EIA WPSR Summary for week ending 5-17-24

Summary

Neutral report.

Crude: +1.8 MMB

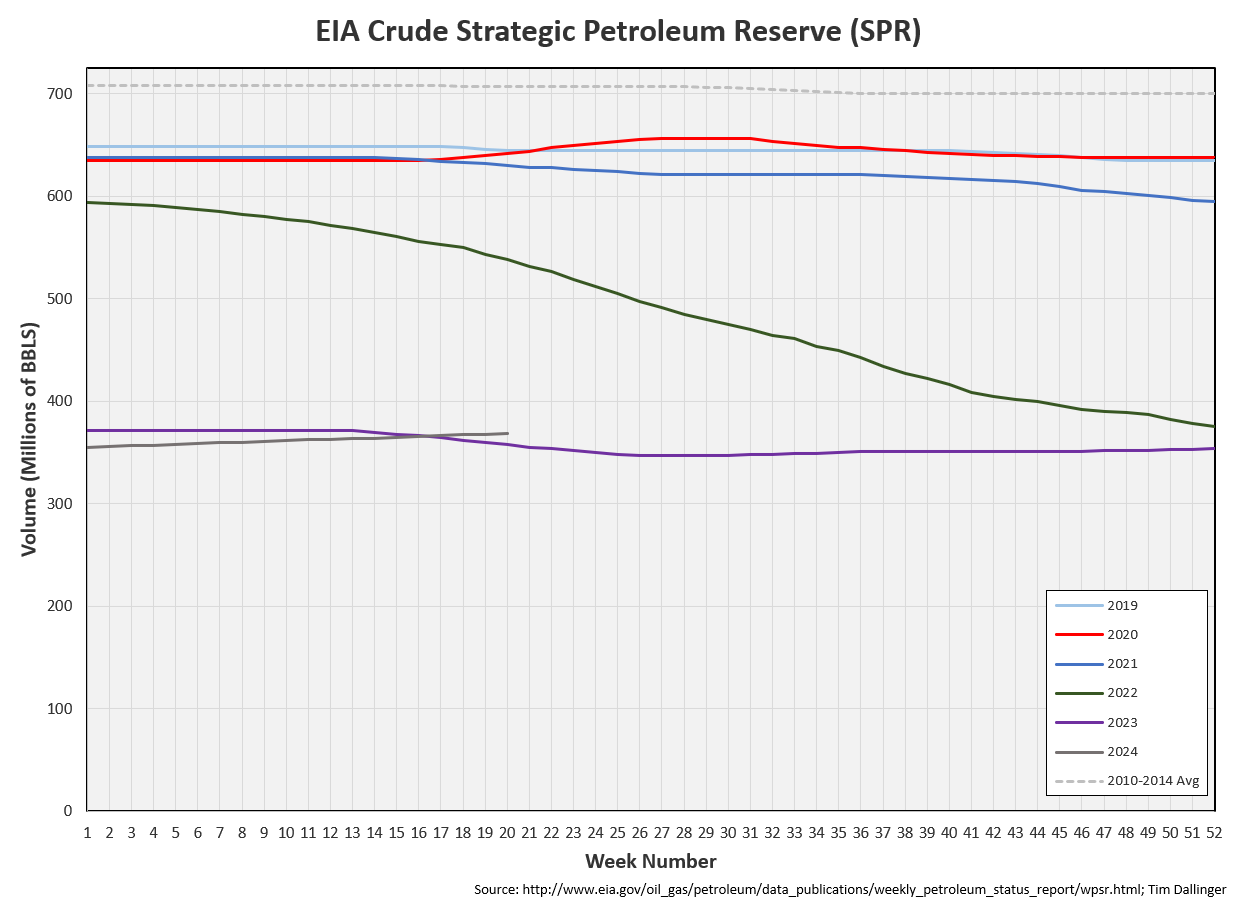

SPR: +1.0 MMB

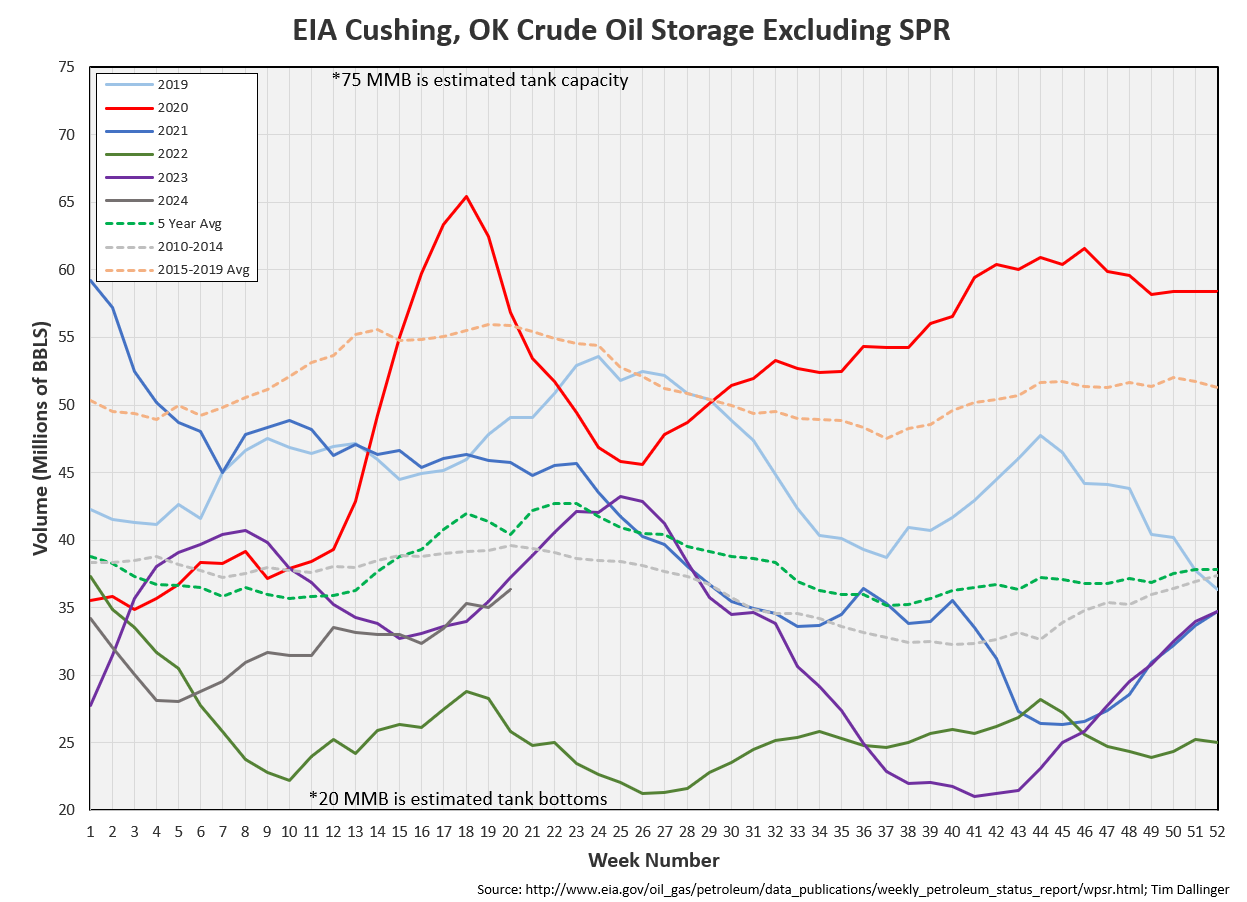

Cushing: +1.3 MMB

Gasoline: -0.9 MMB

Distillate: +0.4 MMB

Jet: +1.1 MMB

Ethanol: -0.3 MMB

Propane: +2.2 MMB

Other Oil: +2.6 MMB

Total: +7.5 MMB

Spot WTI is currently pricing $77. Prices are fairly valued based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 1.8 MMB. Crude inventories are currently 3% below the seasonal average.

1.0 MMB were added to the SPR. 13.6 MMB have been added to the SPR in 2024. The US still hasn’t added the ~17MMB barrels that were released in 2023.

