EIA WPSR Summary for week ending 6-20-25

Summary

Crude: -5.8 MMB

SPR: +0.2 MMB

Cushing: -0.5 MMB

Gasoline: -2.1 MMB

Distillate: -4.1 MMB

Jet: +0.1 MMB

Ethanol: +0.3 MMB

Propane: +5.1 MMB

Other Oil: +2.3 MMB

Total: -4.2 MMB

Spot WTI is currently pricing $65. Spot price is steeply discounted in relation to the estimated fair value based on a price model derived from reported EIA inventories. This is the widest margin this model has ever experienced.

The model may need to be updated because crude is simply not behaving as it has historically. The model is proprietary and not public. The rationale for the discretion is that it is not sensitive enough to trade upon and there is concern that casual readers could mistake this for financial advice.

Crude

US Crude oil supply drew by 5.8 MMB. Crude inventories are currently 11% below the seasonal average. Crude inventories have now fallen below 2022 levels.

US crude oil inventories haven’t been this low since 2014.

If SPR is included, only 2023 has experience inventories this low in recent years. The previous low prior was 2001.

0.2 MMB were added to the SPR.

US crude imports increased back to average levels.

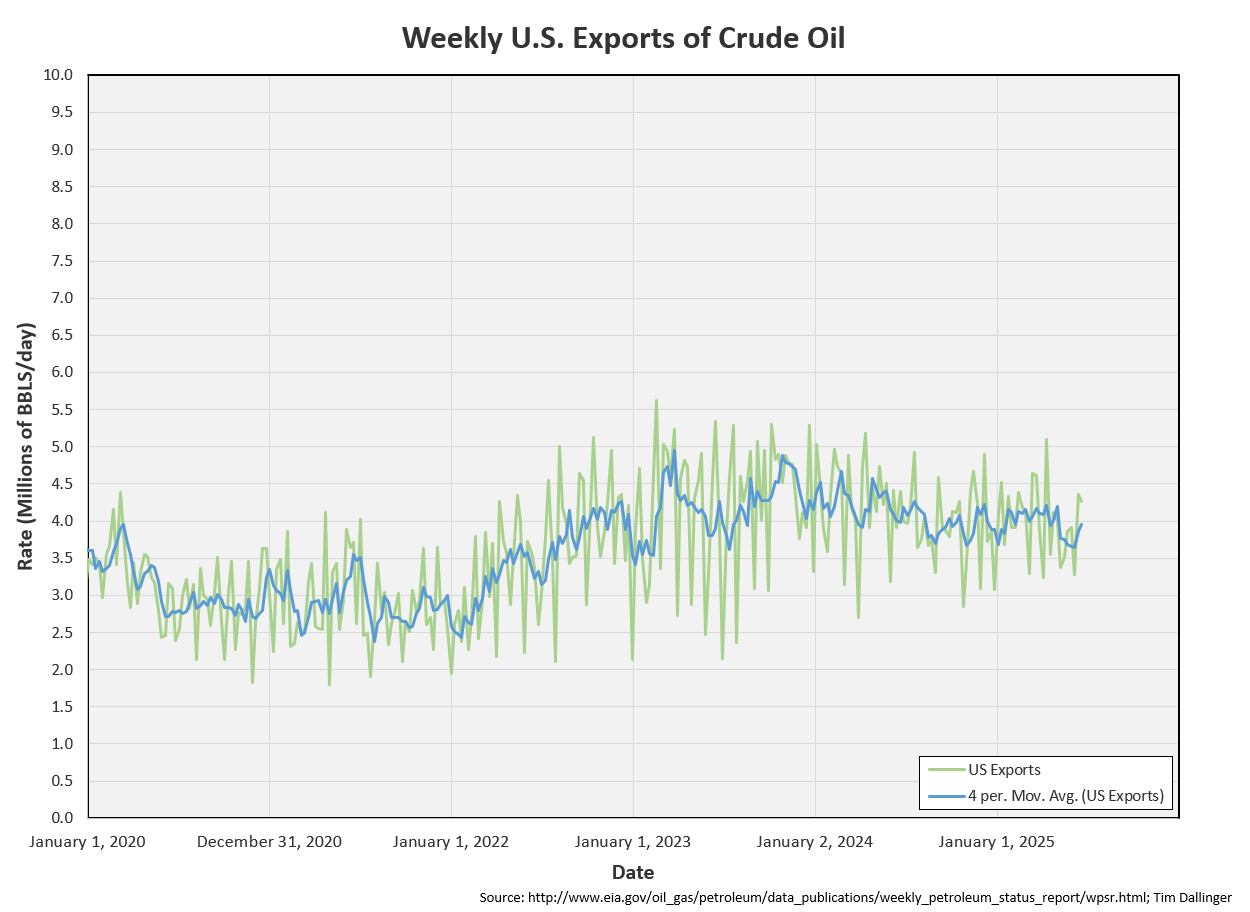

US Crude exports remain above average this week after several months of lackluster numbers.

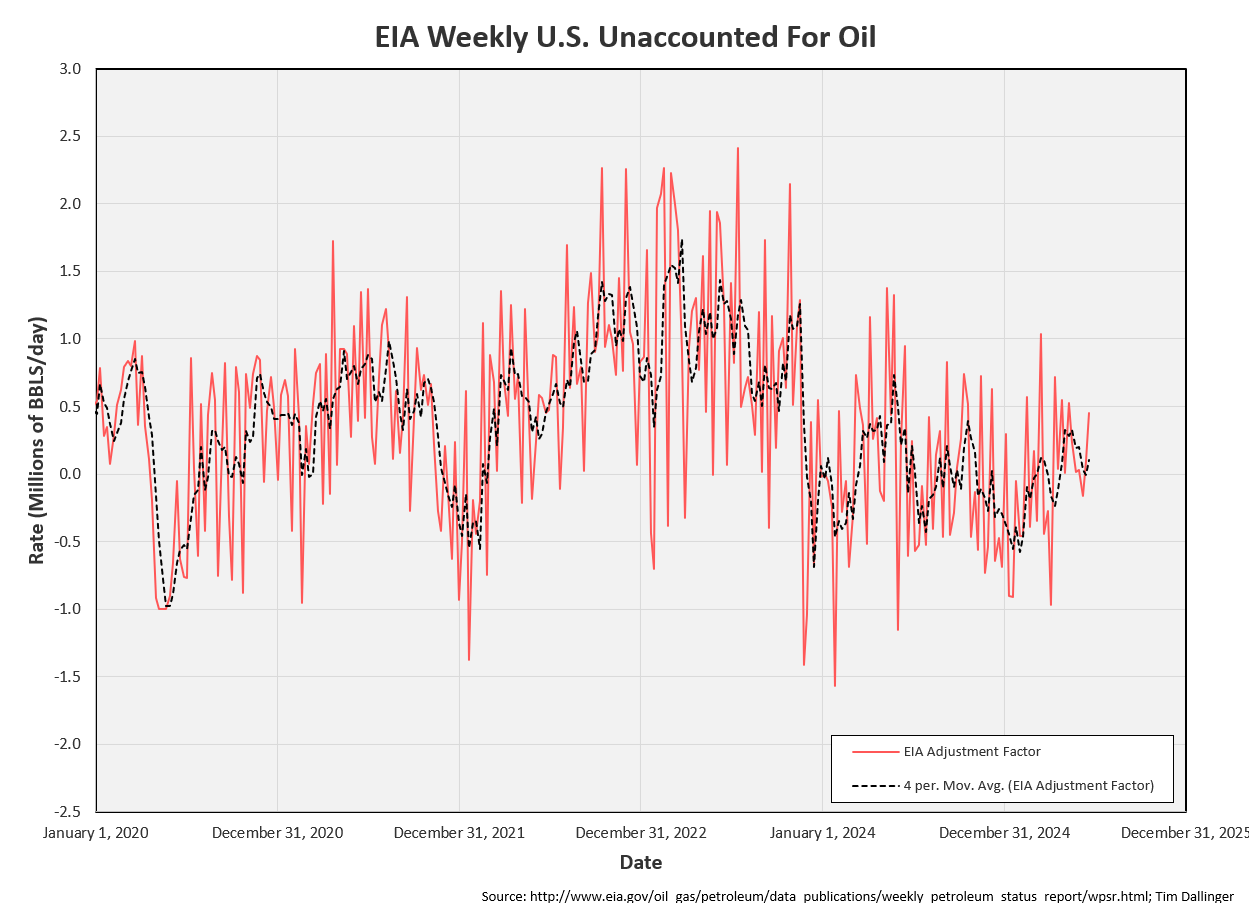

Unaccounted for crude was positive. The source is unclear this week.

