EIA WPSR Summary for week ending 7-4-25

Summary

Crude: +7.1 MMB

SPR: +0.2 MMB

Cushing: +0.5 MMB

Gasoline: -2.7 MMB

Distillate: -0.8 MMB

Jet: -0.9 MMB

Ethanol: -0.2 MMB

Propane: +2.7 MMB

Other Oil: +1.6 MMB

Total: +6.4 MMB

Spot WTI is currently pricing $68. Prices have rallied this week but remain depressed compared to the estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 7.1 MMB. Crude inventories are currently 8% below the seasonal average.

0.2 MMB were added to the SPR.

US crude imports fell back to average levels form last week’s anomalous report.

US Crude exports rebounded a touch but remain considerably below average.

Unaccounted for crude jumped week-on-week. There’s no clear rational. It’s unlikely production is higher than reported. Imports and exports were in-line with estimates from independent ship trackers. Perhaps crude blending is again becoming an issue to combat poor condensate pricing and falling liquid production.

The EIA’s weekly modeled production levels are finally showing signs of decline. Shale well declines might finally become the issue that’s been predicted to be looming for some time.

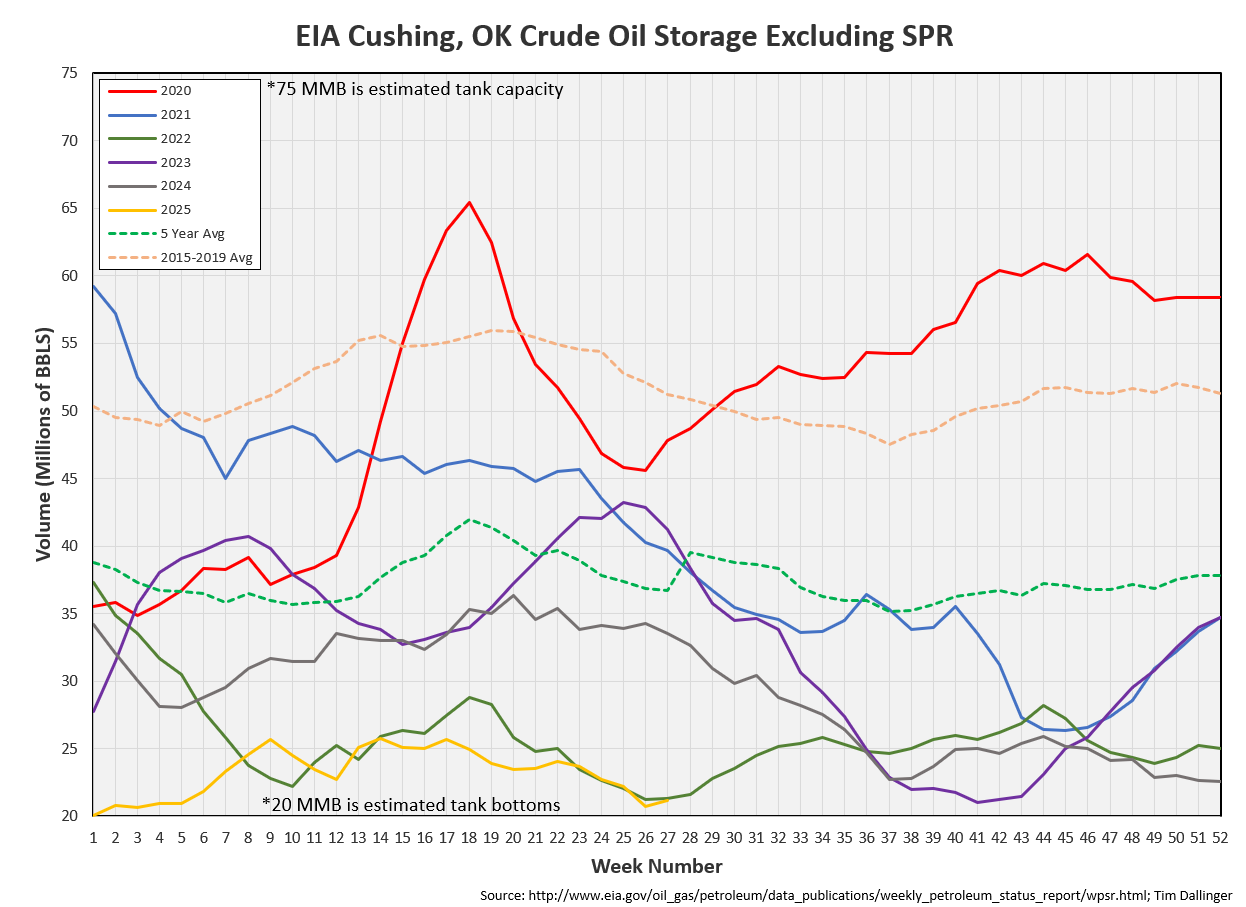

Cushing

Crude storage in Cushing, OK, built by 0.5 MMB week on week. Storage inventories are near tank bottoms, just under 2022 lows.

