EIA WPSR Summary for week ending 3-21-25

Summary

Crude: -3.3 MMB

SPR: +0.3 MMB

Cushing: -0.8 MMB

Gasoline: -1.4 MMB

Distillate: -0.4 MMB

Jet: +1.1 MMB

Ethanol: +0.8 MMB

Propane: -0.2 MMB

Other Oil: +5.7 MMB

Total: +3.2 MMB

Spot WTI is currently pricing $69. Prices remain below estimated fair value based on a price model derived from reported EIA inventories.

Crude

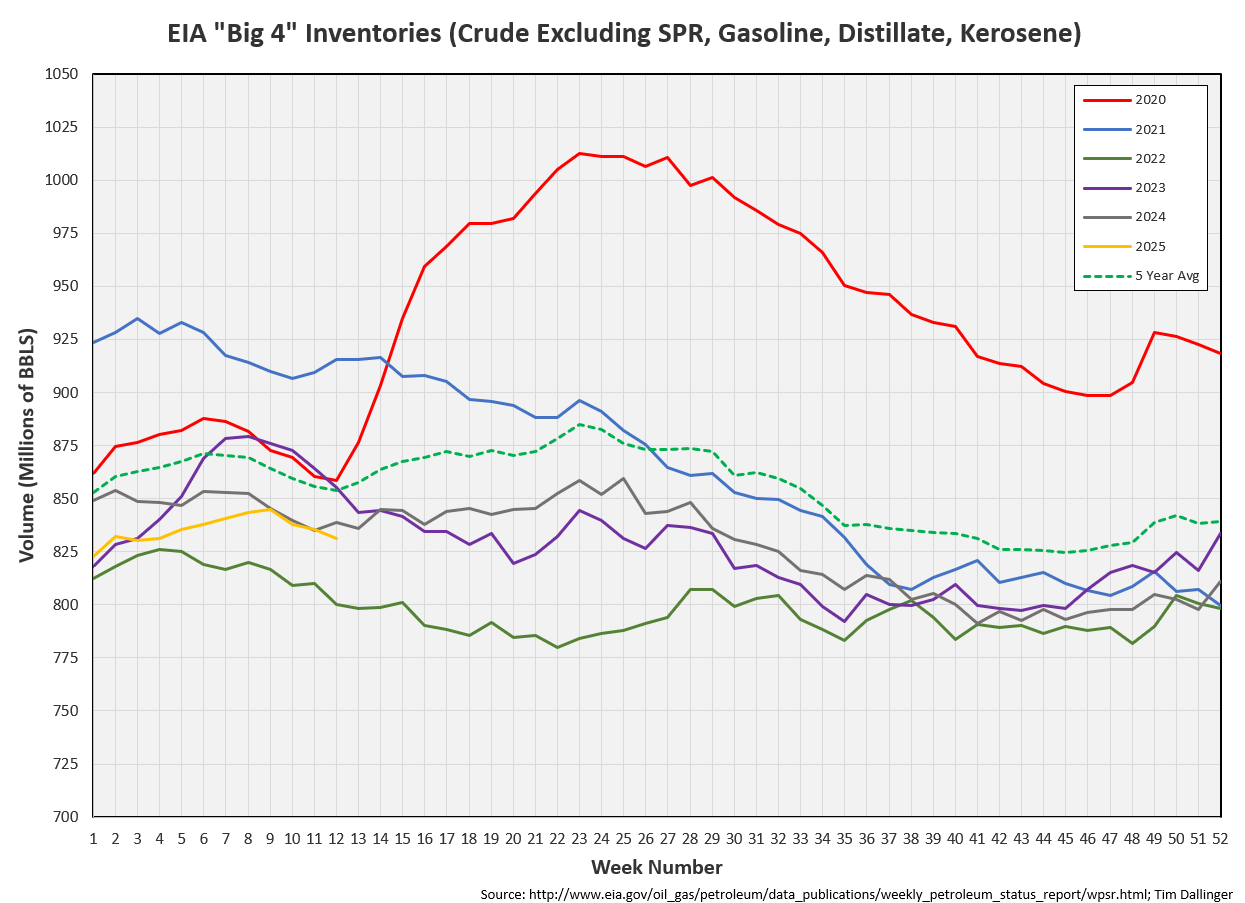

US Crude oil supply drew by 3.3 MMB. Crude inventories are currently 5% below the seasonal average.

0.3 MMB were added to the SPR. SPR refill continues slowly.

US crude imports increased week-on-week.

