EIA WPSR Summary for week ending 1-24-25

Summary

Crude: +3.5 MMB

SPR: +0.2 MMB

Cushing: +0.3 MMB

Gasoline: +3.0 MMB

Distillate: -5.0 MMB

Jet: -0.3 MMB

Ethanol: -0.2 MMB

Propane: -7.9 MMB

Other Oil: -6.9 MMB

Total: -13.9 MMB

This week’s report includes data from the period in which the US Gulf coast experienced the most significant snow event in over 100 years. Most aspects of this week’s report were impacted.

Spot WTI is currently pricing $72. Spot WTI price remain below estimated fair value based on a price model derived from reported EIA inventories.

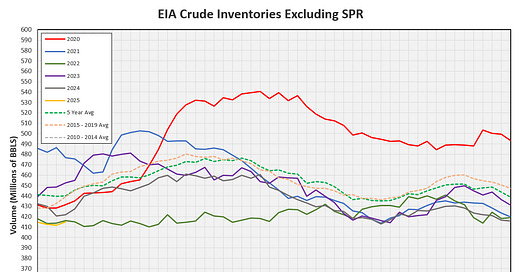

Crude

US Crude oil supply built by 3.5 MMB. Crude inventories are currently 6% below the seasonal average. US crude oil inventories are the lowest they’ve been seasonally since 2015.

