EIA WPSR Summary for week ending 10-18-24

Summary

Crude: +5.5 MMB

SPR: +0.9 MMB

Cushing: -0.3 MMB

Gasoline: +0.9 MMB

Distillate: -1.1 MMB

Jet: +0.6 MMB

Ethanol: -0.1 MMB

Propane: -1.4 MMB

Other Oil: +0.7 MMB

Total: +5.9 MMB

Bearish report, although refinery input hit a record.

Spot WTI is currently pricing $70. Prices remain heavily discounted to implied fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply increased by 5.5 MMB. Crude inventories are currently 4% below the seasonal average, matching 2021 levels.

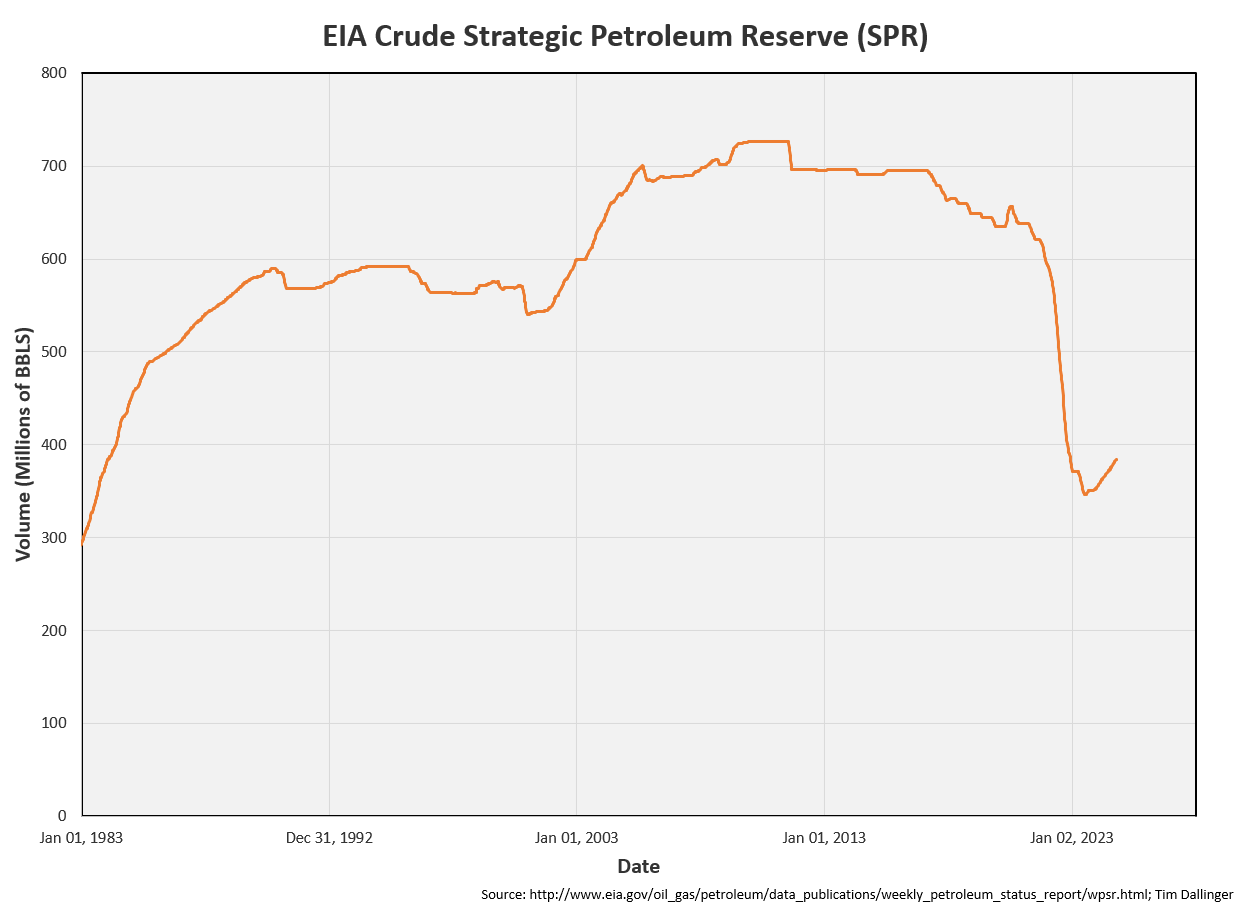

0.9 MMB were added to the SPR. SPR inventories return to December 2023 levels.

The SPR refill continues but volumes remain substantially below historic levels.

