Tracker's Off Scale, Man! They're All Around Us, Man!

EIA WPSR Summary for week ending 11-10-23

Summary

As last week’s WSPR was delayed due to system update, today’s report includes two weeks of data. Both weeks are fairly neutral.

Current Week (week ending 11-10-23)

Crude: +3.6 MMB

SPR: +0.0 MMB

Cushing: +1.9 MMB

Gasoline: -1.5 MMB

Ethanol: +0.0 MMB

Distillate: -1.4 MMB

Jet: -2.1 MMB

Other Oil: +0.9 MMB

Total: -0.1 MMB

Previous week (week ending 11-3-23)

Crude: +13.8 MMB

SPR: +0.0 MMB

Cushing: +1.6 MMB

Gasoline: -6.3 MMB

Ethanol: +0.0 MMB

Distillate: -3.3 MMB

Jet: -1.6 MMB

Other Oil: +1.2 MMB

Total: +1.2 MMB

Spot WTI is currently pricing $76. This is below fair value, based on a price model derived from reported EIA inventories. Today is December WTI expiration so the January contract is experiencing more volume.

Crude

U.S. commercial crude oil inventories increased by 3.6 MMB from the previous week and are about 2% below the seasonal 5-year average.

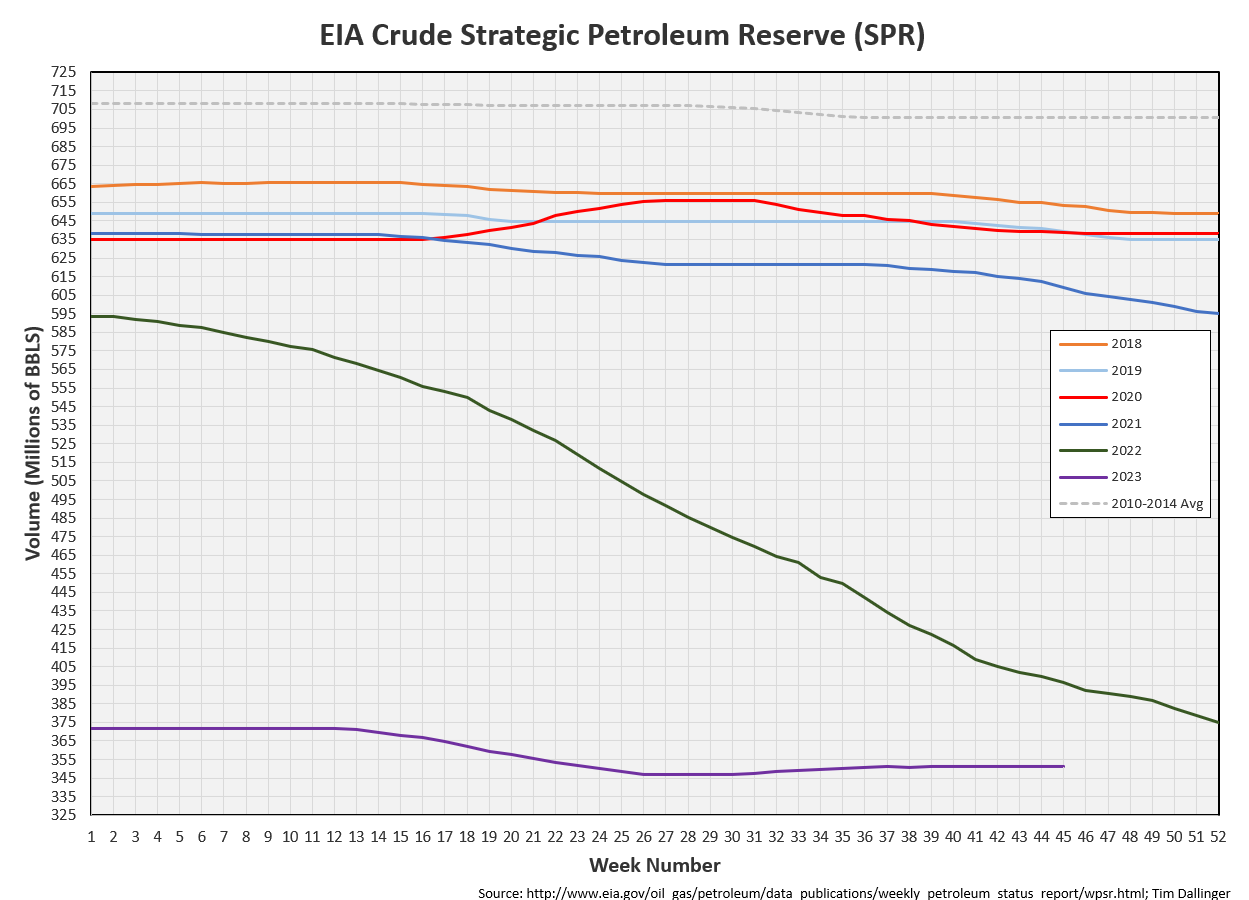

SPR was again unchanged this week. Another 1.2 MMB additions are still planned for the remainder 2023. The US DOE also purchased 1.2 MMB more barrels for delivery in January.

US imports have fallen back from recent high’s.

US exports remains near all-time highs. Bloomberg reports a record 48 supertankers are en-route, scheduled to arrive in the Gulf coast over the next 3 months. Exports should remain high.

The EIA introduced a new metric in the WSPR during last week’s maintenance, transfer to crude oil supply. This is natural gasoline, condensate and unfinished oil, blended into the crude oil supply.

Almost 700 kbd of “crude oil” was actually this lighter blend of fluids. This condensate has been the underlying issue contributing to unaccounted for oil for years. I first identified this issue in 2019:

https://twitter.com/DallingerTim/status/1207865854970486785

This is a downstream effect of shale wells producing more associated gas, resulting in more condensate and NGL’s. These lower priced fluids are blended into the crude stream to fetch crude prices. This blending issue has skewed many other categories. While it is commendable that the EIA is trying to address the underlying problem, it remains unclear how accurately they are capturing the magnitude.

With this change, unaccounted oil should drop back near zero. If it doesn’t, one might infer there is even more condensate and NGL’s are being blended than that which is being captured in “transfer to crude oil supply.”