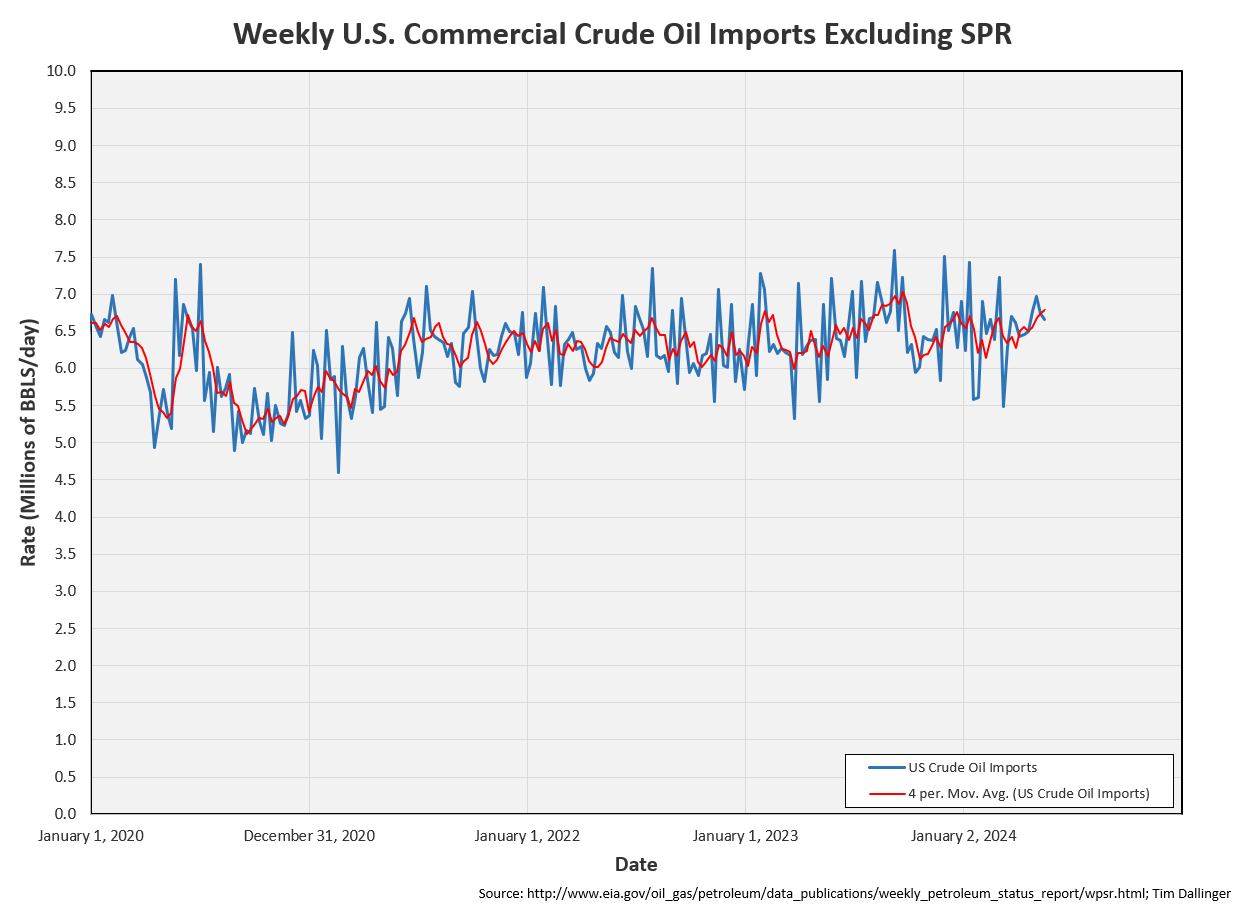

US crude imports were down slightly this week. Ship trackers showed much higher imports than the EIA.