The EIA US production model continues to show elevated production levels. Secondary producer data does not confirm that strength. The next monthly figure will be out on Monday.

Cushing

Crude storage in Cushing, OK, drew by 0.5 MMB week on week. Cushing inventories match 2022 lows.

Gasoline

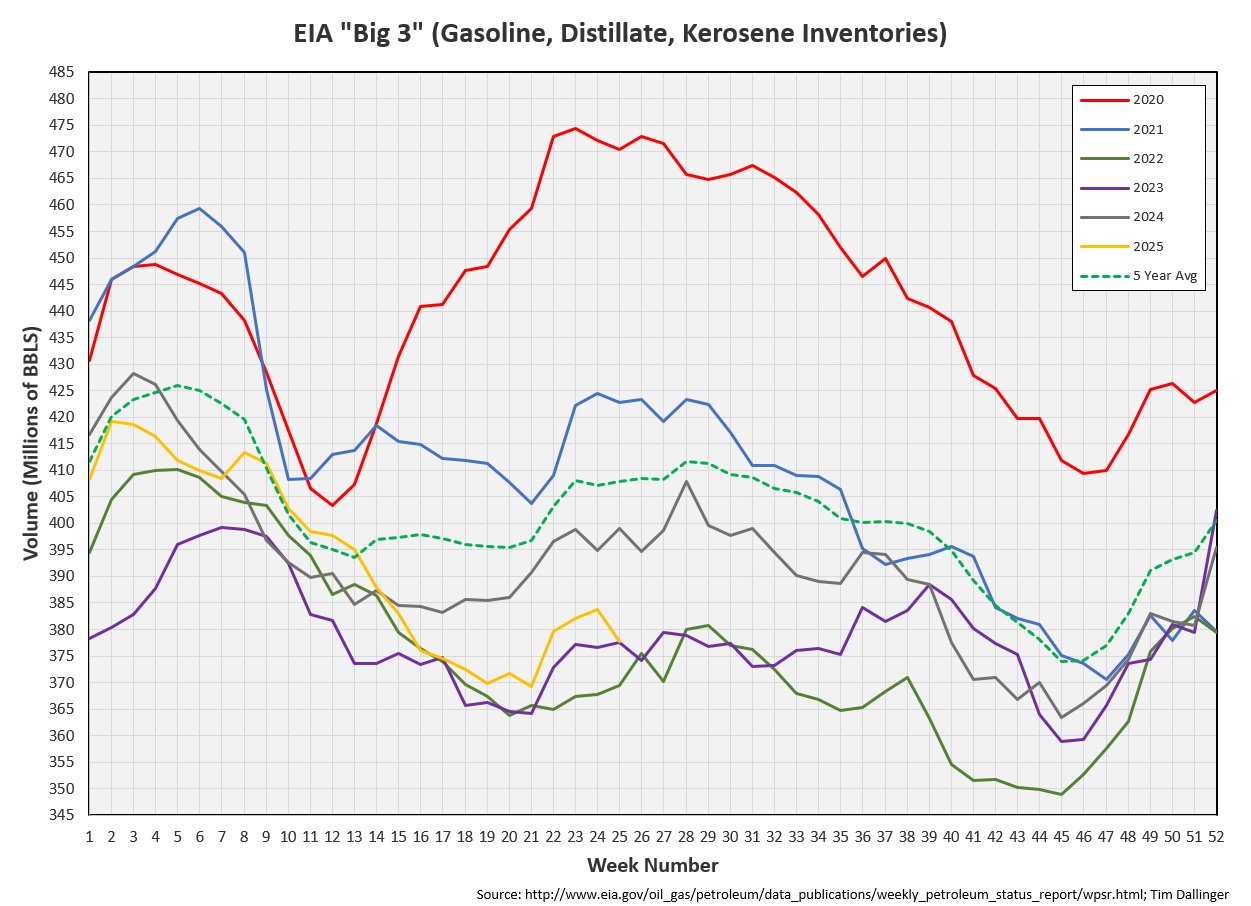

Total motor gasoline inventories decreased by 2.1MMB and are about 3% below the seasonal 5-year average.

Finished gasoline inventories are below average.

Gasoline blending components are below average.

