EIA WPSR Summary for week ending 7-26-24

Summary

Crude: -3.4 MMB

SPR: +0.7 MMB

Cushing: -1.1 MMB

Gasoline: -3.7 MMB

Distillate: +1.5 MMB

Jet: +0.3 MMB

Ethanol: +0.2 MMB

Propane: +2.9 MMB

Other Oil: +0.0 MMB

Total: -2.4 MMB

Mildly bullish.

Spot WTI is currently pricing $78. Prices are only slightly below fair value after today’s movement, based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 3.4 MMB. Crude inventories are currently 4% below the seasonal average.

0.7 MMB were added to the SPR. 19.9 MMB have been added to the SPR in 2024. It isn’t clear but due to several DOE announcements, another 4 MMB of additions appear planned for 2024.

US crude imports were higher than the 2024 average.

US Crude exports surged, just under 5 MMBD. The world wants US light barrels.

Unaccounted for crude was essentially flat.

Cushing

Crude storage in Cushing, OK, drew by 1.1 MMB week on week. Cushing inventories are quietly tightening. As WTI is priced at Cushing, this trend should support WTI prices.

Gasoline

Total motor gasoline inventories decreased by 3.7 MMB and are about 3% below the seasonal 5-year average. Only 2023 experienced lower seasonal inventories during this period.

Gasoline blending components are demonstrating a similar trend.

Distillate

Distillate fuel inventories increased by 1.5 MMB last week and are about 7% below the seasonal 5-year average. The recent distillate deficit is diminishing.

Jet

Kerosene type jet fuel inventories increased by 0.3 MMB. The graph appears bearish but it’s important to realize kerosene jet fuels are only about 5 MMB above average. The range for jet fuels is smaller than other products.

