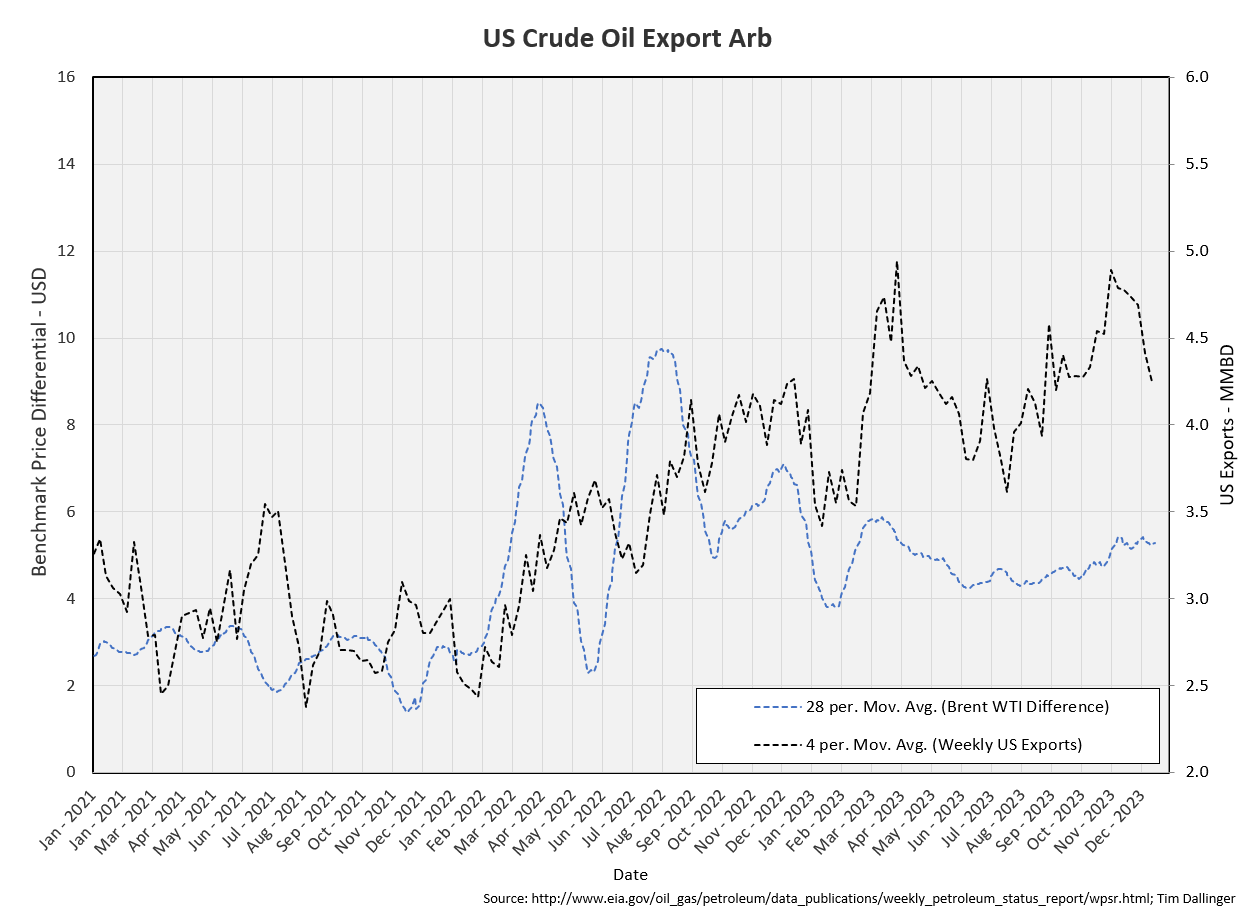

US exports increased. This week’s reported exports were verified by independent ship trackers. As last week’s exports were undercounted, this week should have made up the difference. However, that wasn’t the case.

The export arb remains open. High US export volume should continue.

The adjustment factor turned positive after the previous 2 negative weeks. There remains glaring issues with the WSPR model.

Cushing

Cushing built by 1.7 MMB, in-line with expected seasonal behavior. Cushing builds should continue through year end.

