EIA WPSR Summary for week ending 3-29-24

What Makes Them Think You’re a Risk Management Expert? Guess It’s on my Resume…

EIA WPSR Summary for week ending 3-29-24

Summary

Neutral Report.

Crude: +3.8 MMB

SPR: +0.6 MMB

Cushing: -0.3 MMB

Gasoline: -4.3 MMB

Ethanol: +0.3 MMB

Distillate: -1.3 MMB

Jet: -0.3 MMB

Propane: -0.4 MMB

Other Oil: +1.1 MMB

Total: -2.2 MMB

Spot WTI is currently pricing $85. This above fair value based on a price model derived from reported EIA inventories. The market could be forward-looking or adding some geopolitical price premium.

Crude

US Crude oil supply built by 3.2 MMB. Crude inventories are currently 2% below the seasonal average. Crude inventories have reached an unexpected new annual high. Export volumes were projected to be larger.

0.6 MMB were added to the SPR. 8.6 MMB have been added to the SPR in 2024. The Department of Energy has cancelled the latest announced SPR purchases for August and September delivery, citing higher prices.

Crude imports fell slightly week-on-week.

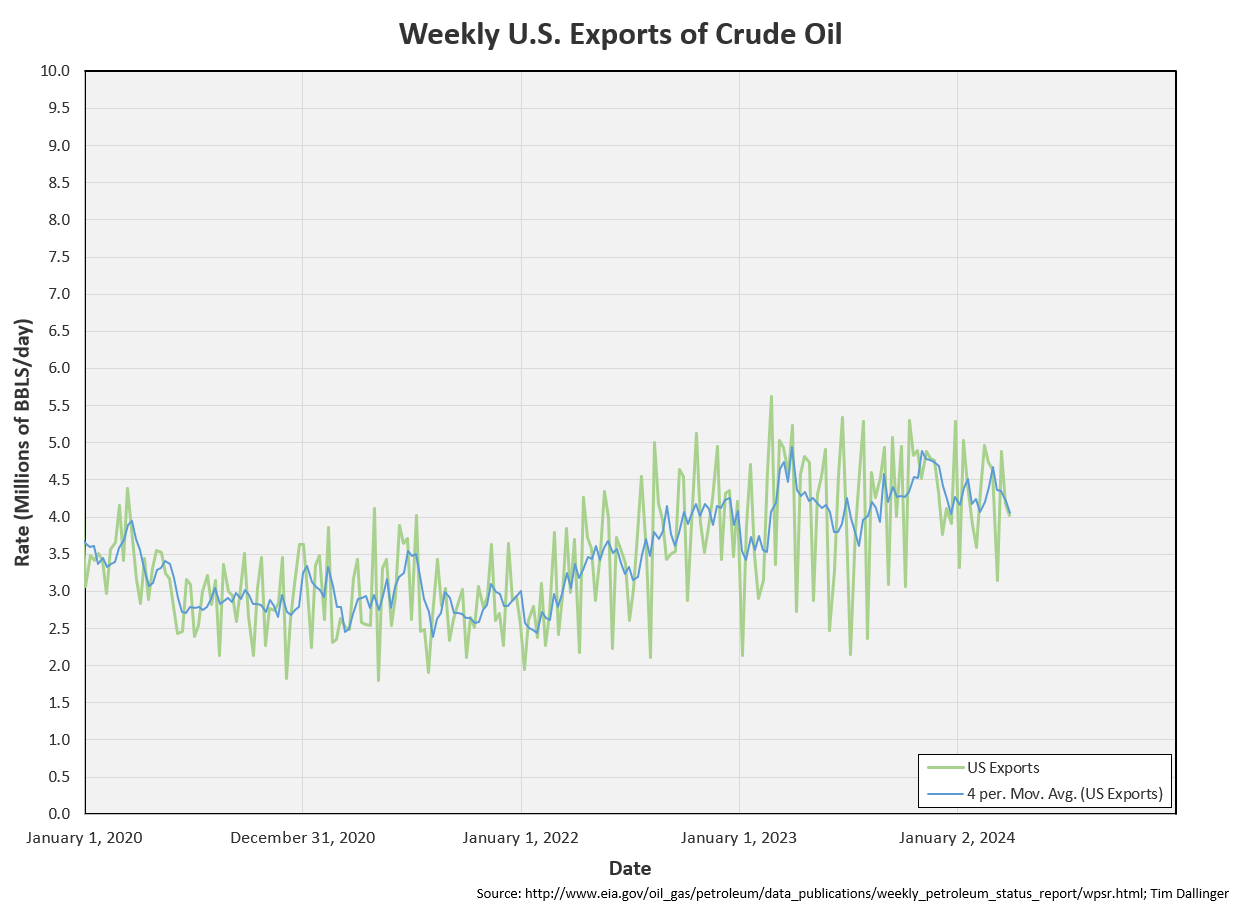

Crude exports were reported at 4.02 MMBD. This was a higher value than that projected by independent ship trackers. However, it still doesn’t make up the for the export barrels that appear to have been miscounted over the remainder of March.

