Something’s “Funky”

EIA WPSR Summary for week ending 8-16-24

Summary

Crude: -4.6 MMB

SPR: +0.6 MMB

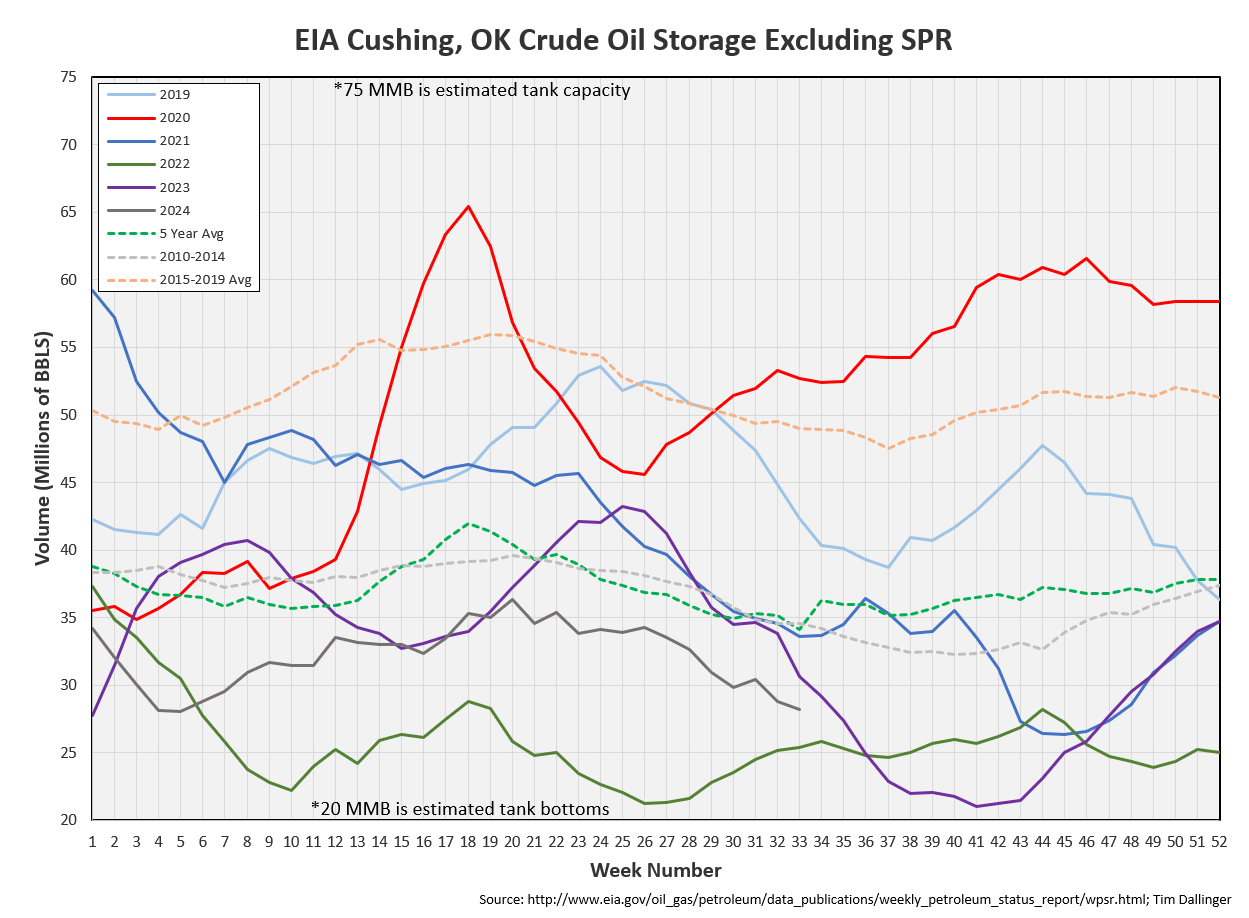

Cushing: -0.6 MMB

Gasoline: -1.6 MMB

Distillate: -3.3 MMB

Jet: +0.6 MMB

Ethanol: +0.2 MMB

Propane: +2.0 MMB

Other Oil: +0.9 MMB

Total: -5.9 MMB

Bullish.