Cushing

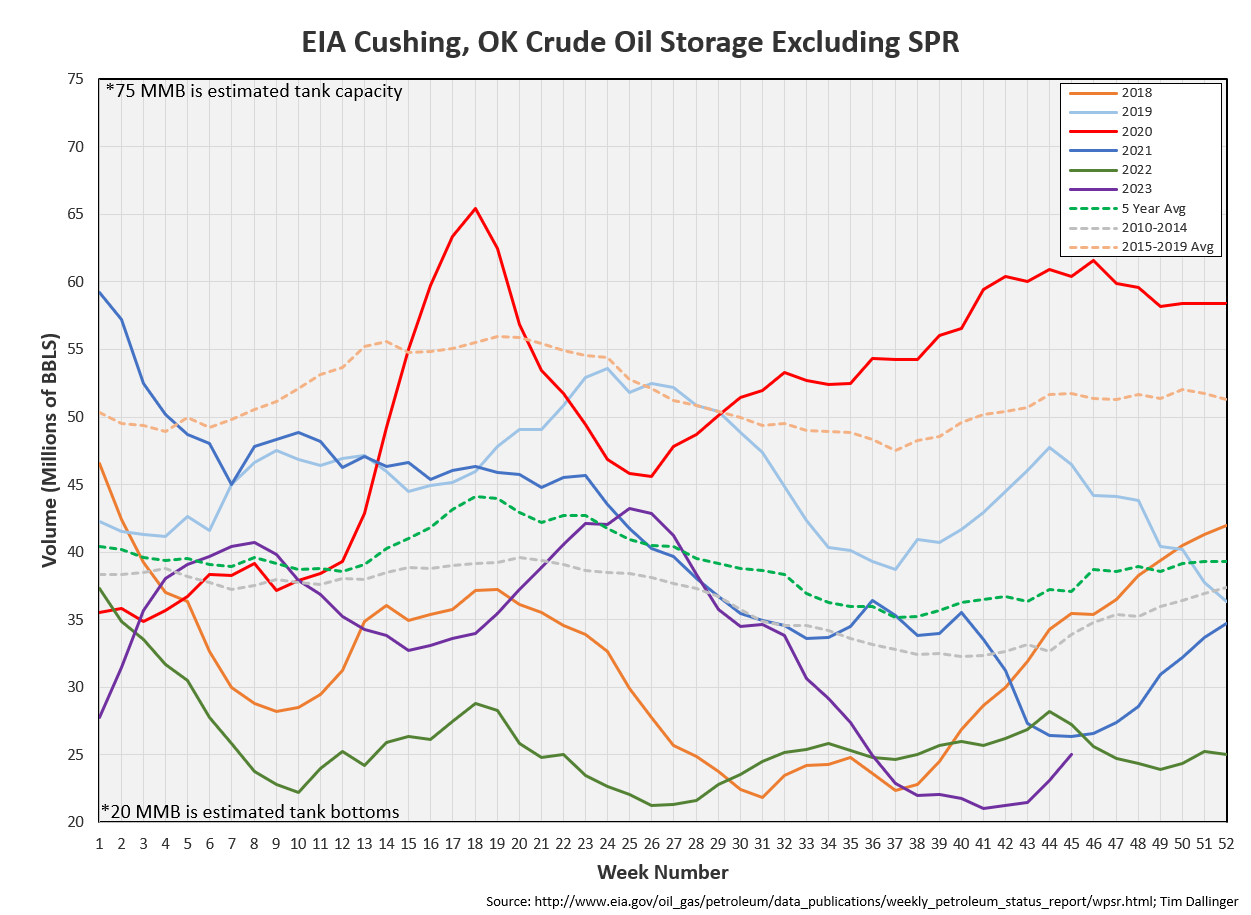

Cushing built by 1.9 MMB. Total Cushing volume sits at 25 MMB. Volumes are seasonally and absolutely low but they have risen off of tank heels.

