EIA WPSR Summary for week ending 5-3-24

Summary

Neutral report

Crude: -1.4 MMB

SPR: +0.9 MMB

Cushing: +1.8 MMB

Gasoline: +0.9 MMB

Distillate: +0.6 MMB

Jet: +0.9 MMB

Ethanol: -1.3 MMB

Propane: +2.2 MMB

Other Oil: -3.1 MMB

Total: -2.1 MMB

Spot WTI is currently pricing $79. Prices are at fair value based on a price model derived from reported EIA inventories. All geopolitical premium has been priced out.

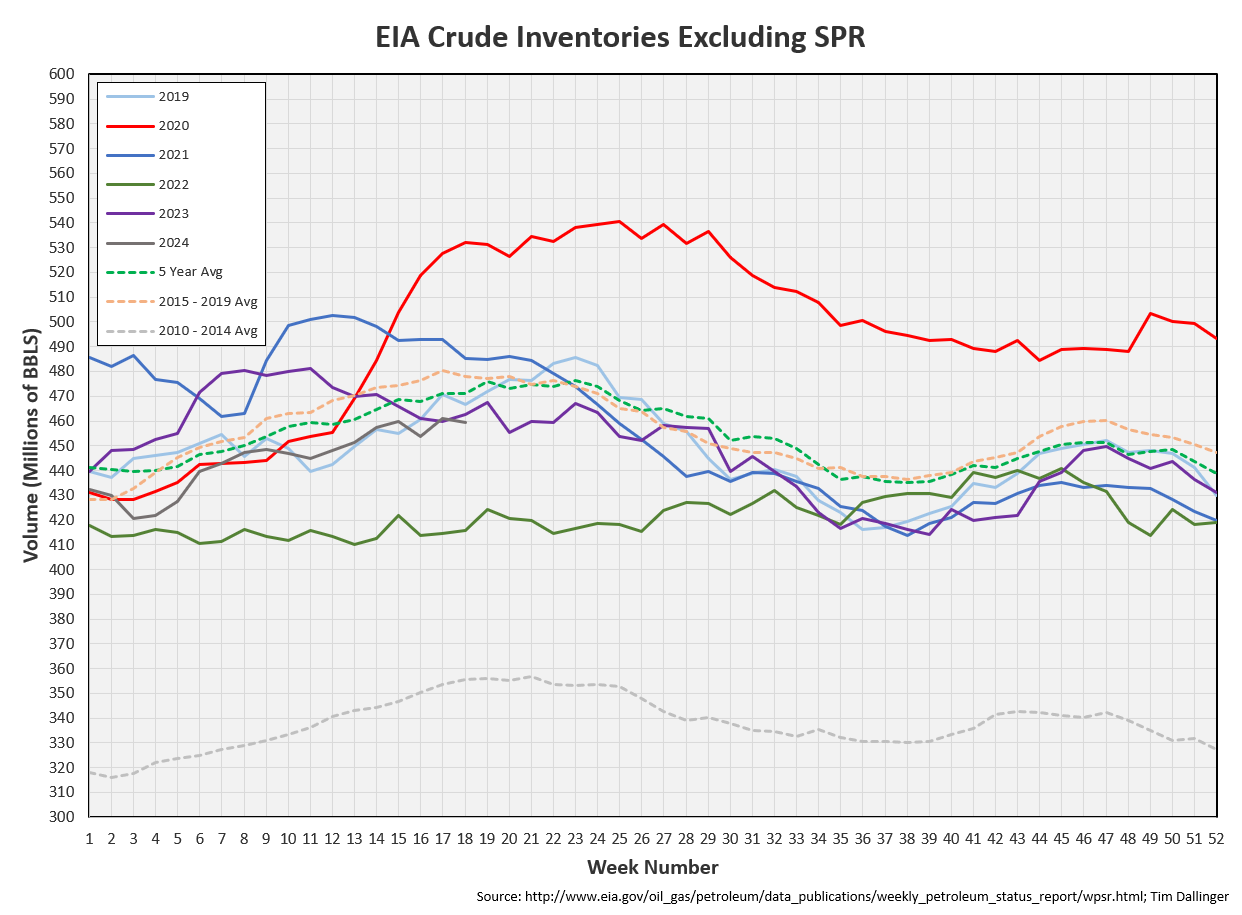

Crude

US Crude oil supply drew by 1.4 MMB. Crude inventories are currently 3% below the seasonal average.

0.9 MMB were added to the SPR. 12.1 MMB have been added to the SPR in 2024. SPR inventories are now slightly higher than a year ago.

This week Amos Hochstein, the energy advisor for the Biden administration, said that there is plenty of SPR to address any supply concerns.

"For now, I think we'll continue to monitor markets and if we need to use the SPR. The president has shown a willingness to use it to support the U.S. economy."

A release this summer to try and bring gasoline prices down in time for the November election seems likely, depending on OPEC’s production decisions.

US crude imports were above average at 6.969 MMBD.

Mexico and Nigeria contributed to the increase.

Crude exports were also up, to 4.468 MMBD.

Saudi Arabia raised their official selling price to Asia for lights. WTI should look more attractive to Asian buyers. Chinese refiners chose to draw down crude inventories instead of paying for barrels priced high due to geopolitical conflict. China should need to return to buying soon.

Unaccounted for crude flipped negative.

Cushing

Crude storage in Cushing, OK, built by 1.8 MMB week on week. The current trajectory appears similar to last year’s Q2 builds.

Gasoline

Total motor gasoline inventories increased by 0.9 MMB and are about 2% below the seasonal 5-year average.

Meanwhile, finished gasoline is at record low’s.

Gasoline blending components have been building.