Spot WTI is currently pricing $71. Price has dislocated from estimated fair value by a substantial margin.

Crude

US Crude oil supply drew by 4.6 MMB. Crude inventories are currently 5% below the seasonal average matching 2022 levels.

0.6 MMB were added to the SPR. 21.9 MMB have been added to the SPR in 2024.

US crude imports were up on the week, back near average levels.

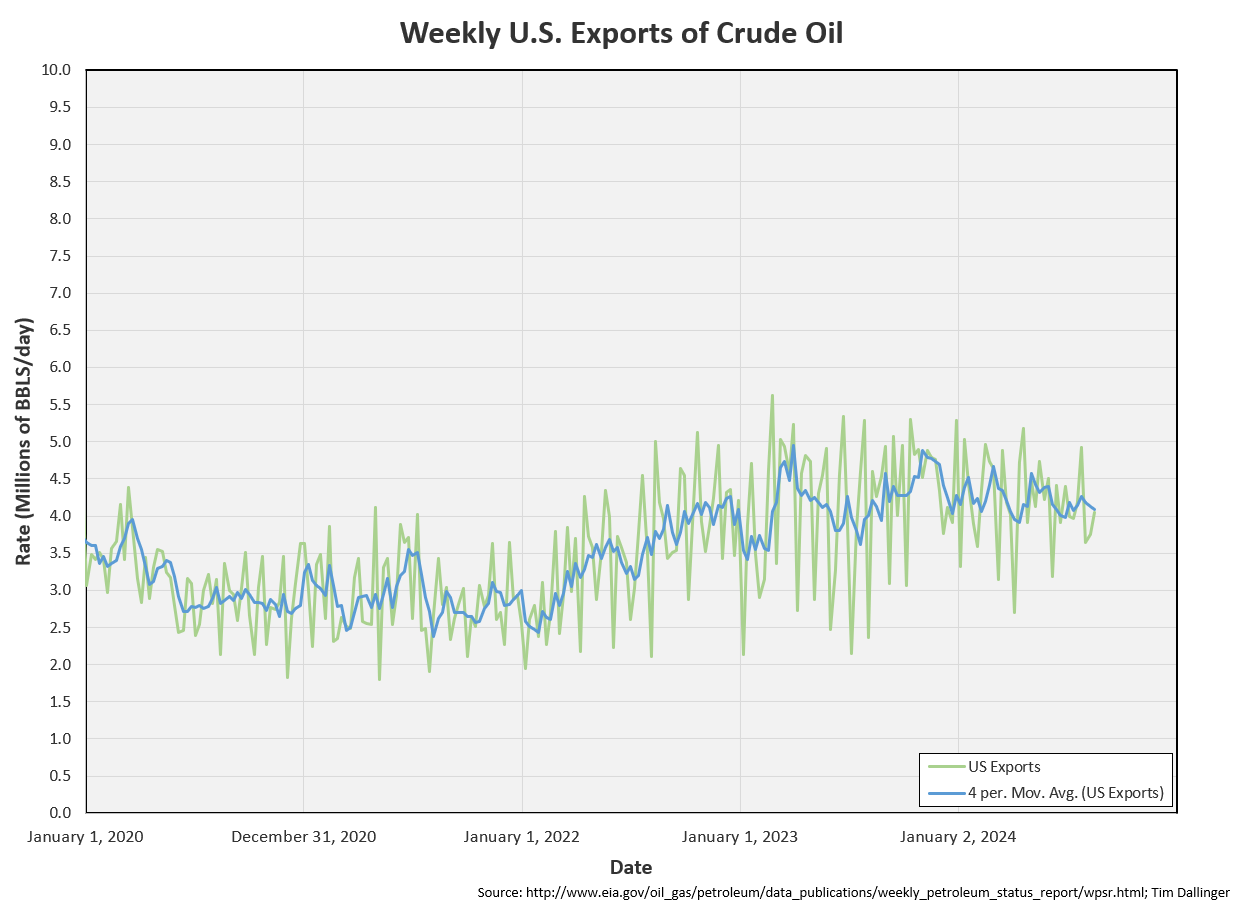

Crude exports were also up, recovering above 4 MMBD. This is also the recent average.