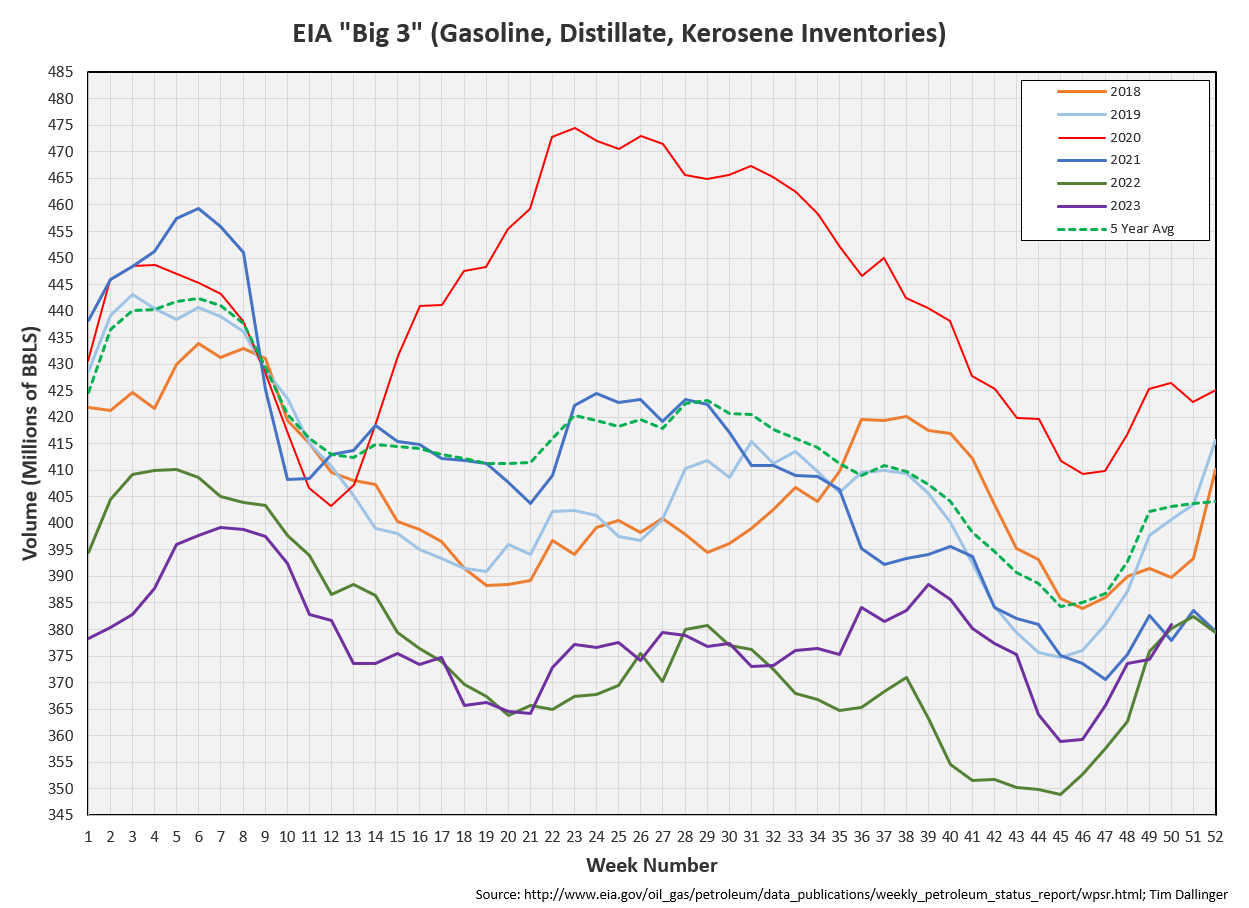

Gasoline

Total motor gasoline inventories increased by 2.7 MMB and are 2% below the seasonal 5-year average.

