EIA WPSR Summary for week ending 6-28-24

Summary

Crude: -12.2 MMB

SPR: +0.4 MMB

Cushing: +0.3 MMB

Gasoline: -2.2 MMB

Distillate: -1.5 MMB

Jet: -0.6 MMB

Ethanol: +0.2 MMB

Propane: +2.3 MMB

Other Oil: +1.3 MMB

Total: -13.0 MMB

Spot WTI is currently pricing $83. Prices slightly exceed approach fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 12.2 MMB. Crude inventories are currently 4% below the seasonal average. They’ve fallen below every previous year except 2022.

0.4 MMB were added to the SPR. 17.4 MMB have been added to the SPR in 2024. This nears the reported 20 MMB addition planned for 2024.

US crude imports were down slightly.

Crude exports recovered back to average levels. Independent ship trackers even showed exports to be slightly higher than the figure reported.

Unaccounted for crude reverted negative. The average is still positive, even with “transfers to crude supply” now included in the figure. US production is understated or additional crude blending is occurring. Industry insiders confirm it’s the latter.

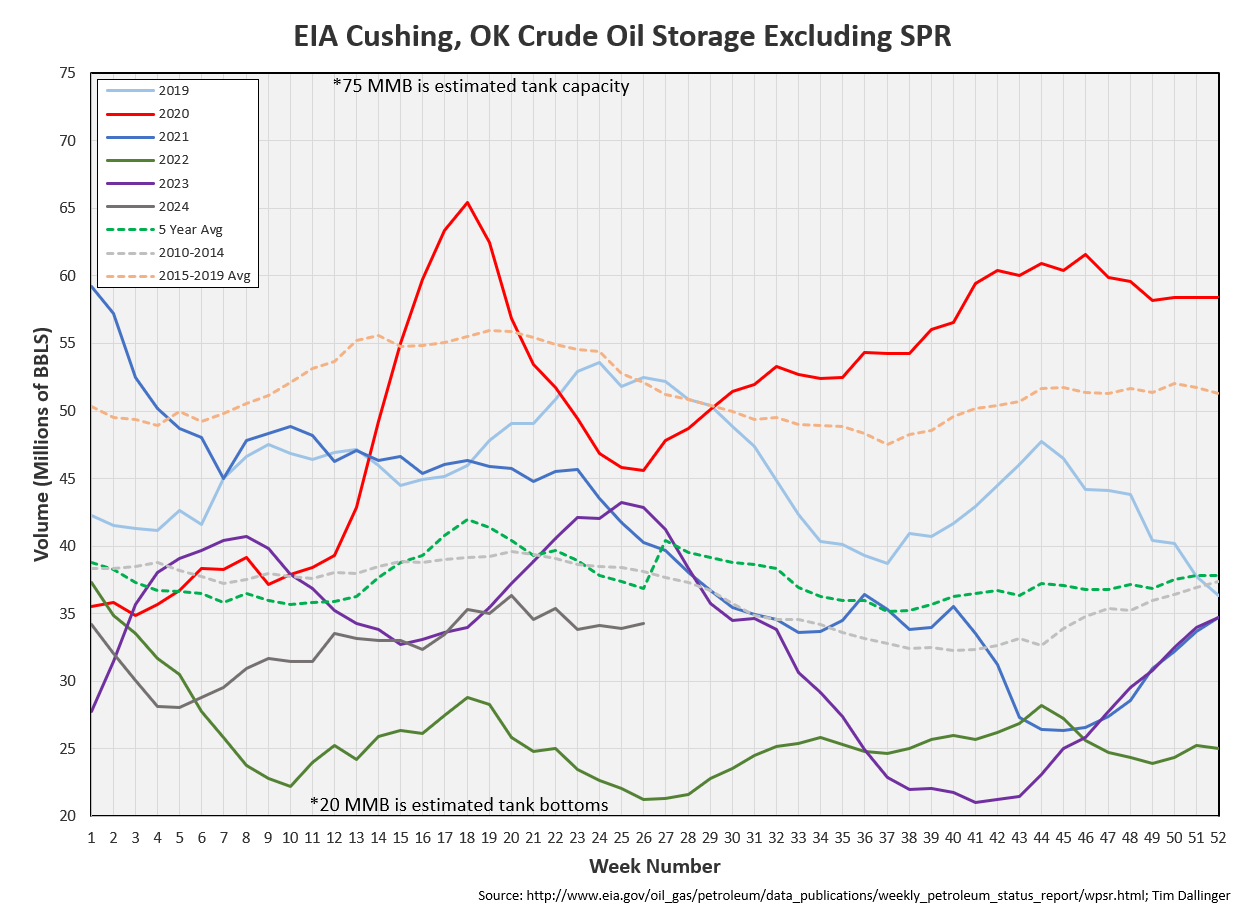

Cushing

Crude storage in Cushing, OK, built by 0.3 MMB week on week. Cushing inventories near recent average levels if the anomalous 2020 is excluded.