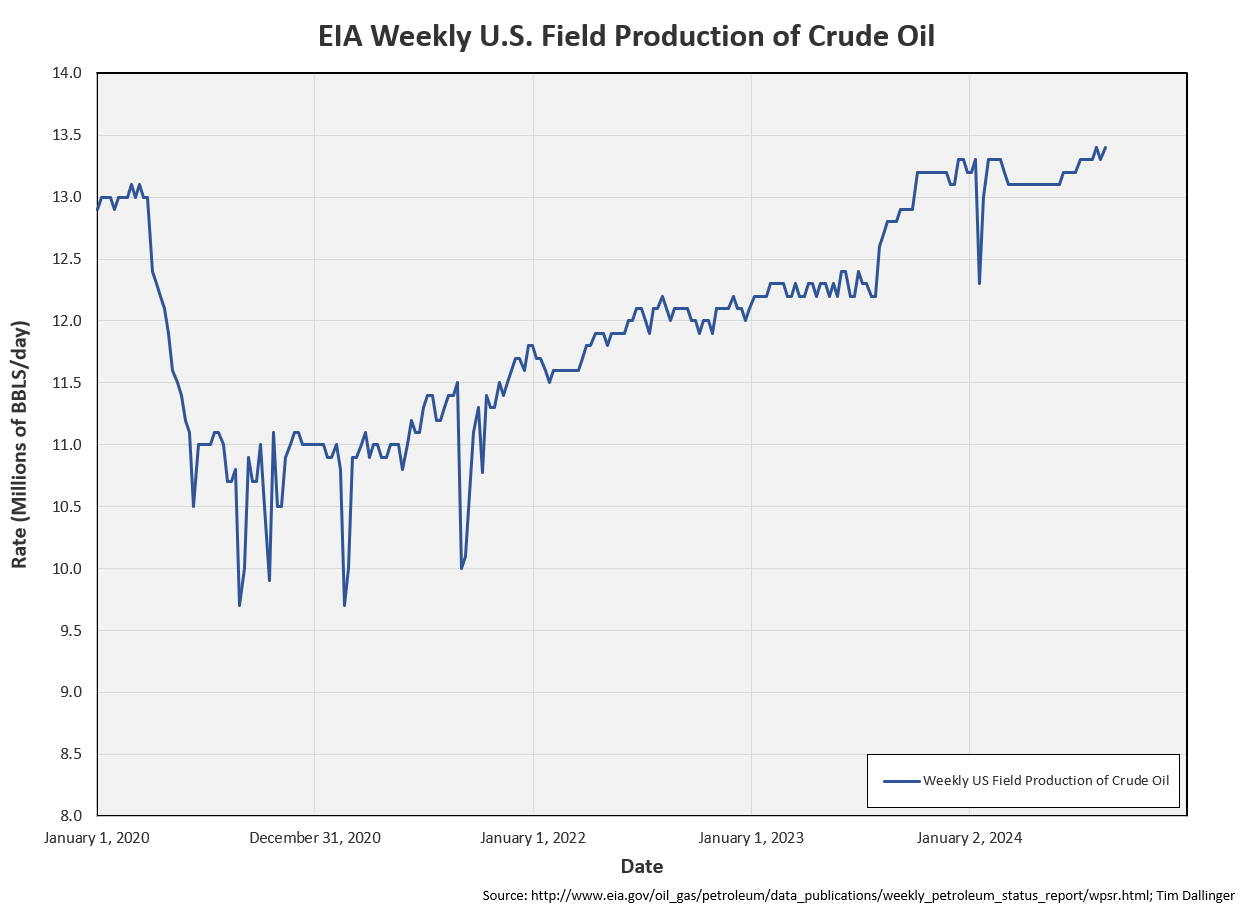

Unaccounted for crude corrected negative as the EIA bumped up domestic production in the STEO again, back to record levels.