Gasoline

Total motor gasoline inventories decreased by 2.7 MMB and are about 1% below the seasonal 5-year average. Gasoline inventories are near seasonal 2024 figures.

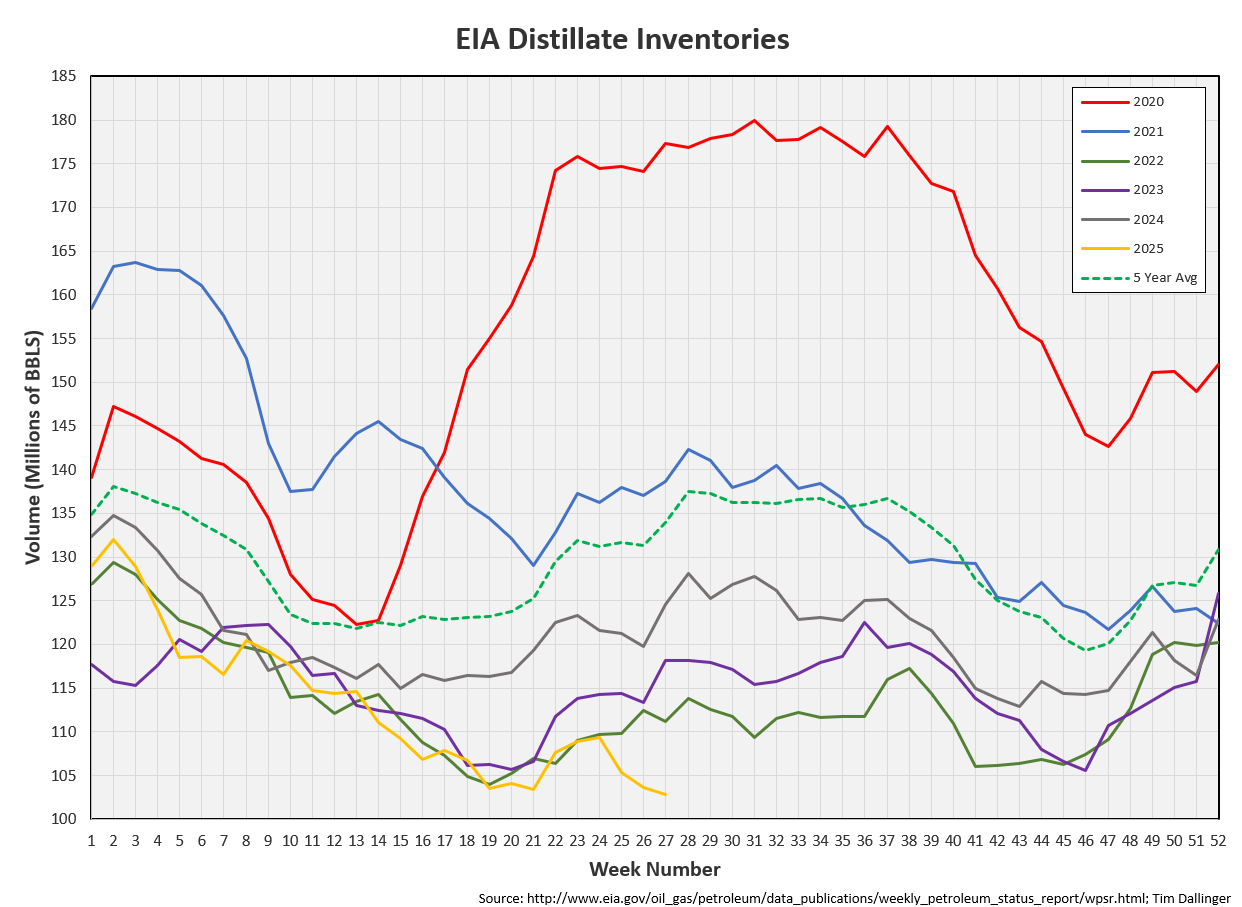

Distillate

Distillate fuel inventories decreased by 0.8 MMB last week and are about 12% below the seasonal 5-year average.