Gasoline

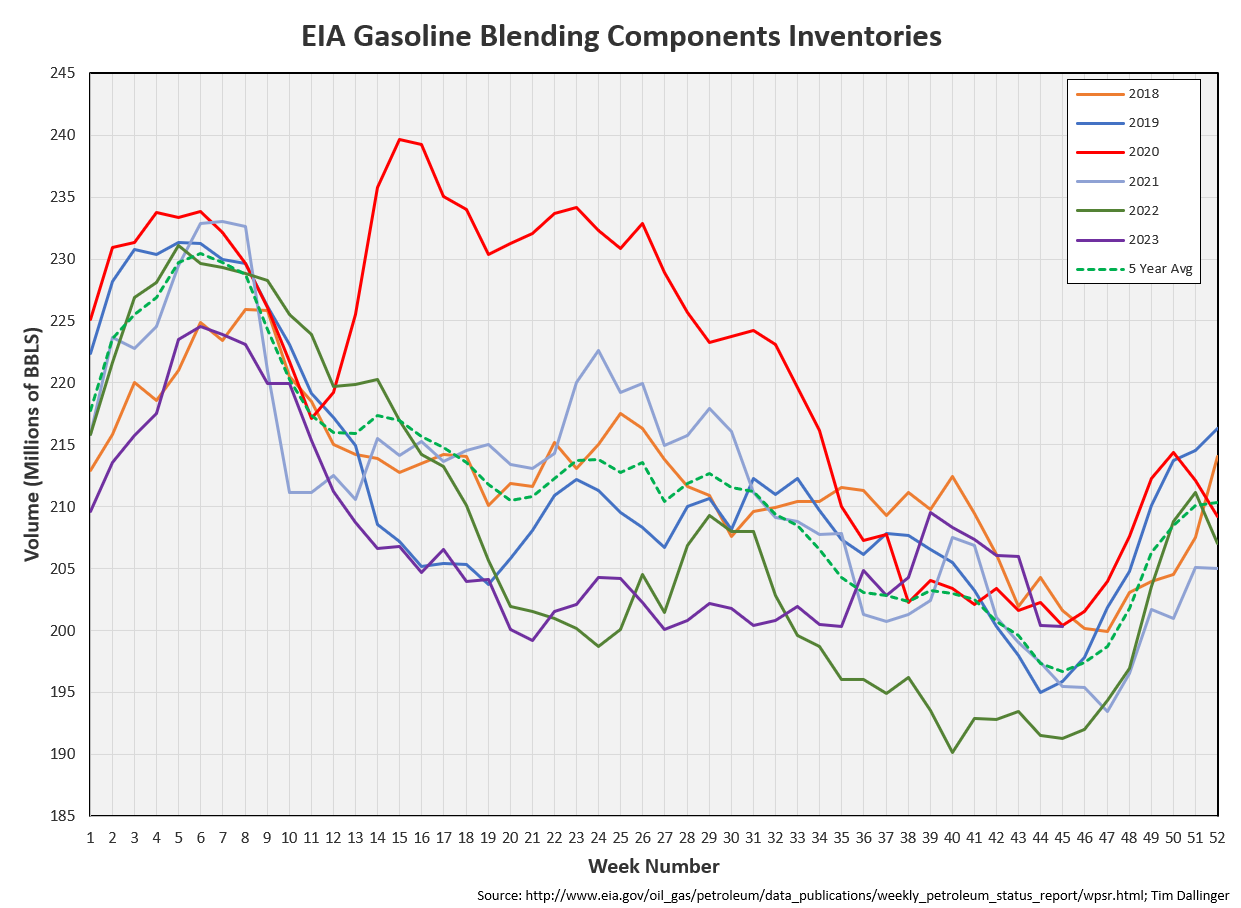

Total motor gasoline inventories decreased by 1.5 MMB and are about 1% above the seasonal 5-year average. Last week showed a sizeable 6 MMB draw.

Gasoline blending components are high while finished gasoline is not.

It seems likely that some of the natural gasoline and condensate captured in the “transfer to crude oil supply” are contributing to higher gasoline blending component inventories.

Ethanol

Ethanol inventories are flat, resulting in volumes near the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 1.4 MMB last week and are about 13% below the season 5-year average. Inventories match 2022 levels.