0.2 MMB were added to the SPR. SPR continues to be replenished but the rate has slowed.

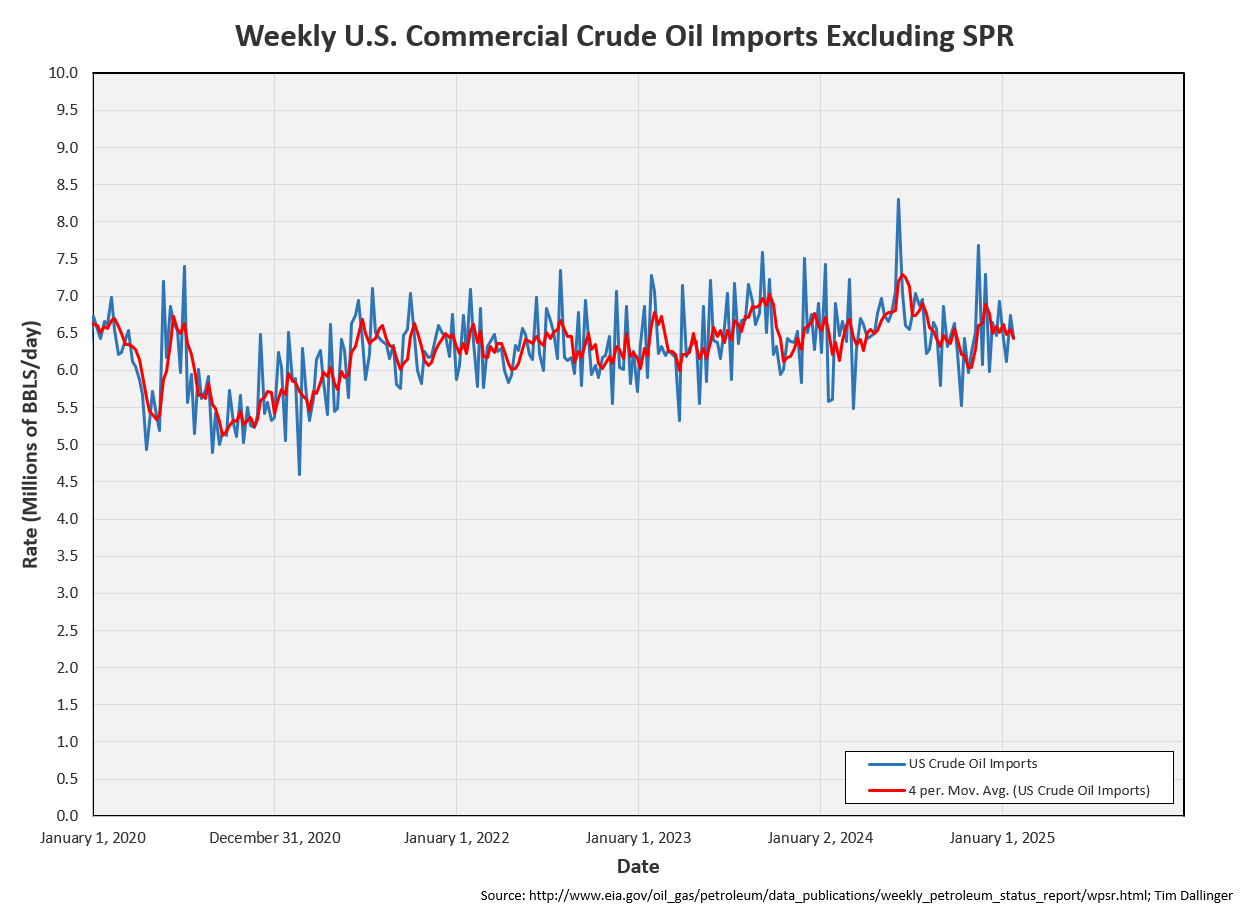

US crude imports were down on the week. Ship traffic was affected by the cold.