Absolute distillate inventories return to multi-decade lows.

Jet

Kerosene type jet fuels declined by 0.9 MMB. Jet fuel inventories are still above average but have now fallen below seasonal 2024 levels.

Ethanol

Ethanol inventories decreased 0.2MMB week-on-week. Ethanol inventories remain at seasonally record levels.

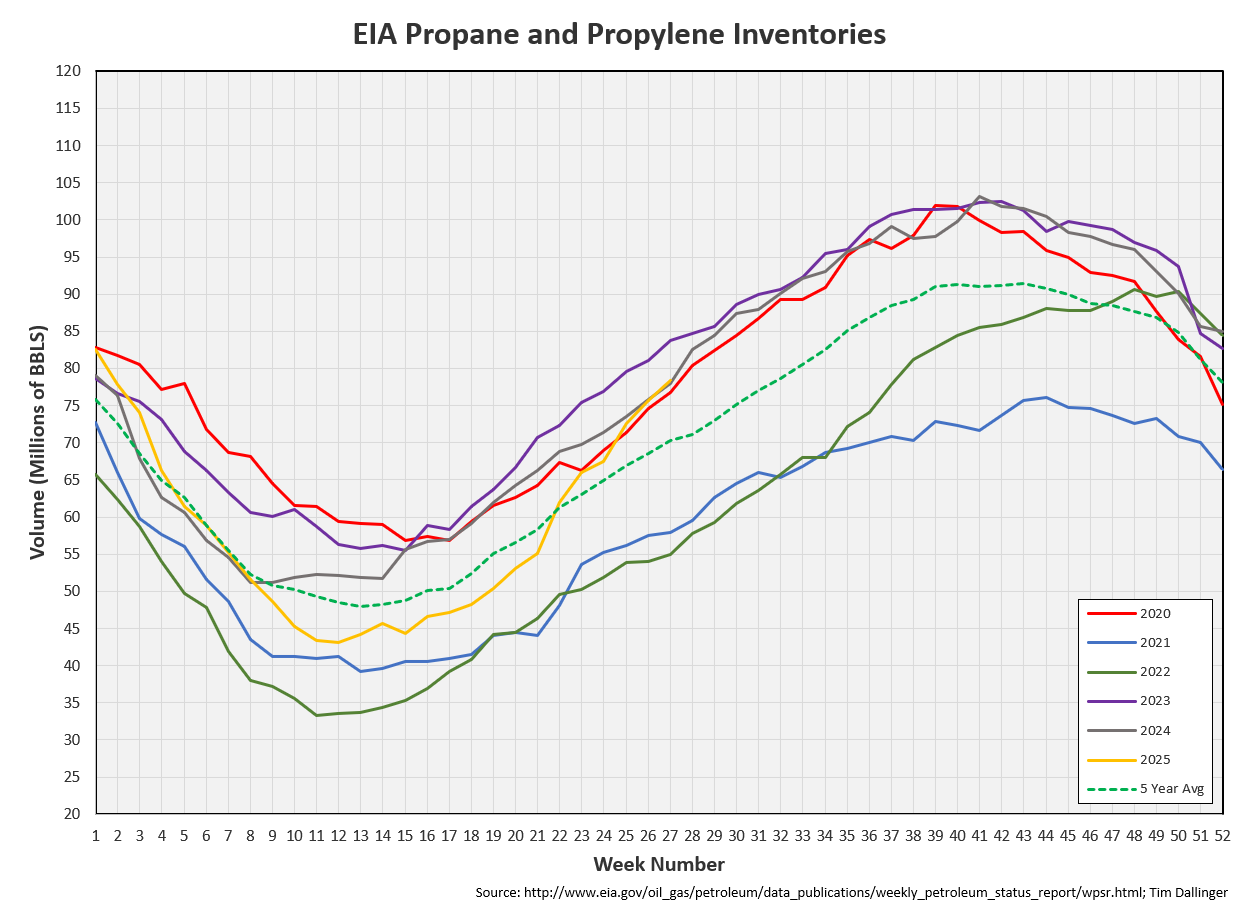

Propane

Propane/propylene inventories built by 2.7 MMB in-line with normal seasonal building trends.