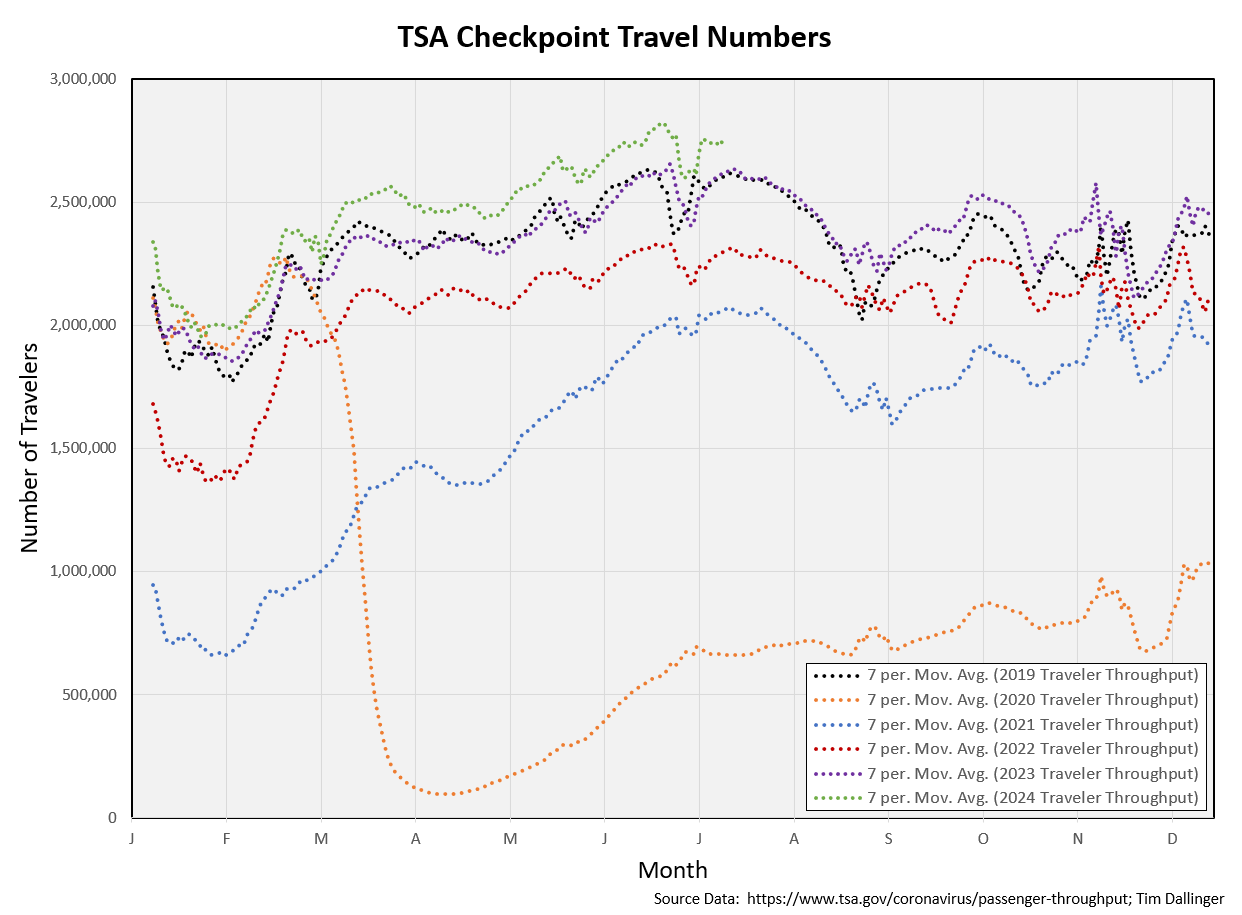

US traveler data continues to hit seasonal records.

Both average global active flights and global miles flown are at all-time record highs.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories increased by 0.2 MMB week-on-week.

Propane

Propane/propylene inventories increased 2.9 MMB. Inventories trend toward record levels.