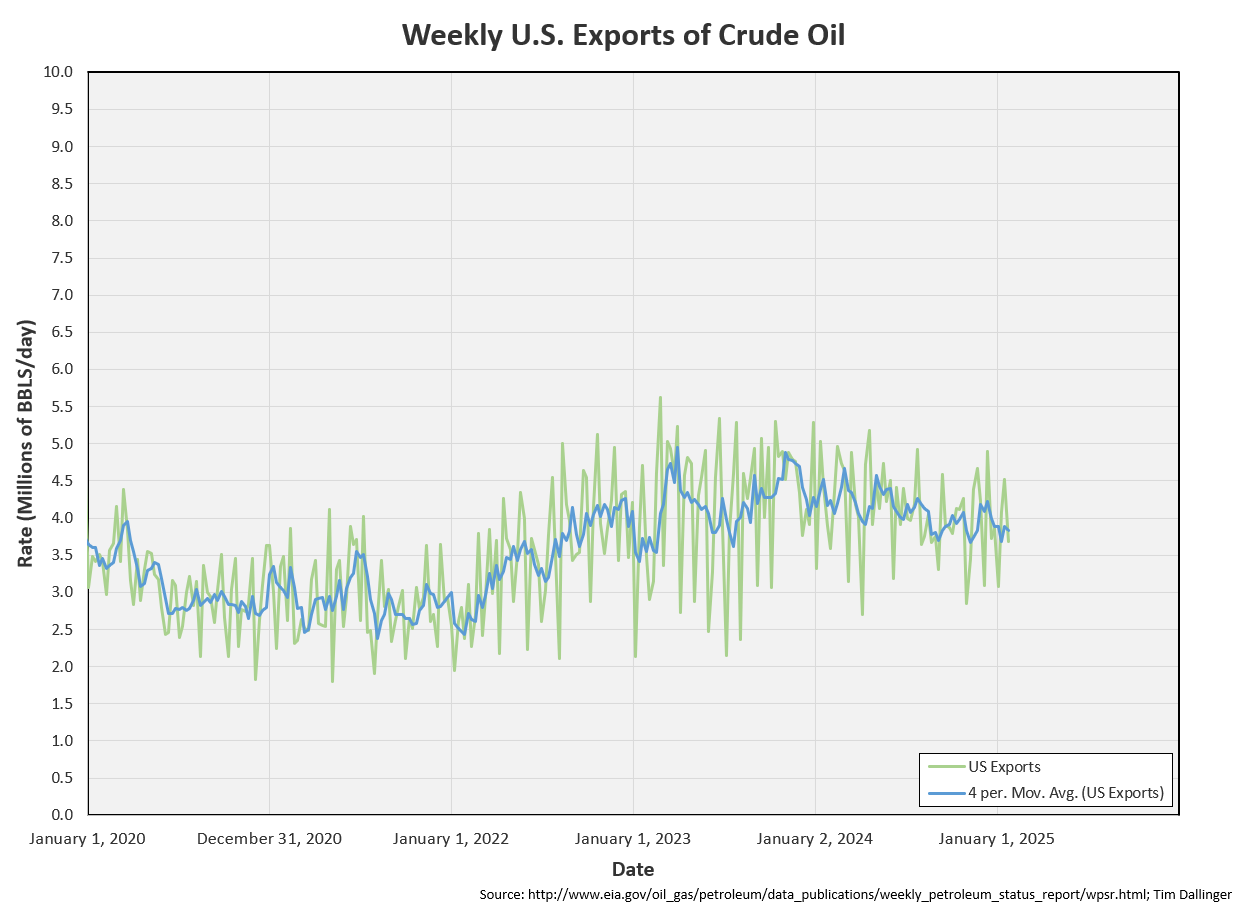

Crude exports were also down.

Unaccounted for crude remains negative, suggesting something in the inventory model is off.

EIA weekly US crude production fell but that primarily due to weather. Contacts within the industry report that tier 2 shale wells continue to produce more and more gas. But that’s not yet showing up in the weekly figures.

Cushing

Crude storage in Cushing, OK, built by 0.3 MMB week on week. Cushing inventory remains near its operational low limit.

Gasoline

Total motor gasoline inventories increased by 3 MMB and are near the seasonal 5-year average.

Blending component levels are above average.

Distillate

Distillate fuel inventories decreased by 5.0 MMB last week and are about 9% below the seasonal 5-year average, falling below 2022 levels.

Jet

Kerosene type jet fuels decreased by 0.2 MMB. Inventories are above average, but the magnitude isn’t significant.