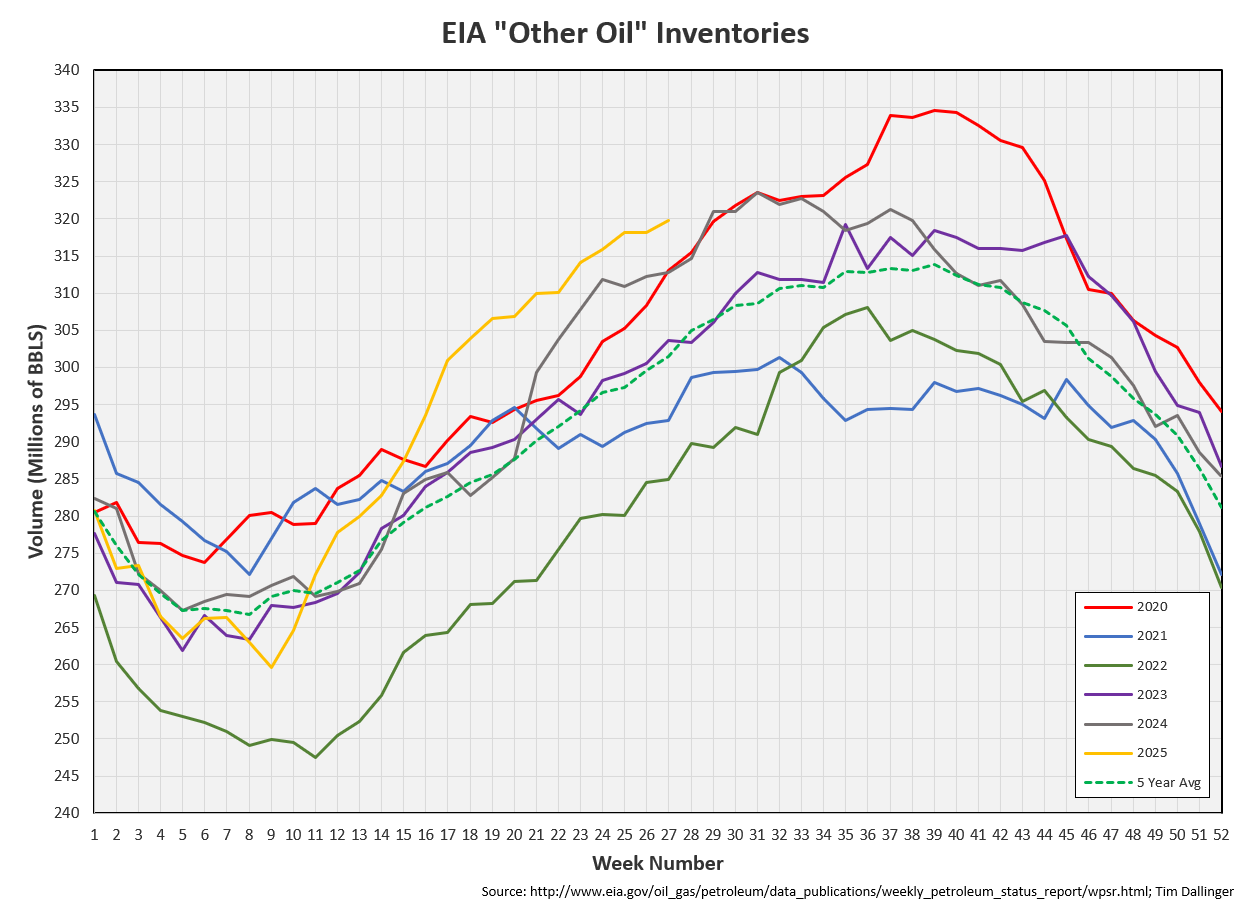

Other Oil

Other oil built by 1.6 MMB. Even though the trajectory of the other oil inventory builds has slowed, seasonal levels remain at record highs.