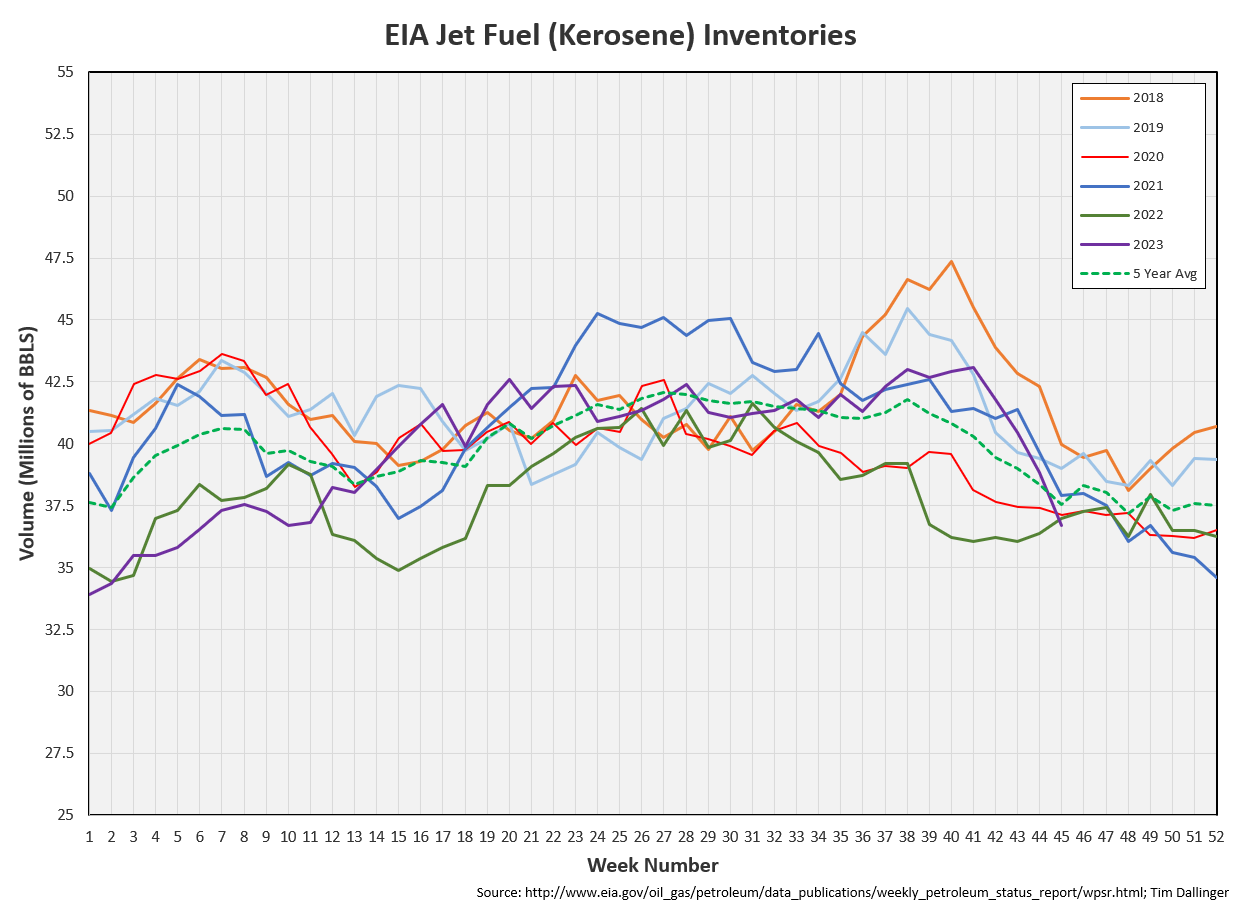

Jet

Kerosene type jet drew 2.1 MMB. Inventories are 2% below the seasonal 5-year average.

The EIA jet fuel demand proxy jumped over the past 2 weeks.