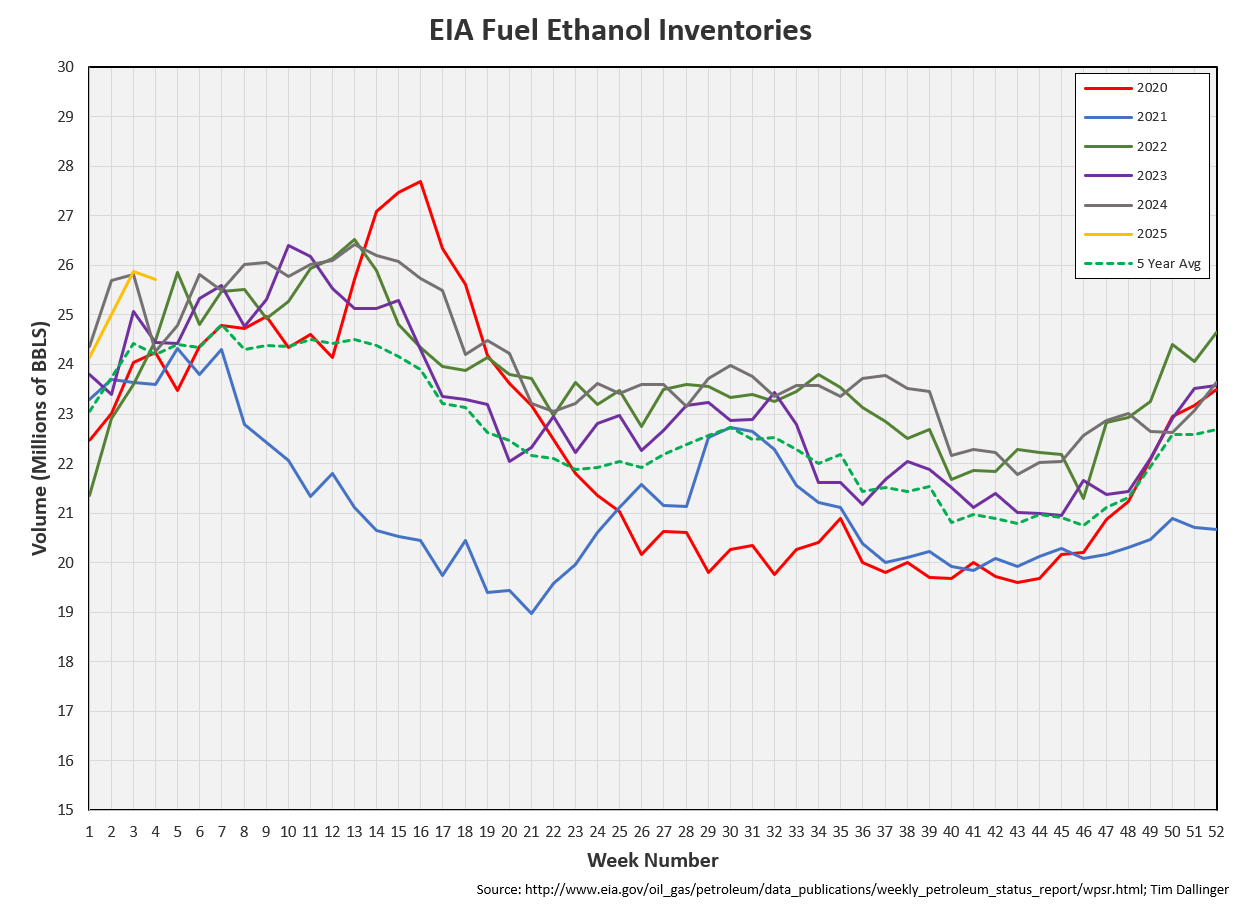

Ethanol

Ethanol inventories decreased by 0.2 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories drew by 7.9 MMB. Inventories approach average levels. This is a quite a feat as fall 2024 experienced the highest propane inventories on record. The cold weather aided in propane demand.

Other Oil

Other oil drew by 6.9 MMB. Other oil inventories fall below average levels and match 2023. Only 2022 has seen lower in the recent past.

Total Commercial Inventory

Total commercial inventories drew by 13.9 MMB, due primarily to propane and other oil.

Natural Gas

The chart for natural gas inventories presented below is the same as last week. Due the holiday, the EIA petroleum report and the natural gas inventories were released on the same day. The next natural gas report will be released tomorrow.

The near-term weather projects are warm. The northeast will be cold for the next couple of days but then it should warm up.

There is still some activity in the poles that could develop into a system in February. But for now, that appears to be a low probability event.