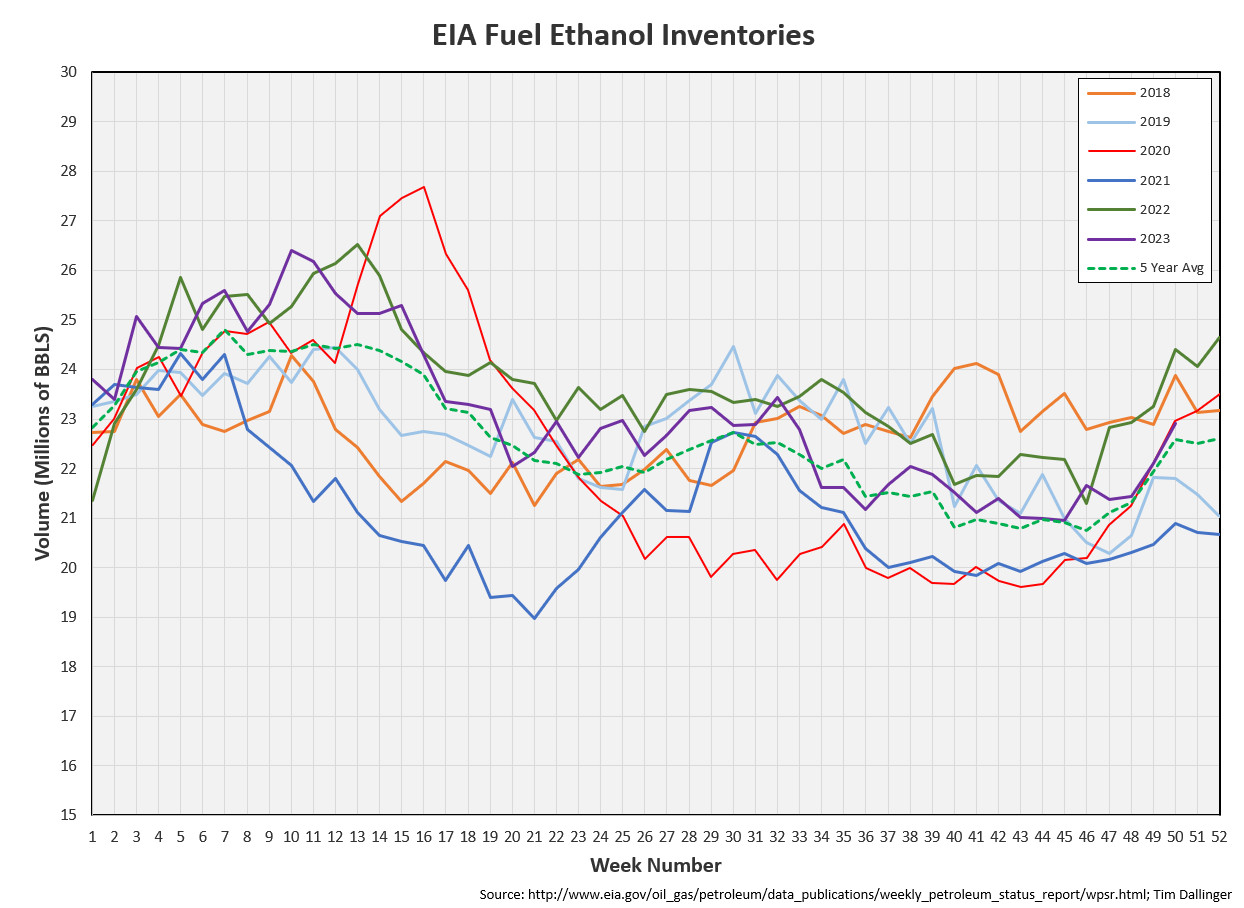

Ethanol

Ethanol inventories built by 0.8 MMB, resulting in volumes near the seasonal 5-year average.

Distillate

Distillate fuel inventories increased by 1.5 MMB last week and are about 10% below the season 5-year average.

Jet

Kerosene type jet fuels increased by 2.4 MMB. Jet fuel demand should increase this week with holiday travel.

US TSA passenger data shows traveler numbers are similar to 2019.