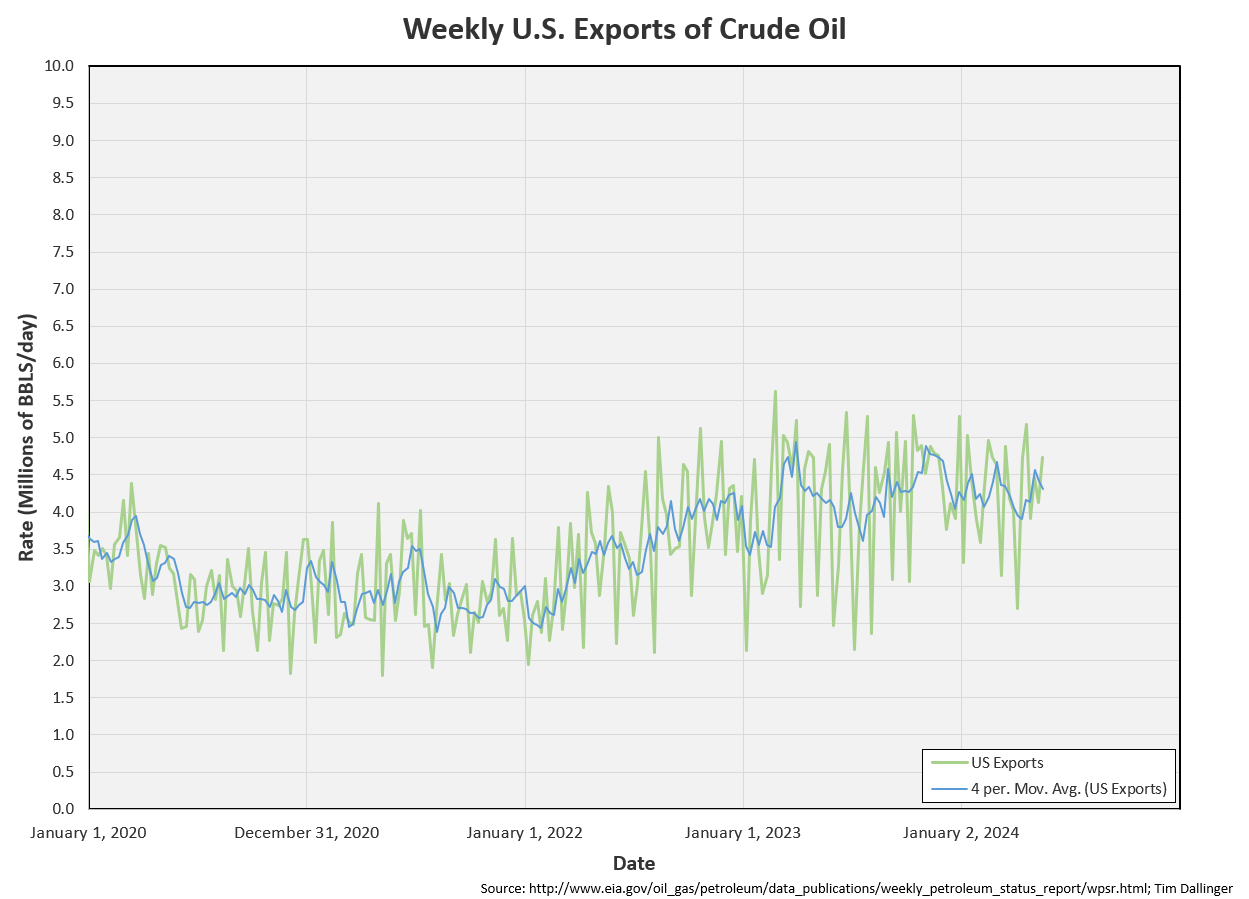

Crude exports increased. Again, ship trackers showed lower volumes. US exports do need to pick back up for US inventories to draw as expected this summer.

Unaccounted for crude was up to a staggering 1.376 MMBD. This can be explained by undercounting imports and overcounting exports.

Cushing

Crude storage in Cushing, OK, built by 1.3 MMB week on week. The inventory trajectory is matching 2023.