Other Oil

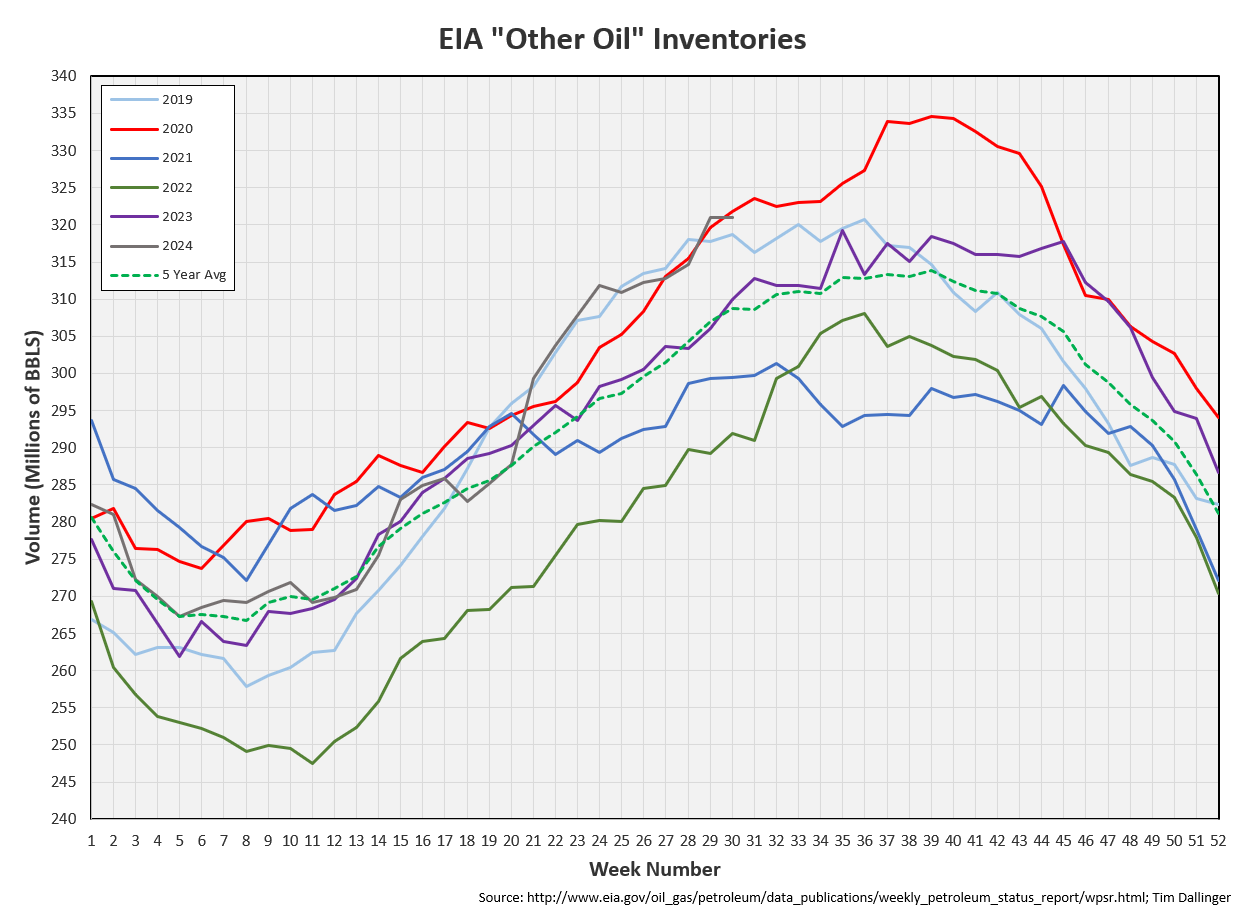

Other oil was flat week-on-week. Other oil inventories are near the 2020 highs.

Total Commercial Inventory

Total commercial inventories decreased by 2.4 MMB. Total commercial inventories are just below average, even with bloated propane and other oil figures.

Natural Gas

Natural gas inventories are still high but have eased off the aggressive build trajectory slightly.