The EIA continues to miscategorize crude and all liquids.

Cushing

Crude oil storage in Cushing, OK, drew by 0.6 MMB week on week.

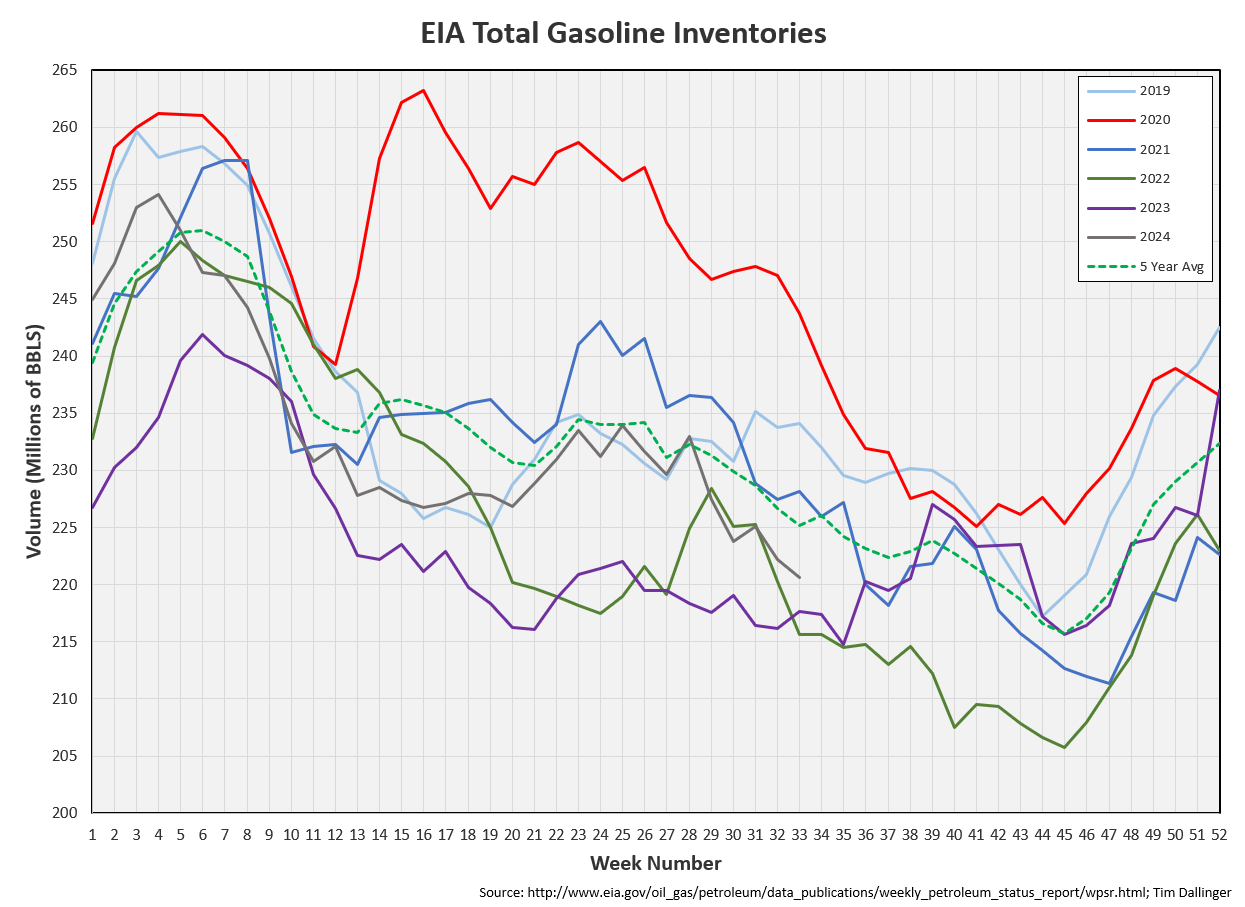

Gasoline

Total motor gasoline inventories decreased by 1.6 MMB and are about 3% below the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 3.3 MMB last week and are about 10% below the seasonal 5-year average.