US Crude exports jumped. Last week was the highest amount of US crude oil exported for 2025. This week was the second highest.

Unaccounted for crude is again negative. Imports and exports were confirmed by independent ship trackers.

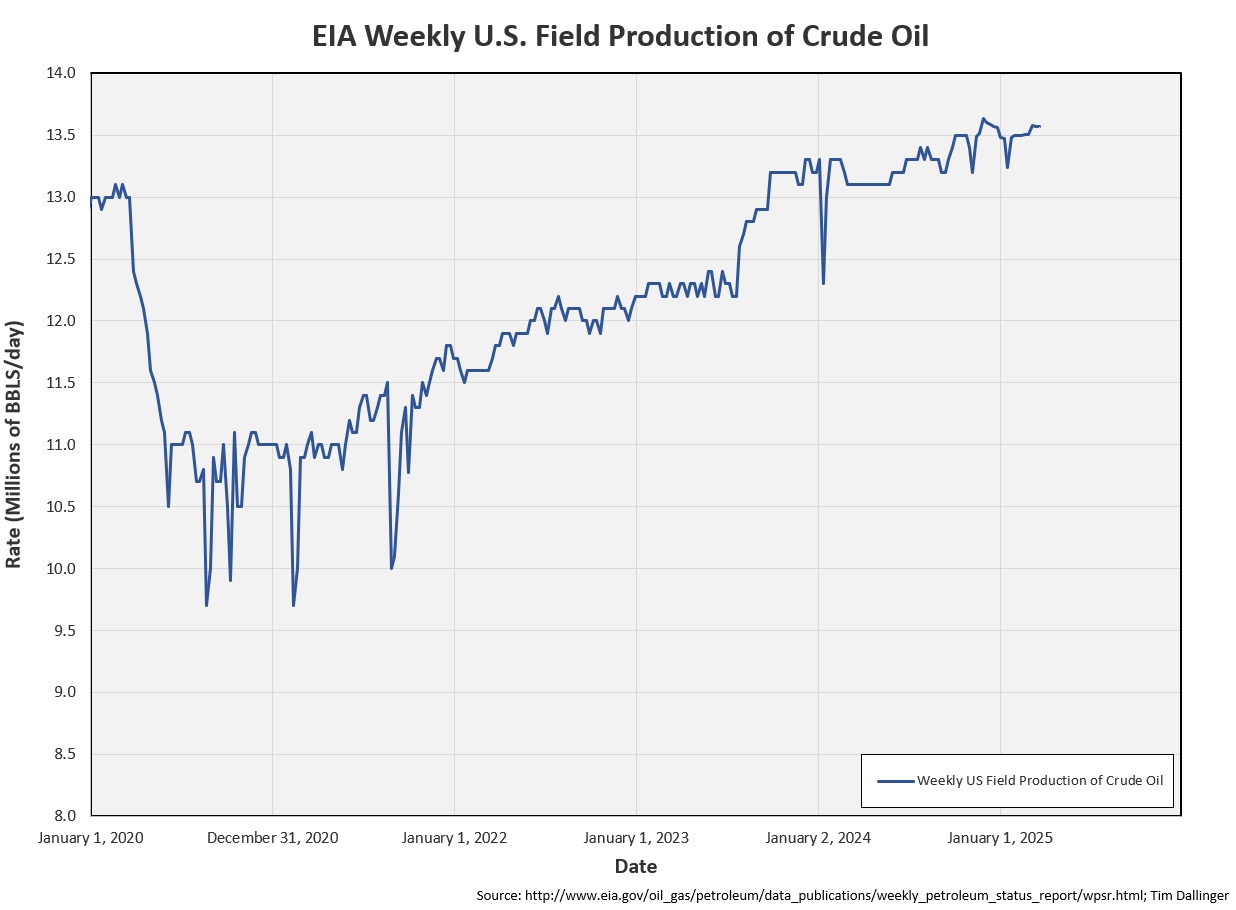

So, it appears the EIA is overcounting US production.

At the bottom of the first page of the Weekly Petroleum Status report, there are footnotes. One of them reads:

“6. Domestic crude oil production includes lease condensates and is estimated using a combination of short-erm forecasts for the 48 states and the latest available production estimates from Alaska.”

With the growing associated gas production in West Texas, there is likely more lease condensate.