US crude imports returned to average levels.

Crude exports were also average.

Unaccounted for crude jumped. The source isn’t apparent. The EIA isn’t overcounting US production and independent ship trackers pegged import/exports near reported numbers.

The EIA reports US production at the record 13.5 MMBD. They're expect the Matterhorn Express pipeline relieved some of the shut-in production due to increased gas takeaway. It’s unclear as to whether this is an accurate assumption or if this simply reducing Basin flaring. The 914 should provide a better picture in several months.

Cushing

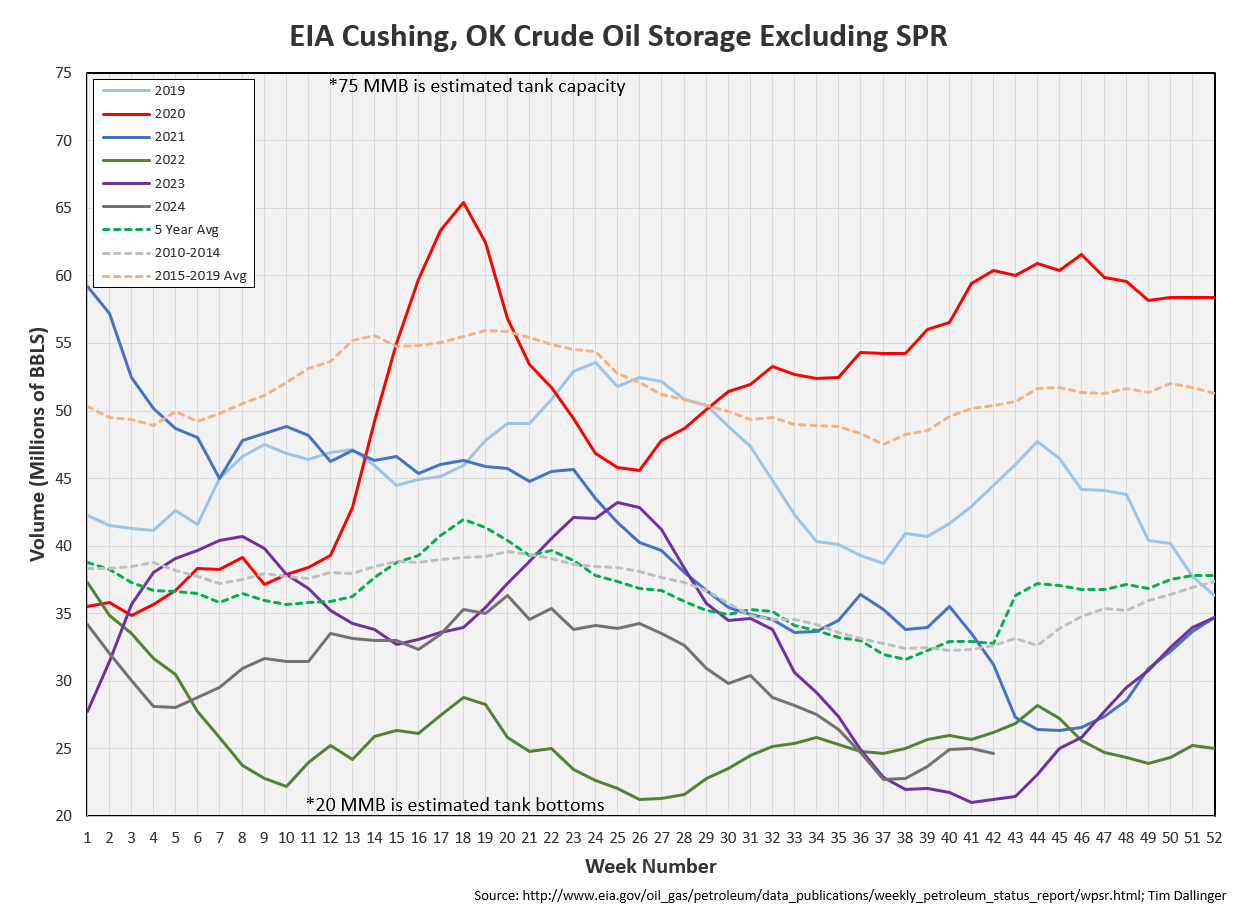

Crude storage in Cushing, OK, drew by 0.3 MMB week on week.

