EIA WPSR Summary for week ending 3-15-24

Summary

Bullish report.

Crude: -2.0 MMB

SPR: +0.8 MMB

Cushing: -0.1 MMB

Gasoline: -3.3 MMB

Ethanol: +0.2 MMB

Distillate: +0.6 MMB

Jet: -0.1 MMB

Propane: +0.4 MMB

Other Oil: -2.7 MMB

Total: -6.1 MMB

It appears some export barrels weren’t counted again. A more bullish report was expected.

Spot WTI is currently pricing $81. This is near fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 1.5 MMB. Crude inventories are currently 3% below the seasonal average. Crude supplies have peaked for the year.

0.8 MMB were added to the SPR. 7.3 MMB have been added to the SPR in 2024.

US Energy Secretary Jennifer Granholm made headlines earlier this week at the CERAWeek conference in Houston when she claimed that the SPR will return to prior levels by year-end. This is misleading. The US does not intend to replenish the 200 MMB sold over 2021 and 2022. Instead, they plan to add 40 MMB and cancel the 140 MMB that were planned for sale over 2024 to 2027, to fund the Congressional budget.

Crude imports were up week-on-week. They came in a little higher than expectations.

The chart axis for import and export have been updated so that the relative magnitude is comparable.

Crude exports jumped to a reported 4.88 MMBD. This is a high value, although independent ship trackers estimated this value higher. Preliminary exports for next week appear down, however, customs might count the barrels it appears they missed the past two weeks.

The WTI Brent spread is almost $5. US crude exports should remain elevated.

Unaccounted oil turned positive. There’s no apparent explanation.

Cushing

Crude inventories in Cushing, OK fell 0.1 MMB. Inventories are low but there remains adequate levels for operation.

Gasoline

Total motor gasoline inventories decreased by 3.3 MMB and are 2% below the seasonal 5-year average.

Ethanol

Ethanol inventories built 0.2 MMB week-on-week. Inventories are still above average.