Refiners

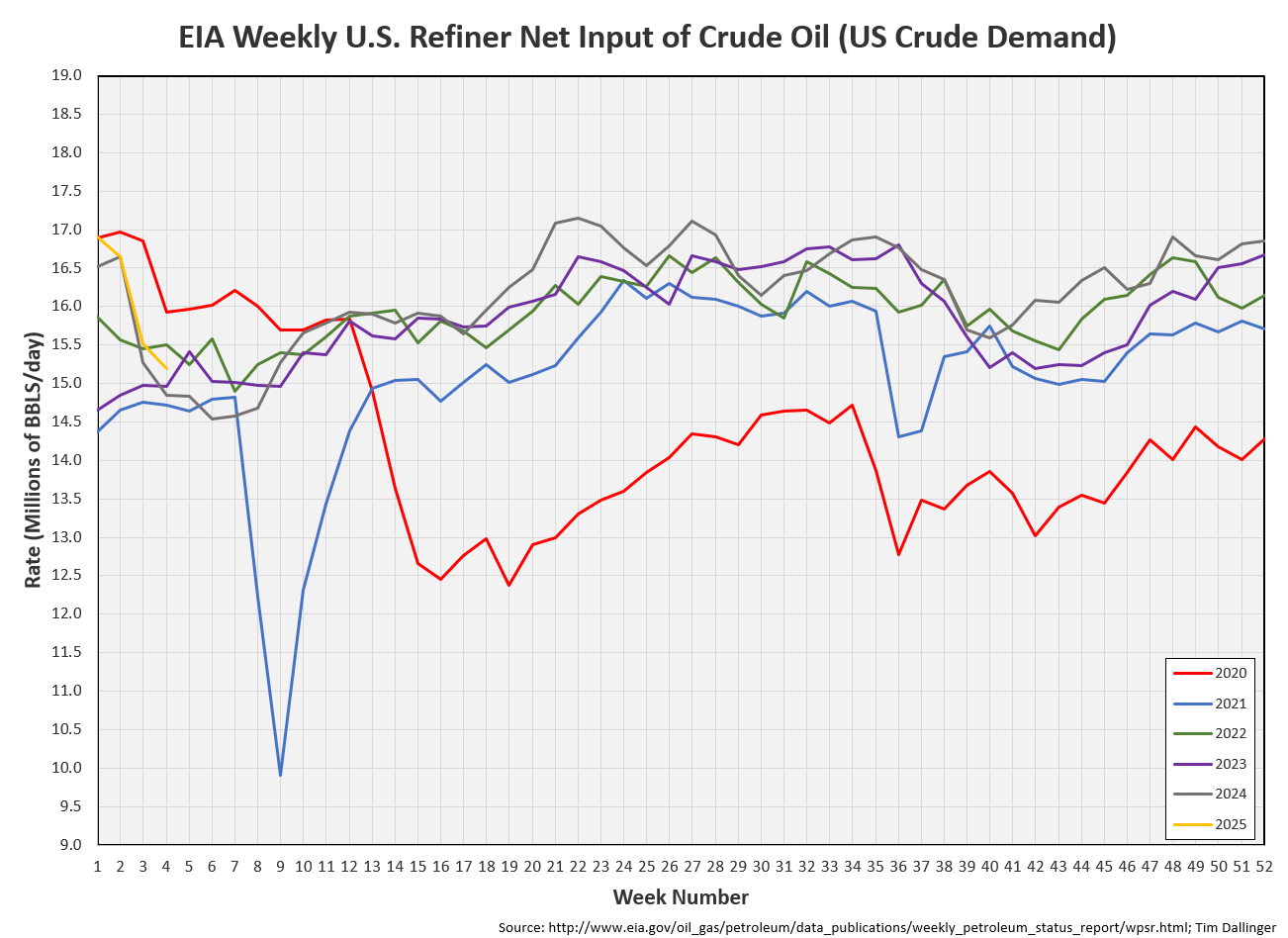

The amount of crude oil refiners processes last week fell again. Some of this is seasonality and some was weather. Winter maintenance season approaches. Crude will likely build during this period, but the market will focus on products.

The EIA’s product demand proxy showed a bounce. Only 2022 has been higher seasonally.

Transportation inventories drew, due to distillates.

When crude is included, inventories are near 2022 levels.