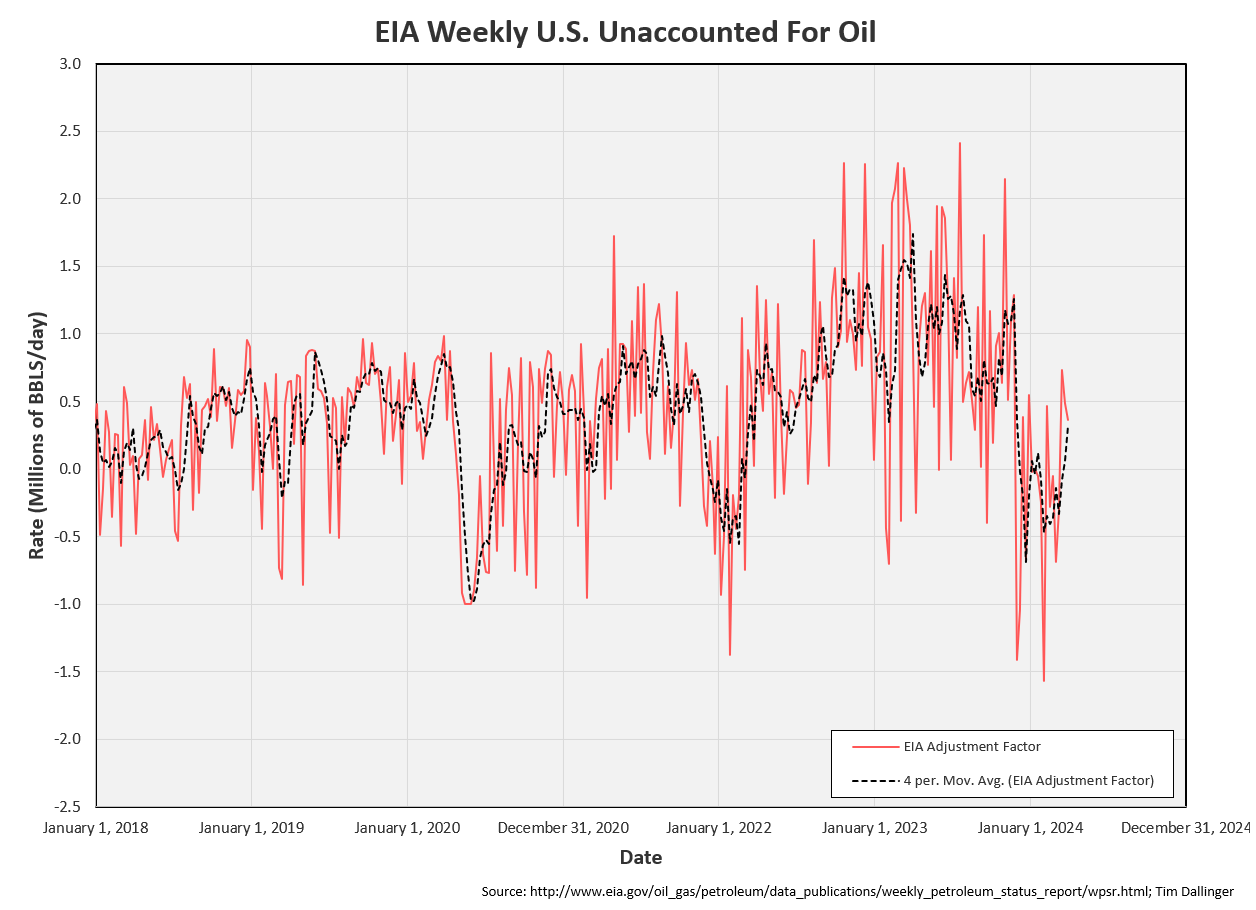

Unaccounted for oil was positive again. That makes 3 consecutive weeks of positive adjustments, a new high for 2024. This should correct negative soon.