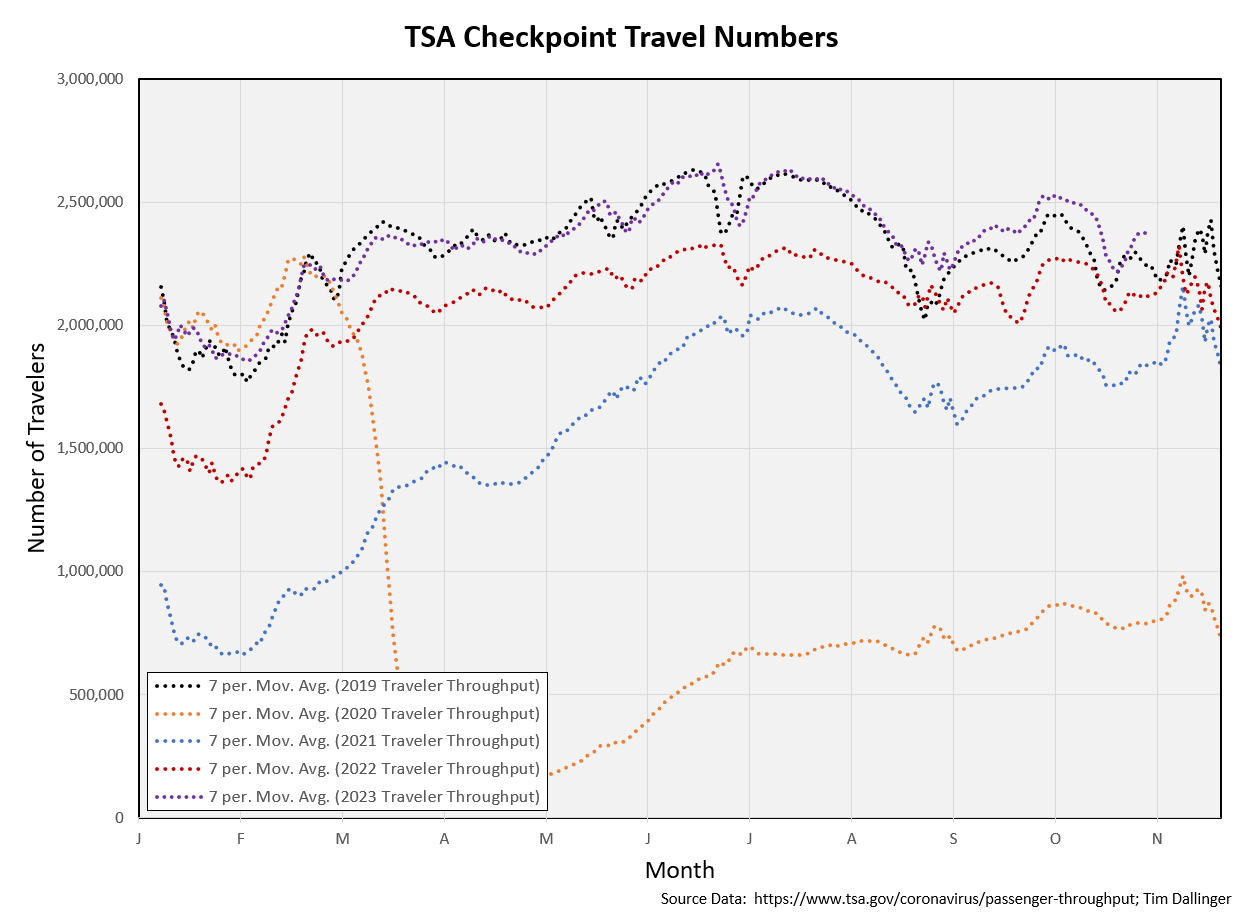

US TSA traveler numbers have surpassed 2019 levels.

Propane

Propane/propylene inventories increased by 1.3 million barrels from last week and are 17% above the seasonal 5-year average. When addressing this product glut, consider that propane is an NGL.

Other Oil

Other oil increased 0.9 MMB. Other oil is not following the season trajectory. Other oil includes unfinished oils, which the EIA now recognizes are being categorized as crude.

Total Commercial Inventory

Total commercial inventories drew 0.1 MMB. Inventories are slightly below the seasonal 5-year average. When comparing year-on-year figures, remember that the EIA is acknowledging that 5% of current crude production figure is not actually crude oil.