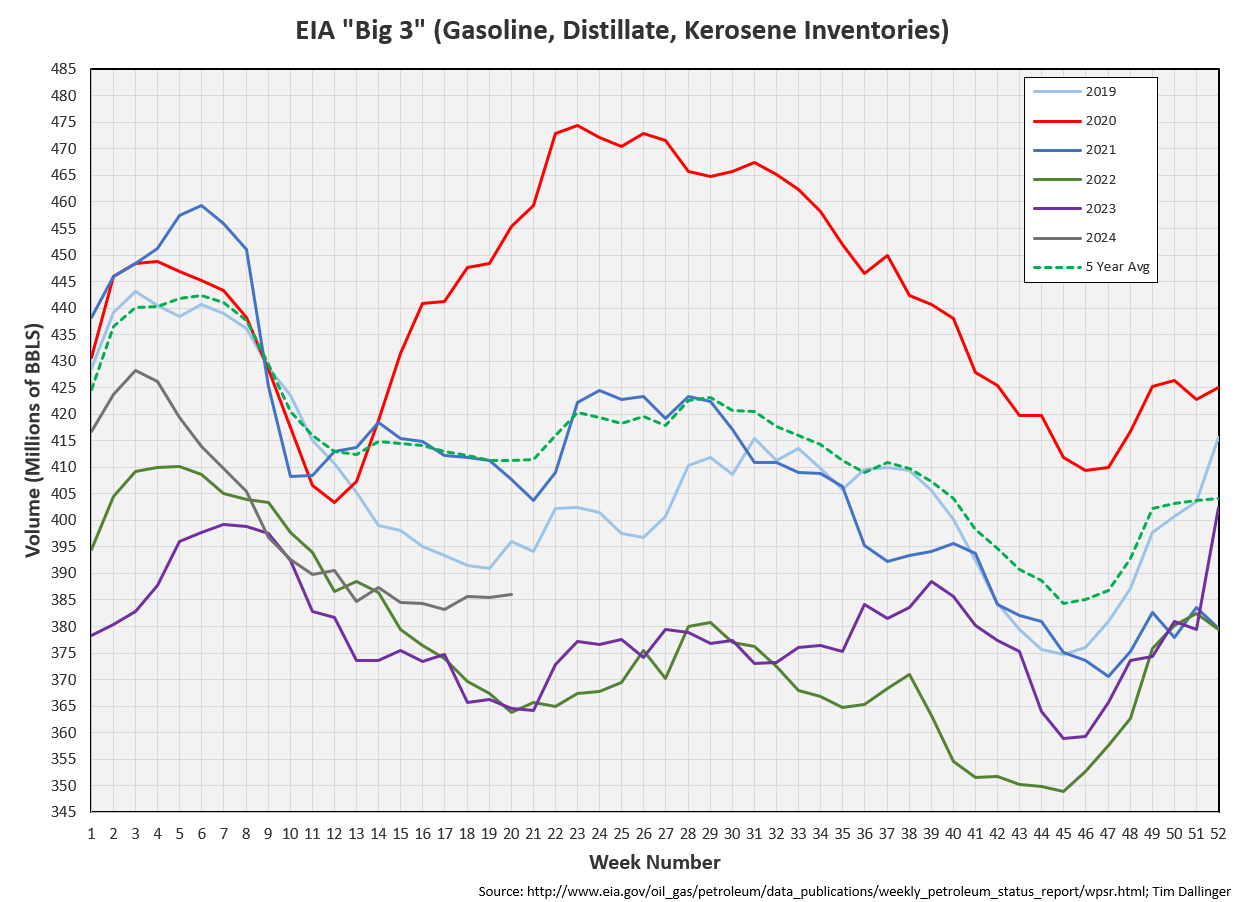

Gasoline

Total motor gasoline inventories decreased by 0.9 MMB and are about 3% below the seasonal 5-year average.