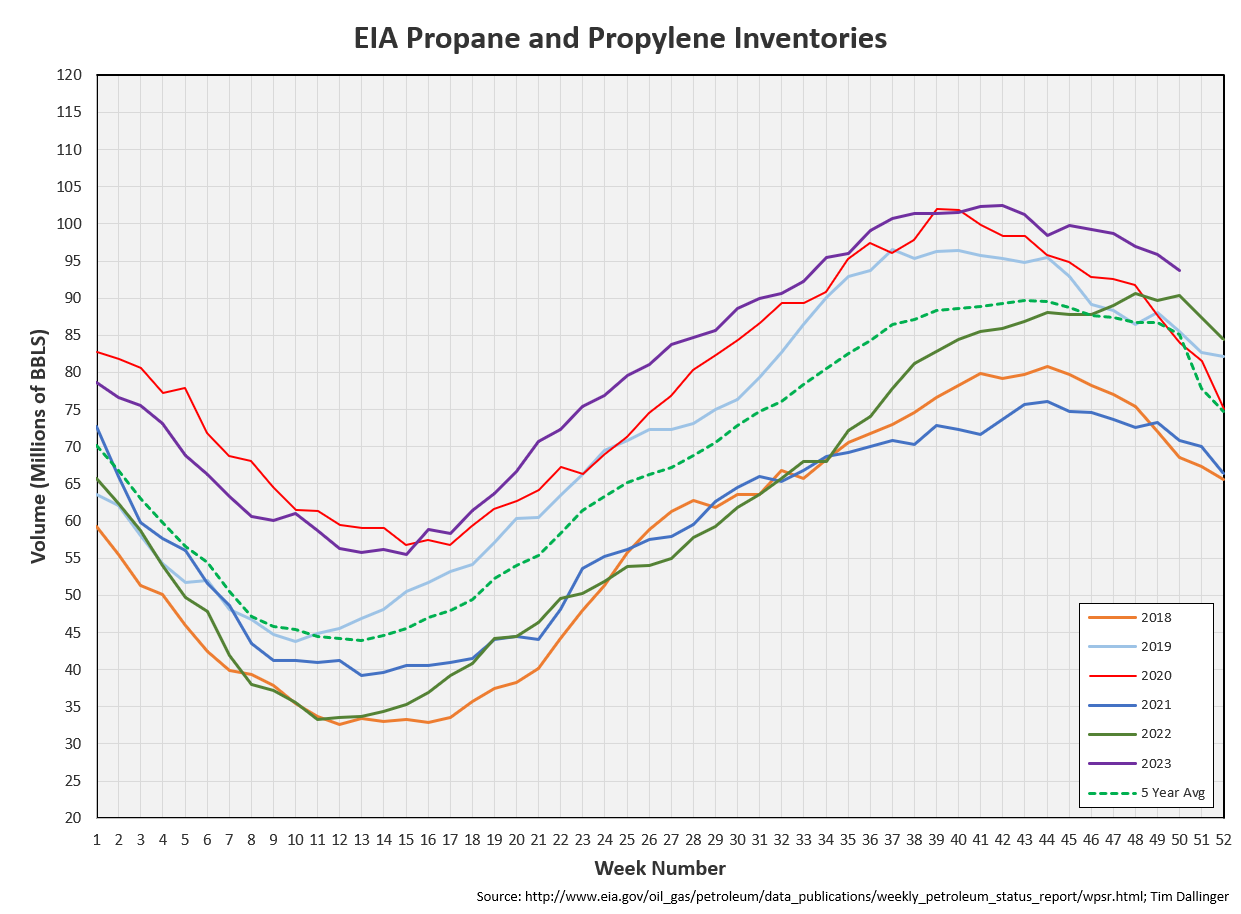

Propane

Propane/propylene inventories decreased by 2.2 MMB from last week and are 19% above the seasonal 5-year average.

Other Oil

Other oil decreased by 4.6 MMB. Other oil inventories approach the 5-year seasonal average.

