EIA WPSR Summary for week ending 2-23-24

Summary

Neutral report.

Crude: +4.2 MMB

SPR: +0.9 MMB

Cushing: +1.5 MMB

Gasoline: -2.8 MMB

Ethanol: +0.5 MMB

Distillate: -0.5 MMB

Jet: -1.1 MMB

Propane: -3.4 MMB

Other Oil: -0.4 MMB

Total: -3.2 MMB

Spot WTI is currently pricing $78. This is slightly above fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built 4.2 MMB. Crude inventories are currently 1% below the seasonal average.

0.9 MMB were added to the SPR. That makes 5.2 MMB added to the SPR in 2024.

US crude imports were again at seasonal average levels.

US crude exports were again at the high end of normal. Independent ship trackers confirmed this export volume.

Unaccounted for oil nears zero.

Cushing

Crude storage at Cushing, OK built by 1.5 MMB. Draws are expected to resume after maintenance season.

Gasoline

Total motor gasoline inventories decreased by 2.8 MMB and are 2% below the seasonal 5-year average.

Ethanol

Ethanol inventories built by 0.5 MMB. Ethanol inventories are 4% above average.

Distillate

Distillate fuel inventories decreased by .05 MMB last week and are about 8% below the seasonal 5-year average. Distillate volumes near 2022 lows.

PADD 1 distillate inventories fall to record lows.

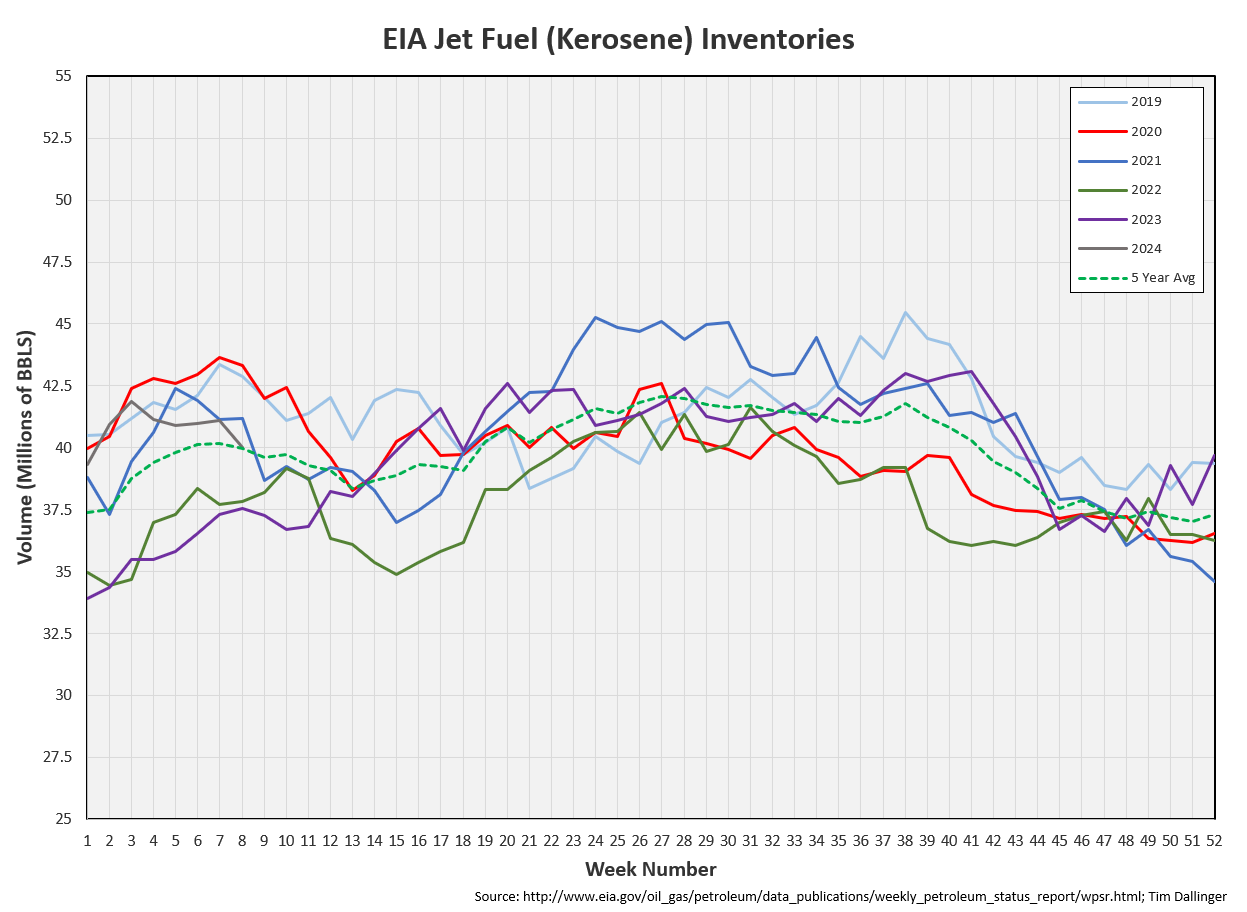

Jet

Kerosene type jet fuels decreased by 1.1 MMB. Seasonal jet inventories are at the 5-year average.

Global flights and airfare miles traveled continue to hit seasonal records.

This is lead by all-tine high Chinese flights.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories decreased by 3.4 MMB from last week. Inventories remain slightly below seasonal averages.

Other Oil

Other oil decreased by 0.4 MMB. Other oil inventories are just above seasonal average.

Total Commercial Inventory

Total commercial inventories drew by 3.2 MMB.

Natural Gas

There’s no update this week to the natural gas storage chart. Last week’s WSPR was delayed until Thursday due the federal holiday, so it included data released on 2-22-24. New weekly natural gas number are available at the EIA tomorrow.

The US near-term weather outlook appears to be moderate so expect little additional demand.

Discussion

Refiners processed slightly more crude oil this week. Utilization may lag for another additional week. However, refiners should be exiting maintenance soon. BP Whiting is scheduled to begin restart this week.

The EIA product demand proxy continues to show weakness.

However, transportation inventories have drawn quickly over this quarter.

Cracks sold off following this report. It appears the market was expecting more product draw.

Brent timespreads are ripping. Longer shipping routes are starting to have effect on the international physical market. Houthis continue to disrupt cargo traffic in the Red Sea. They’ve also started targeting undersea internet cables to Europe and Asia.

The Brent WTI spread will drive US exports. The US will also tighten with maintenance concluding.

Last week’s report really flashed a bullish signal. While this week’s report wasn’t bearish, it doesn’t produce as much enthusiasm. Timespreads are the bright spot. Product demand needs to pick up and boost cracks again. Cracks were higher at the beginning of the week though so that can change quickly.

Russia bans gasoline exports for 6 months, starting March 1. This should help product markets.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed

Brennan is excited about receiving a Wookie mask gift even though it could be considered a letdown compared to Dale’s in the 2008 American comedy film, “Step Brothers.”