Refiners

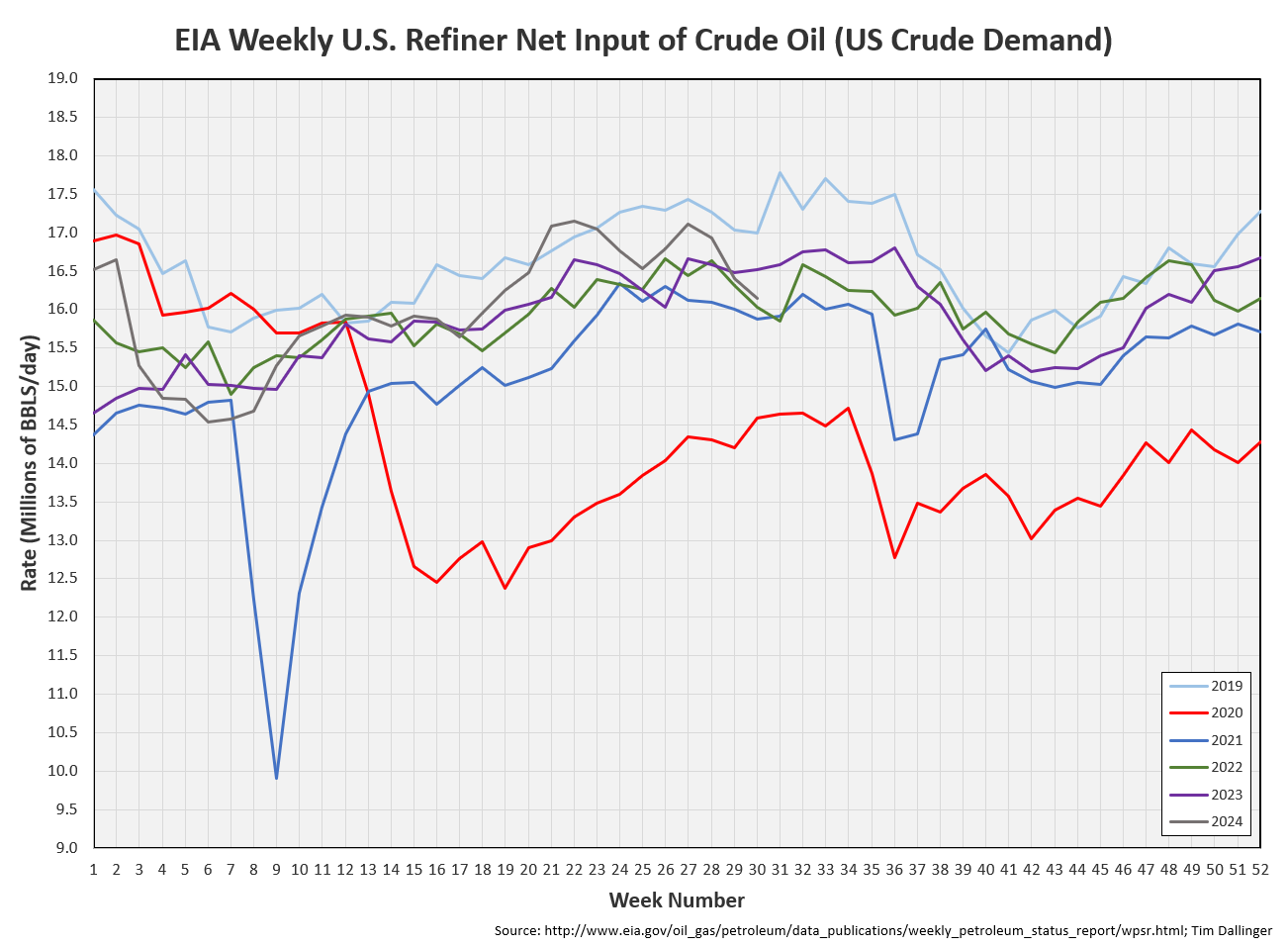

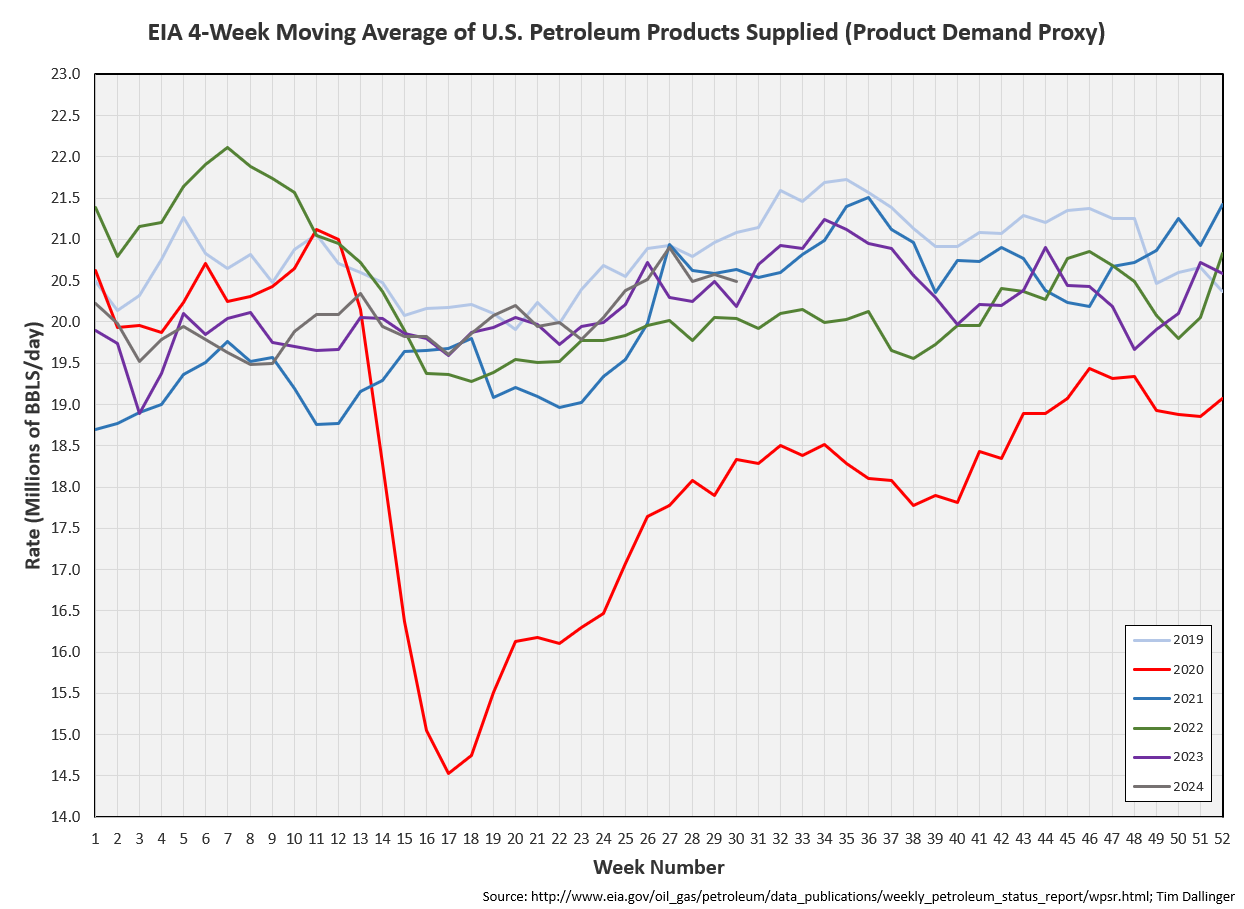

The amount of crude oil refiners processed last week fell. There were several unplanned outages at US facilities as well as pressure on crack spreads.

The EIA’s product demand proxy decreases slightly but remains above every year but 2019 and 2021.

The May Petroleum Supply monthly (PSM) was released today. It showed a massive upward revision in implied demand versus the weekly. Interestingly, there was a similar discrepancy between the weekly and monthly figures during this monthly time period in 2023 as well. The magnitude of the difference is just more substantial in 2024.

Looking at the weekly implied demand for transportation fuels, there isn’t substantial weakness. Demand appears healthy despite the narrative suggesting otherwise. This publication has been adamant that the weekly implied demand figures are not an accurate reflection of actual demand. This PSM reinforces that claim.

US refiners are reporting their 2024 second quarter earnings now. Conference calls and guidance will be reviewed, and highlights included in the near future. This should provide additional support for healthy demand.

Transportation inventories draw, supporting cracks.

Simple cracks have somewhat recovered.