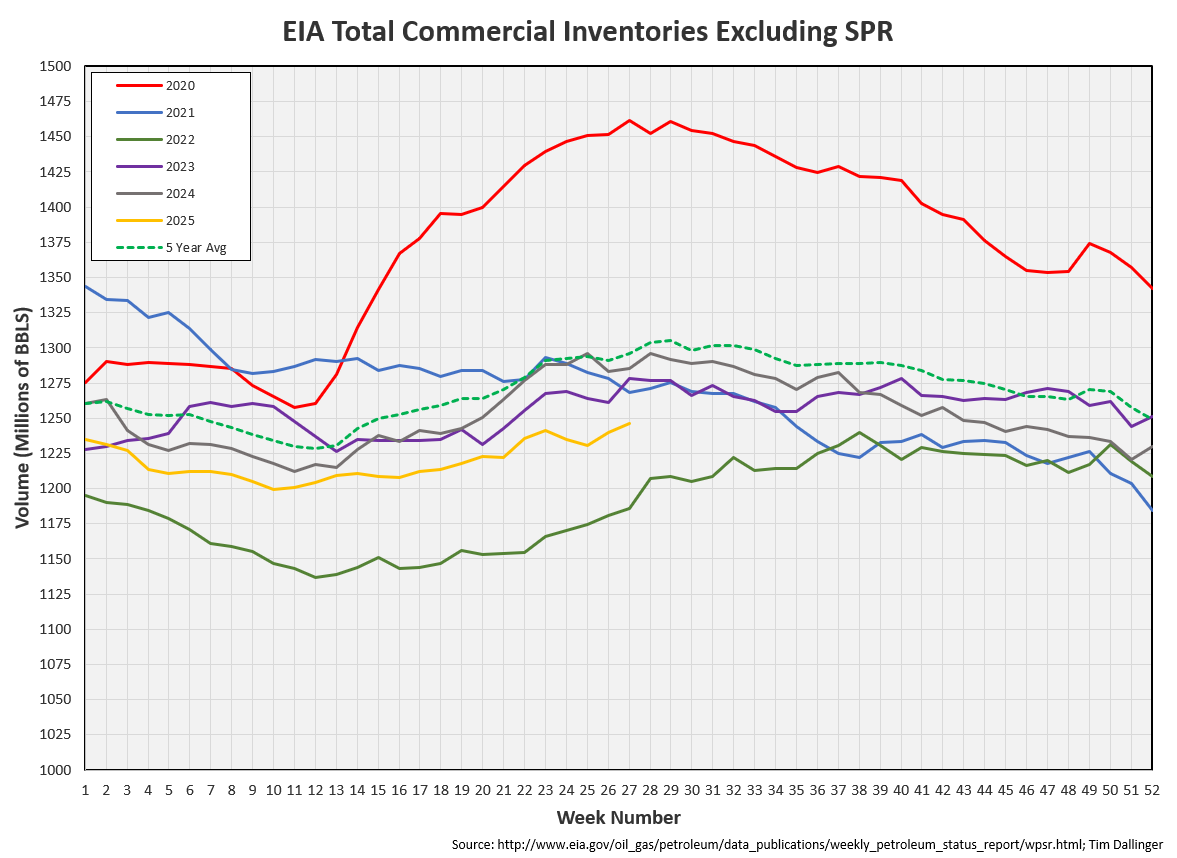

Total Commercial Inventory

Total commercial inventories built by 6.4 but remain below average.

Natural Gas

Natural gas inventories are above average, but the build pattern appears normal compared to historic values.