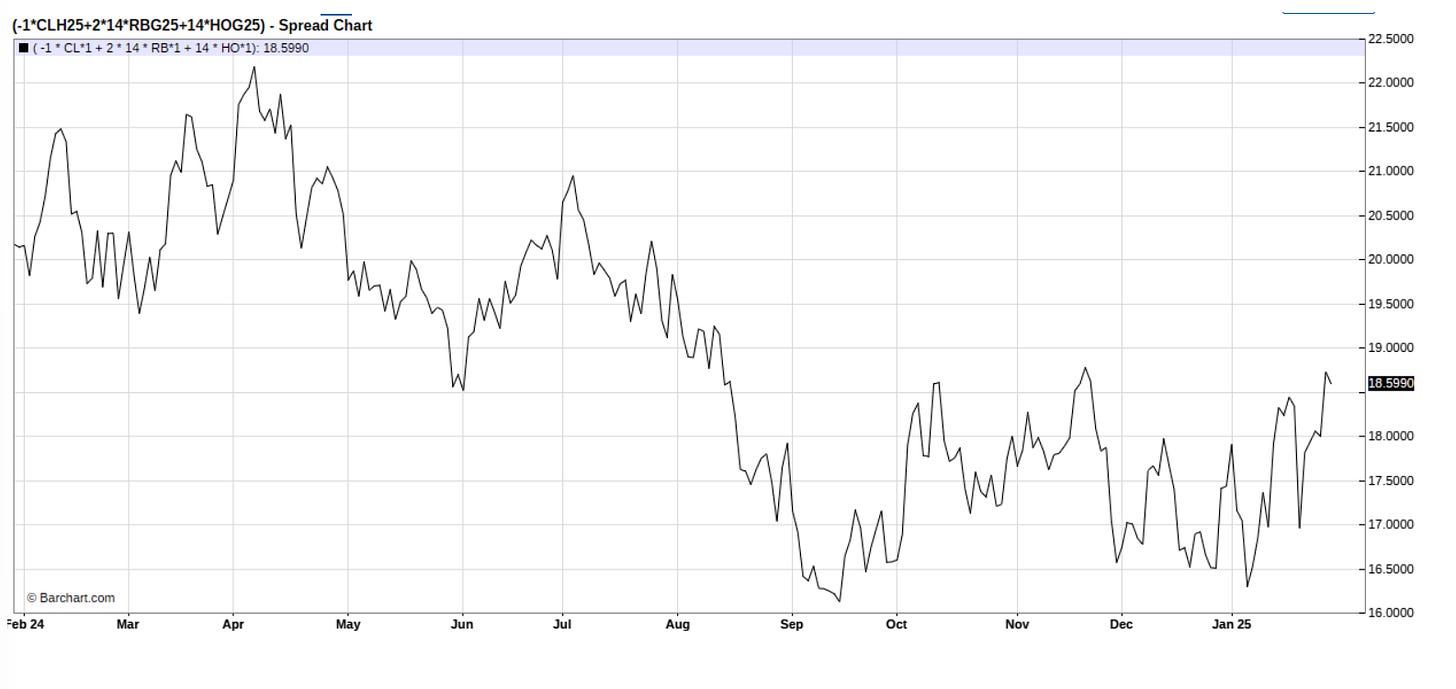

Simple cracks have rallied again this week. Turn-around season should provide additional support. Then refiners should be ready to run hard into driving season.

Discussion

Both WTI and Brent remain firmed backwarded.

Mainstream articles claim the world is awash with oil. Yet, no global inventory data confirms this assertion. Oil-on-water continues to fall. Even Chinese stocks don’t appear to be building.

“Drill, baby, drill” continues to be the oft repeated mantra and yet none of the advocates can identify where.

Shale producers are touting the improvement in frack efficiencies. The ability to re-frack wells and frack longer wells is impressive. But what isn’t mentioned is that this requires more power. In one sense, fracking is be more efficient but the power required and thus costs also rise. Producers also only seem to mention production without addressing GOR (gas-to-oil ratio) and BOE (barrel of oil equivalent). Tight production generates condensate and natural gas liquids as well as crude. Condensate and NGL’s have value but they fetch a fraction of the price of crude oil. They cannot be used to make the same slate of products as crude oil.

While the world focuses on the latest Chinese model, the energy market continues to grow tighter. It’s hard for oil bulls to get excited, having been burned so frequently. However, inventories and prices are near where they were at the start of 2022, before the spring run to $130/barrel. While $130 is not expected again, there are considerable fundamental reasons that oil prices can increase from current levels within the next several months.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Hawkeye, portrayed by Jeremy Renner, struggles with loss in the 2019 action Marvel adventure film, “Avengers: End Game.”