Gasoline

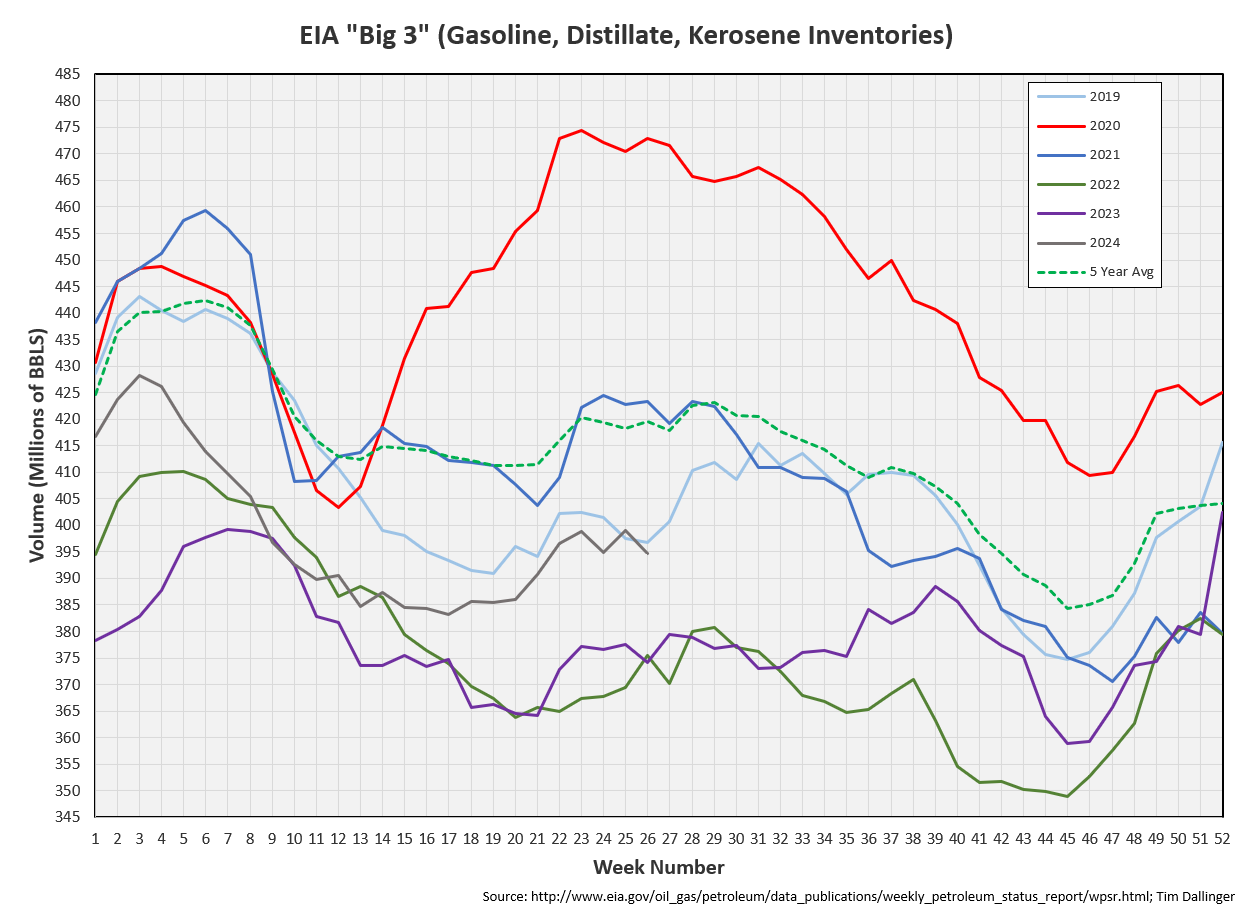

Total motor gasoline inventories decreased by 2.2 MMB and are about 1% below the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 1.5 MMB last week and are about 10% below the seasonal 5-year average.

Jet

Kerosene type jet fuels drew 0.6 MMB. Jet fuel inventories are near average levels.