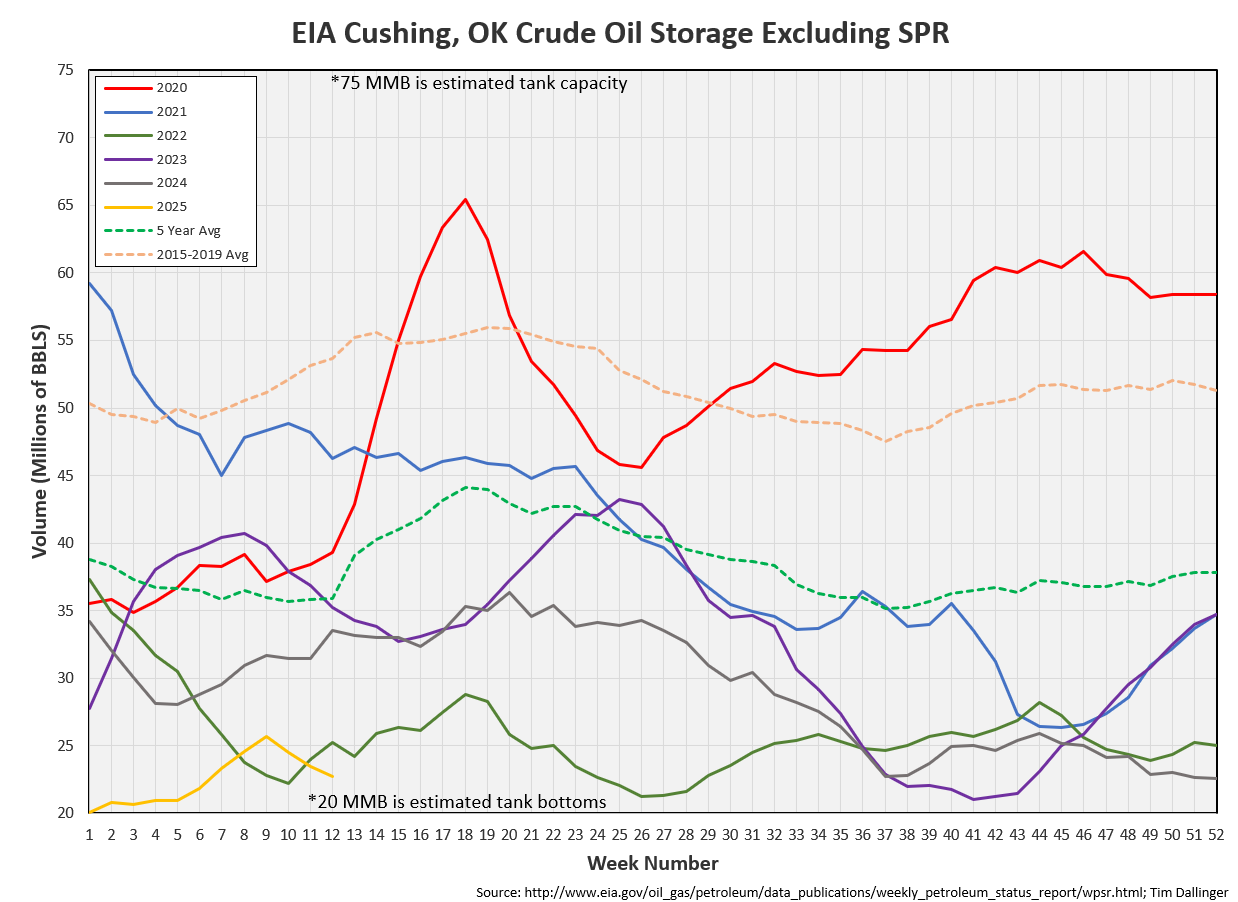

Cushing

Crude storage in Cushing, OK, drew by 0.8 MMB week on week. After a brief late winter build, Cushing inventories are again falling. Tank bottoms are again in sight as refiners process more crude in preparation for driving season.

Gasoline

Total motor gasoline inventories decreased by 1.4 MMB and are about 2% above the seasonal 5-year average. Gasoline inventories aren’t falling at the normal trajectory.

This is odd as the EIA gasoline demand proxy is near record levels.

Distillate

Distillate fuel inventories decreased by 0.4 MMB last week and are about 11% below the seasonal 5-year average. Only 2022 was lower in the recent past.

Jet

Kerosene type jet fuels increased by 1.1 MMB. Inventories are above average.

Implied demand is at record levels though.

Ethanol

Ethanol inventories increased by 0.8 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories drew by 0.2 MMB. Propane draw season nears its end.

Other Oil

Other oil built by 5.7 MMB. This is anomalous behavior with no apparent explanation.

Implied other oil demand is down.