Discussion

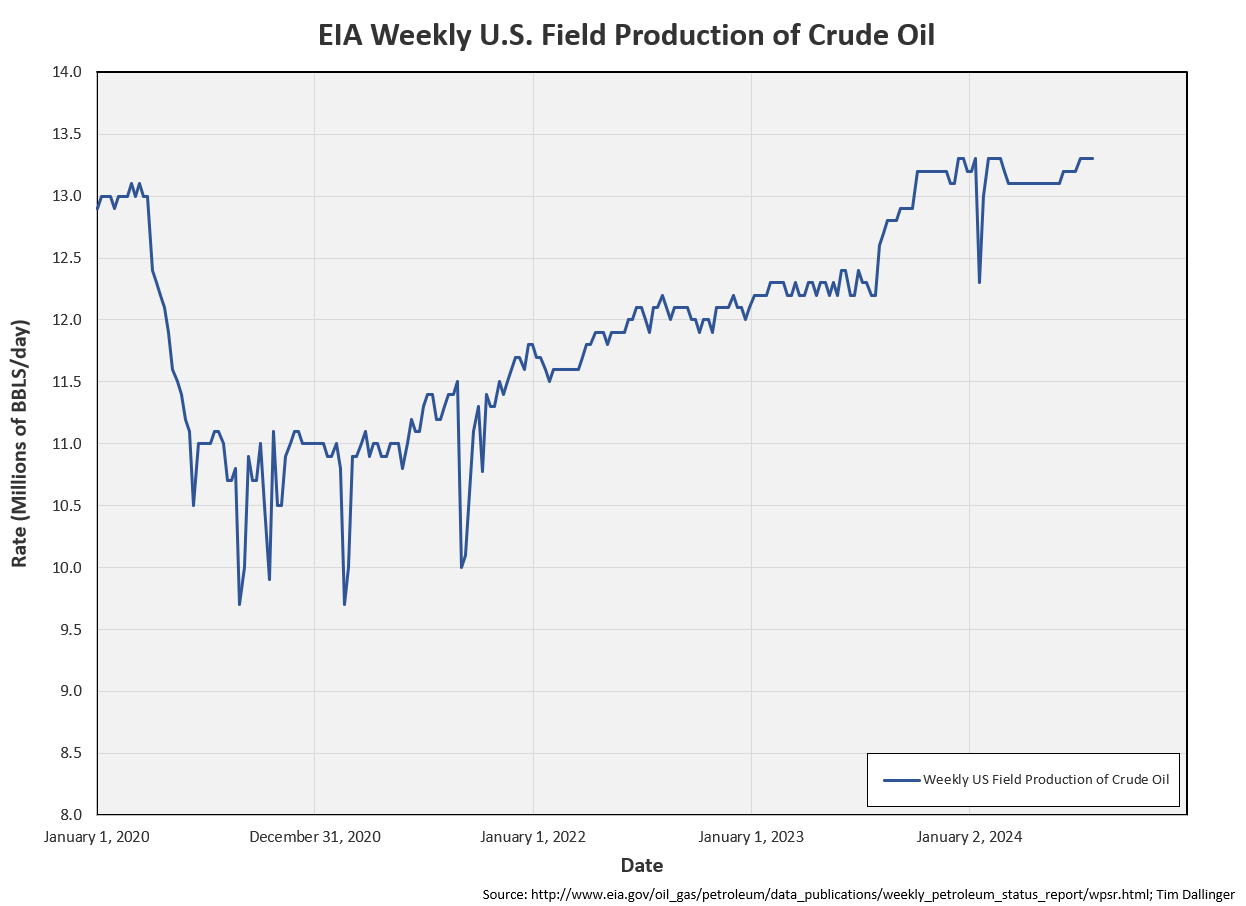

The EIA is showing that US crude production has grown recently. This seems unlikely. Unaccounted for oil has also trended lower during the same period. The EIA continues to struggle with blending accounting. Adding the Transfers to Crude Supply category seems to have helped but still doesn’t appear to have fixed the issue.

OPEC discipline continues. OPEC+ exports remain down. The crude time structure remains firmly backwarded. The physical market is healthy. There have been some refinery run cuts, especially in Asian markets. This has lead to product draw and cracks improving.

The recent selloff in crude seems odd. Today snapped the losing streak though as prices responded positively to this report. Bearish sentiment remains but the underlying fundamental still appear supportive.

Iran reported that Israel assassinated Hamas leader, Ismail Haniyeh, by airstrike in Tehran early this morning. Iranian Supreme Leader, Ayatollah Ali Khamenei, has called for a direct Iranian strike on Israel in retaliation.

No oil supply has been interrupted currently but tension in the region remain high.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Detective Del Spooner, portrayed by Will Smith, warned of the potential danger of a robot revolution in the 2004 American science fiction film ‘I, Robot.”

Thank you as always!

Airline travel way up but jet fuel inventories at record highs?