Distillate

Distillate fuel inventories decreased by 4.1 MMB last week and are about 20% below the seasonal 5-year average.

Jet

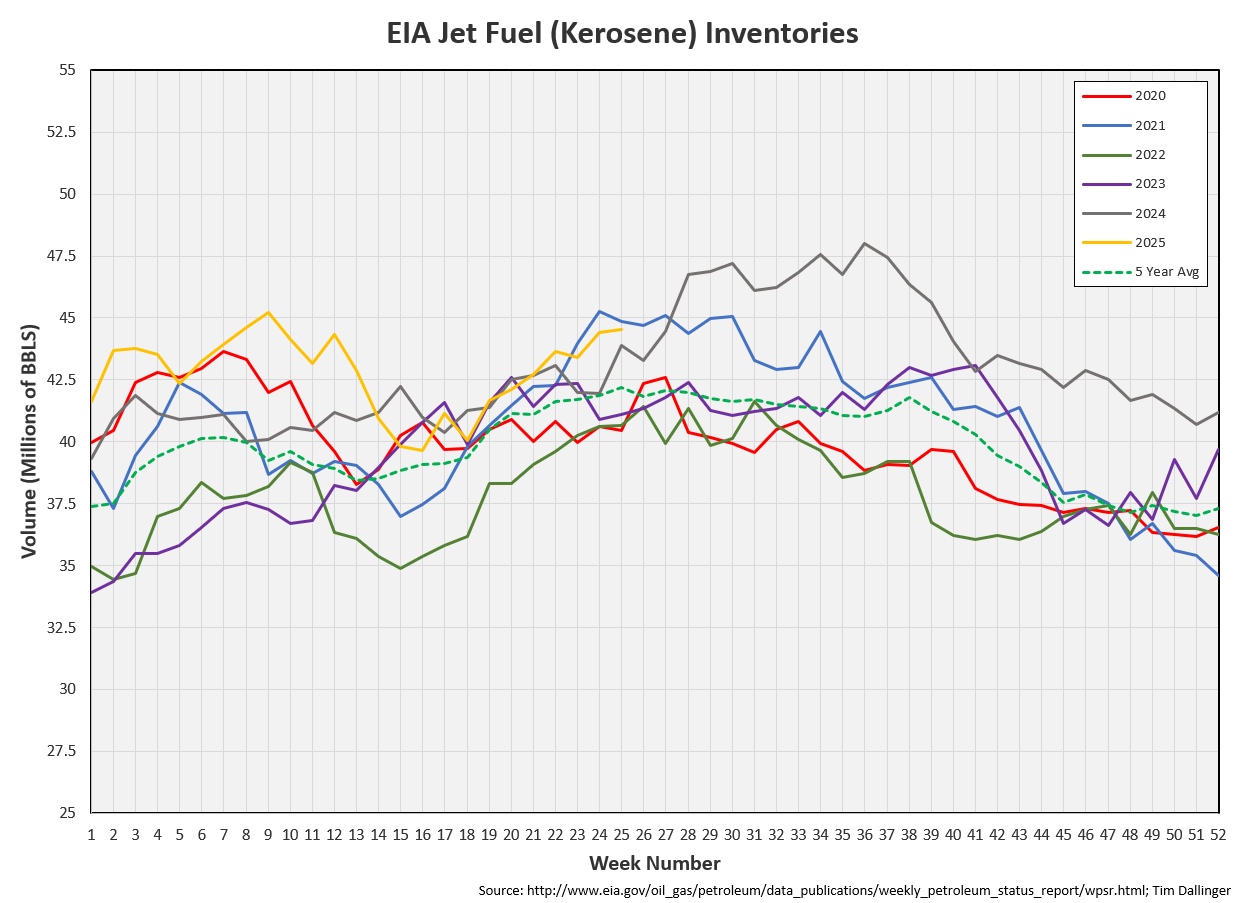

Kerosene type jet fuels increased by 0.1 MMB. Jet fuel inventories are above average but so is jet fuel demand.

Ethanol

Ethanol inventories increased 0.3 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories increased 5.1 MMB, in-line with normal seasonal trends.