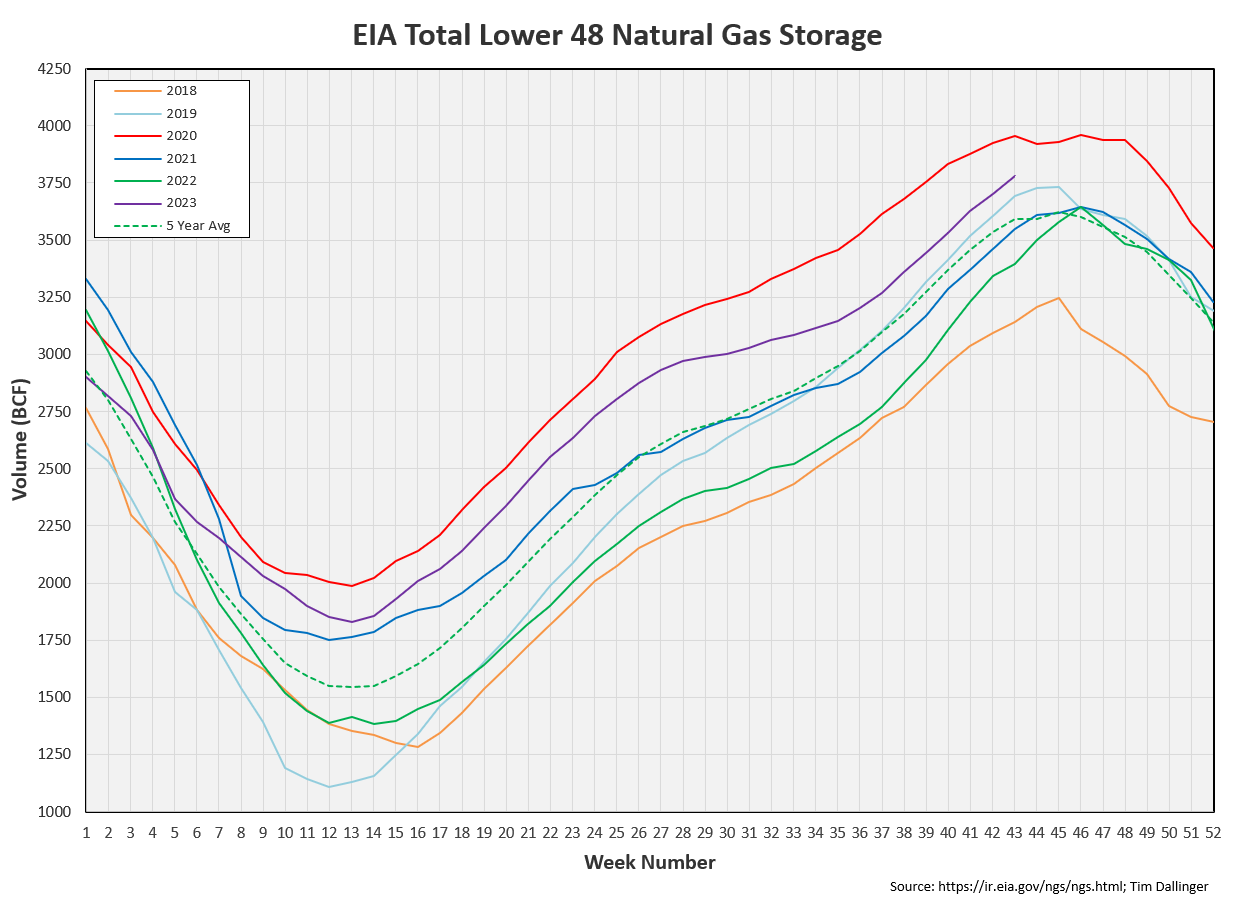

Natural Gas

Natural gas continues its seasonal build.