Gasoline

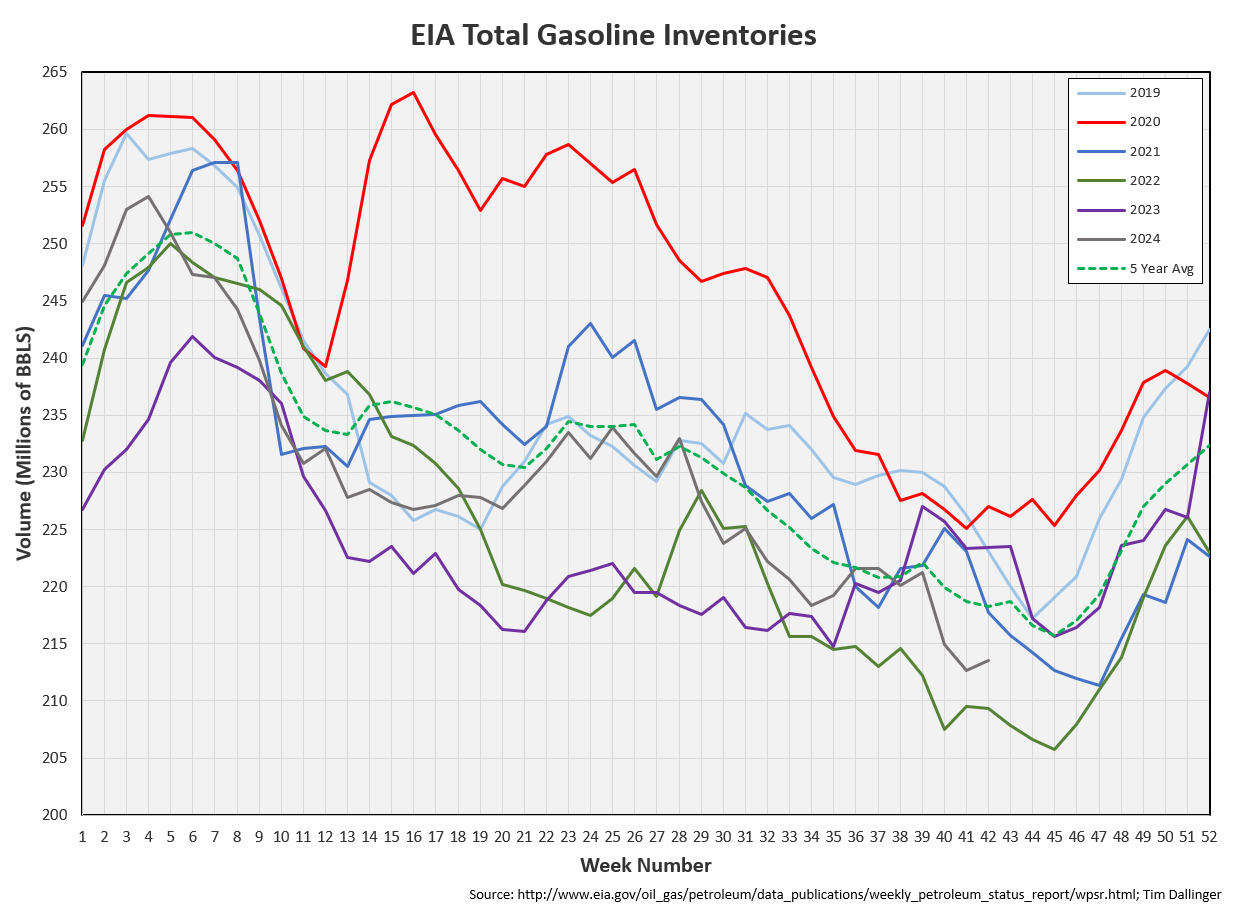

Total motor gasoline inventories increased by 0.9 MMB and are about 3% below the seasonal 5-year average. Only 2022 has been lower though in recent years.

Distillate

Distillate fuel inventories decreased by 1.1 MMB last week and are about 9% below the seasonal 5-year average. Distillate inventories are slightly elevated above 2023 levels.

Jet

Kerosene type jet fuels built by 0.6 MMB. Jet fuel inventories are above average.

Global flights are still at record levels. If active number of flights don’t pick up in the near term, they will fall below 2019.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories decreased by 0.1 MMB week-on-week. Inventories are at record levels.