Jet

Kerosene type jet fuel built by 0.6 MMB.

The 7-day moving average for global active flights and air miles traveled remains at seasonal records although it has come down slightly from all-time highs.

https://www.airportia.com/flights-monitor/

TSA checkpoint traveler data is declining absolutely due to seasonality. It’s still at seasonal records.

Ethanol

Ethanol inventories increased 0.2 MMB week-on-week. Inventories are near 2022 levels.

Propane

Propane/propylene inventories increased 2 MMBD. Propane inventories match last year’s record levels.

Other Oil

Other oil built 0.9 MMB.

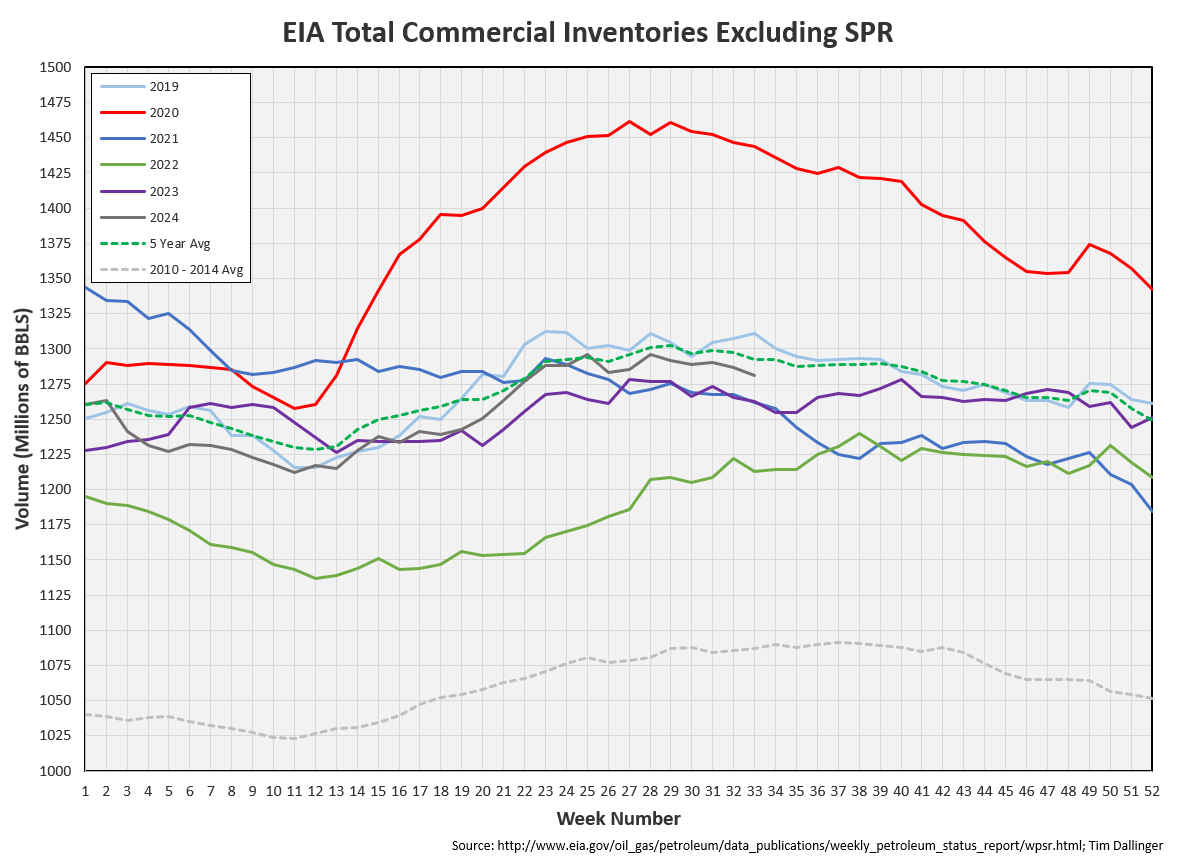

Total Commercial Inventory

Total commercial inventory drew 5.8 MMB. Total commercial inventories are below the 5-year average.