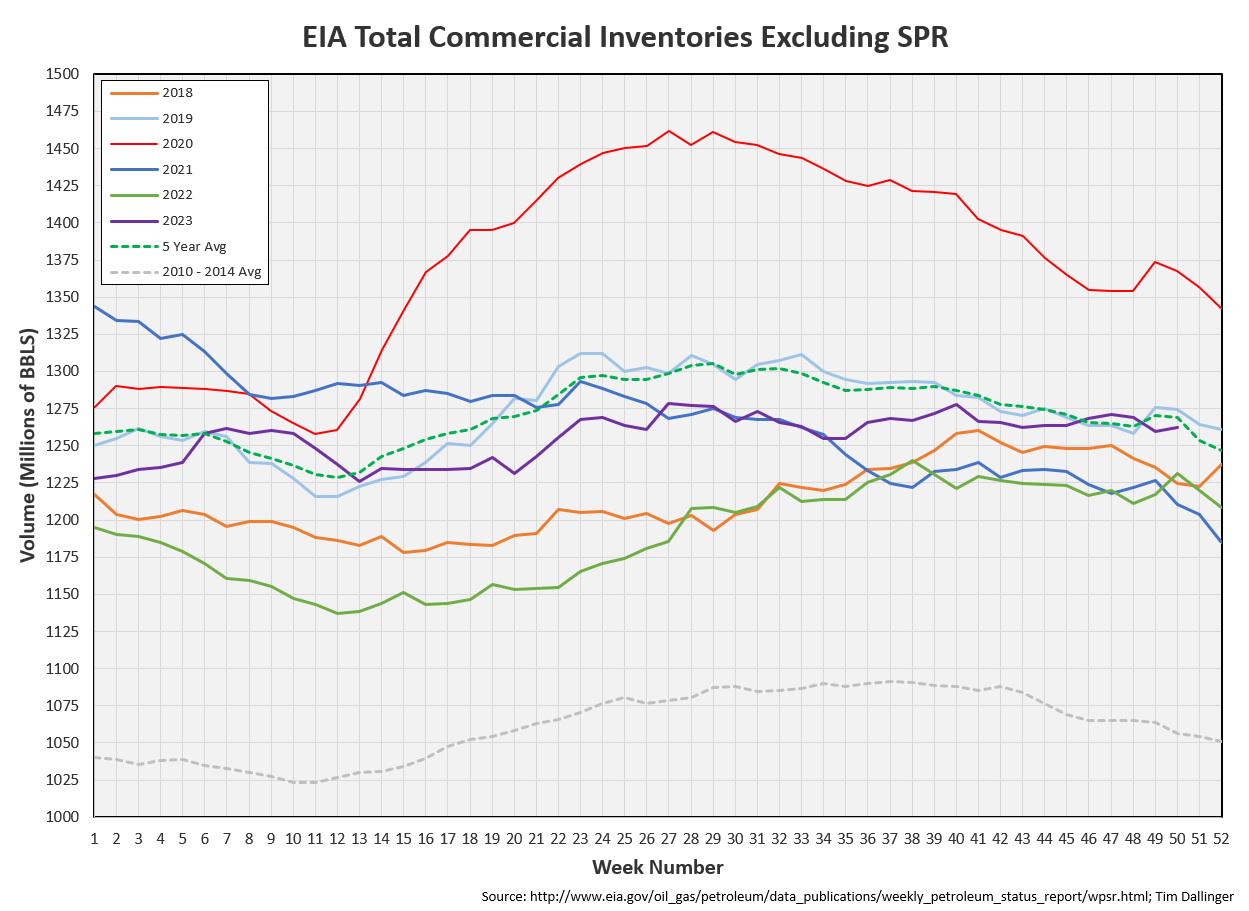

Total Commercial Inventory

Total commercial inventories built by 2.7 MMB.

Natural Gas

Natural gas storage is near full. There’s just so much associated gas with current shale production.

It doesn’t appear heating demand will increase significantly in the near-term.

Discussion

Refinery crude input jumped. It’s near 2019 levels and only lagging 2018.

Yet, the EIA continues to report impacted consumer product demand as evidenced by the product supplied proxy.

Transportation inventories are at some of the lowest seasonal levels.

Simple crack spreads have recovered.