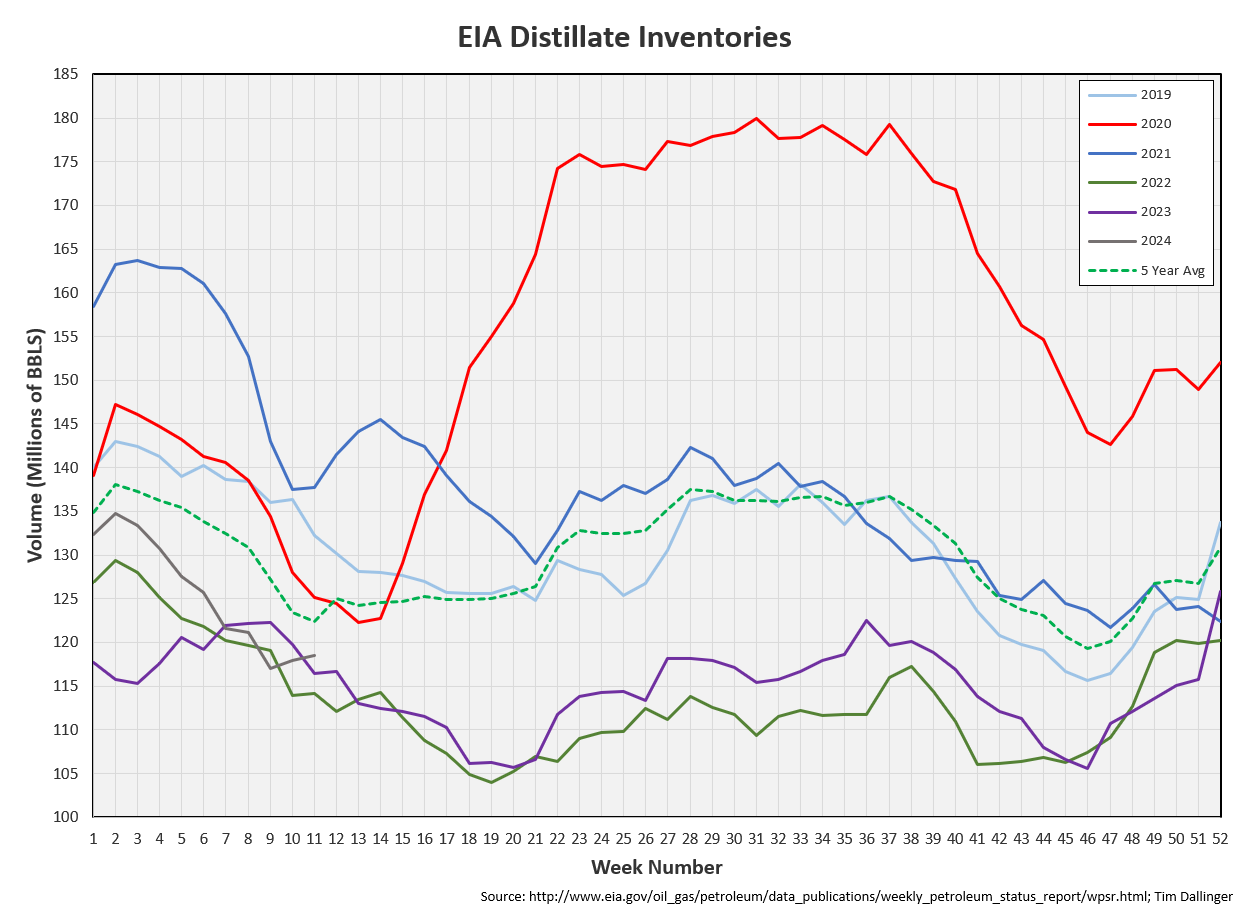

Distillate

Distillate fuel inventories increased by 0.6 MMB last week and are about 7% below the seasonal 5-year average. This is unexpected. Distillate draws are still expected over the next two months.

Jet

Kerosene type jet fuels decreased by 0.1 MMB. Seasonal jet inventories are above the 5-year average.

Propane

Propane/propylene inventories built 0.4 MMB week-on-week. Inventories are above seasonal averages, and their build has started early. This suggests US NGL production has increased.

Other Oil

Other oil decreased by 1.7 MMB. Other oil inventories are just below seasonal average.

Total Commercial Inventory

Total commercial inventories drew by 6.1 MMB. Only 2022 was lower in the recent past.

Natural Gas

Natural gas inventories drew slightly. Inventories remain high.