Refiners

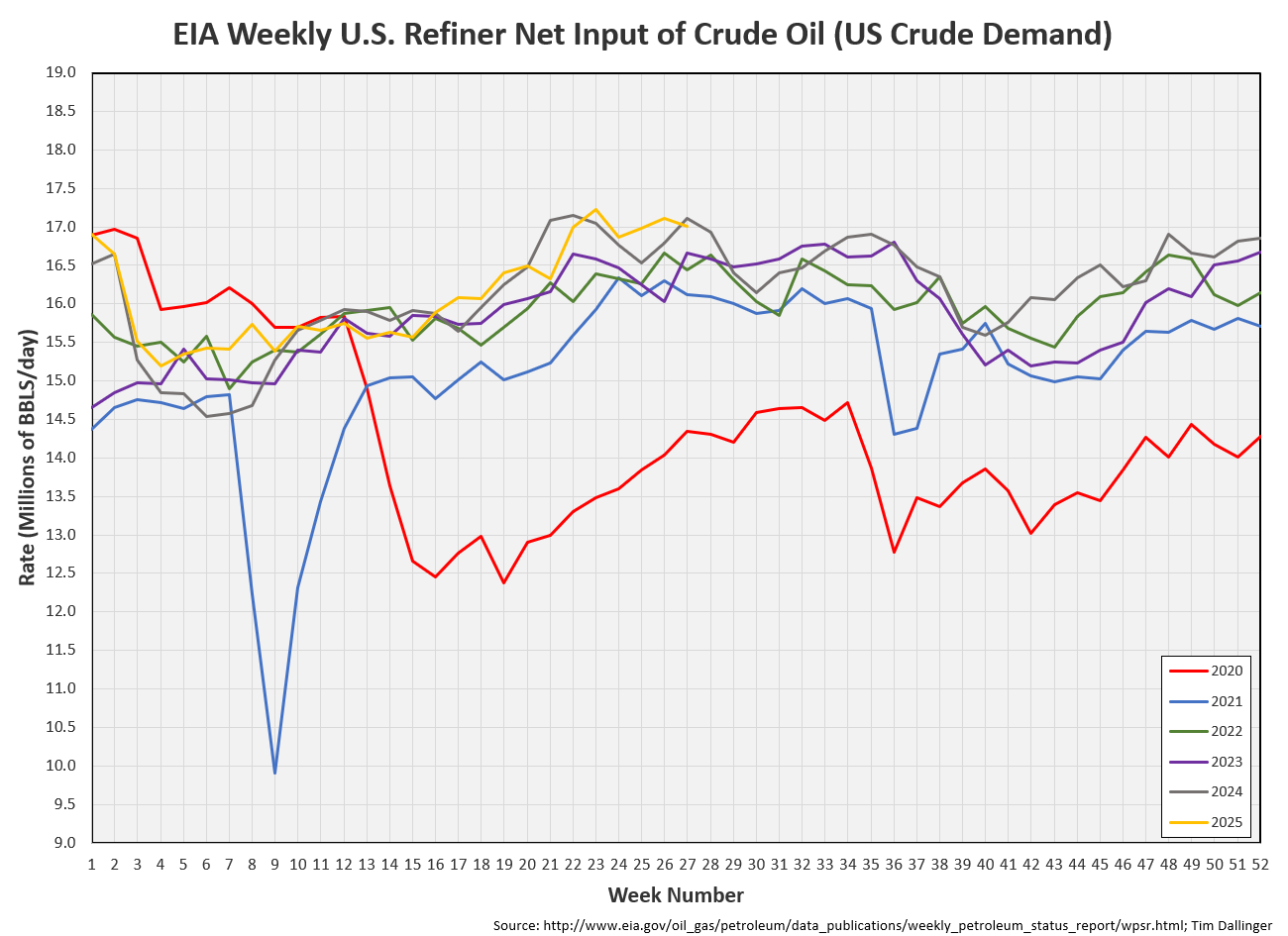

US refiners continue to run hot. Utilization falls back from record levels this week.

The EIA’s product demand proxy is below record levels but very healthy.

There’s usually a spike around the 4th of July as retail suppliers build inventory for holiday travel.

The FAA reported that 2025 Fourth of July experienced the busiest travel in 15 years.

Transportation inventories fell.

Implied demand for transportation inventories is modeled to be just below all-time highs.

Consumer demand supports a rally in simple crack spreads. Refiners are expected to continue to operate at high utilization levels to capitalize on this lucrative opportunity. Crude may not draw but only if exports remain this low. That, in turn, tightens the global market.

Discussion

Over the weekend OPEC approved another larger-than-planned hike in production for August quotas. Unnamed sources also suggested the group will unwind the cuts completely in September. Crude is rallying on the news, confusing many casual market observers. Why would more supply lead to higher prices? Opposing camps fight over the implication.

Even though OPEC production quotas have increased, export volumes have not. Much of the “cuts” were on paper. The group nears maximum capacity and the glut that was predicted has not materialized. Inventories have built in China. But there is overhang of physical barrels anywhere else in the world. Oil bulls have long argued that OPEC spare capacity was a shell game. If that’s the case and US growth is also dwindling, supply begins to grow tight.

This publication has been highlighting that spot price is below estimated fair value for most of this year. Yet the paper market has been in charge. As energy prices have been lowered than what the physical market suggests they should, demand has not been impacted. Demand has remained robust as the world loves cheap energy. But a physical commodity market cannot remain unbalanced forever. This is the first hint that suggests actual supply and demand fundamentals are once again becoming important. This will likely be a slow process. Pessimistic demand outlook from the international energy administration drives the consensus narrative. Republicans still chant “drill, baby, drill,” like it’s anything more than a slogan now. And inventories quietly draw.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Thanos describes the nature of all things in the 2018 Marvel film, Infinity War.

Feels like supply and demand are starting to matter again to me too. Price action has changed character. Let’s see what unfolds