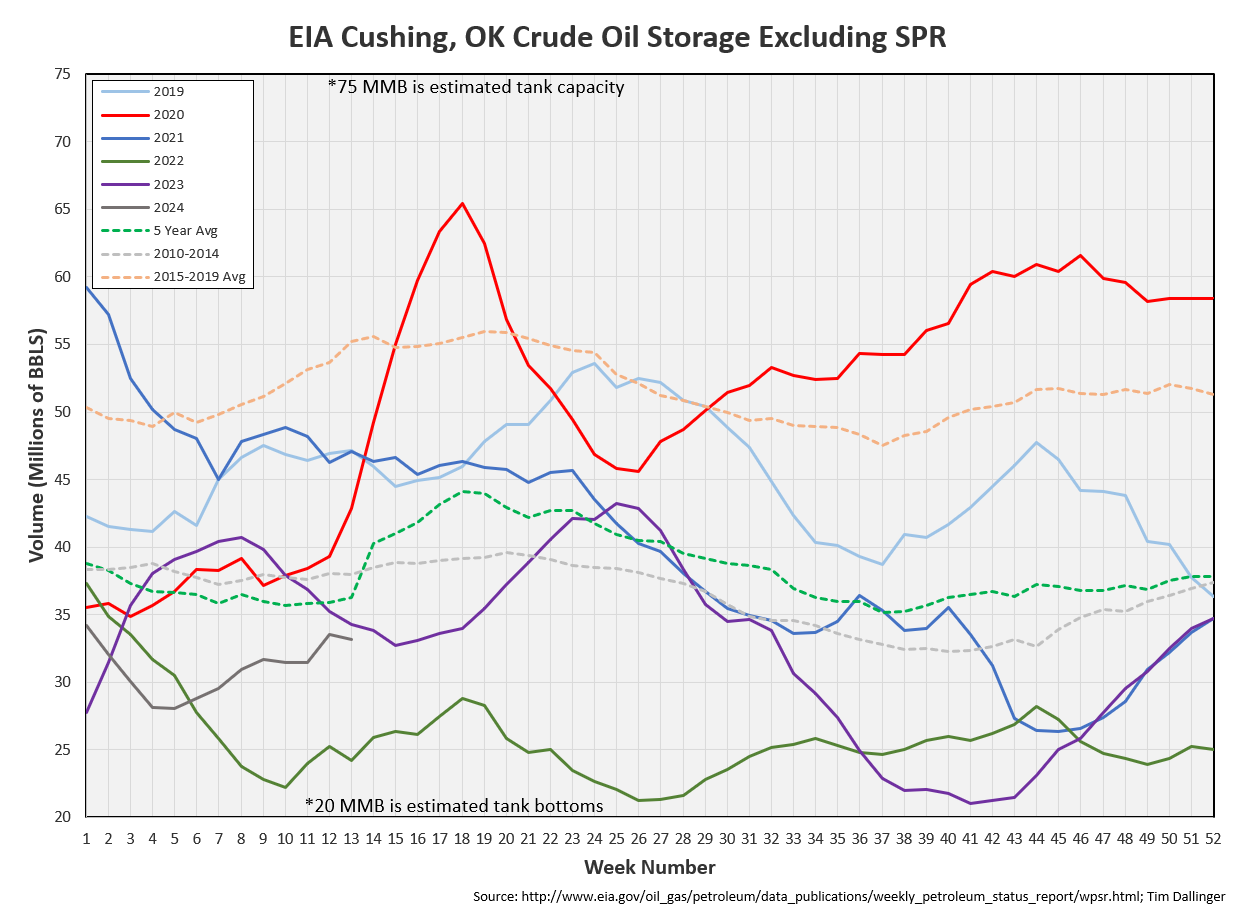

Cushing

Crude inventories in Cushing, OK dew by 0.3 MMB. Draws are expected but a considerable movement downward could be a month away.