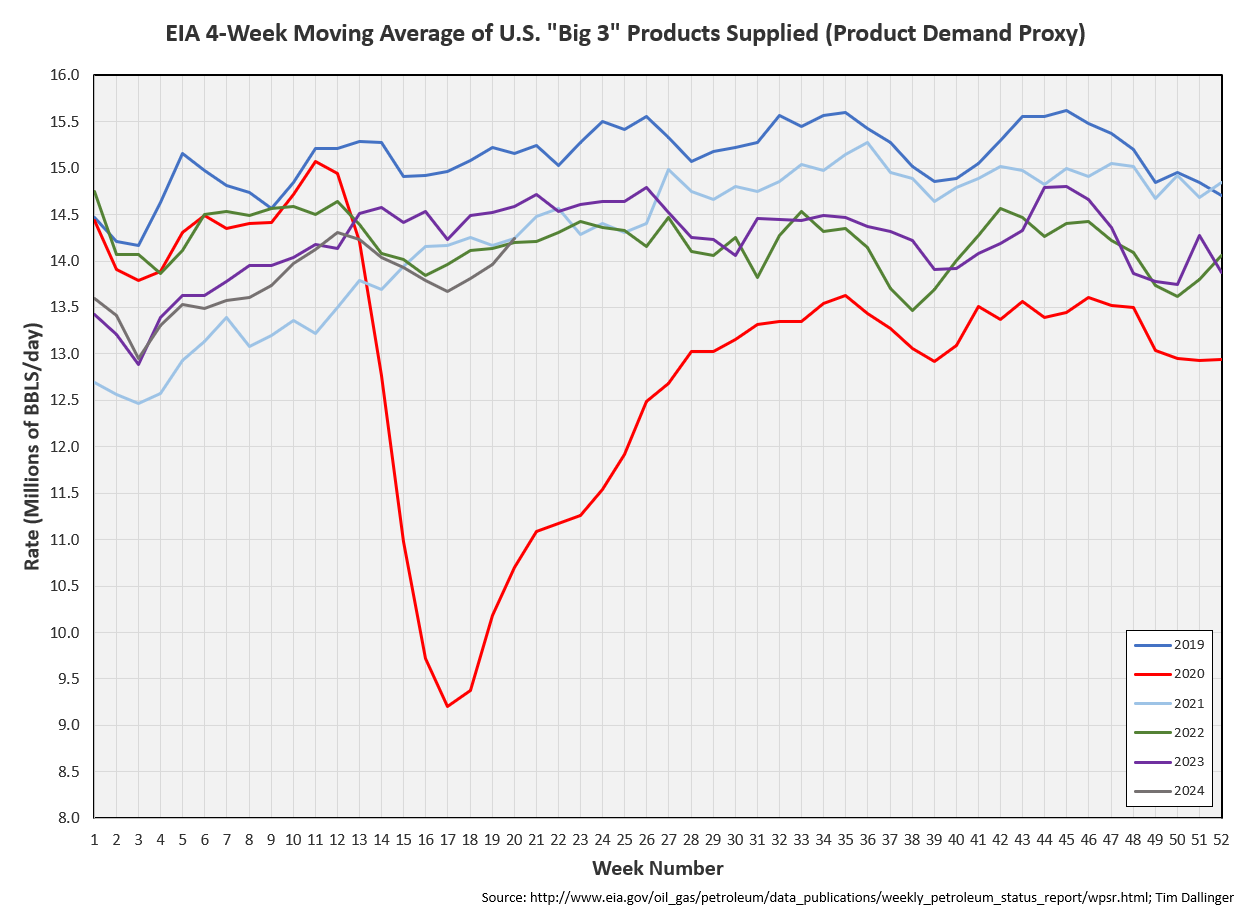

The implied gasoline demand proxy jumped this week, overtaking 2022.

Distillate

Distillate fuel inventories increased by 0.4 MMB last week and are about 7% below the seasonal 5-year average.

Implied distillate demand is also picking up off the recent low’s.

Jet

Kerosene type jet fuels built by 1.1 MMB and are 2023 levels.

Global flights and miles continue to set seasonal records. Summer travel is expected to hit all-time record high’s.

Ethanol

Ethanol inventories decreased 0.3 MMB week-on-week. Inventories are about still above seasonal averages.

