EIA WPSR Summary for week ending 5-16-25

Summary

Crude: +1.3 MMB

SPR: +0.8 MMB

Cushing: -0.5 MMB

Gasoline: +0.8 MMB

Distillate: +0.6 MMB

Jet: +0.5 MMB

Ethanol: -0.5 MMB

Propane: +2.7 MMB

Other Oil: +0.3 MMB

Total: +4.9 MMB

Spot WTI is currently pricing $61. While this was a moderately bearish print, spot prices remain deeply discounted versus estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 1.3 MMB. Crude inventories are currently 6% below the seasonal average.

0.8 MMB were added to the SPR.

Combining commercial crude inventories and SPR shows US crude stores are low.

US crude imports picked up this week.

Crude exports remain quite low. Either the world doesn’t want to pay up for light barrels or Gulf refiners won’t let them go.

Unaccounted for crude remains positive. It’s unclear as to the source of those barrels this week.

The EIA continues to model US production high.

Cushing

Crude storage in Cushing, OK, drew by 0.5 MMB week on week. Inventories are at seasonal record lows and drawing.

Gasoline

Total motor gasoline inventories increased by 0.8 MMB and are about 2% below the seasonal 5-year average.

Distillate

Distillate fuel inventories increased by 0.6 MMB last week and are about 16% below the seasonal 5-year average. Distillate inventories remain near record lows.

Jet

Kerosene type jet fuels built by 0.5 MMB and are just above average levels.

Ethanol

Ethanol inventories fell 0.5 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories increased by 2.7 MMB and are 7% below the seasonal 5-year average.

Other Oil

Other oil built by 0.3 MMB.

Total Commercial Inventory

Total commercial inventory built by 4.9 MMB but remain below every year except 2022.

Natural Gas

Natural gas inventories continue to build. The bull case for natural gas is tenuous even as US crude production takes a hit. There’s so much associated gas supply.

Seasonal cooling demand doesn’t appear to be strong yet.

Refiners

US refiners tied a record high for the amount of crude oil processed last week.

The EIA’s product demand proxy falters though. This is gaining attention among the few remaining energy analysts. It may be a headwind, but demand is not weak. If analysts want to trumpet this as the reason for lower crude prices, they should have highlighted 4 weeks ago when implied demand was at record levels. More likely, market watchers are scrambling for any reason to explain these low prices.

Some will point to implied transportation demand as the reason for the weakness.

The moving averages for implied gasoline demand doesn’t look bullish.

Neither does the moving average for implied distillate demand.

Implied jet demand has come down from record highs but it’s still at seasonal records.

Implied other oil demand is showing some strength.

But if one examines the weekly numbers, they’ll see this is simply a messy metric. There is no clear trend.

Transportation inventories are still low although no longer at record seasonal lows.

If product demand was weak, why would simple crack spreads be near record levels? Implied demand is something to watch but it isn’t as instructive as some are suggesting. Price drives narrative.

Discussion

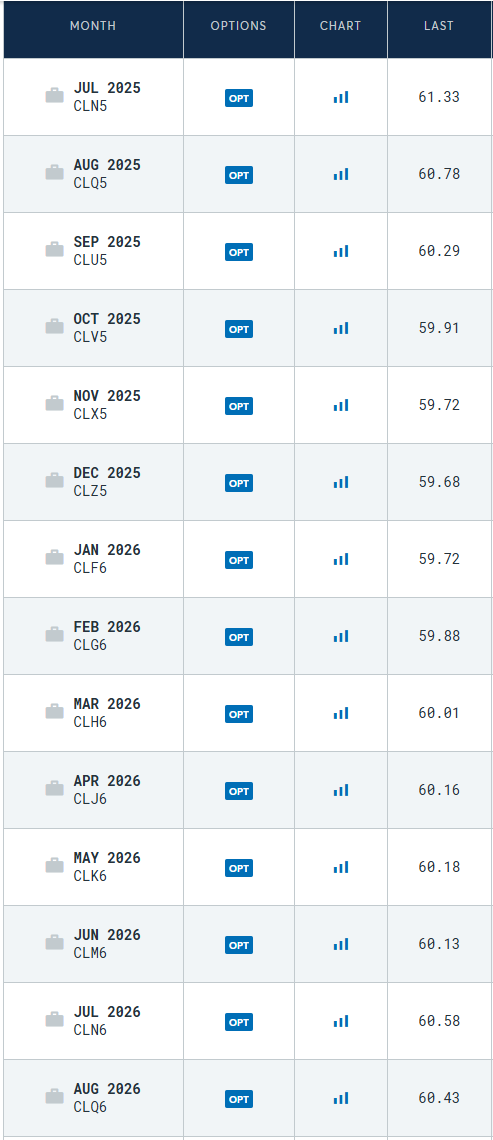

Backwardation has come in and the back end of the curve has moved slightly into contango. This is usually bearish, implying that there is a supply glut looming. However, recall that there has was historic backwardation and that didn’t lead to increased prices. This looks more like the front of the curve is being suppressed due to recession fears.

The physical market is just not as weak as prices indicate. If anything, Low prices also limiting supply growth while simultaneously encouraging demand.

The IEA quietly “found missing barrels” this week. They’ve been inaccurately modeling the demand figures in emerging markets for the past 3 year. The IEA has never been a reliable source for accurate market information. But this is excessive, even by their standards.

Bloomberg even picked up the story.

Rumors are circulating that already poor relations between Iran and Israel are worsening, again with risk of direct conflict. The market is not pricing any geopolitical premium. Perhaps that’s warranted because Iran has returned to record crude exports. Sanctions continue to reman unenforced.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Ray tries to take author, Terrence Mann, to attend a baseball game in the 1989 classic American film, “Film of Dreams.”

Great detailed breakdown — appreciate the nuance on inventory builds vs. demand signals. Curious to see how geopolitical risks, especially in the Middle East, might reshape this dynamic if tensions escalate.