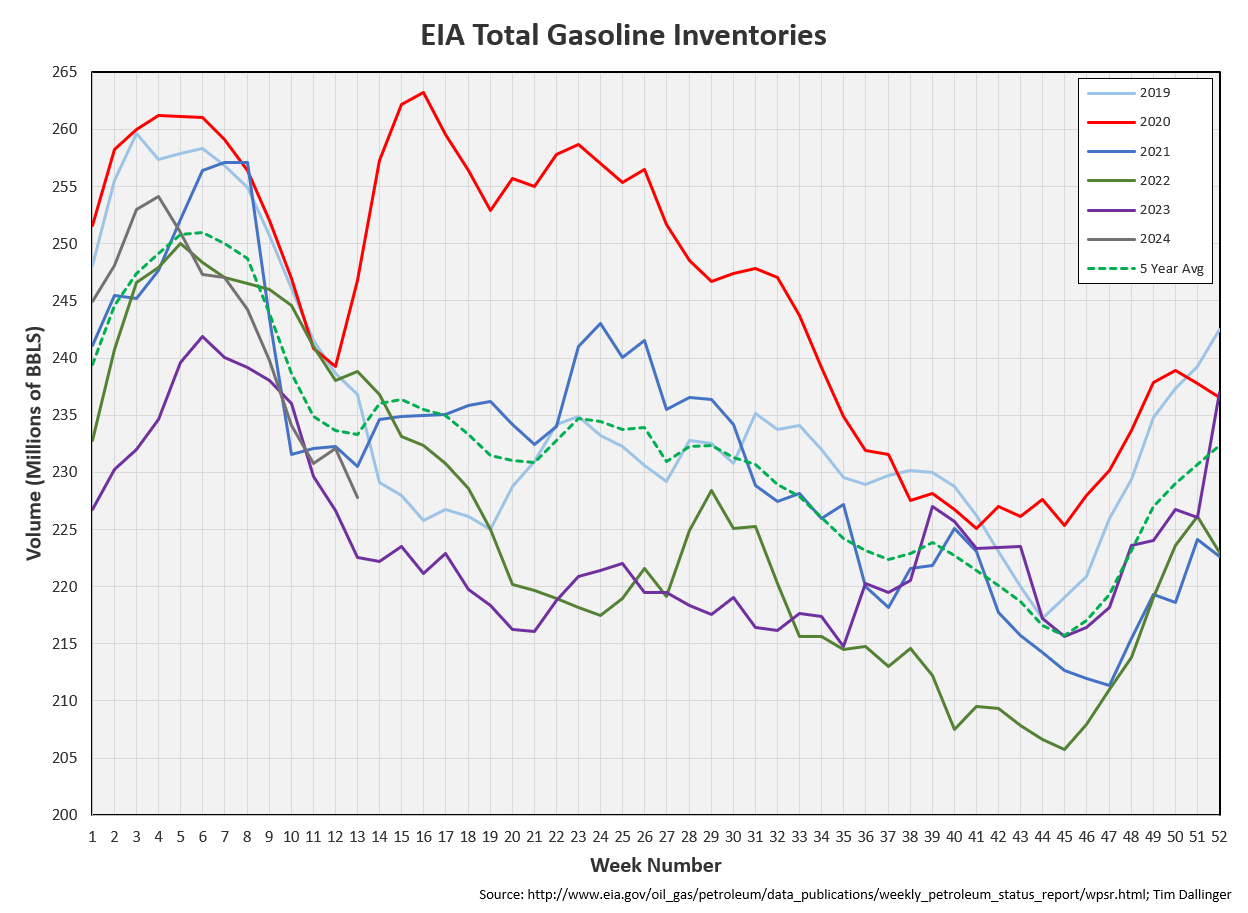

Gasoline

Total motor gasoline inventories decreased by 4.3 MMB and are about 3% below the seasonal 5-year average.

Ethanol

Ethanol inventories are at 2022 high levels, 5% above the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 1.3 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels decreased by 0.3 MMB. Seasonal jet inventories are almost 10% above the 5-year average.

Global air travel is at seasonal record highs.