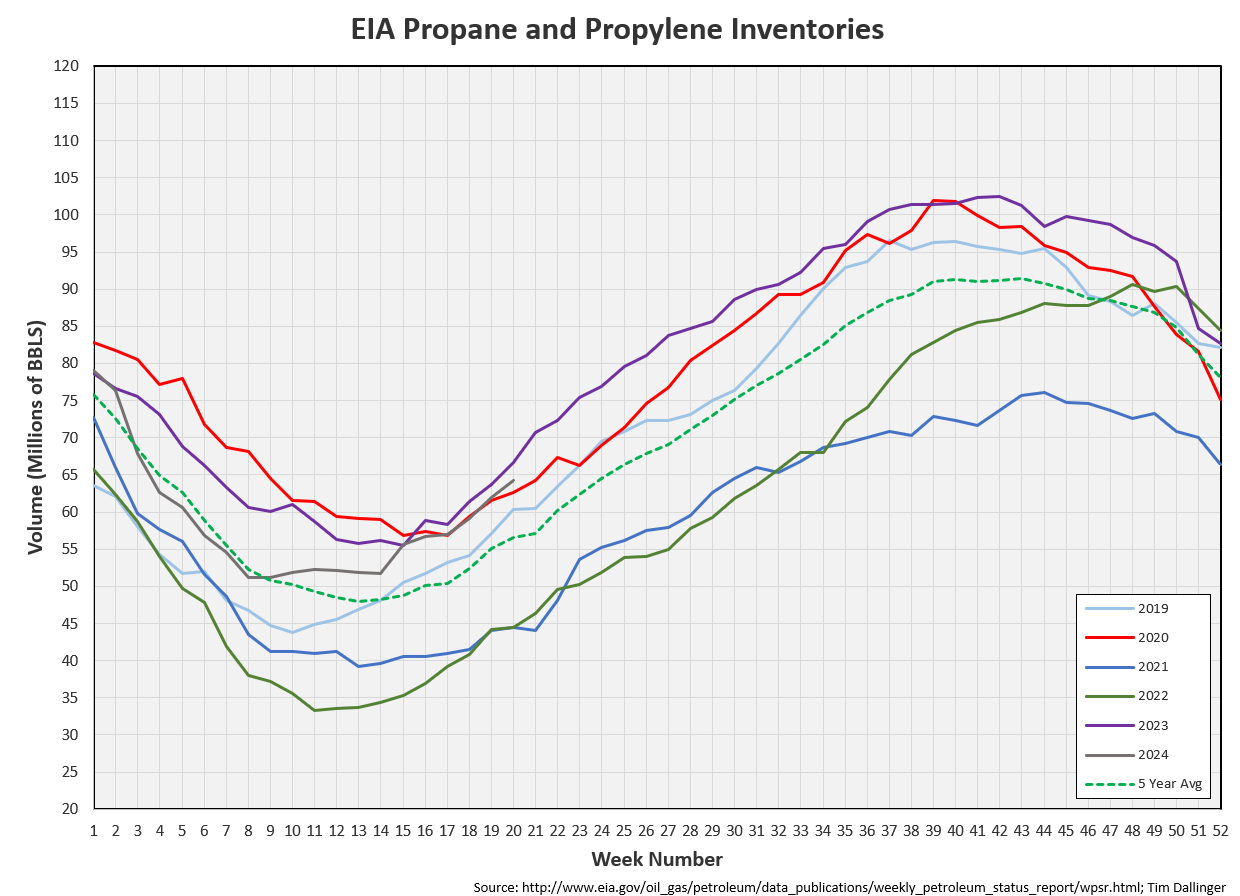

Propane

Propane/propylene inventories increased by 2.2 MMB, in-line with seasonal expectations.

Other Oil

Other oil built by 2.6 MMB and is at the seasonal average.

Interestingly, other oil implied demand, while still at seasonal records, falls considerable as gasoline implied demand jumps.

Total Commercial Inventory

Total commercial inventories increased by 7.5 MMB. Inventories are still below seasonal averages.

Natural Gas

Natural gas inventories remain high.

Refiners

Refiners are approaching an all-time seasonal record for crude processed. This is astounding considering there were more refineries open in 2019.

The EIA’s product demand proxy hits a seasonal record.

Transportation inventories are below average but higher than the recent previous years.

Transportation inventory implied demand is still struggling.

Simple cracks are still down off the recent high’s.

But backwardation remains in crude.

Discussion

Bearish sentiment remains. This seems overdone. The physical market did loosen but many signals seem to indicate demand is picking up globally now.

The weekly US production model shows no growth. It almost looks like the EIA is simply copying and pasting this figure forward each week. Production hasn’t ever been flat for this long.

Congress has scheduled the sale of the entire 1 MMB Northeast Gasoline supply reserve by the of 2024 fiscal year. This reserve was created following the storm Sandy in 2014. While one hopes that the US government isn’t using energy in a politically motivated manner, signs indicate otherwise. “By strategically releasing this reserve in between Memorial Day and July 4th, we are ensuring sufficient supply flows to the ... northeast at a time hardworking Americans need it the most,” said Energy Secretary Jennifer Granholm..

The physical market needs to tighten further and consumer demand must pick up into summer for the bullish energy thesis to continue.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Mel Brooks aptly describes the energy market in the 1981 comedy film, “History of the World Pt 1.”