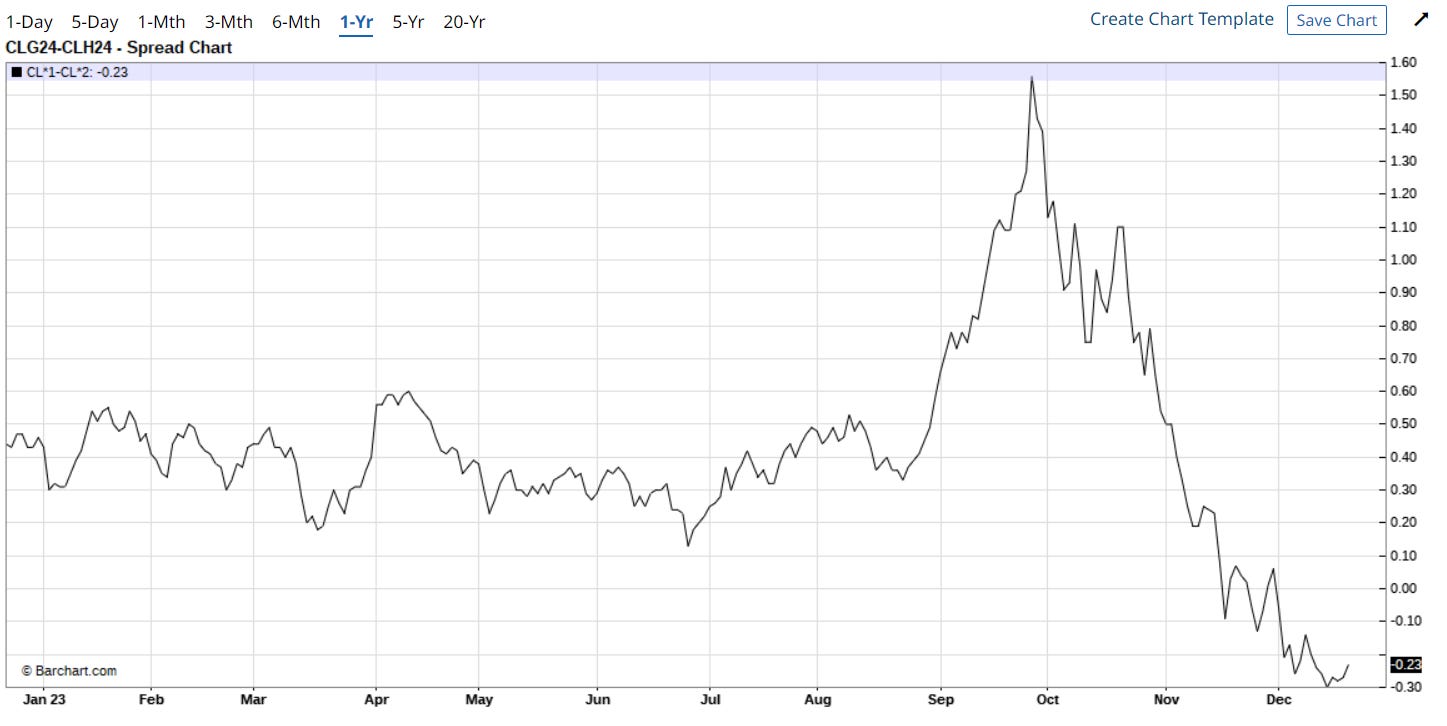

Slight backwardation has returned. This is a positive signal for bulls. Yet, this needs to steepen more to signify that the physical market is tightening again.