The EIA is showing gasoline implied demand is a multi-year lows. This is not corroborated by any of the refiners. Conference calls stated gasoline demand was at record levels or just lagging 2023.

Distillate

Distillate fuel inventories increased by 0.6 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuel increased by 0.9 MMB.

Global flights are at seasonal record numbers. Global miles near all-time records.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories decreased 1.3 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories built by 2.2 and match 2020 inventory levels.

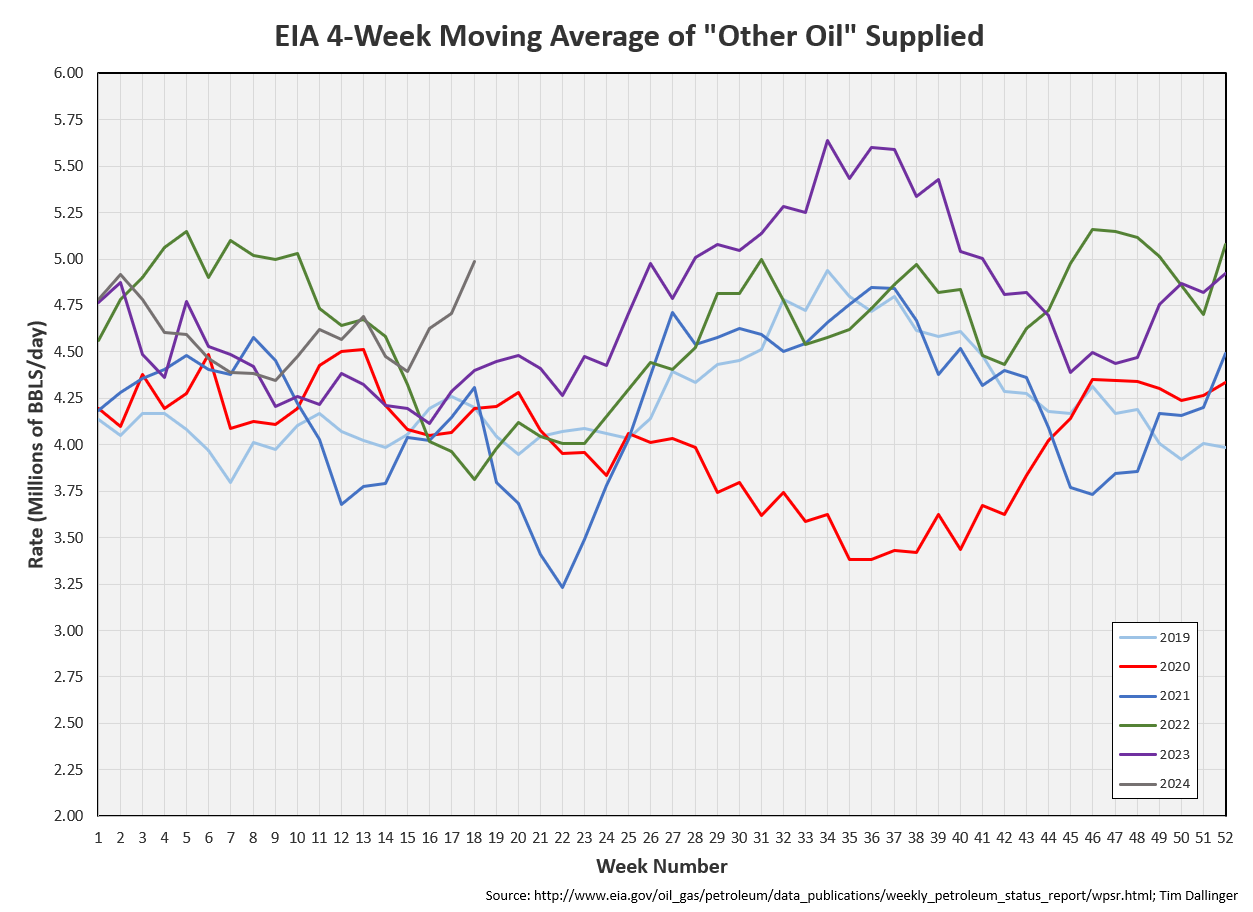

Other Oil

Other oil drew by 3.1 MMB. This is counter-seasonal movement.

Other oil demand is at seasonal high’s. There’s some overlap between “other oil” and gasoline blending components so perhaps products are being miscategorized.

Total Commercial Inventory

Total commercial inventories drew by 2.1 MMB. Inventories are near 2023 levels.

Natural Gas

Natural gas inventories built, but slower than the previous week. There remains a glut of natural gas. However, WAHA gas prices turned positive this week.

Refiners

The amount of crude oil refiners processed last week was slightly down. However, 2019 is the only year where the moving average of crude refined is higher.

The EIA’s product demand proxy is near 2023.

Transportation inventories have built.

Simple cracks are under pressure.

WTI and Brent remain backwarded. Although the magnitude has decreased, showing that the physical market has weakened some.

Discussion

The physical market has loosened over April as Chinese buying decreased. The remainder of the year’s supply and demand dynamics depend on OPEC’s decision. The next production meeting is about a month away. If prices remain in this region, it doesn’t seem likely that Saudi Arabia will unwind its additional voluntary cut. Consensus is for a production-cut extension.

Some are already looking past 2024. The EIA’s May STEO was released this week. They expect US production to grow 673 kbd over the next year. That seems ambitious with current rigs and fracks. They expected this growth in 2024 as well and it isn’t materializing.

Prices are in-line with current inventories. In the absence of conflict, the physical market must tighten for crude prices to move higher.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

The Neutral President of the Neutral Planet is the leader of the Democratic Order of Planets in Matt Groening’s television series, “Futurama.”