https://www.airportia.com/flights-monitor/

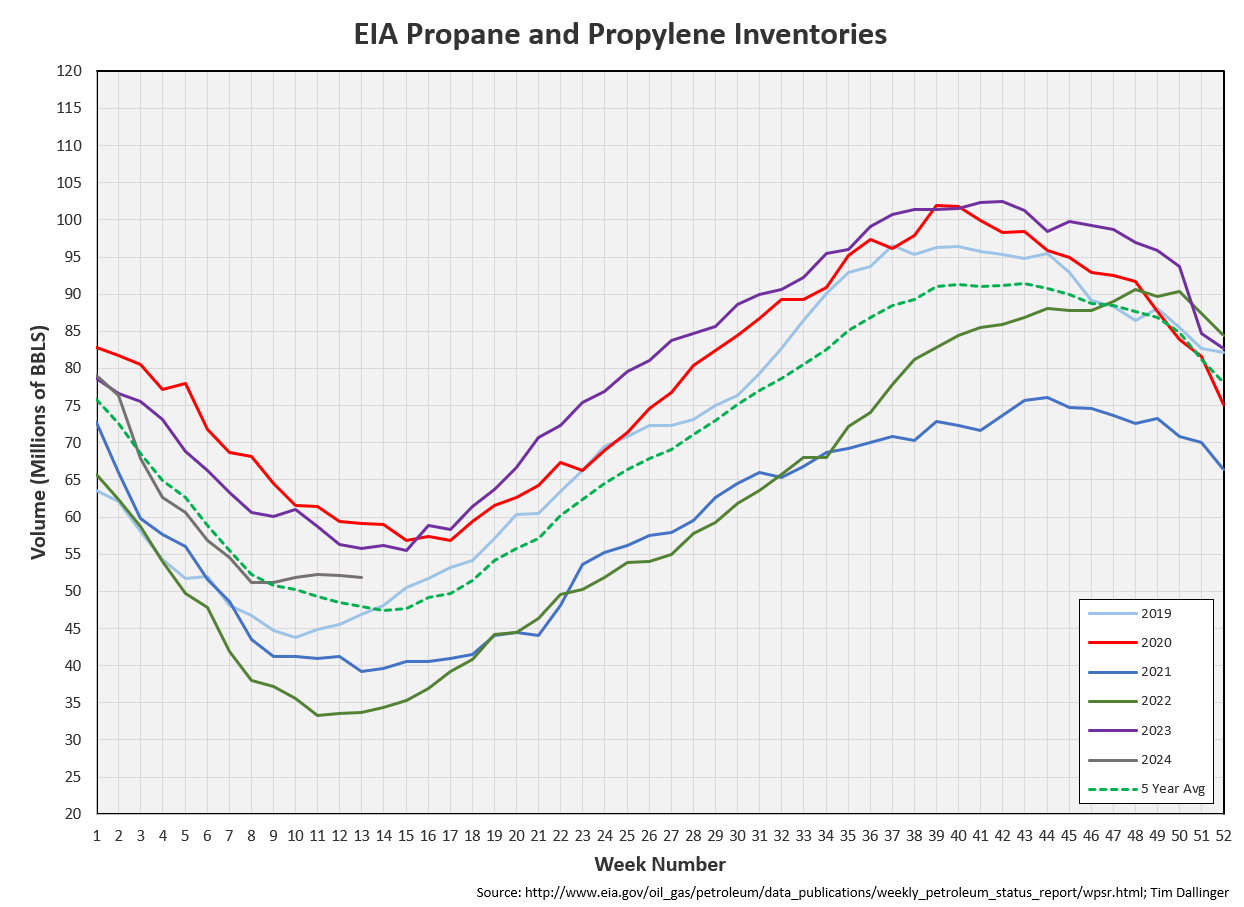

Propane

Propane/propylene inventories decreased 0.4 MMB week-on-week. Inventories are above seasonal averages.

Other Oil

Other oil increased by 1.1 MMB. Other oil inventories are just below seasonal average.

Total Commercial Inventory

Total commercial inventories fell by 2.2 MMB, bringing them below 2019 levels.