Total Commercial Inventory

Total commercial inventory built by 3.2 MMB, driven by mostly other oil. Still, only 2022 was lower.

Natural Gas

Natural gas inventories should be near the annual low. Steady build generally occur from here with warmer weather until mid-summer when electricity demand spikes. Builds continue but slow during that period.

Refiners

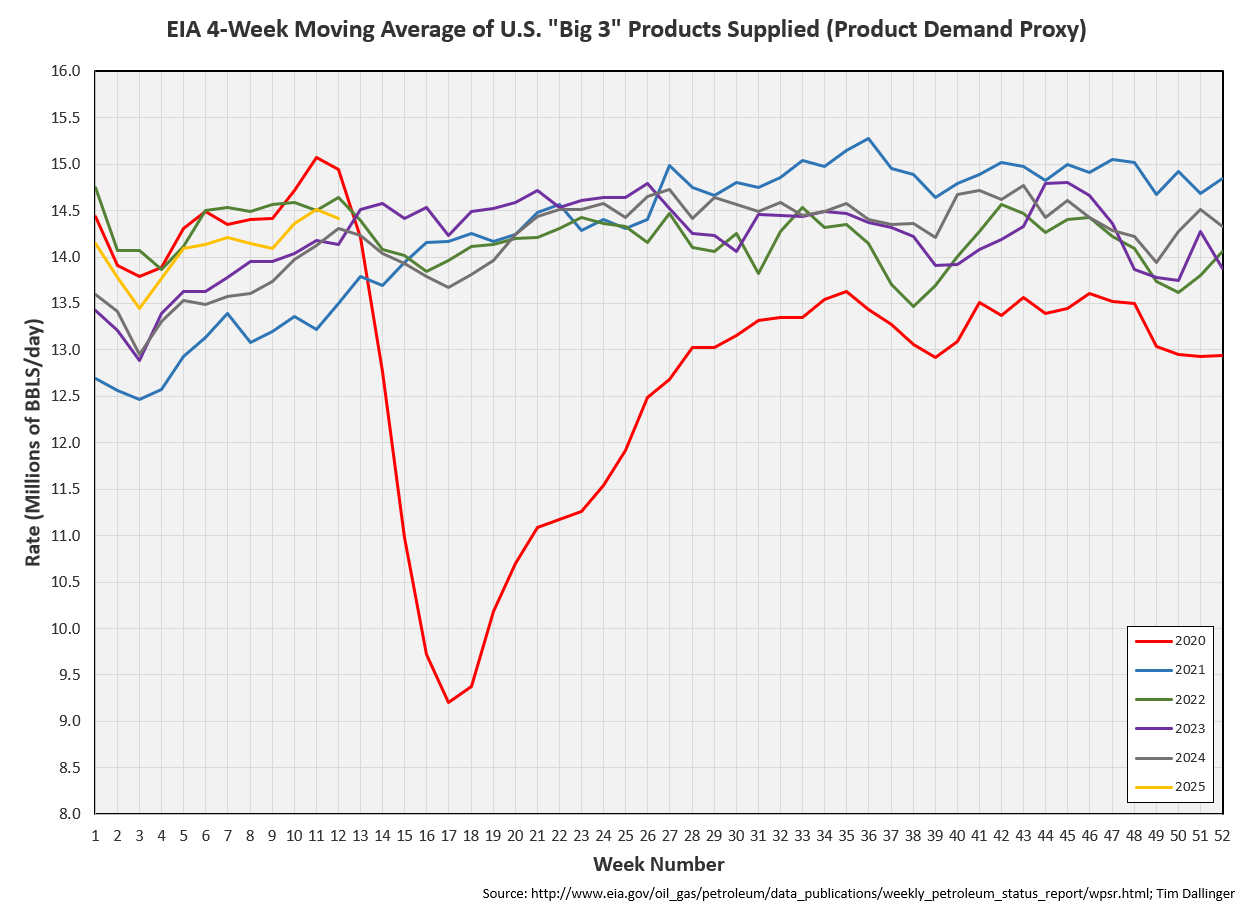

Seasonal crude oil demand is near record levels.