Discussion

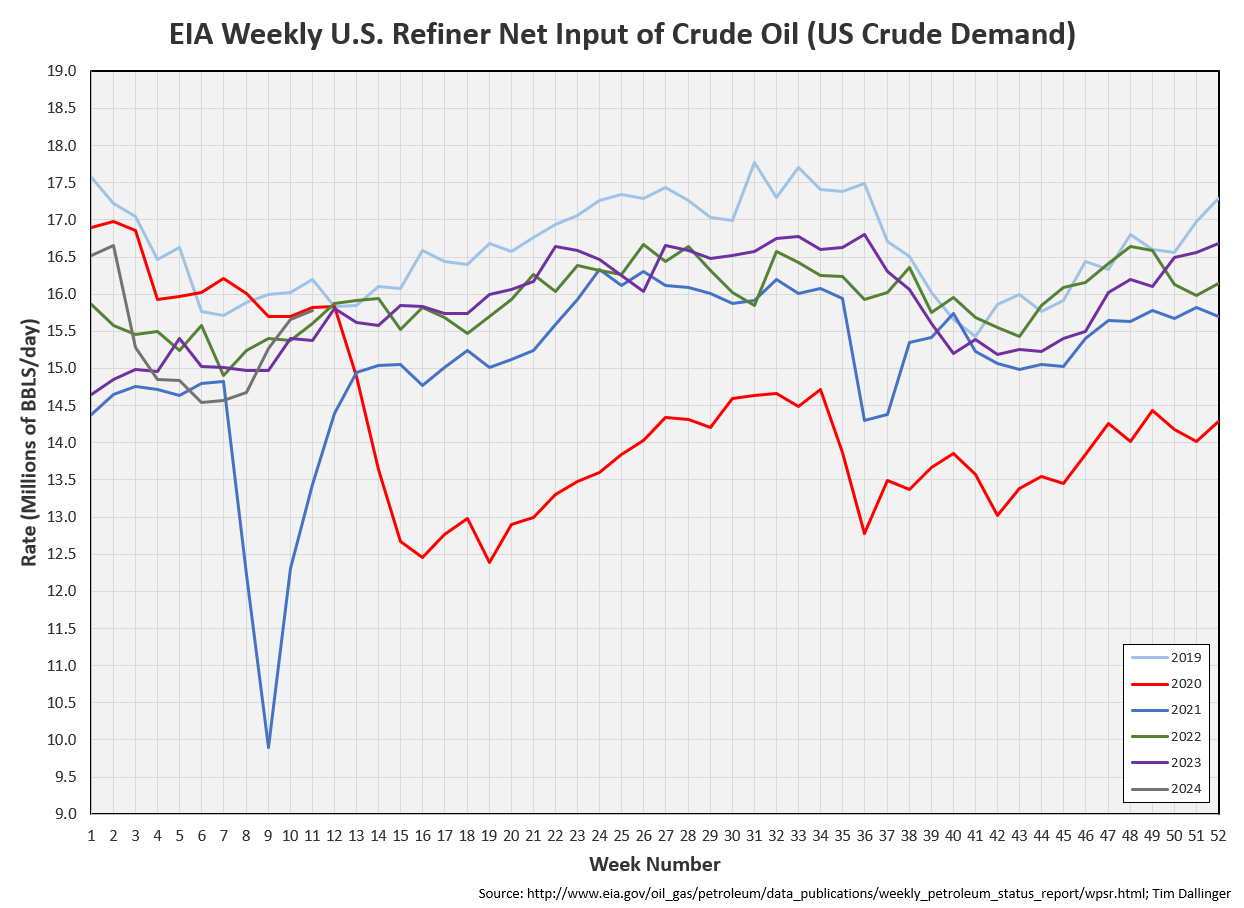

US refiners increased utilization again this week. Most US refiners are completing maintenance season. BP’s Whiting facility is reported to have restarted. That should show up in next week’s report.

Demand remains healthy and the EIA’s product proxy demand calculation is finally showing it. Demand should pick up further into summer.

Transportation inventories are at low seasonal levels.

Ukrainian drones struck Russian refineries, taking between 600 and 900 kbd of refining capacity offline. It’s currently unknown as to how long Russian refiners will be down.

Source: Bloomberg

Crack spreads moved meaningfully higher.

Refiners have significant incentive to refiner more product. This should lead to more crude oil draws. WTI and Brent are now trading in the $80 USD range. It appears there’s fundamental and technical support to remain at these prices.

Analysts caught off-guard by the recent crude movement, are being forced to review their forecasts. Morgan Stanely is “cautiously optimistic,” concluding that Brent could reach $90 by Q3 due to unexpected global inventory draws.

Conversely, Citigroup digs its heels in on bearish outlook.

Source: SeekingAlpha

Citi cites group in US, Canada and Brazil contributing to oversupply.

As for the US, consider the following chart:

Zooming in, the trends are more apparent. Rigs, DUC’s and production has flat lined. This suggests there are very few productive DUC’s left that will produce. If the US doesn’t meaningfully add rigs, it’s hard to see significant production growth.

Over the past 6 years, much of the entire global liquid production growth was confined to two counties in West Texas. If the Permian is maturing as it appears, the global energy market is entering a new era.

Can Brazil fill that supply gap? Unlikely.

The bullish thesis remains intact.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

The “Wind of Change” is a 1990 track from the German rock band, Scorpions.

Thanks for these Tim!

Am I interpreting the (unzoomed) last chart correctly? It looks like COVID hit, drilling stopped, then slowly the rig count grew once again to finish all the DUCs... but they didn't drill any significant number of *new* wells.