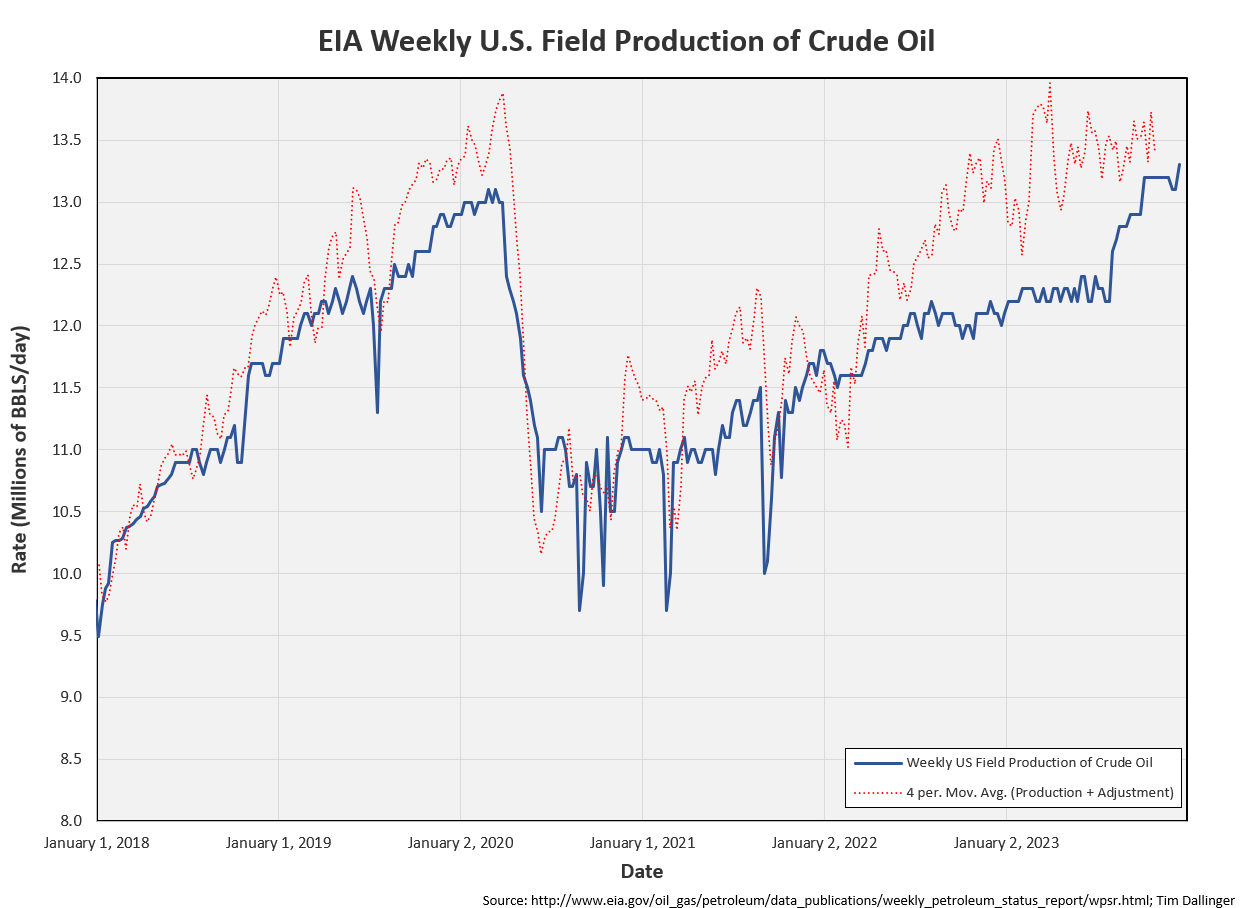

Although spot crude prices have increased this week, they continue to struggle. Many speculators point to alleged surging US production. This week’s EIA production model reported lower 48 production increased 200 kbd.

The EIA WSPR continues to show increased US production. These reports should be met with a healthy dose of skepticism. US production has grown but much of the growth is condensate and NGL’s, counted as crude oil.

This month’s Drilling report does show a slight annual improvement of production per rig. But it also shows increased decline in legacy wells in every basin.

Increased production just offsets losses.

The US growth is not infinite, despite bear rhetoric. There seems little reason for OPEC+ to try and flood the market when US production will hit a peak on its own. Estimates show the peak shouldn’t be much higher than currently reported levels.

Tensions have increased in the middle east. Yemen Houthi harassment of ships in the red sea continues. Commercial ships are electing to avoid the area, increasing travel time. Unconfirmed reports suggest the US has mobilized assets to counter Houthi action.

Conflict rages in the Gaza strip and there remains risk of it spreading to surrounding areas. Yet, there is no geopolitical premium in prices.

Managed money position in crude is at record lows. Positioning appears ripe for a squeeze with any bullish new.

Though the EIA will release a WSPR next week, there will be no summary. I will be traveling to spend the holiday with my family. The publication will resume again in 2024. I wish all readers a happy holiday season and thank you all for your continued support.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Beloved character, Cousin Eddie, is portrayed by Randy Quaid, in the classic 1989 Christmas comedy film, “National Lampoon’s Christmas Vacation.”