Propane

Propane/propylene inventories fell 1.4 MMB, starting their seasonal draw. Levels dipped just below 2023.

Other Oil

Other oil increased 0.7 MMB and is at seasonal averages.

Total Commercial Inventory

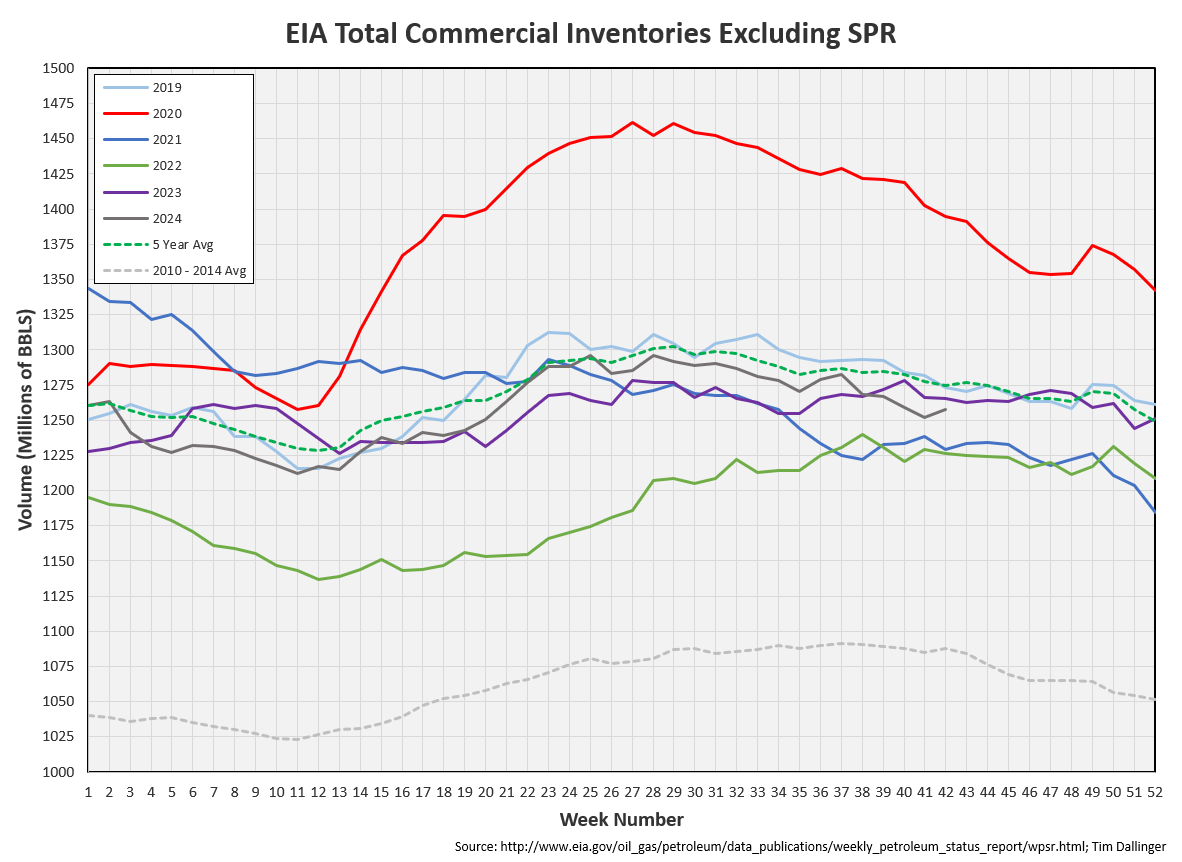

Total commercial inventory increased by 5.9 MMB, driven by crude.