Other Oil

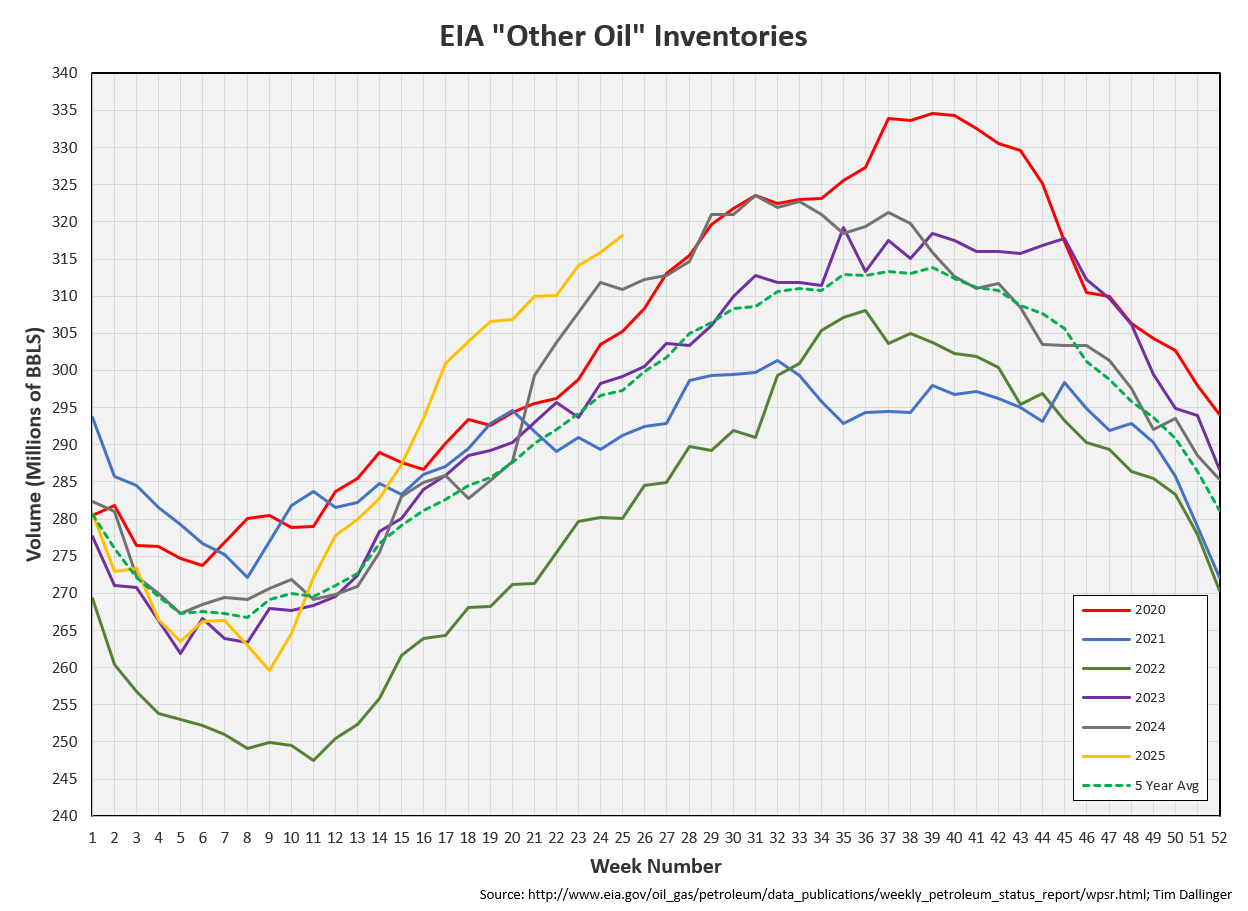

Other oil increased by 2.3 MMB.

Total Commercial Inventory

Total commercial inventory drew by 4.2 MMB.

Natural Gas

Natural gas inventories are above average.