Natural Gas

Natural gas inventories actually declined last week. Gas prices have once again fallen into negative territory at WAHA hub. Independent West Texas producers have had to curtain oil production as struggle with associated gas pricing.

Refiners

US refining increased last week. The volume of crude oil processed only slightly lags 2022 levels.

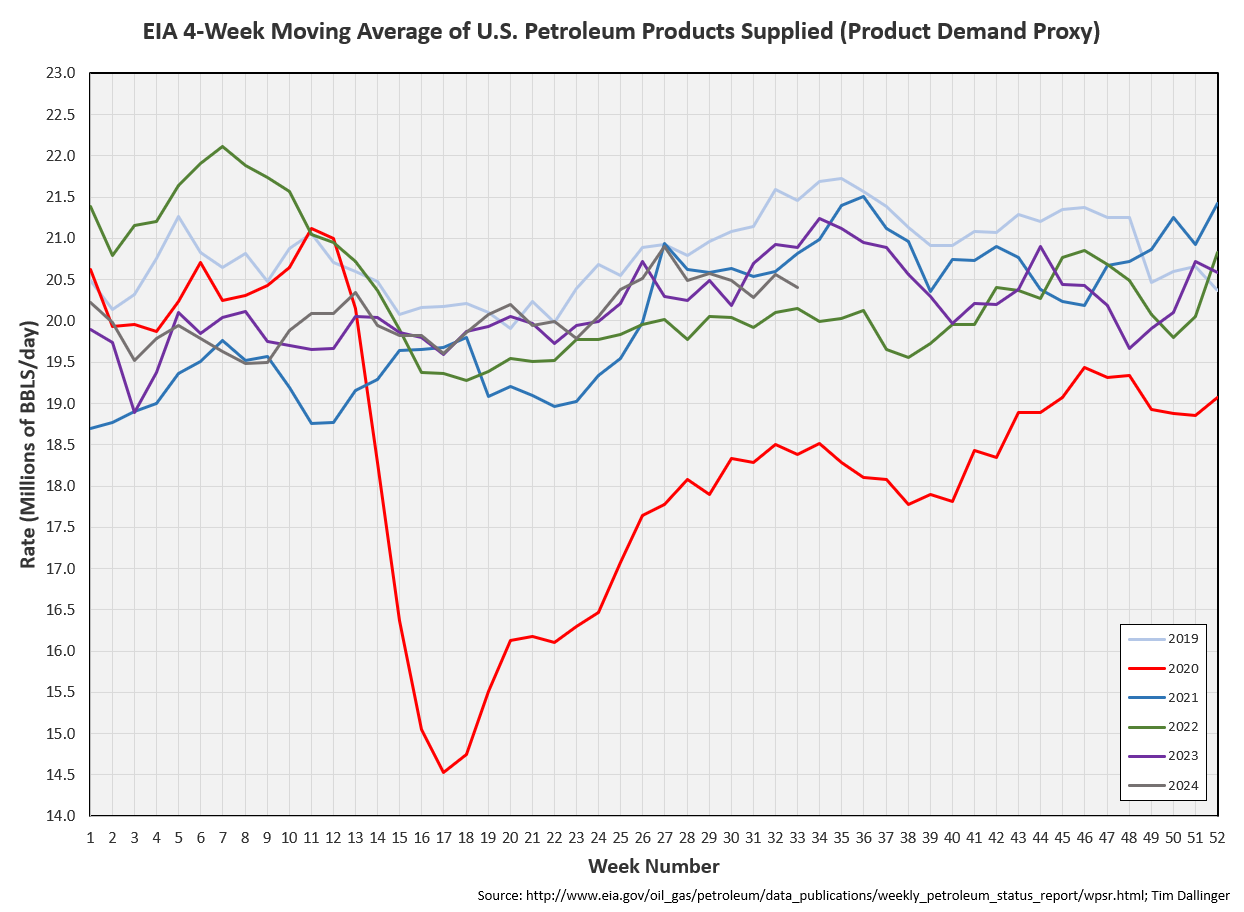

The EIA’s product demand proxy shows weakness, although that is not echoed elsewhere.

Transportation inventories fall in the face of “weak demand.”

Adding crude oil figures to transportation inventories better illustrates the physical tightness not clearly demonstrated in total commercial inventories. That’s because total commercial inventories include propane and other oil, the categories with physical gluts.