Air travel fell back from all-time records but remain at seasonally record levels.

https://www.airportia.com/flights-monitor/

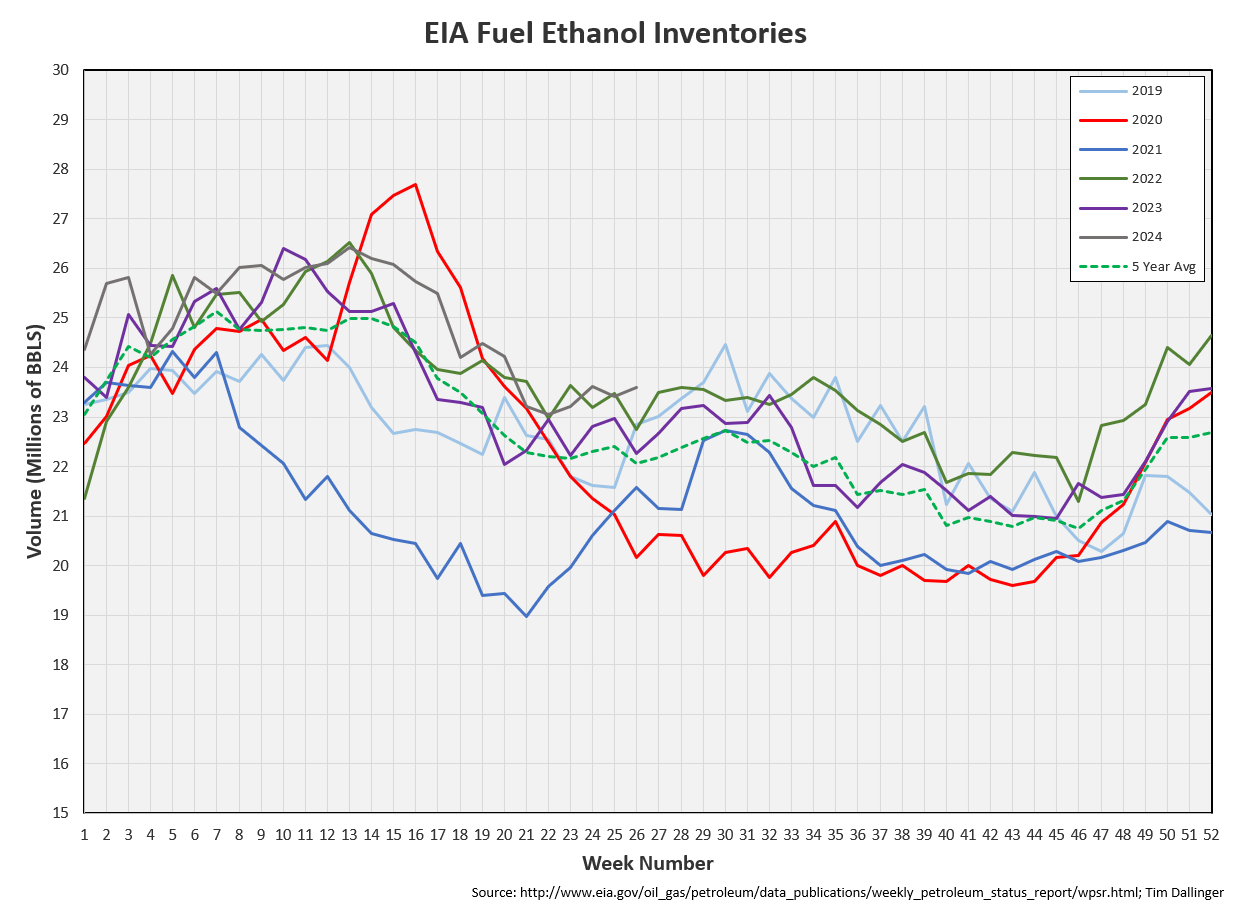

Ethanol

Ethanol inventories increased 0.2 MMB week-on-week. Inventories are elevated above seasonal averages.

Propane

Propane/propylene inventories increased in a seasonally normal manner, 2.3 MMB.