Discussion

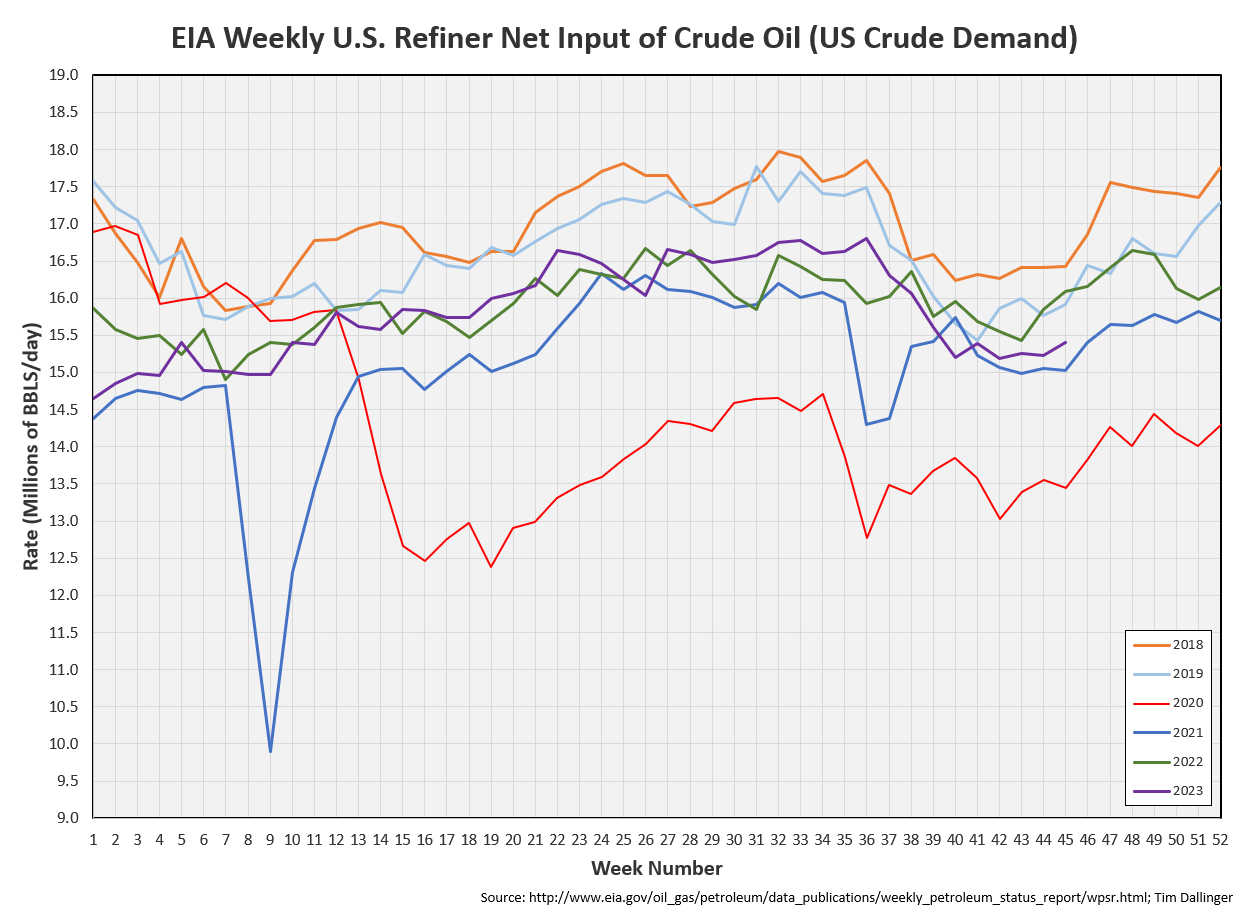

Refiners appear to coming out of turn-around now.

The weekly product demand proxy remains noisy. It’s necessary to wait for the lagging Petroleum Supply Monthly to get a more accurate picture.

Transportation fuels have drawn hard the past 3 weeks, leading to rebound in crack spreads.

Transportation fuels have drawn hard the past 3 weeks, leading to rebound in crack spreads.

The crude futures curve has flattened out but still remains in slight backwardation. This suggests the physical market has loosened. The significant deficit modeled for Q4 has not materialized. The US and Brazil have grown more than expected. Iran is selling whatever storage they have in case the US starts to enforce sanctions. Russia exports show surprising resilience. China buying has slowed. The global economy doesn’t appear strong.

Traders have reduced long positions and increased short.

Prince Abdulaziz bin Salman stated, “It’s not weak,” in response to questions about global demand. “People are pretending it’s weak. It’s all a ploy.” The next OPEC+ meeting is on November 26. Short-selling speculators risk another ouch-inducing surprise.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Aliens is 1986 American science-fiction film, directed by James Cameron.