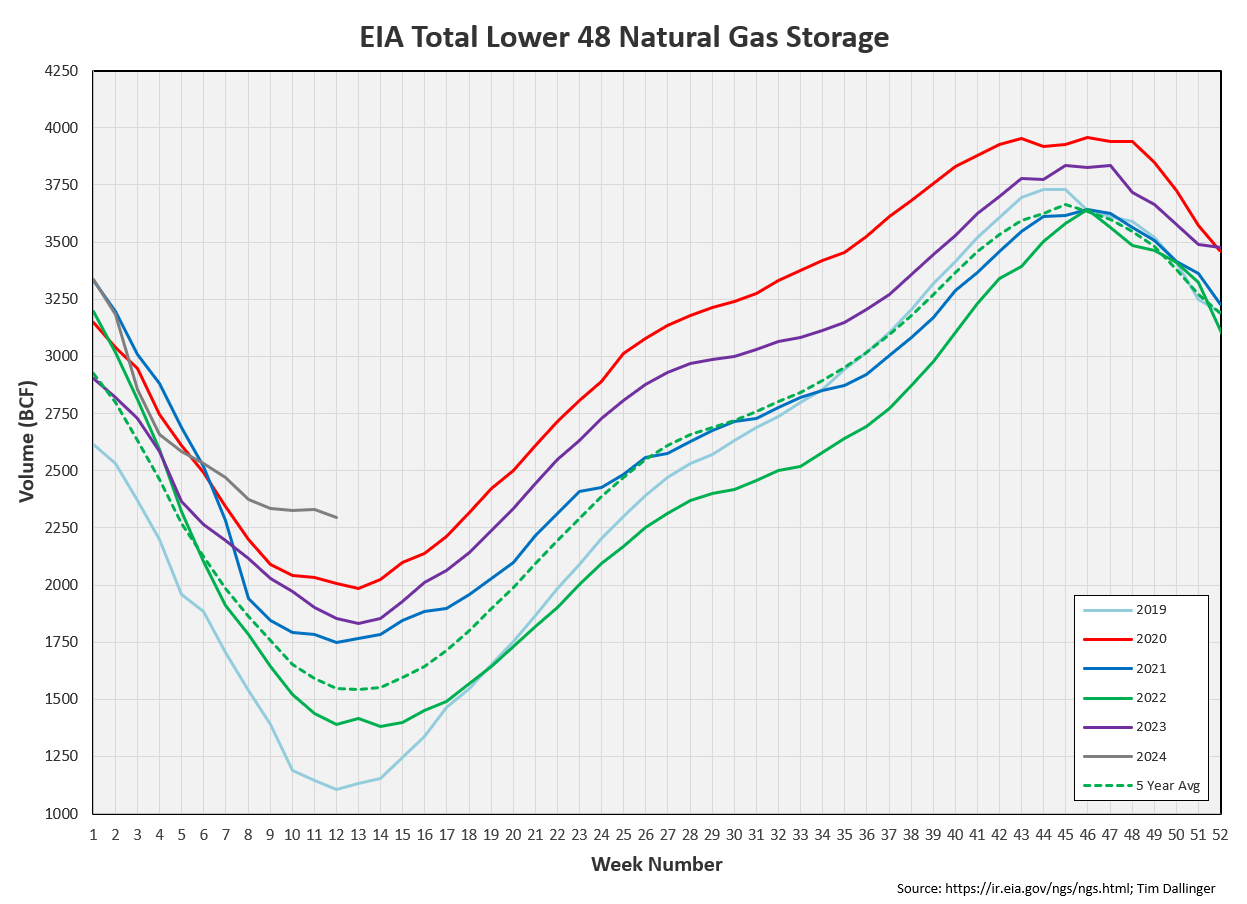

Natural Gas

Natural gas inventories remain at seasonal record highs.

Refineries

US refiner weekly crude input fell slightly week on week. Crude oil processing is still near record seasonal highs.

EIA’s consumer demand proxy is picking up, coming in at over 21 MMB. The 4-week moving average can be seen below.

Transportation inventories trend down. Only 2023 has been lower in recent years.

3-2-1 Crack spreads fell back slightly but remain near the important $30 level. Long-time readers will notice a change in the magnitude of this chart. The equation has been updated so both the magnitude and curve shape are now correct.

The WTI futures curve maintains its backwardation. The physical market is tight as refiners pay for prompt crude delivery.

Discussion

Ukraine drones have attacked more Russian refineries. Crack spreads did not respond this time. The market is awaiting signs of shortage before pricing products higher.

The latest EIA 914 was released late last week. US production experienced a substantial reduction. While shale does appear to be experiencing some struggles currently, this decrease was due primary to freeze conditions in January 2024 in west Texas and New Mexico. February’s report should be more valuable to check on the status of US tight production.

The USD WTI curve used to be included each week in this summary. Dollar strength is usually a headwind for oil, but the relationship broke in August 2024. This correlation is checked every week but not included when it appears to have little utility.