Simple cracks sold off again. This is odd behavior for current product inventory levels.

Discussion

Crude oil continues its selloff. Even with the pressure on prompt contracts, the curve structure for both brent and WTI have remained backwarded. That suggest this more related to paper markets than physical.

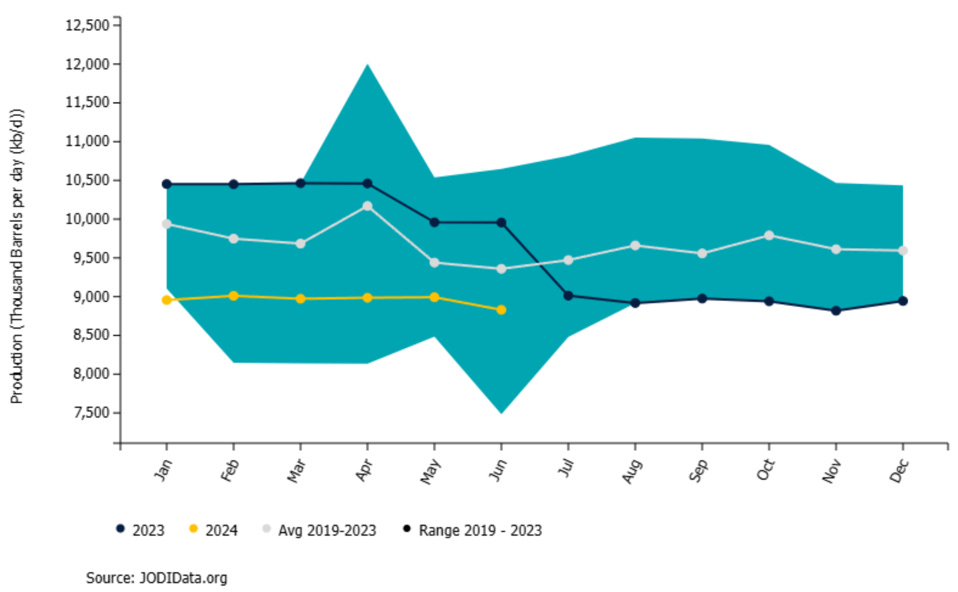

June JODI data is out and it’s showing record global oil demand.

OPEC remains disciplined but most of the heavy lifting is being done by Saudi Arabia. Speculators worry that Saudi Arabia will not continue this behavior.

The base case should be that OPEC+ rolls over cuts instead of easing them in Q4 as previously guided.

Swiss commodity trader, Kim Benni, shows floating storage. Iran has sold nearly all of their floating storage, without pushing the market into a glut.