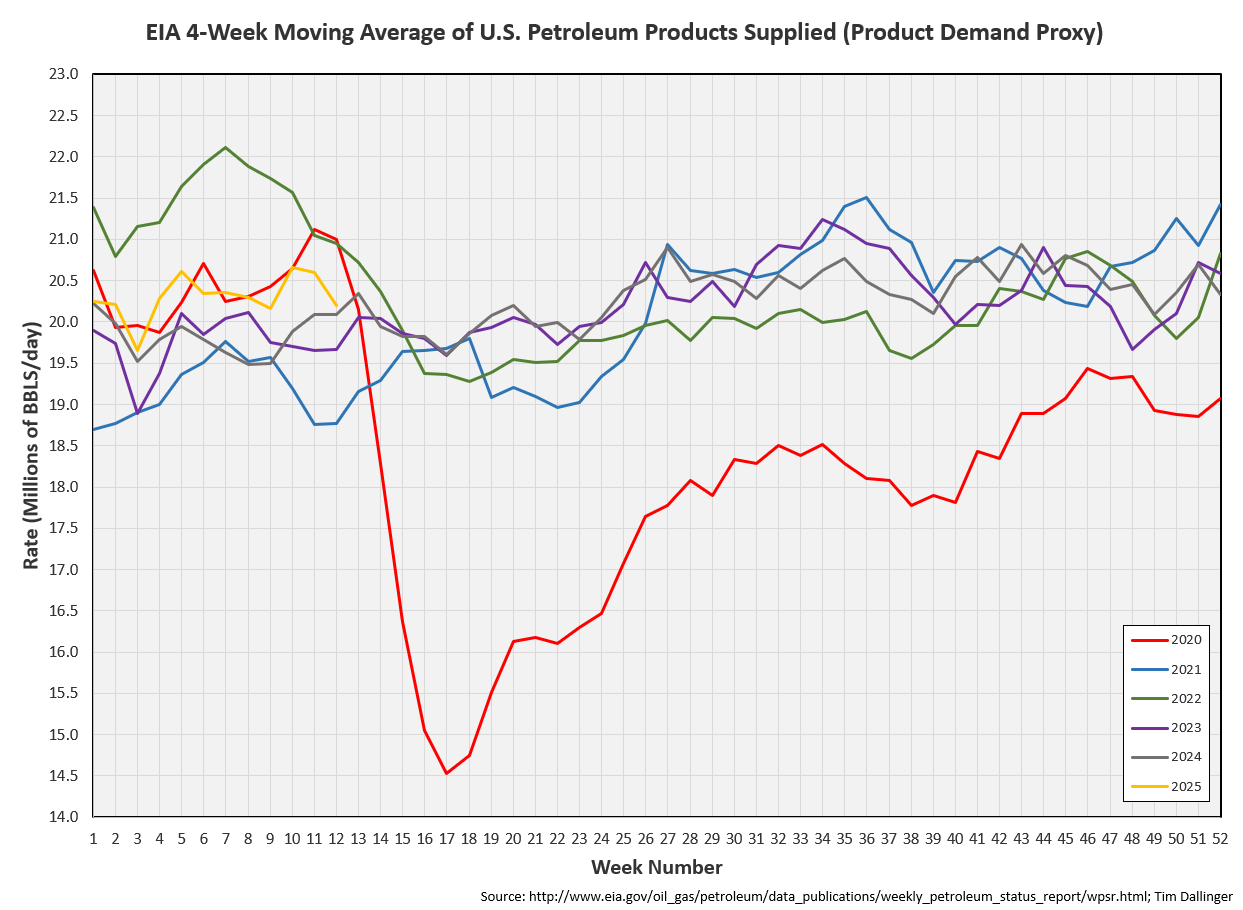

The EIA’s product demand proxy has faltered. But much of that is due to other oil weakness.

Transportation fuel implied demand is near seasonal highs.

Transportation inventories are slightly elevated due to kerosene and gasoline.

If crude is included, the inventory picture appears more bullish.

Simple cracks are at very healthy levels even with current reported gasoline inventories.

Discussion

Spot price continues to struggle. Both WTI and Brent remain backwarded though, suggesting there’s no physical market overhang. Likely some of the pressure is related to the overall market action. There is a significant amounts of short-interest in WTI. Traders are likely using a crude trade as a recession proxy.

https://x.com/Barchart/status/1904393469696589928

The IEA released its Global Energy Review 2025 this week. Fatih Birol used this opportunity to boast of their prediction of slower growth demand, saying, “We say at IEA, ‘Data always wins.’” That’s an interesting take because the the IEA doesn’t open-source their data. The report reads:

Yet in the appendix, a table shows:

The figures labeled energy supply were quoted earlier as energy demand.

Clear graphs of total production and demand and are not provided. Instead only growth demand is considered.

The EIA data may be messy and questionable at times. But at least it’s published fully for careful review.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Shredder interrogates Danny in the 1990 movie, Teenage Mutant Ninja Turtles.