Refiners

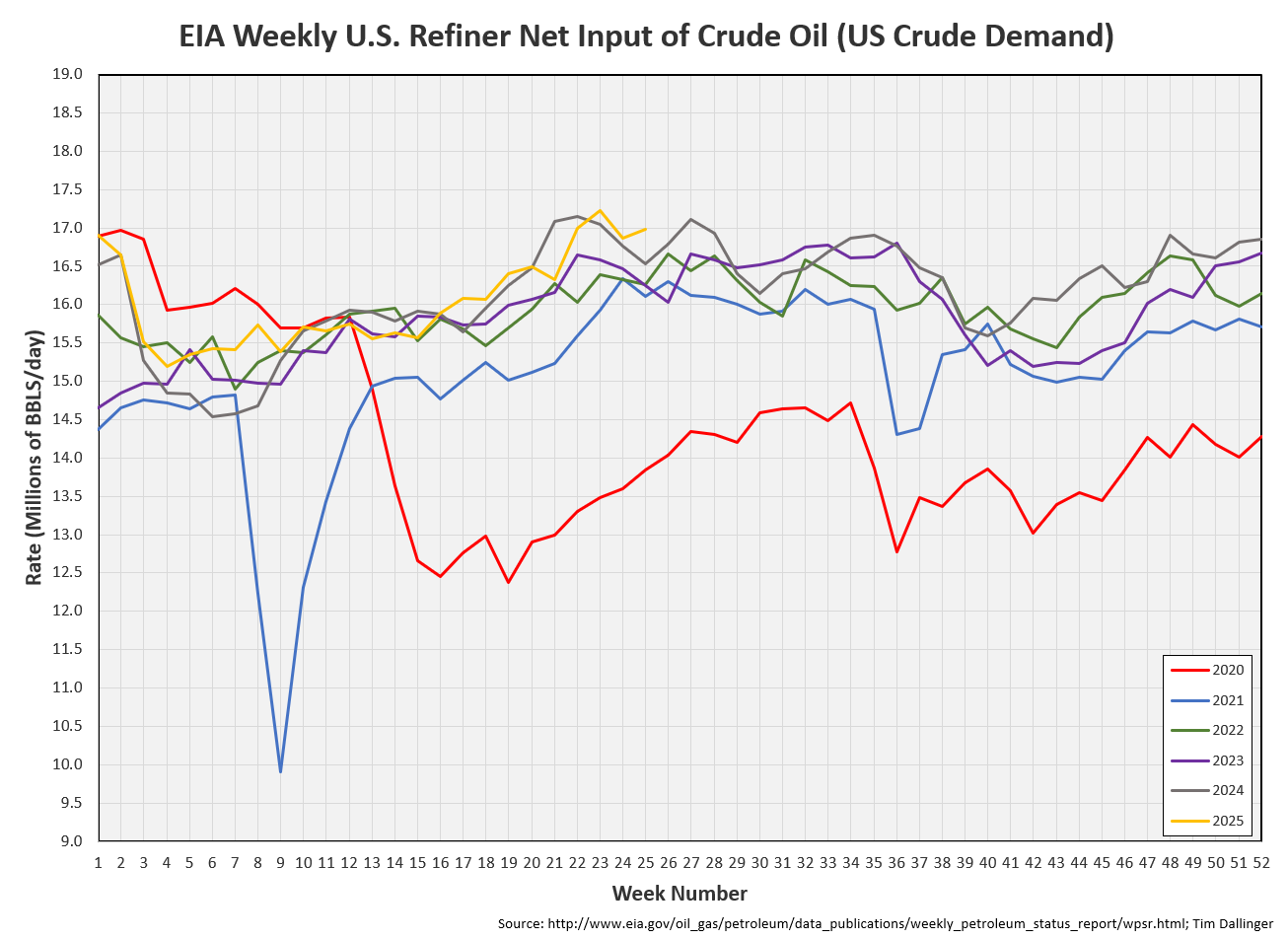

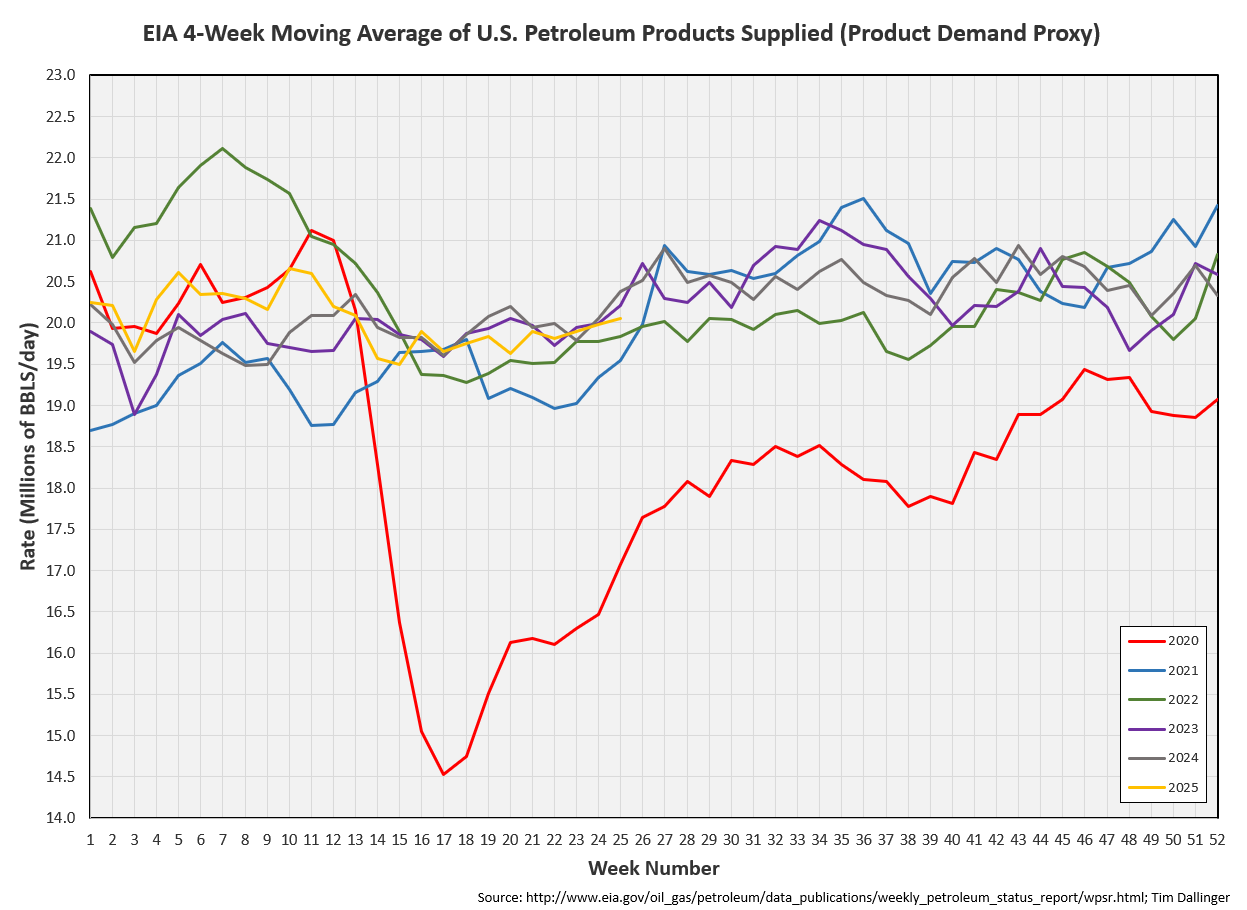

US refiners continue to run hard.

The 4-week moving average of the EIA’s product demand proxy is healthy, although below record levels.

Moving averages are better for this measure because the figure is noisy. But weekly implied demand figures continue to increase.

Transportation inventories are low, matching 2023 seasonal levels.

When crude is included, the aggregate approaches 2022 levels.

Simple cracks rebounded after the geopolitical premium in crude sold off.

Discussion

Readers have likely already been keeping abreast of the global conflict in the middle east. As of this writing, there appears to be at least a ceasefire, if not outright end to the conflict. The US helped Israel attack Iranian nuclear facilities. Iranian nuclear facilities appear to have been severely damaged but there are conflicting reports as to whether sites were destroyed.

Crude oil rallied on the threat of supply interruption but has since sold off all of the geopolitical premium. No barrels were lost in the conflict. Iran moved tankers out quickly so there is currently more oil-on-water.

Producers took this opportunity to hedge future barrels. This acts as selling pressure on price but allows producers lock in some future profit, bringing down the cost of production temporarily. This may give shale producers a little more runway.

The market returns to fundamental supply and demand dynamics. The market outlook appears to be skewing bearish even though inventories remain supportive. If spot price and futures continue to remain under pressure, production will fall. This sets the stage for the next bull leg up but the market must continue to see enough positive signals to override the bearish outlook or the physical market must tighten enough to force compliance in the paper market. There does appear to be the next bullish opportunity building but investors are recommended to exercise caution in a volatile market.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Dr. Walter Kornbluth, portrayed by Eugene Levy, expresses frustration in the 1984 American comedy, Splash.