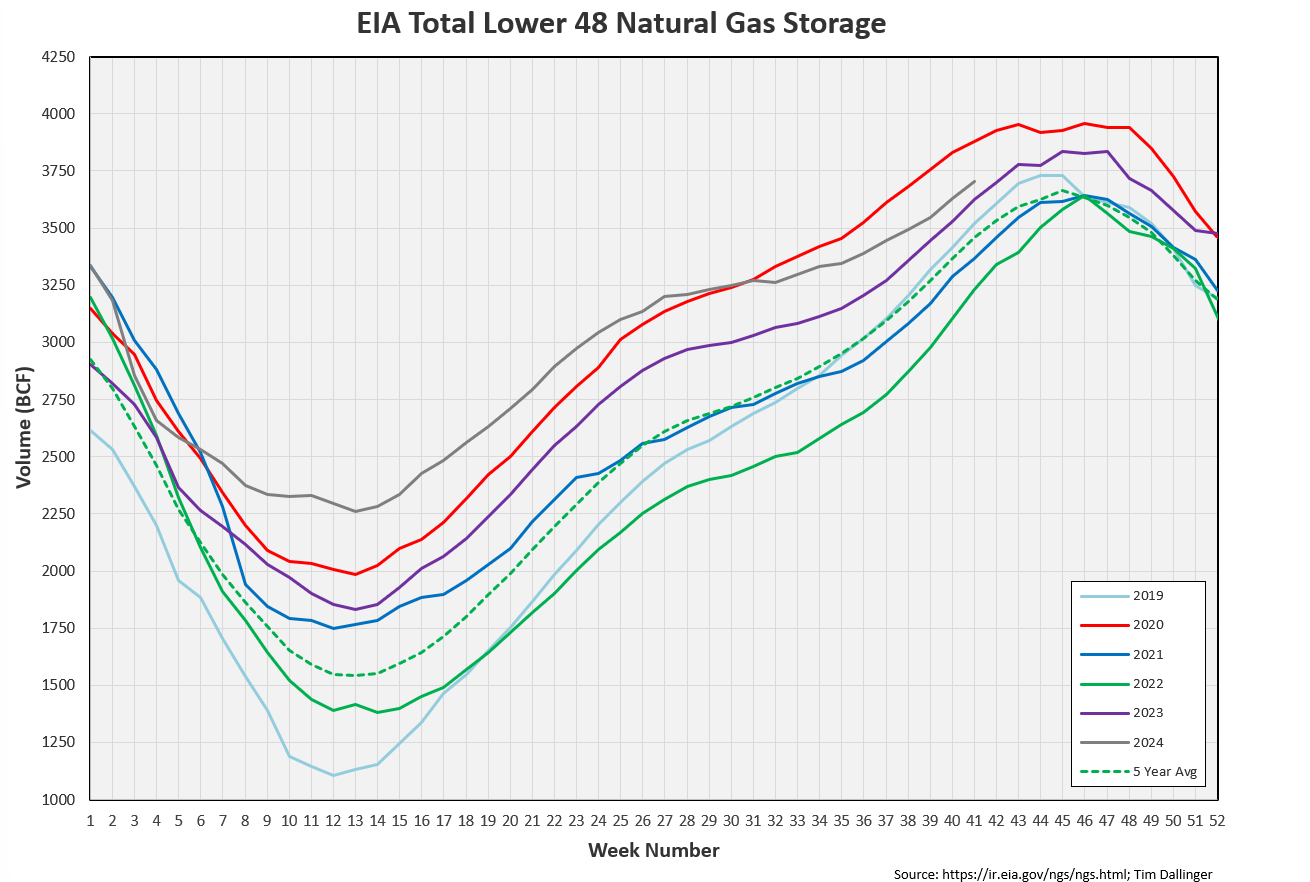

Natural Gas

The graph shown below of natural gas inventories is identical to last week as the WSPR was delayed due to the US holiday. Natural gas inventories are updated on Thursdays.

Refiners

In the most bullish category of this week’s report, refiners processed a record amount of crude oil. Maintenance season should occur for another 2 to 3 weeks. However, refiners guided this season would be short. Perhaps turnaround is already wrapping up.

The EIA’s product demand proxy fell slightly.

Implied demand for transportation fuels is still higher than the past two years.

Transportation inventories are below average but remain flat week-on-week with the gasoline and jet build offsetting the distillate draw.

Simple cracks but are off the lows still relatively weak.

Discussion

Both Brent and WTI remain backwarded.

This week, the Chinese Commerce Ministry announced an increase in crude import quotas for 2025 for non-state-owned companies. China also decreased interest rates in further measure to stimulate its economy.

The market appears fixated on projected 2025 production growth from non-OPEC countries. The US and Brazil are expected to be significant contributors but there are considerable reasons to question those rosy growth projections. Namely, increased GOR (gas to oil ratio) in tight US production, limited rig count and Brazil’s historic tendency to disappoint growth metrics.

While rumors abound, no further development has yet occurred in relation to the middle east conflict.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Ron Burgandy, portrayed by Will Ferrell, expresses disbelief in the 2004 American comedy, “Anchorman: the Legend of Ron Burgunday.”