The Canadian Trans Mountain pipeline has been structurally completed and linefill has begun. Startup is expected sometime in Q2. This has been responsible for the narrowing of the WTI-WCS differential as the Canadian oil sands now have access to global customers. China’s Sinochem has purchased its first Canadian Cargo. Though it appears much of the TMX volume will be exported by tanker, south to the California coast.

Israel struck a target near the Iranian Consulate in Damascus, Syria, killing 5 high-ranking members of the Iranian Islamic Revolutionary Guard Corps. Iran and Hezbollah have vowed “punishment and revenge” for this escalation.

OPEC+ met today. No changes were made to quotas or demand forecasts. Offending members were told that oil compliance cuts needed improvements. Iraq and Kazakhstan pledged to compensate for their recent overproduction. Russia guided that they would also lower production. However, that seems more likely due to impacted refining capacity than being responsible OPEC members. The next OPEC+ meeting is scheduled for June 1, 2024.

Crude oil prices have run recently. They appear to be overvalued here. However, there is a deficit in the physical market, and it’s currently projected to tighten further this summer. Driving season begins now. The bullish thesis remains but the near-term could experience volatility. Readers are encouraged to manage their risk accordingly.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available, but accuracy of 3rd party data cannot be guaranteed.

George Costanza, portrayed by Jason Alexander, must give a lecture on Risk Management to the Yankees front office in the 1990’s American Sitcom, Seinfeld.

Feels like a wild ride ahead, more vol than we’ve been seeing recently. Thanks Tim!