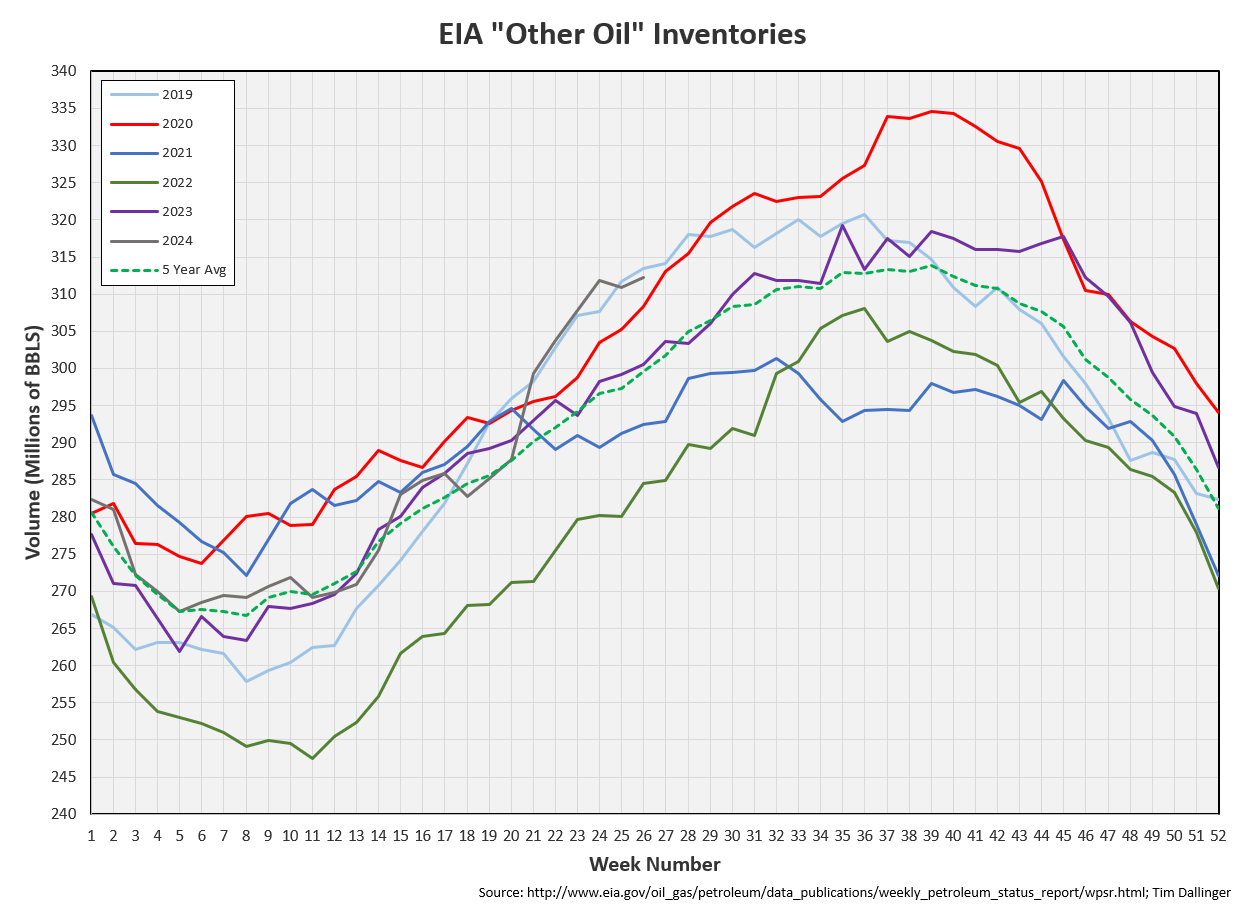

Other Oil

Other oil increased 1.3 MMB.

Total Commercial Inventory

Total commercial inventories drew by 13 MMB and are back below average levels.

Natural Gas

Natural gas inventories remain high but power burn and voluntary gas production curtailment has limited the build rate.

Weather outlook is mixed. Extreme weather is the primary driver of power burn.

Refiners

The amount of crude oil refiners processes last week increased. Run rates only lag 2019. Crude demand is high.

The EIA’s product demand proxy was up but is lower on a 4-week moving average basis. This calculation remains of little utility, although the market watches it.

Transportation inventories fell and cracks have rebounded. Fuels will be anomalous next week with the 4th holiday obscuring normal behavior.

$25 Simple cracks are supportive. Refiners will continue to run.

WTI and brent both remains firmly backwarded. The global physical market is tight.

Discussion

Hurricane Beryl appears to be weakening currently as it enters the Gulf. It will likely impact imports and exports next week. At the moment, limited Gulf production platforms appear at risk. The storm is currently expected to hit Mexico where it could impact refining. There is a chance it could hit the Houston area. This would be temporarily bearish crude oil as refiners would need to cut runs to protect facilities.

Ship tracker service KPLR is showing OPEC exports are down a whopping 2.5 MMBD since June. Oil on water is drawing hard. This is primarily what’s driving the global physical tightness and resulting backwardation.

The latest petroleum supply monthly shows that US production is near that which has been previously reported in the weekly figures. US producers have gotten creative with refracks and work-overs, keeping production high without deploying more rigs. This trend cannot continue forever. Rigs will need to increase for the US to maintain current production levels.

This was a very bullish report. Draws should continue, supporting crude price. Price has front-run US inventories slightly. The market is watching global figures more carefully or anticipating continued US draws.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Office John Mclaine’s describes the current US oil market, in the 1990 American action film, “Die Hard 2.”

Good point. Thank you for the critique. I communicated that poorly. It's more to protect the staff. Also, if they lose power, they can't run. That happened during Harvey. Yes, damage to a plant is bearish for that company. But cracks will increase as product store is drawn down. Refiners that can operate, make more money during that period.

Good report. "[R]efiners would need to cut runs to protect facilities." These plant are exposed running or not: it's bad if the plant gets damaged, but if oil or an oil product is running through that area at the time, things can get much worse. Is that the idea? And if a plant gets damaged badly, it's bad for that company but bullish for refiners overall?