https://x.com/BenniKim/status/1826154525033431351

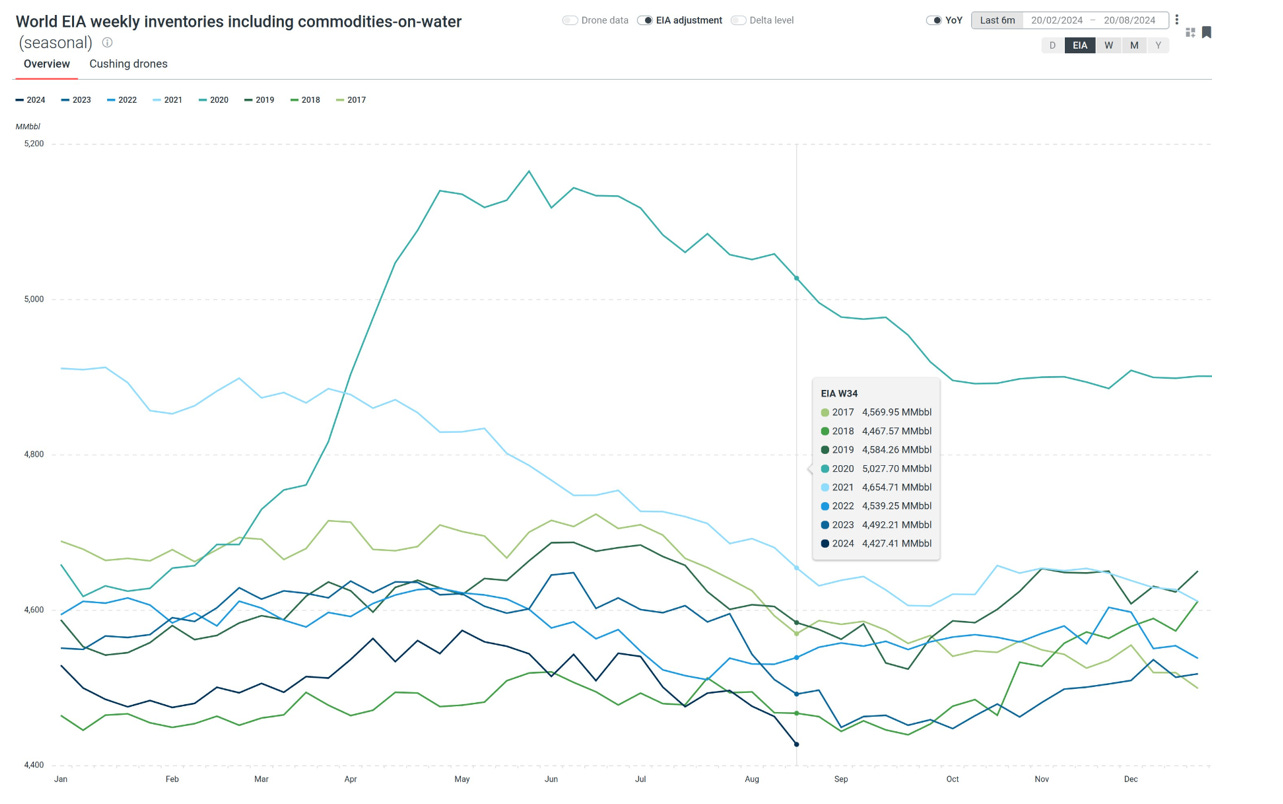

On-water measures show similar behavior. Global inventories are drawing at some of the fastest rate ever recorded. Yet pricing falls too.

There is legitimate concern over Chinese demand. Chinese teapot refineries have significantly reduced crude purchases. That alone seems inadequate to explain price action.

Although, the recent Goldman analyst note warns of Brent falling below $70 if Chinese demand weakness continues.

There seems to be a distinction between the paper market and physical. Short interest continues to grow despite falling crude and product inventories. The market appears to be forward looking for potential demand impacts. But it’s ignoring supply risk.

Peace discussions between Israel and Hamas are failing. IDF airstrikes continue in Lebanon. The Houthi’s continue to harass tankers in the Red Sea, bombing another oil tanker just today. The Greek ship is reported to be without command, ablaze and drifting currently. This grows exceedingly closer to becoming a direct conflict with Iran. Unrest can easily spread further across the region.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed

Bubbles is a fictional character in the Canadian cult comedy favorite, Trailer Park Boys. One of his famous quotes seems to accurately capture the recent price action in energy markets.